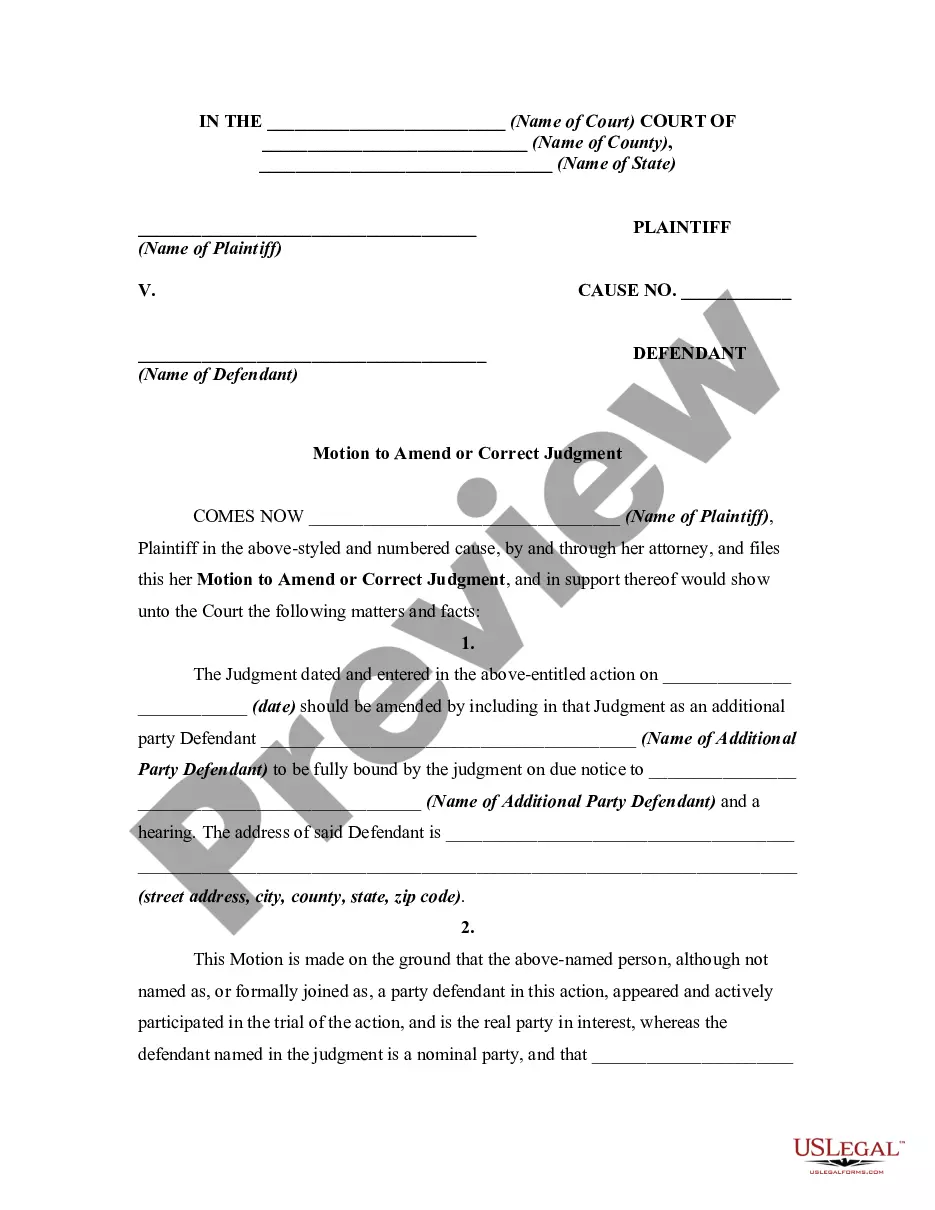

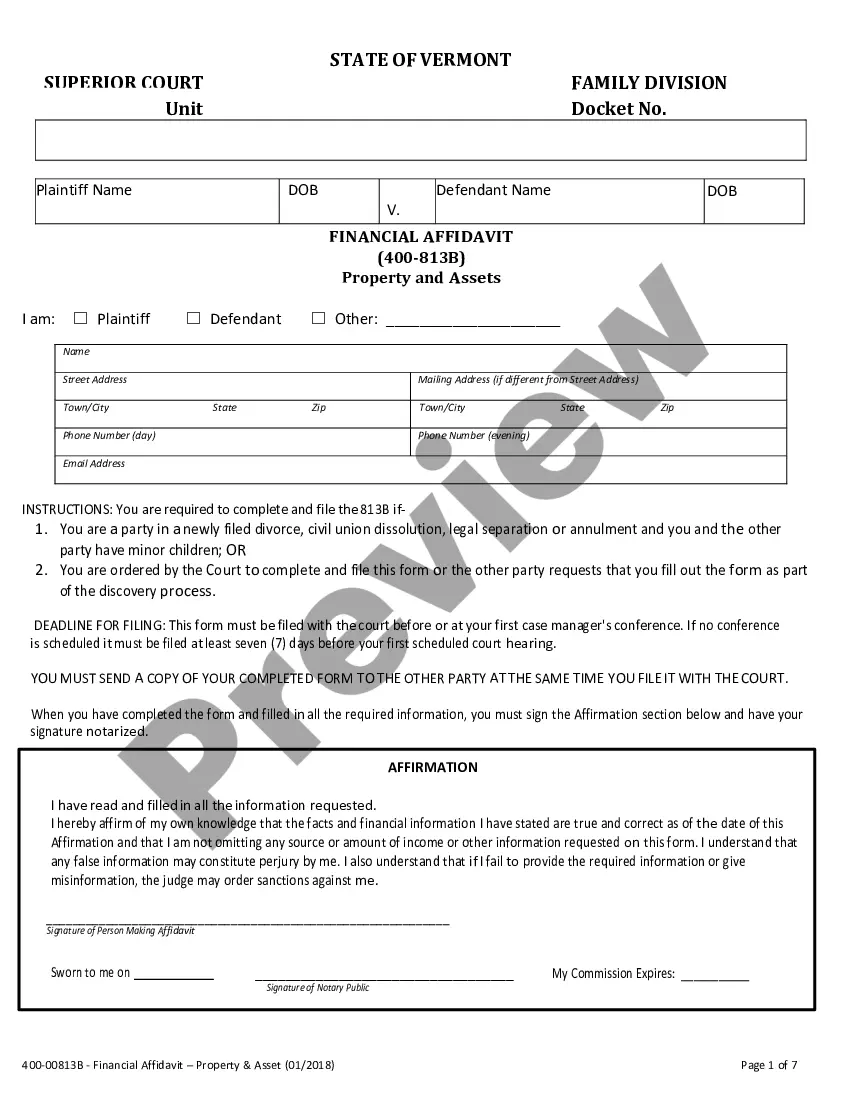

This form is an Application for Release of Right to Redeem Property from IRS After Foreclosure. Check for compliance with your specific facts and circumstances.

California Application for Release of Right to Redeem Property from IRS After Foreclosure

Description

How to fill out Application For Release Of Right To Redeem Property From IRS After Foreclosure?

You might spend numerous hours online trying to locate the correct document format that meets both state and federal requirements.

US Legal Forms offers thousands of legal templates that can be reviewed by professionals.

You can download or print the California Application for Release of Right to Redeem Property from IRS After Foreclosure from the platform.

