Colorado Electronic Publishing Agreement

Description

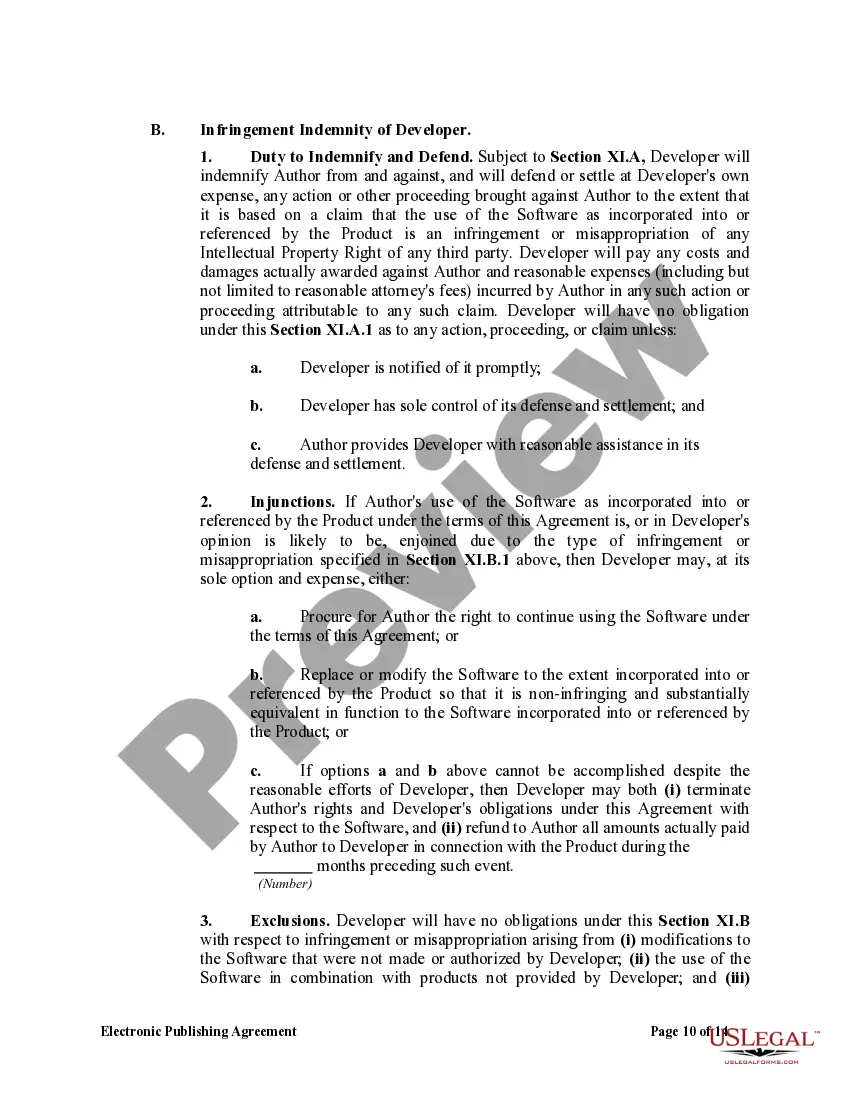

How to fill out Electronic Publishing Agreement?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides a variety of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can obtain the latest versions of forms such as the Colorado Electronic Publishing Agreement in minutes.

If you already have an account, Log In and download the Colorado Electronic Publishing Agreement from your US Legal Forms library. The Download button will be available on each form you view. You can find all previously obtained forms in the My documents section of your profile.

Complete the transaction. Use a Visa or Mastercard or PayPal account to finalize the transaction.

Select the format and download the form onto your device. Edit it. Fill out, modify, print, and sign the downloaded Colorado Electronic Publishing Agreement.

Every template you add to your account does not expire and is yours permanently. Thus, if you wish to download or print another version, simply go to the My documents section and click on the form you need.

Access the Colorado Electronic Publishing Agreement with US Legal Forms, one of the most extensive legal document repositories. Utilize a vast selection of professional and state-specific templates that meet your business or personal needs and requirements.

- Make sure you have selected the appropriate form for your city/state.

- Click the Review button to examine the form's content.

- Read the form description to ensure you have chosen the correct form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, choose the payment plan you prefer and provide your credentials to register for an account.

Form popularity

FAQ

Yes, having a remote employee in Colorado typically creates Nexus for your business. This means your business will have tax obligations in the state, regardless of where your headquarters are located. It's crucial to understand how remote work affects your compliance status. The Colorado Electronic Publishing Agreement encourages businesses to address these matters proactively.

Doing business in Colorado involves engaging in activities that generate revenue within the state, such as selling goods or providing services. Factors like employing staff or maintaining an office contribute to this classification. Knowing what qualifies as doing business is important for compliance. The USLegalForms platform can provide detailed insights to help determine your specific situation.

Nexus in Colorado can be created through various factors, including having a physical presence, employees, or meeting sales thresholds in the state. This connection obligates you to collect and remit sales tax. Understanding what constitutes Nexus is vital for compliance with Colorado tax laws. The Colorado Electronic Publishing Agreement often considers these factors when determining obligations.

For tax year 2024, Colorado plans to implement several changes affecting personal and corporate taxes. These reforms aim to simplify tax calculations and improve overall taxpayer compliance. It's essential to stay informed about these changes to ensure your business adapts accordingly. The USLegalForms platform offers resources to help you navigate these modifications effectively.

Yes, the Colorado Department of Revenue does accept electronic signatures, which can streamline many processes. Electronic signatures help expedite document submission and reduce paper usage. When preparing documents related to the Colorado Electronic Publishing Agreement, consider using electronic signatures for added convenience. Check the department's guidelines to ensure compliance.

Colorado form 106 must be filed by corporations doing business within the state or franchises earning revenue in Colorado. This form reports the corporation's income and helps determine the tax owed. If your business falls under these categories, it's essential to file accurately and on time. Using the USLegalForms platform can simplify your understanding of this requirement.

To mail an e-filer attachment form in Colorado, you should send it to the appropriate department indicated on the form. Generally, this includes the Colorado Department of Revenue or the relevant tax authority. Ensuring that you send it to the correct address is crucial to avoid delays. By utilizing resources like the USLegalForms platform, you can find the right mailing address quickly and efficiently.

Royalties in publishing agreements are payments made to authors based on sales or usage of their work. These payments can vary widely depending on the type of agreement and the success of the publication. If you are looking into a Colorado Electronic Publishing Agreement, it's important to clarify the royalty structure to ensure fair compensation for your contributions.

Journal consent for publication is the permission granted by authors to a journal for the publication of their work. This consent typically confirms that the authors retain certain rights while granting the journal the authority to publish and distribute the work. When considering a Colorado Electronic Publishing Agreement, understanding your rights in this process is essential for protecting your intellectual property.

Open access (OA) publishing provides unrestricted access to research articles, which increases visibility and citations. It allows readers to engage with the material freely, fostering a wider discussion of important topics. Through a Colorado Electronic Publishing Agreement, you can leverage these benefits while ensuring your work reaches the broadest audience possible.