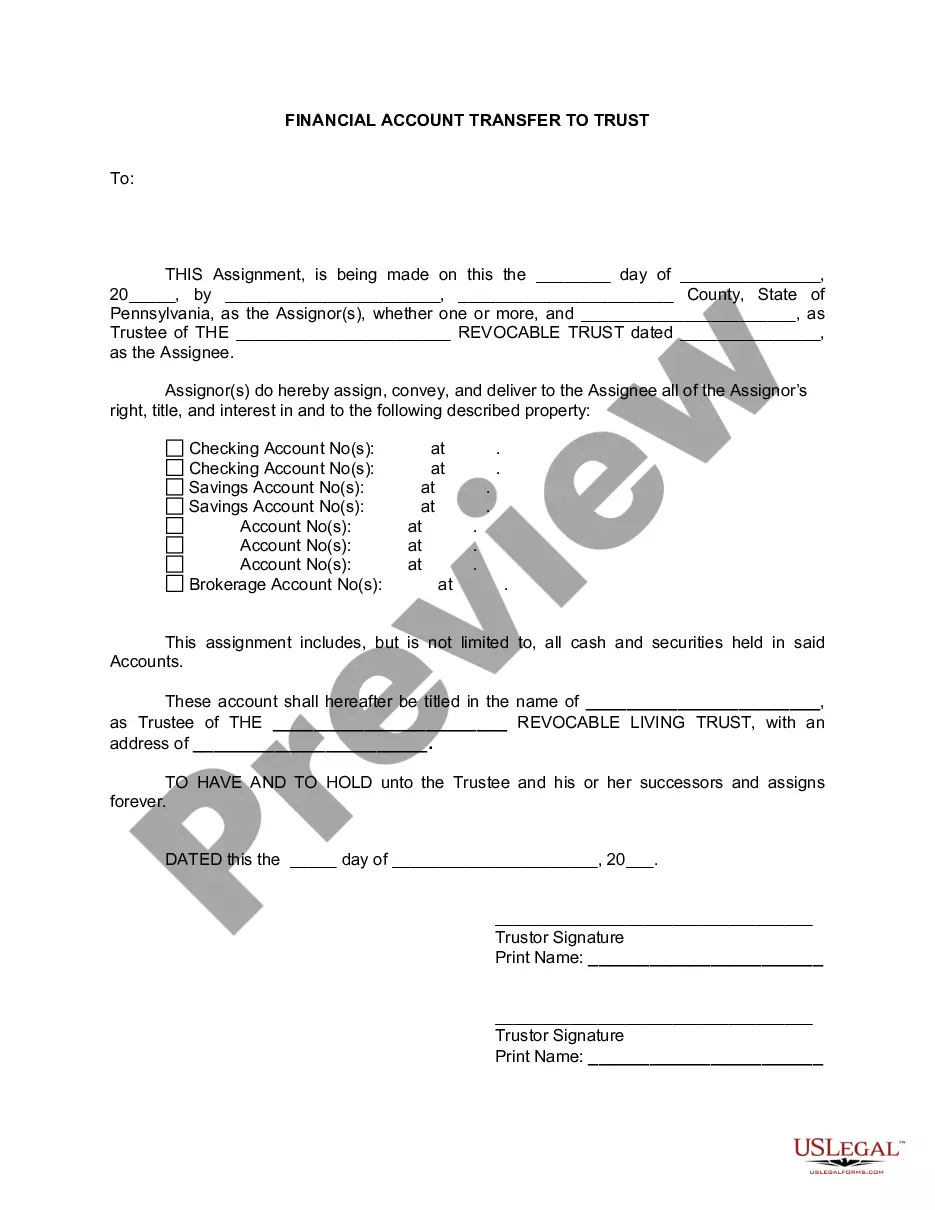

Pennsylvania Financial Account Transfer to Living Trust

Description

How to fill out Pennsylvania Financial Account Transfer To Living Trust?

The work with papers isn't the most easy task, especially for those who almost never deal with legal papers. That's why we advise making use of accurate Pennsylvania Financial Account Transfer to Living Trust templates made by professional lawyers. It allows you to avoid problems when in court or handling formal institutions. Find the templates you want on our website for top-quality forms and accurate descriptions.

If you’re a user having a US Legal Forms subscription, simply log in your account. When you are in, the Download button will automatically appear on the template web page. After getting the sample, it’ll be saved in the My Forms menu.

Customers with no an active subscription can quickly create an account. Use this short step-by-step help guide to get the Pennsylvania Financial Account Transfer to Living Trust:

- Make sure that file you found is eligible for use in the state it’s needed in.

