District of Columbia Chapter 13 Plan 100 Plus Interest on Priority Claim is a payment plan designed by the District of Columbia Bankruptcy Court for individuals who are unable to pay their priority creditors in full. The plan allows debtors to pay over time, while still giving priority creditors priority over other creditors. This plan allows debtors to pay at least 100% of the amount owed to their priority creditors, plus interest. Priority creditors are typically those who are owed a legal claim or judgment against the debtor, such as child support, taxes, and secured creditors. There are two types of District of Columbia Chapter 13 Plan 100 Plus Interest on Priority Claim: the 100% Payment Plan and the Partial Payment Plan. The 100% Payment Plan requires the debtor to pay 100% of their priority creditor’s claim plus interest within the bankruptcy timeframe. The Partial Payment Plan allows the debtor to pay a percentage of the priority creditor’s claim plus interest, up to 100%.

District of Columbia Chapter 13 Plan 100 Plus Interest on Priority Claim

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

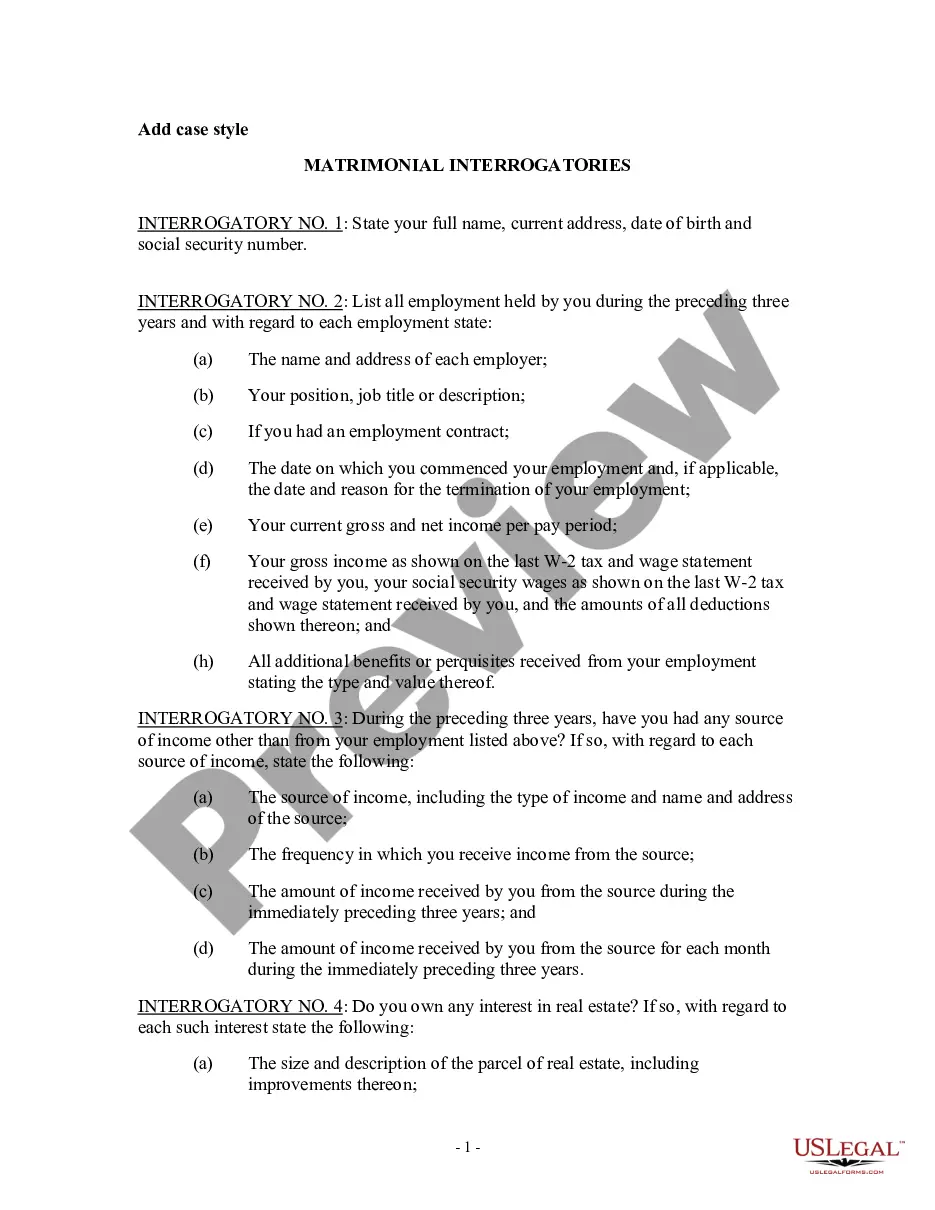

How to fill out District Of Columbia Chapter 13 Plan 100 Plus Interest On Priority Claim?

