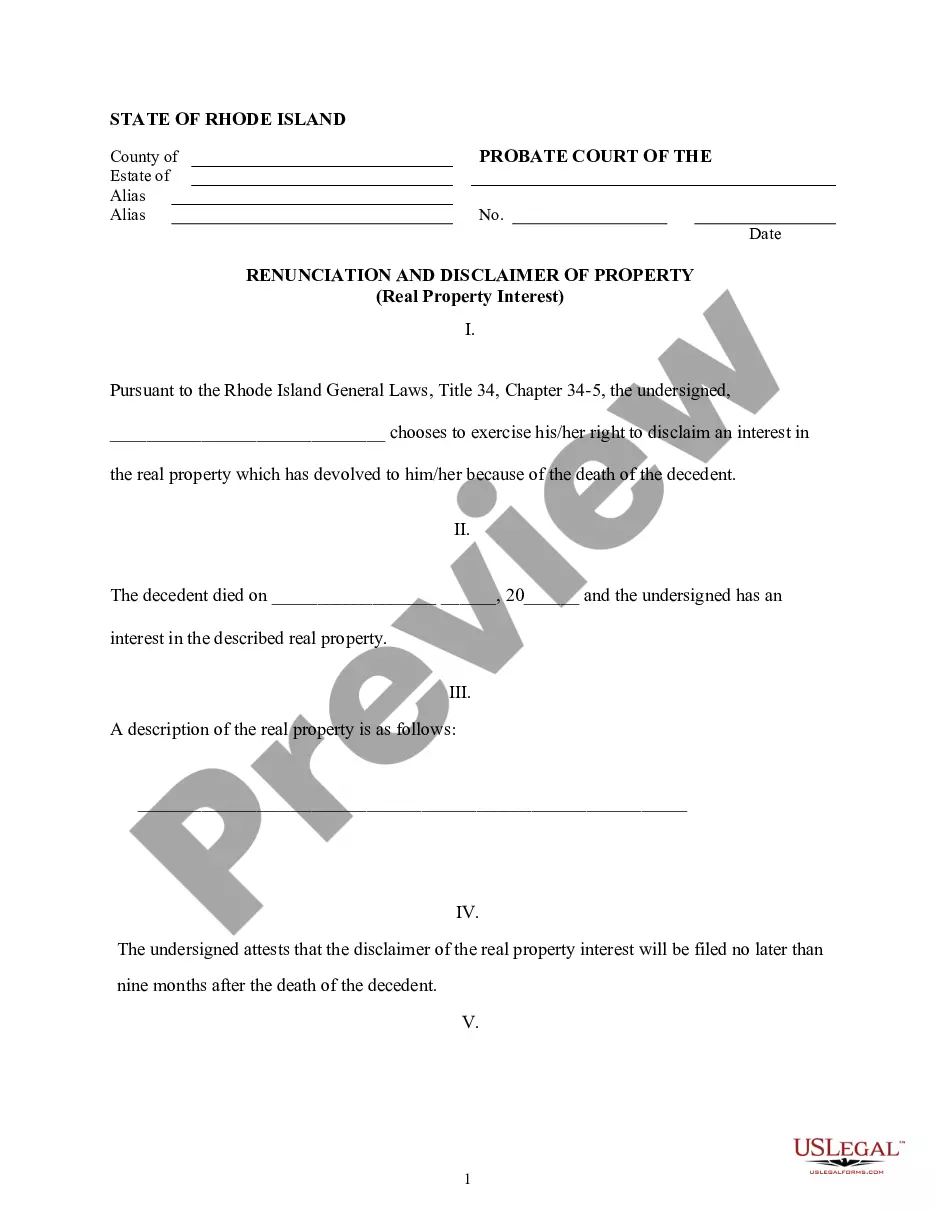

Rhode Island Renunciation And Disclaimer of Real Property Interest

About this form

The Renunciation and Disclaimer of Real Property Interest form allows a beneficiary to officially reject their inherited interest in real property following a decedent's death. This legal document ensures the beneficiary's choice to renounce any claim to the property is recorded, facilitating a clear transfer of rights to other heirs. This form is specifically designed for beneficiaries in Rhode Island who wish to relinquish their stake in a property inherited through inheritance, thus distinguishing it from other estate planning documents like wills or trusts.

Form components explained

- Identification of the beneficiary disavowing their interest.

- The decedent's date of death, which is relevant for timing the disclaimer.

- A detailed description of the real property being disclaimed.

- An attestation that the disclaimer will be filed within nine months of the decedent's death.