- Confirm the document. Utilize the Preview option or read its description (if offered).

- Click Buy Now if this sample is the thing you need or use the Search field to get another one.

- Select a suitable subscription and create your account.

- Utilize your PayPal or credit card to pay for the service.

- Download your file in a required format.

After doing these straightforward actions, you are able to complete the sample in an appropriate editor. Recheck filled in data and consider asking a legal professional to examine your Pennsylvania Financial Account Transfer to Living Trust for correctness. With US Legal Forms, everything becomes much easier. Try it out now!

Form popularity

FAQ

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.

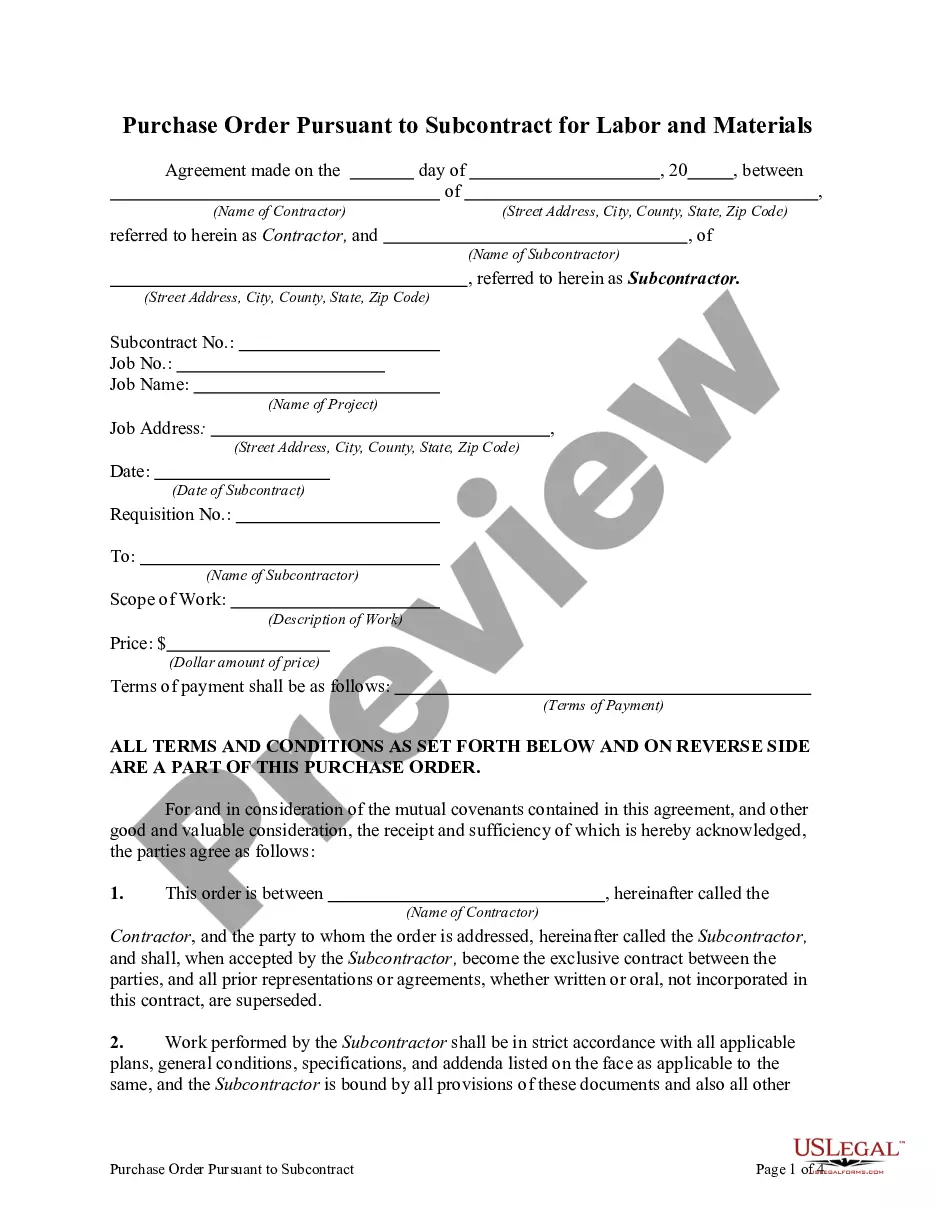

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

To put checking or savings accounts into the trust, go down to your bank and fill out the institutional paperwork. You don't have to change the name on the checks. When you die, your successor trustee will assume control of the account and distribute the money to your heirs.