Completing formal paperwork can be quite a hassle if you lack instantly available fillable templates. With the US Legal Forms online collection of official documentation, you can be confident in the blanks you receive, as all of them align with federal and state standards and are verified by our specialists.

So if you require to complete District of Columbia Chapter 13 Plan 100 Plus Interest on Priority Claim, our service is the optimal destination to acquire it.

Here’s a quick guideline for you: Document compliance check. You should thoroughly examine the content of the form you require and ensure whether it fulfills your needs and complies with your state law regulations. Previewing your document and reviewing its general description will assist you in doing just that. Alternative search (optional). If there are any discrepancies, search the library using the Search tab at the top of the page until you discover a suitable template, and click Buy Now when you identify the one you need. Account registration and form purchase. Create an account with US Legal Forms. After your account is verified, Log In and select the subscription plan that suits you best. Make a payment to proceed (PayPal and credit card options are provided). Template download and further usage. Choose the file format for your District of Columbia Chapter 13 Plan 100 Plus Interest on Priority Claim and click Download to save it on your device. Print it to manually complete your paperwork or utilize a comprehensive online editor to prepare an electronic version more swiftly and efficiently. Haven’t you used US Legal Forms yet? Register for our service now to obtain any official document swiftly and effortlessly whenever you need to, and keep your paperwork organized!

- Retrieving your District of Columbia Chapter 13 Plan 100 Plus Interest on Priority Claim from our service is incredibly straightforward.

- Previously registered users with an active subscription just need to Log In and click the Download button after locating the appropriate template.

- Later, if necessary, users can select the same document from the My documents section of their profile.

- Nonetheless, even if you are a newcomer to our service, signing up with a valid subscription will take just a few moments.

Form popularity

FAQ

The 100 percent Chapter 13 plan ensures that all creditors receive full payment on their claims during bankruptcy. This plan is particularly focused on prioritizing specific debts, especially those classified as priority claims. In the District of Columbia, a Chapter 13 Plan 100 Plus Interest on Priority Claim aims to satisfy these obligations in a structured and efficient manner. By adhering to this plan, individuals can regain financial stability while addressing their debt obligations.