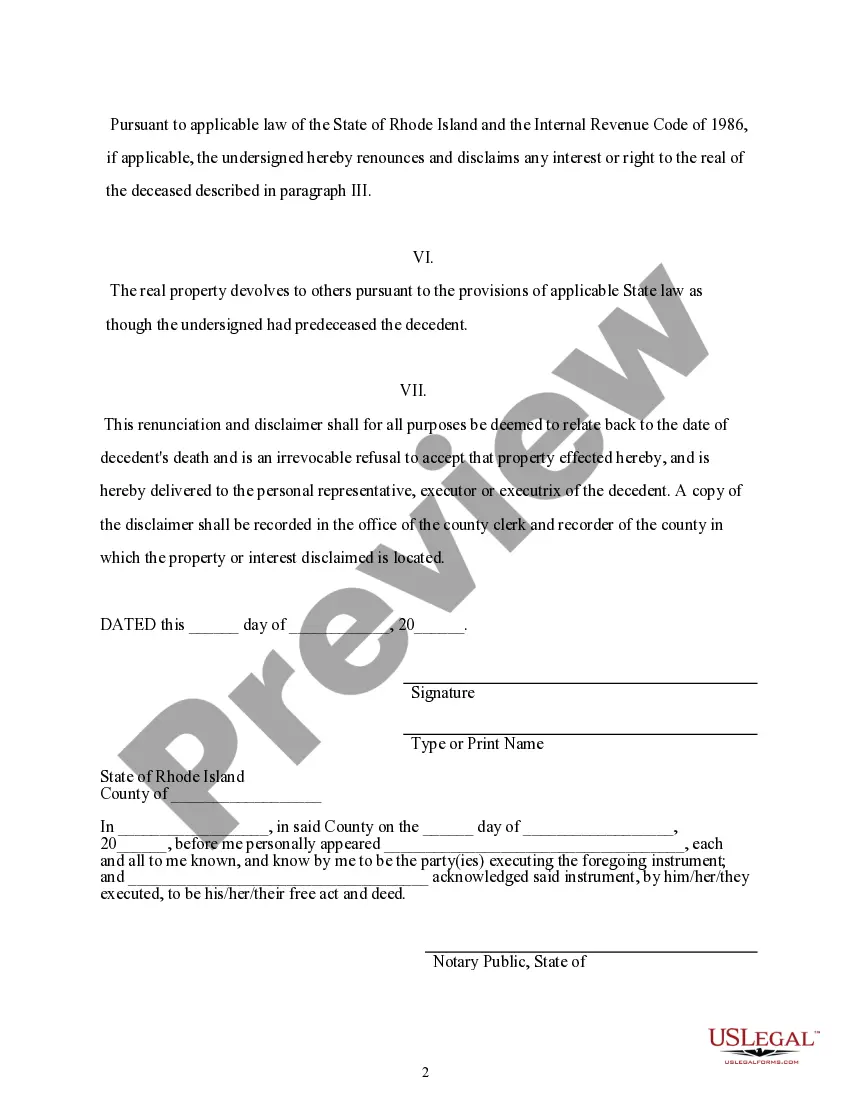

- Renunciation of any legal interest in the real property as per applicable laws.