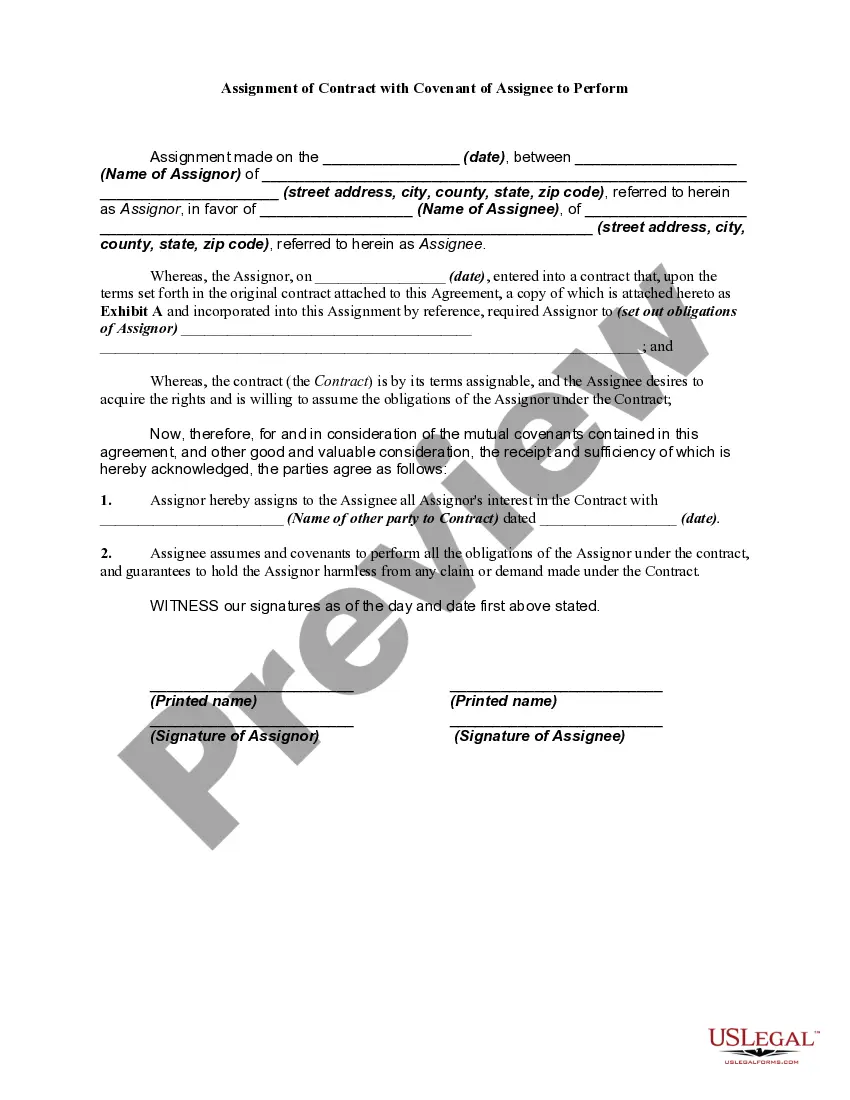

If available, utilize the Review button to look through the document format as well. To acquire another version of the form, use the Search field to find the format that suits your needs and requirements. Once you have identified the format you desire, click on Purchase now to proceed. Select the pricing plan you prefer, enter your credentials, and sign up for a free account on US Legal Forms. Complete the purchase. You can use your credit card or PayPal account to acquire the legal form. Locate the format in the document and download it to your device. Make modifications to the document if necessary. You can complete, edit, sign, and print the California Application for Release of Right to Redeem Property from IRS After Foreclosure. Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click the Download button.

- Subsequently, you can complete, modify, print, or sign the California Application for Release of Right to Redeem Property from IRS After Foreclosure.

- Every legal document format you purchase is yours indefinitely.

- To obtain an additional copy of a purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, adhere to the straightforward instructions outlined below.

- Firstly, ensure that you have selected the correct document format for the state/city of your choice.

- Review the form details to confirm that you have chosen the appropriate form.