To transfer assets into a trust, the grantor must transfer titles from their name to the legal name of the trust. A grantor can create a living trust using an online legal document provider or by hiring an attorney. They can transfer almost any asset, including bank accounts, into a trust.

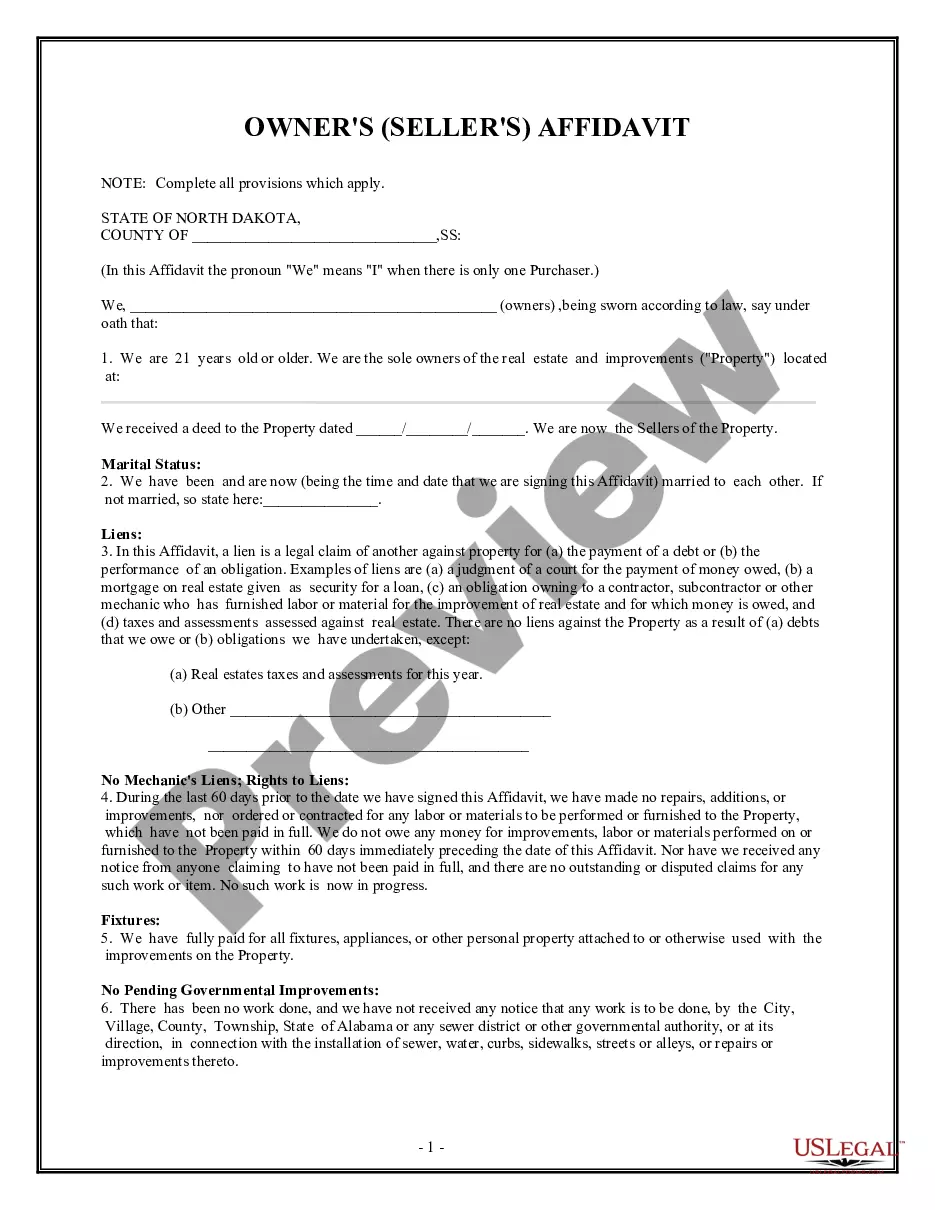

Visit your local bank branch and let the branch manager or representative know you want to transfer your bank account into the trust. Give the bank representative a signed and notarized copy of your trust document. The bank will need to confirm that you're the owner and verify the name of the trust.

Visit your local bank branch and let the branch manager or representative know you want to transfer your bank account into the trust. Give the bank representative a signed and notarized copy of your trust document. The bank will need to confirm that you're the owner and verify the name of the trust.

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.