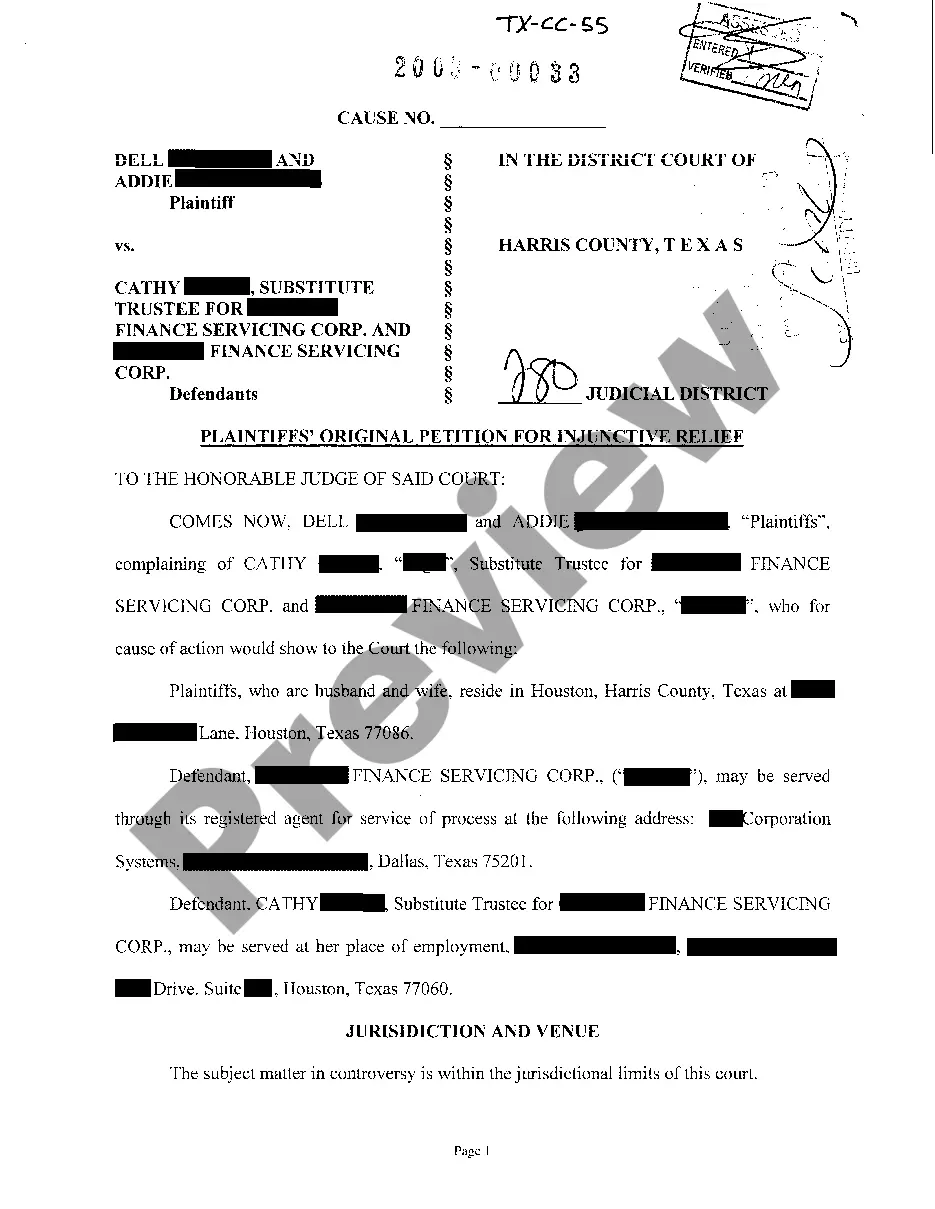

To file a Chapter 13 plan, first complete the required bankruptcy forms, which include detailed information about your debts, income, and expenses. Once your plan is drafted, you file it with the bankruptcy court in your district. The District of Columbia Chapter 13 Plan 100 Plus Interest on Priority Claim can guide you through this intricate process, ensuring that you adhere to legal standards and effectively address your financial obligations.

To amend a Chapter 13 plan, you must file a motion with the bankruptcy court detailing the proposed changes. This process allows you to adjust your repayment terms due to changes in your financial situation or to address priority claims differently. It’s important to stay informed about the District of Columbia Chapter 13 Plan 100 Plus Interest on Priority Claim, as any amendments must comply with specific regulations and receive approval from the court.

Yes, you can file a Chapter 13 on your own, but it is often recommended to seek assistance from a professional. The filing process involves complex paperwork, and misunderstanding the requirements can lead to errors or delays. Using the District of Columbia Chapter 13 Plan 100 Plus Interest on Priority Claim through platforms like uslegalforms can simplify this process by providing the necessary forms and guidance tailored to your needs.

To file for Chapter 13, you need to have a regular income and unsecured debts under a certain limit, which is updated annually. For 2023, unsecured debt limits are approximately $465,275, while secured debts can be up to around $1,422,975. In the District of Columbia Chapter 13 Plan 100 Plus Interest on Priority Claim, understanding these limits helps you determine if you qualify for this repayment plan, which can protect your assets.

A priority claim in Chapter 13 refers to a debt that is classified as higher in importance under bankruptcy law. These debts typically include certain taxes, child support, and alimony payments. In the context of the District of Columbia Chapter 13 Plan 100 Plus Interest on Priority Claim, priority claims must be addressed fully during the repayment plan. This ensures that these critical obligations receive the attention they deserve while you work on repaying other debts.

Priority claims are those granted special status by the bankruptcy law, such as most taxes and the costs of bankruptcy proceeding. (3) Secured claims are those for which the creditor has the right take back certain property (i.e., the collateral) if the debtor does not pay the underlying debt.

Your debts will not be discharged. Often creditors?especially unsecured creditors?don't bother to file claims with the bankruptcy court and their debts get discharged, but only if you complete the plan. When the case is dismissed, those creditors stay with you.

Examples of priority claims include: employee compensation owed, unpaid contributions to employee benefits plans, tax obligations owed to the government, pending personal injury or workplace injury or death claims, certain deposits given to the Creditor to secure future goods or services, alimony, child support, and

The Code's Order of Priority In general, the Code provides that secured creditors are entitled to receive the entire value of the collateral securing their claims up to the full amount they are owed. Unsecured creditors, then, get to look to any remaining assets of the estate.