This form is an Application for Certificate of Discharge of IRS Lien. Use to obtain certificate of release when lien has been removed or satisfied. Check for compliance with your specific circumstances.

California Application for Certificate of Discharge of IRS Lien

Description

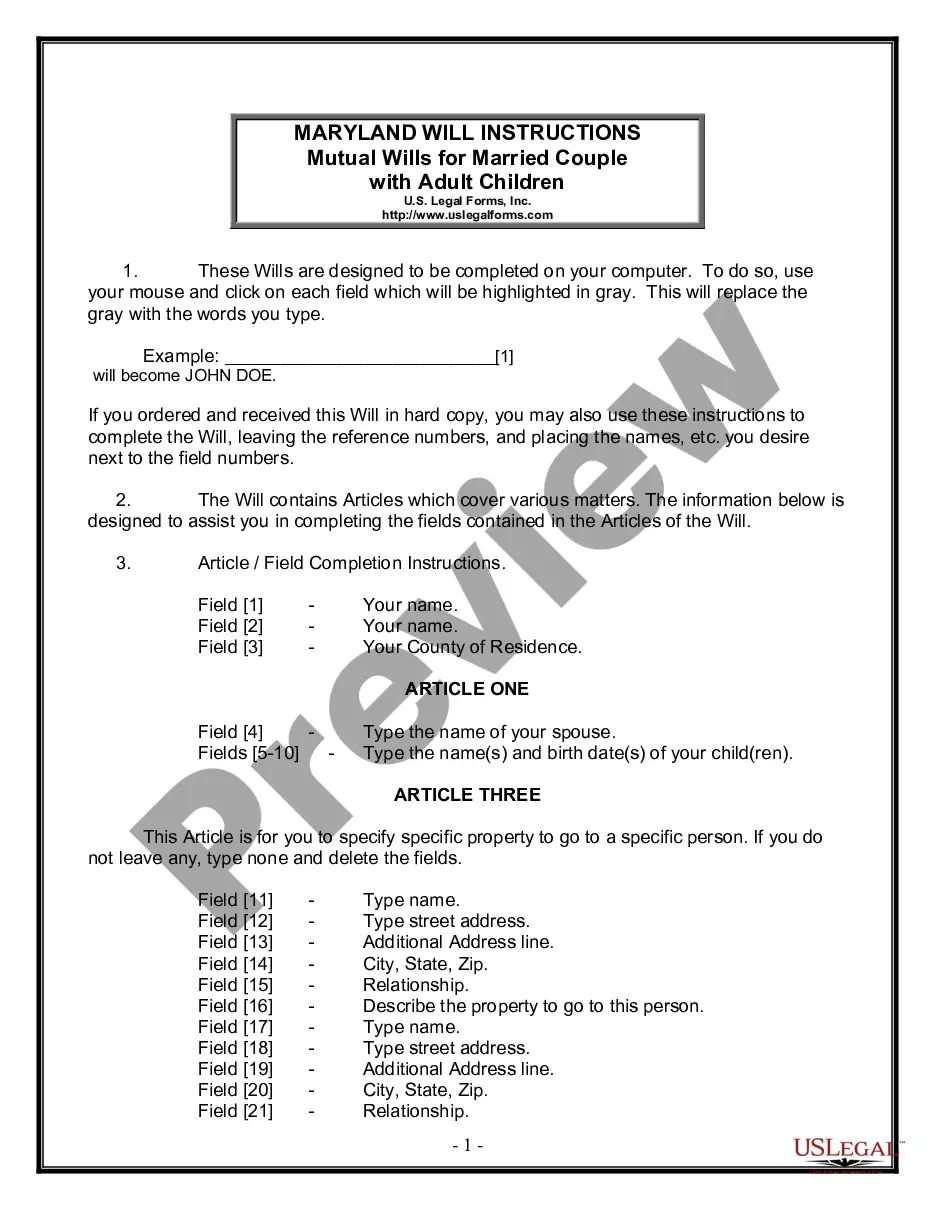

How to fill out Application For Certificate Of Discharge Of IRS Lien?

