California Job Sharing Agreement Form

Description

How to fill out Job Sharing Agreement Form?

If you need to finish, download, or create valid document templates, utilize US Legal Forms, the largest assortment of legal forms accessible online.

Utilize the site's straightforward and user-friendly search to locate the documents you need. Numerous templates for business and personal use are organized by categories and states, or keywords.

Employ US Legal Forms to find the California Job Sharing Agreement Form in only a few clicks.

Every legal document template you purchase is yours permanently. You have access to every form you saved in your account. Browse the My documents section and select a form to print or download again.

Be proactive and download, and print the California Job Sharing Agreement Form with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal requirements.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to retrieve the California Job Sharing Agreement Form.

- You can also access forms you have previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/region.

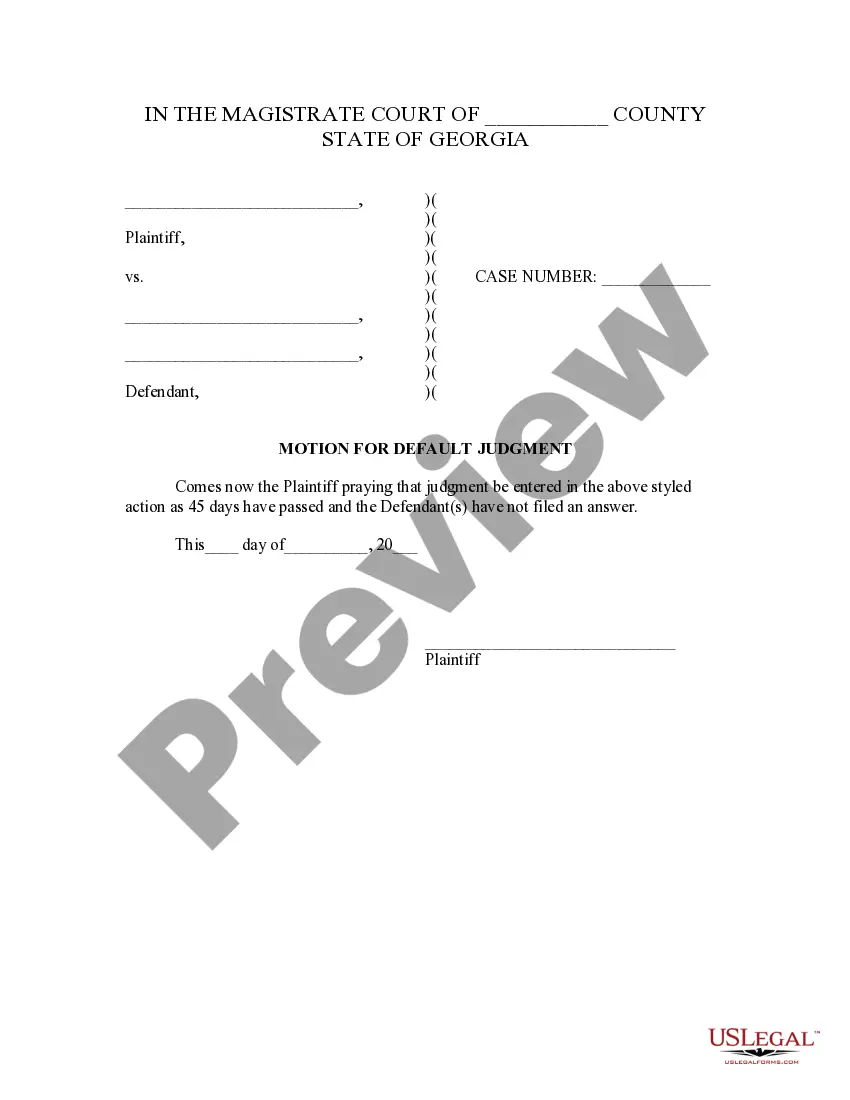

- Step 2. Use the Preview option to review the form's content. Remember to peruse the details.

- Step 3. If you are not satisfied with the form, utilize the Lookup field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have identified the form you require, click the Get now button. Select the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the payment. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the file format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the California Job Sharing Agreement Form.

Form popularity

FAQ

Under California's Work Sharing program, an employer facing the same situation could file a Work Sharing plan with EDD reducing the work week of all employees from five days to four days (a 20 percent reduction). The employees would be eligible to receive 20 percent of their weekly unemployment insurance benefits.

As a temporary alternative to layoffs, the Employment Development Department's (EDD) Work Sharing program allows the payment of a prorated percentage of Unemployment Insurance (UI) benefts to workers whose hours and wages are reduced.

This notice provides instructions on completing the Notice of Reduced Earnings, DE 2063. A DE 2063 is prepared by you when a full-time employee becomes partially unemployed through no fault of. his/her own, and: 2022 The employee works less than normal full-time hours because of lack of work; and.

Under California's Work Sharing program, an employer facing the same situation could file a Work Sharing plan with EDD reducing the work week of all employees from five days to four days (a 20 percent reduction). The employees would be eligible to receive 20 percent of their weekly Unemployment Insurance benefits.

Once the EDD has determined that you are eligible to receive partial unemployment benefits through the Workshare program, the EDD will use your Employer's Work Sharing Certification, DE 4581WS to process all following benefit payments in two week installments.

Am I eligible for Unemployment Insurance? You may file a claim for UI benefits if you are out of work or your hours have been reduced. To be eligible to receive UI benefits, you must be out of work due to no fault of your own and be physically able to work, ready to accept work, and looking for work.

The Work-Sharing program enables employers to deal with a temporary shortage of. work without laying off employees. Under a Work-Sharing agreement, employers can. reduce the employees' working hours by between 10% and 60%.

To prevent more widespread layoffs, CA EDD has implemented the Workshare Program. Employees participating in the Work Sharing program, if eligible, will receive the percentage of their weekly Unemployment Insurance benefit amount.

States with workshare programs include Arizona, Arkansas, California, Colorado, Connecticut, Florida, Iowa, Kansas, Maine, Maryland, Massachusetts, Michigan, Minnesota, Missouri, Nebraska, New Hampshire, New Jersey, New York, Ohio, Oregon, Pennsylvania, Rhode Island, Texas, Vermont, Washington, and Wisconsin.

Partial claims are for employees whose employers want to retain them when there is a lack of work. EDD provides employers with a Notice of Reduced Earnings, DE 2063 or a Notice of Reduced Earnings (Fisherperson), DE 2063F for employees in the fishing industry.