Form popularity

FAQ

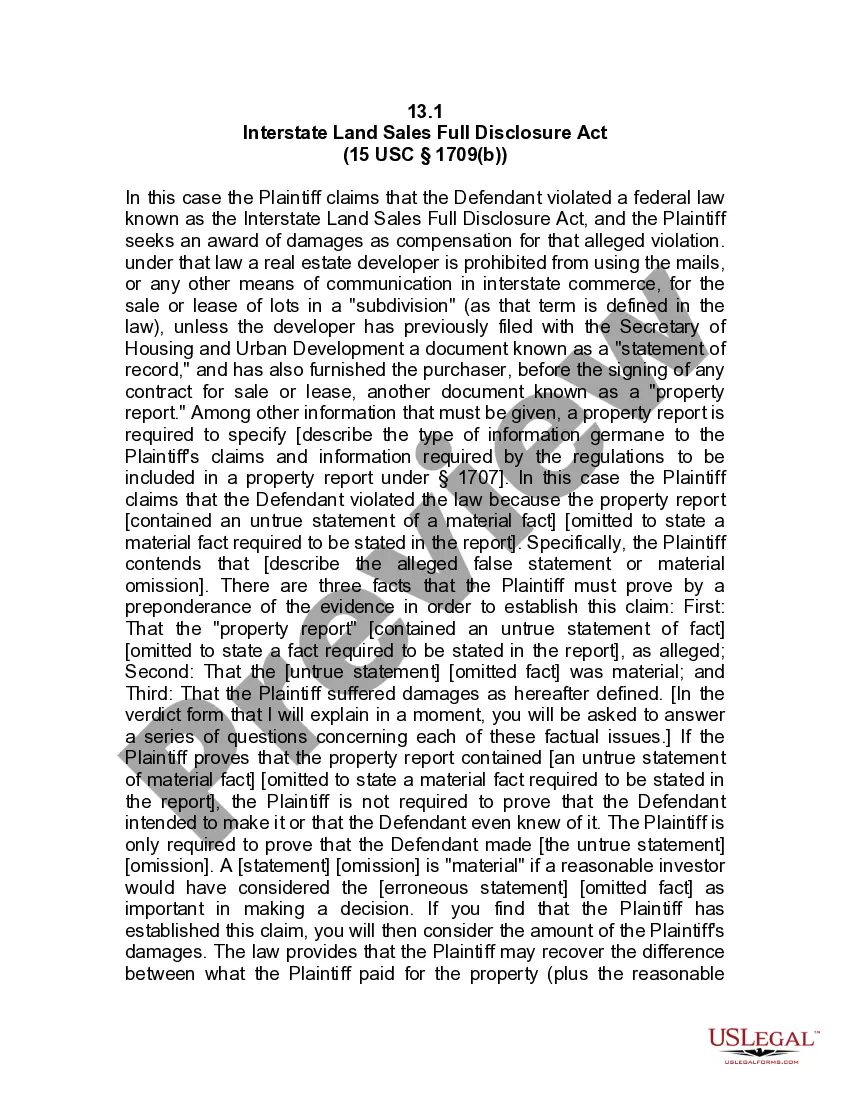

The IRS right to redeem foreclosure allows the agency to reclaim a property for a limited time after a foreclosure sale. This period typically lasts for 120 days, during which the IRS can assert its claim for unpaid tax debts. To address this issue proactively, consider the California Application for Release of Right to Redeem Property from IRS After Foreclosure to ensure your rights are protected.

The redemption period for tax deeds in California usually lasts for five years. During this time, the original owner can reclaim their property by paying the necessary taxes and fees. It's beneficial to file the California Application for Release of Right to Redeem Property from IRS After Foreclosure to clarify any IRS claims on your property during this period.

In California, the right of redemption allows property owners to reclaim their property after a foreclosure sale by paying the full amount owed. This right typically exists until the property is sold at a public auction. Utilizing resources like the California Application for Release of Right to Redeem Property from IRS After Foreclosure can help streamline this process.

The IRS right of redemption in a foreclosure allows the IRS to claim the property for a certain period, usually within 120 days after the sale. This right ensures that the IRS can secure any tax debts owed by the property owner. To effectively navigate this process, consider the California Application for Release of Right to Redeem Property from IRS After Foreclosure.

The right to redeem property after a foreclosure allows the original owner to reclaim their property by paying off the debt within a specific period. This right varies by state, but in California, it generally extends until the property is sold. Understanding this right is essential, especially when considering the California Application for Release of Right to Redeem Property from IRS After Foreclosure.

Foreclosure redeemed means that the property owner has reclaimed ownership of the property after a foreclosure sale. This process often involves paying off the amount owed, including any interest and fees. Filing the California Application for Release of Right to Redeem Property from IRS After Foreclosure is a crucial step to ensure that the IRS does not retain a claim on the property.

The IRS 7 year rule refers to the time frame in which negative information, including tax liens, can remain on your credit report. After seven years, the IRS typically removes this information, potentially improving your credit score. However, it's important to understand that the lien itself may still exist until you file the California Application for Release of Right to Redeem Property from IRS After Foreclosure.

After foreclosure, the federal tax lien may remain attached to the property. This means that even if you lose the property, the IRS can still pursue the debt. To remove the lien, you may need to file a California Application for Release of Right to Redeem Property from IRS After Foreclosure. This application can help you regain your rights and clear the lien, allowing you to move forward without the burden of the tax debt.