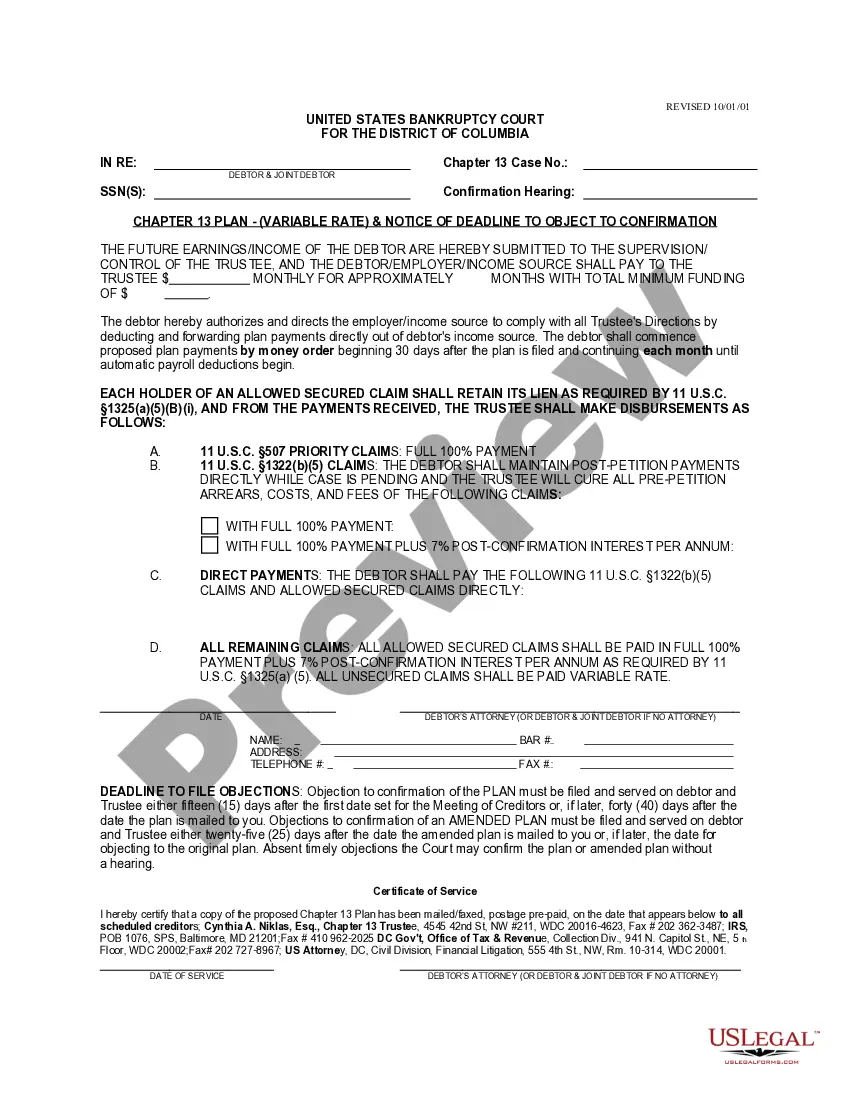

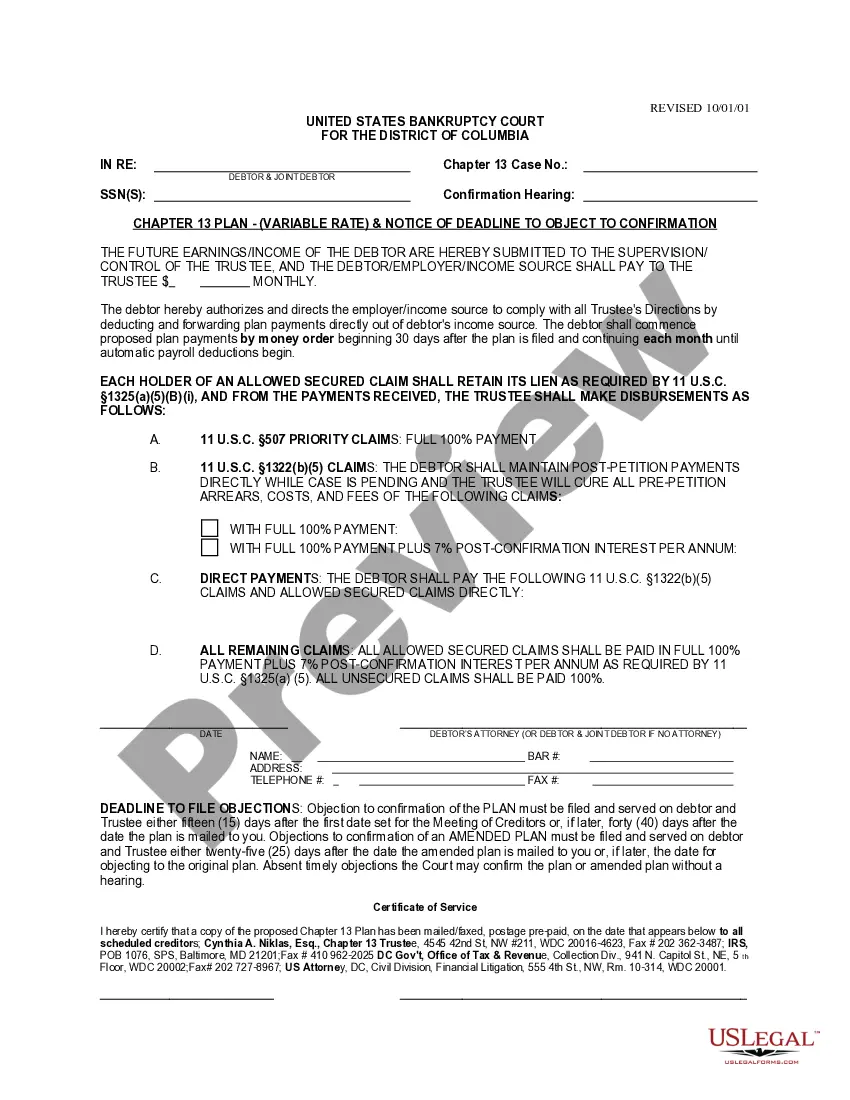

The debtor may use this form to authorize and direct that his/her future earnings be submitted to the control of the trustee and that money be distributed among the creditors. The form also lists the deadline date to file an objection to the confirmation.