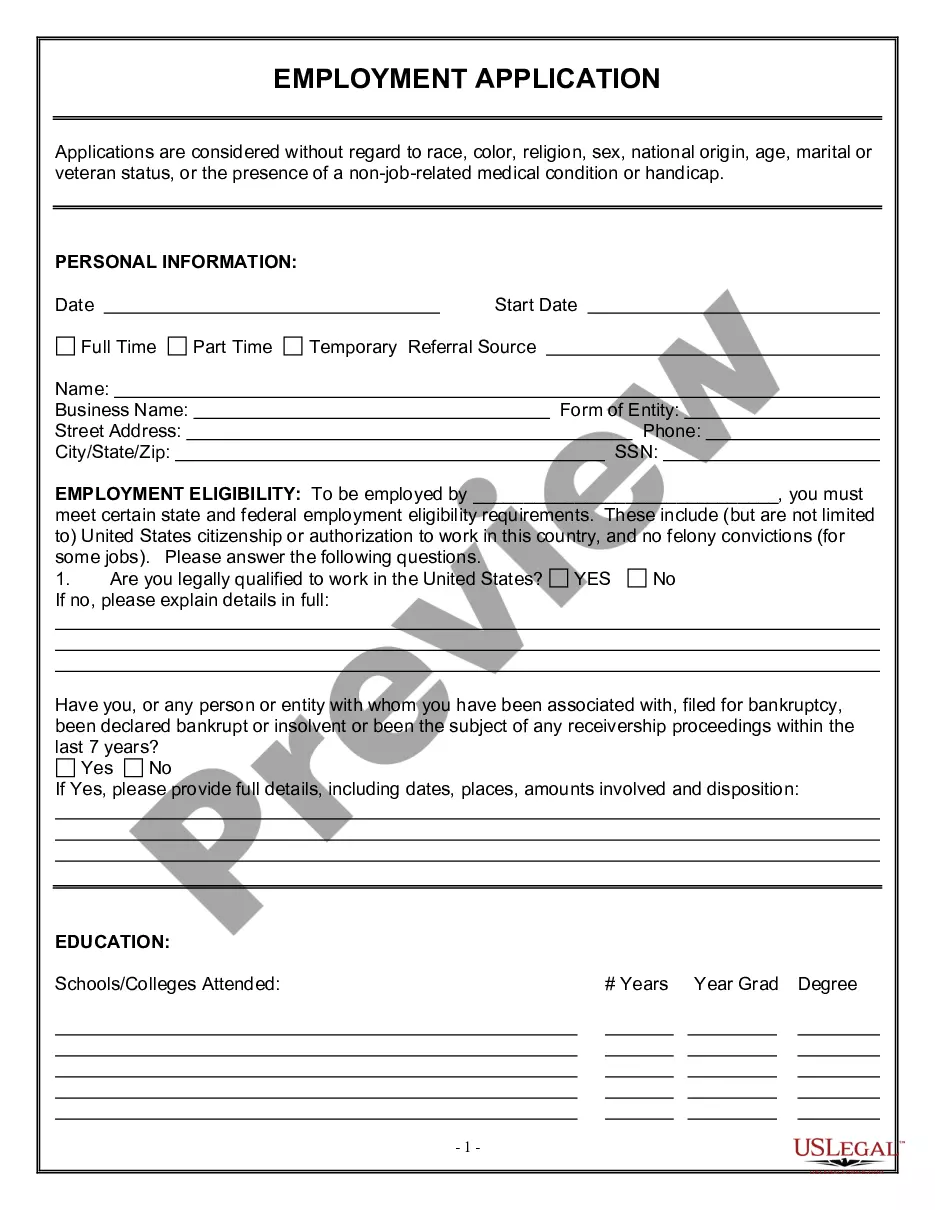

If you want to comprehensive, down load, or produce authorized document web templates, use US Legal Forms, the most important collection of authorized types, which can be found online. Take advantage of the site`s simple and easy hassle-free research to get the paperwork you will need. A variety of web templates for organization and individual reasons are sorted by types and claims, or search phrases. Use US Legal Forms to get the California Application for Certificate of Discharge of IRS Lien within a handful of clicks.

In case you are previously a US Legal Forms buyer, log in to the account and then click the Acquire switch to get the California Application for Certificate of Discharge of IRS Lien. Also you can accessibility types you previously delivered electronically in the My Forms tab of your own account.

If you are using US Legal Forms the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the form for that right area/country.

- Step 2. Take advantage of the Review choice to examine the form`s articles. Do not forget to read through the description.

- Step 3. In case you are not happy using the type, utilize the Search industry at the top of the screen to discover other versions of your authorized type format.

- Step 4. When you have discovered the form you will need, click on the Get now switch. Select the prices plan you prefer and include your references to sign up to have an account.

- Step 5. Method the transaction. You may use your credit card or PayPal account to finish the transaction.

- Step 6. Pick the format of your authorized type and down load it on the gadget.

- Step 7. Total, edit and produce or indication the California Application for Certificate of Discharge of IRS Lien.

Every authorized document format you buy is the one you have for a long time. You have acces to every single type you delivered electronically in your acccount. Select the My Forms section and select a type to produce or down load again.

Remain competitive and down load, and produce the California Application for Certificate of Discharge of IRS Lien with US Legal Forms. There are thousands of expert and express-particular types you can use for the organization or individual requirements.