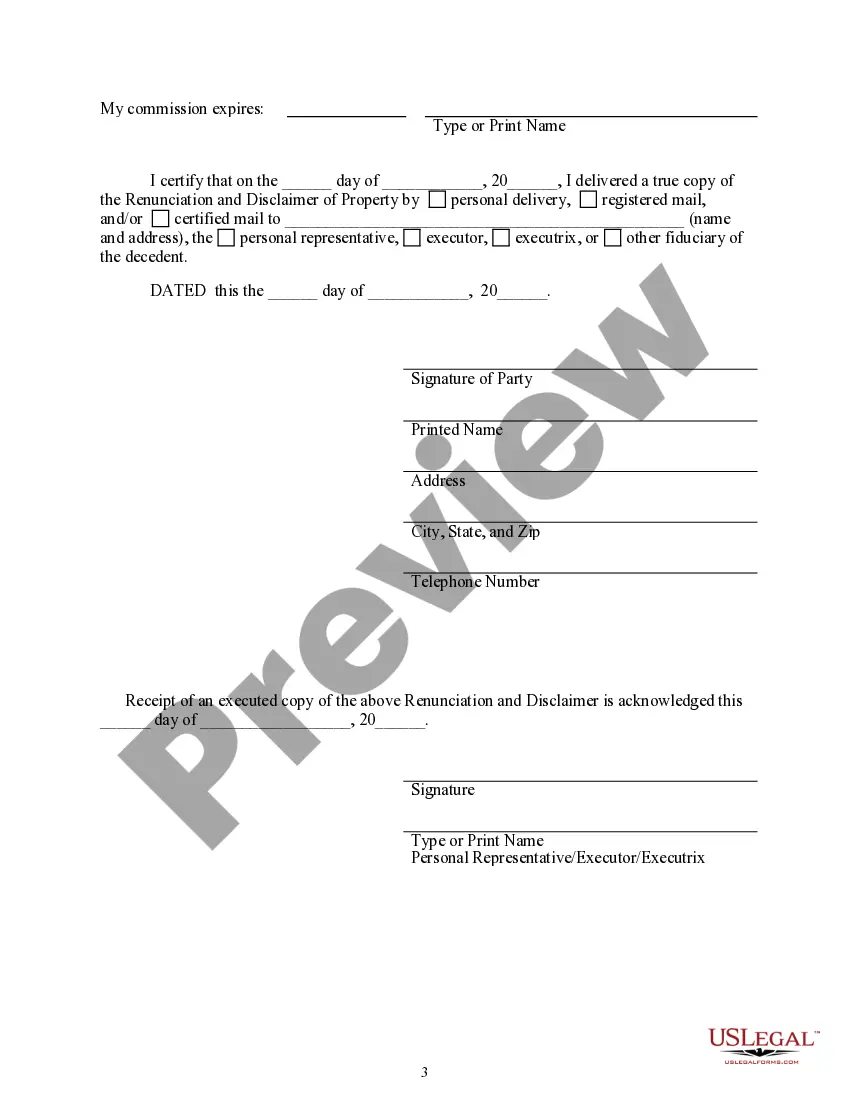

- State-specific acknowledgment and certification of document delivery.

Situations where this form applies

This form is necessary when a beneficiary inherits real property from a deceased individual but decides not to accept the interest for personal, tax, or family reasons. By submitting this form, the beneficiary ensures that the property can devolve to other eligible heirs, aligning with the decedentâs intentions. Scenarios might include wanting to avoid tax implications, disputes among family members, or simply choosing not to manage the property.

Who this form is for

This form is appropriate for:

- Beneficiaries who have inherited real property from a deceased individual in Rhode Island.

- Individuals who wish to formally renounce their inherited interest to simplify estate management.

- Those seeking to clarify their legal rights and the subsequent ownership of the property.

How to prepare this document

- Begin by identifying yourself, the beneficiary, at the top of the document.

- Provide the date of death of the decedent accurately.

- Include a thorough description of the real property in question.

- Sign and date the form, confirming it will be submitted within the nine-month deadline.

- Ensure any state-specific acknowledgment sections are completed as required.

Notarization requirements for this form

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Avoid these common issues

- Failing to file the form within the nine-month timeframe, which may invalidate the disclaimer.

- Not including a complete and clear description of the real property.

- Overlooking necessary signatures or state-specific acknowledgments.

Why complete this form online

- Convenience: Access and complete the form from anywhere, anytime.

- Editability: Modify the document as needed before finalizing it.

- Reliability: Forms are developed by licensed attorneys to ensure compliance with legal standards.

Legal requirements by state

This form adheres to the laws outlined in the Rhode Island General Laws, Title 34, Chapter 34-5, which govern the renunciation and disclaimer of real property interests. Proper completion and timely filing of this form are crucial for compliance with state regulations.

Form popularity

FAQ

A beneficiary is always free to refuse to accept benefits under a trust or a will.The beneficiary may be willing to sign a disclaimer as she does not wish to accept the bequest. The disclaimer would protect you as Trustee from a breach of a fiduciary duty by distributing the assets to a different beneficiary.

Disclaimer of interest, in the law of inheritance, wills and trusts, is a term that describes an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust. A disclaimer of interest is irrevocable.

In law, a disclaimer is a statement denying responsibility intended to prevent civil liability arising for particular acts or omissions. Disclaimers are frequently made to escape the effects of the torts of negligence and of occupiers' liability towards visitors.

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor,

What is a Deed of Disclaimer? A Deed of Disclaimer is a document that you can execute if you wish to Disclaim an inheritance due via the Rules of Intestacy and you are not applying for probate. A typical example of this is if a spouse of a deceased would prefer the estate passes to the children.

A beneficiary of a trust may wish to disclaim their interest in the trust for:Any disclaimer of an interest in a trust by a trust beneficiary must be made to the trustee of that trust. For a disclaimer to be valid, it must be supported by some evidence that the beneficiary is disclaiming their interest.

A qualified disclaimer is a part of the U.S. tax code that allows estate assets to pass to a beneficiary without being subject to income tax. Legally, the disclaimer portrays the transfer of assets as if the intended beneficiary never actually received them.

Disclaim, in a legal sense, refers to the renunciation of an interest in, or an acceptance of, inherited assets, such as property, by way of a legal instrument. A person disclaiming an interest, right, or obligation is known as a disclaimant.

1a : a denial or disavowal of legal claim : relinquishment of or formal refusal to accept an interest or estate. b : a writing that embodies a legal disclaimer. 2a : denial, disavowal. b : repudiation.