District of Columbia Chapter 13 Plan - 100 percent plus Interest and Notice of Deadline to Object

Description

How to fill out District Of Columbia Chapter 13 Plan - 100 Percent Plus Interest And Notice Of Deadline To Object?

The greater the number of documents you need to assemble - the more anxious you become.

You can find countless District of Columbia Chapter 13 Plan - 100 percent plus Interest and Notice of Deadline to Object templates online, yet you are uncertain about which ones to trust.

Eliminate the stress and simplify obtaining samples with US Legal Forms. Acquire precisely formulated forms that comply with state requirements.

Locate each file you receive in the My documents menu. Simply navigate there to prepare a new version of the District of Columbia Chapter 13 Plan - 100 percent plus Interest and Notice of Deadline to Object. Even when using expertly drafted templates, it is crucial to consider consulting a local legal expert to verify that your document is accurately filled out. Achieve more for less with US Legal Forms!

- Verify the District of Columbia Chapter 13 Plan - 100 percent plus Interest and Notice of Deadline to Object is applicable in your state.

- Confirm your choice by reviewing the description or utilizing the Preview feature if available for the selected document.

- Select Buy Now to initiate the registration process and choose a pricing option that suits your needs.

- Fill in the required information to create your profile and complete the payment for the order using PayPal or credit card.

- Choose a convenient file format and download your template.

Form popularity

FAQ

After the District of Columbia Chapter 13 Plan - 100 percent plus Interest and Notice of Deadline to Object is successfully discharged, the closure of your case typically occurs about 30 to 60 days later. The court will review all required payments, ensuring everything meets compliance. Once confirmed, you will receive a final decree, marking the official end of your case. It is important to stay informed during this process to ensure a smooth conclusion.

Filing a Chapter 13 plan in the District of Columbia involves a few key steps. First, you must complete the plan documentation, including providing a detailed budget and proof of income. Next, submit the plan to the bankruptcy court along with required forms and fees. To streamline this process, consider using the uLegalForms platform, which offers guidance designed for your District of Columbia Chapter 13 Plan - 100 percent plus Interest.

For Chapter 13, the best interest of creditors test determines whether you are offering adequate repayment to secured and unsecured creditors. This test is an integral part of validating your District of Columbia Chapter 13 Plan - 100 percent plus Interest and Notice of Deadline to Object. The formula considers the total value of debts and assets when proposing your plan. If you are unsure about meeting these requirements, platforms like uslegalforms can guide you in preparing a strong case for your creditors.

The best interest test in Chapter 13 focuses on the amount creditors would recover through a liquidation process as compared to a repayment plan. In the context of a District of Columbia Chapter 13 Plan - 100 percent plus Interest and Notice of Deadline to Object, it's important for you to ensure that your plan offers a payment structure favorable for your creditors. This test protects the rights of creditors and assists individuals in effectively managing their debts. Utilizing resources like uslegalforms can provide clarity on crafting a compliant Chapter 13 plan.

The best interest of creditors test is a critical component in the District of Columbia Chapter 13 Plan - 100 percent plus Interest and Notice of Deadline to Object. This test examines whether creditors would receive at least as much under this plan as they would in a Chapter 7 bankruptcy. Essentially, it ensures fairness to creditors while helping you structure a manageable repayment plan. Understanding this test is essential for anyone considering a Chapter 13 option.

The deadline for objecting to a proof of claim in a Chapter 13 bankruptcy is typically set by the court when you file your case. It is vital to be aware of this timeline, especially in the context of your District of Columbia Chapter 13 Plan - 100 percent plus Interest and Notice of Deadline to Object. Addressing any objections promptly ensures your rights are protected and your interests are pursued without unnecessary delays. Consulting with resources from uslegalforms can help you stay informed about these important deadlines.

Objections to a Chapter 13 plan can arise based on several grounds. Common reasons include failure to comply with legal requirements, not providing adequate protection to secured creditors, or proposing a plan that is not feasible. If you are facing objections, understanding the specifics of your District of Columbia Chapter 13 Plan - 100 percent plus Interest and Notice of Deadline to Object is crucial. To navigate this process effectively, leveraging tools from uslegalforms might help clarify your plan details.

Yes, interest does accrue during a Chapter 13 bankruptcy. When you establish your District of Columbia Chapter 13 Plan - 100 percent plus Interest and Notice of Deadline to Object, it is vital to understand how interest on your debts may accumulate. The total amount owed can increase over time due to this accruing interest. To manage your finances effectively, consider consulting with uslegalforms for detailed resources on handling debts under Chapter 13.

The 90 day rule for Chapter 13 refers to the required time frame within which a debtor must submit their Chapter 13 Plan for confirmation. This is crucial for those pursuing a District of Columbia Chapter 13 Plan - 100 percent plus Interest and Notice of Deadline to Object, as it sets a clear timeline for all parties involved. Failure to meet this deadline can result in delays or even dismissal of your case. Hence, it is essential to stay organized and adhere to these timelines.