Form popularity

FAQ

The IRS generally uses Form 668?W(ICS) or 668-W(C)DO to levy an individual's wages, salary (including fees, bonuses, commissions, and similar items) or other income. Form 668-W(ICS) and/or 668-W(C)(DO) also provides notice of levy on a taxpayer's benefit or retirement income.

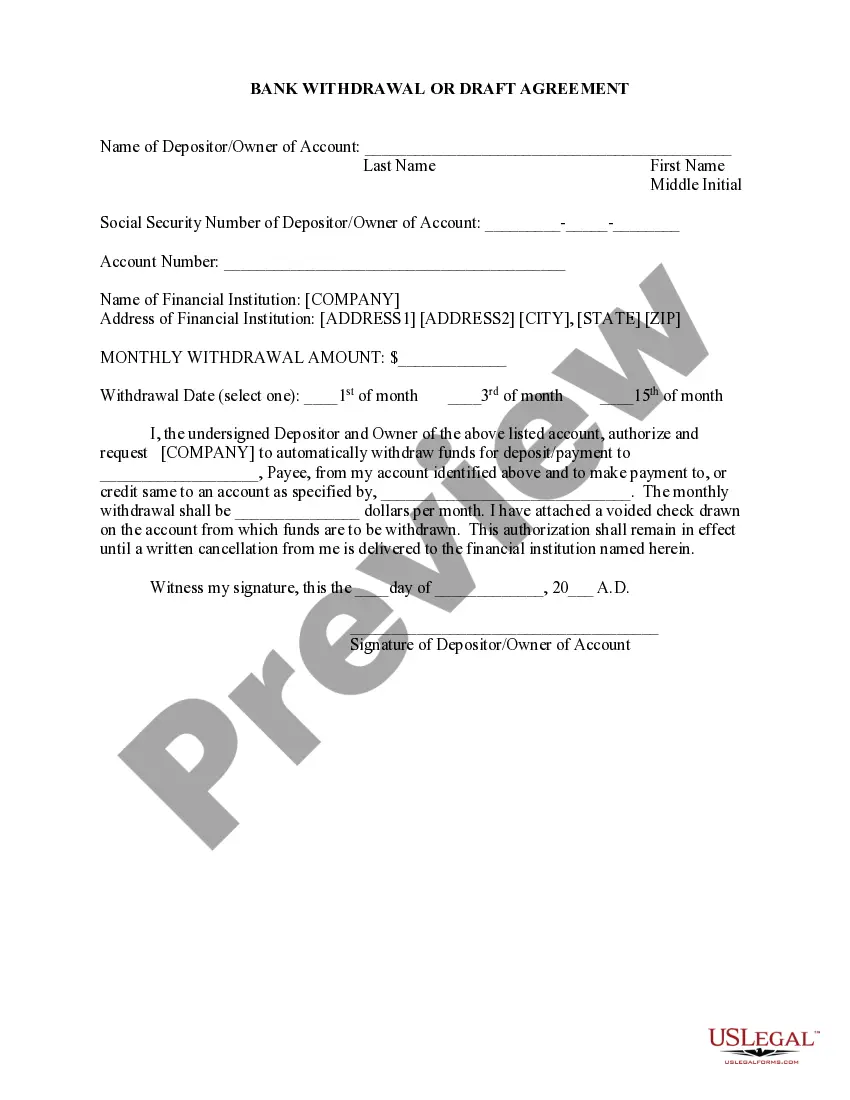

Discharge means the IRS removes the lien from property so that it may transfer to the new owner free of the lien. Use Form 14135. Subordination means the IRS gives another creditor the right to be paid before the tax lien is paid.

Generally, a Notice of Federal Tax Lien is active for ten years and thirty days from the date the tax liability is assessed. (See ?Self-Releasing Liens? section on page 4 of this publication.)

The removal of a lien on a motor vehicle or real property after the claim has been satisfied is referred to as a ?discharge of lien?.

If you've paid your tax debt or fully paid your accepted Offer in Compromise and, if applicable, the outstanding amount of any related collateral agreement, and the lien was released, you can ask the IRS in writing to withdraw the lien.

To request IRS consider discharge, complete Form 14135, Application for Certificate of Discharge of Property from Federal Tax Lien. See Publication 783, Instructions on how to apply for a Certificate of Discharge from Federal Tax Lien, for more information on how to request discharge.

Discharge means the IRS removes the lien from property so that it may transfer to the new owner free of the lien. Use Form 14135. Subordination means the IRS gives another creditor the right to be paid before the tax lien is paid.

If the Internal Revenue Service (IRS) has placed a tax lien on your property, once you've satisfied the debt, the IRS should notify you that the lien has been removed. To do so, the IRS should send you a ?Certificate of Release of Federal Tax Lien,? also known as Form 668(Z).