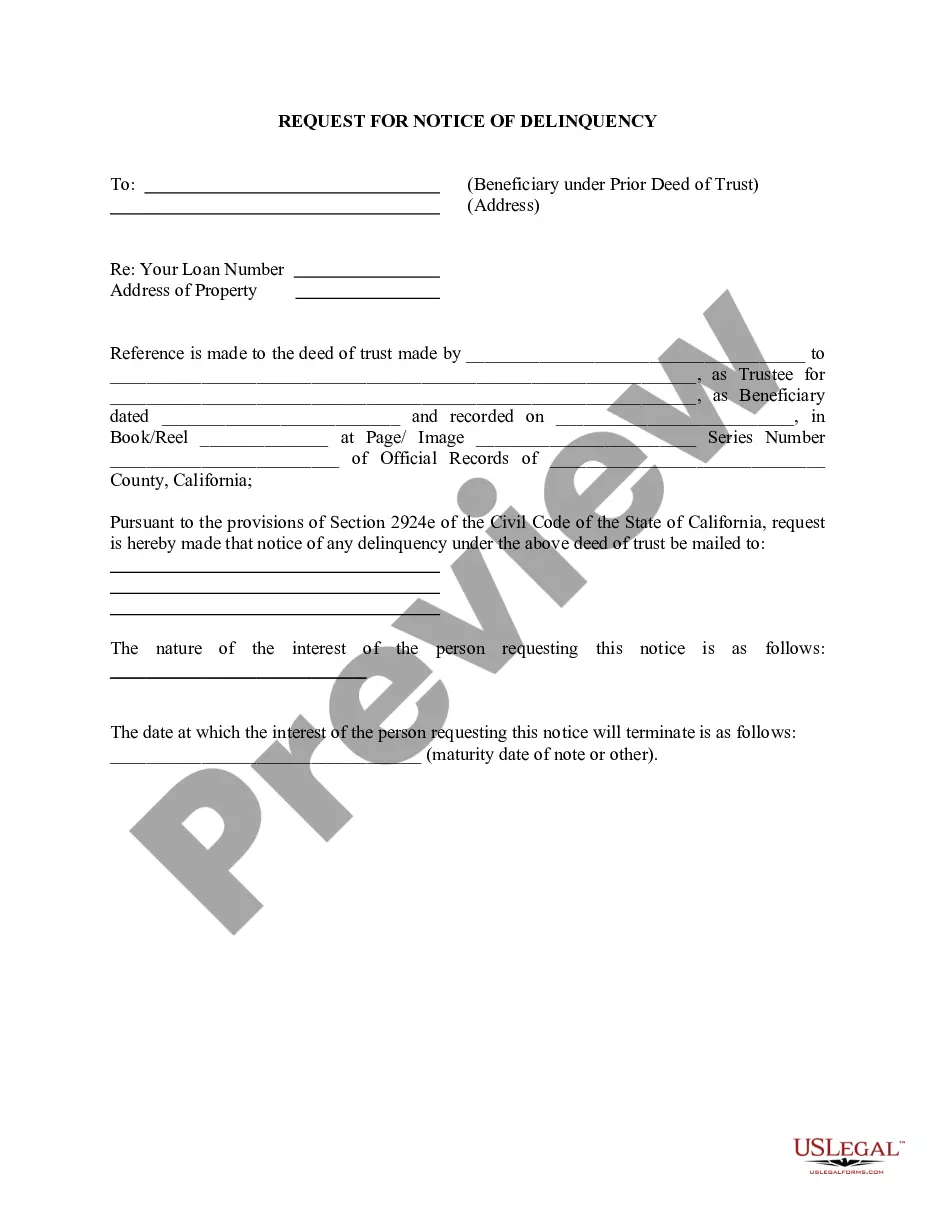

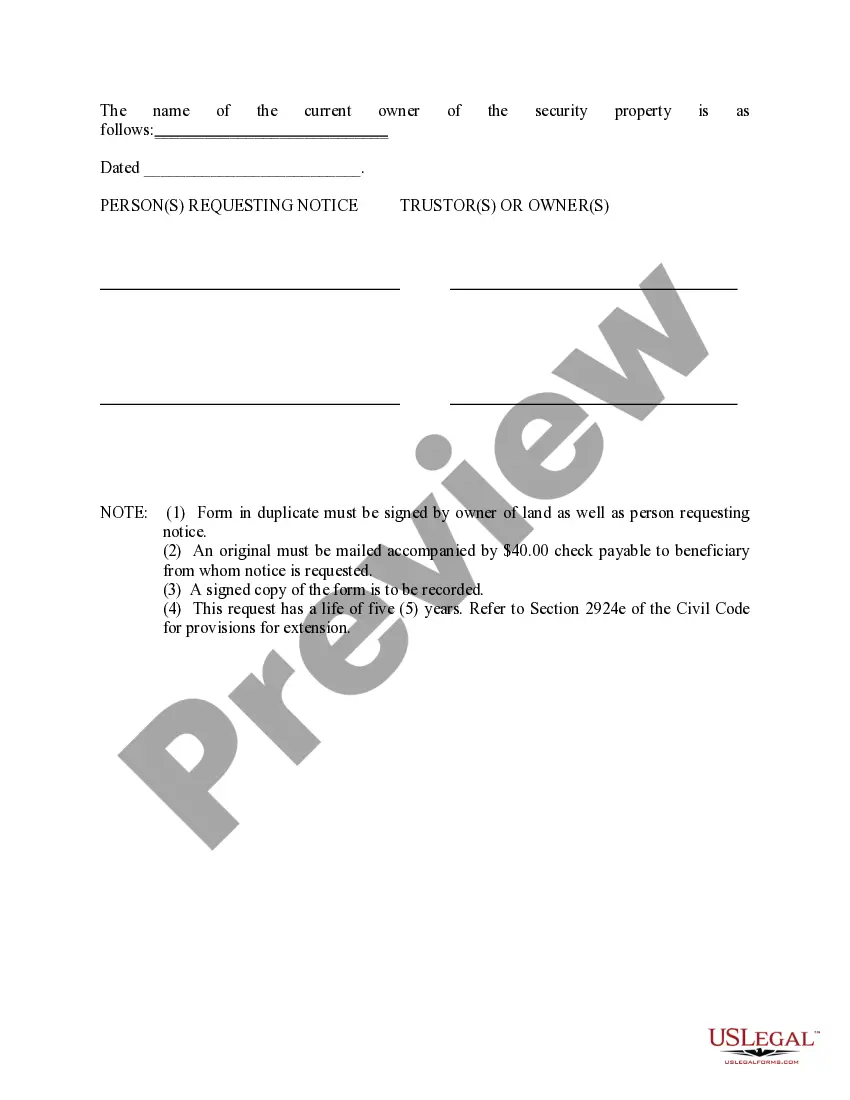

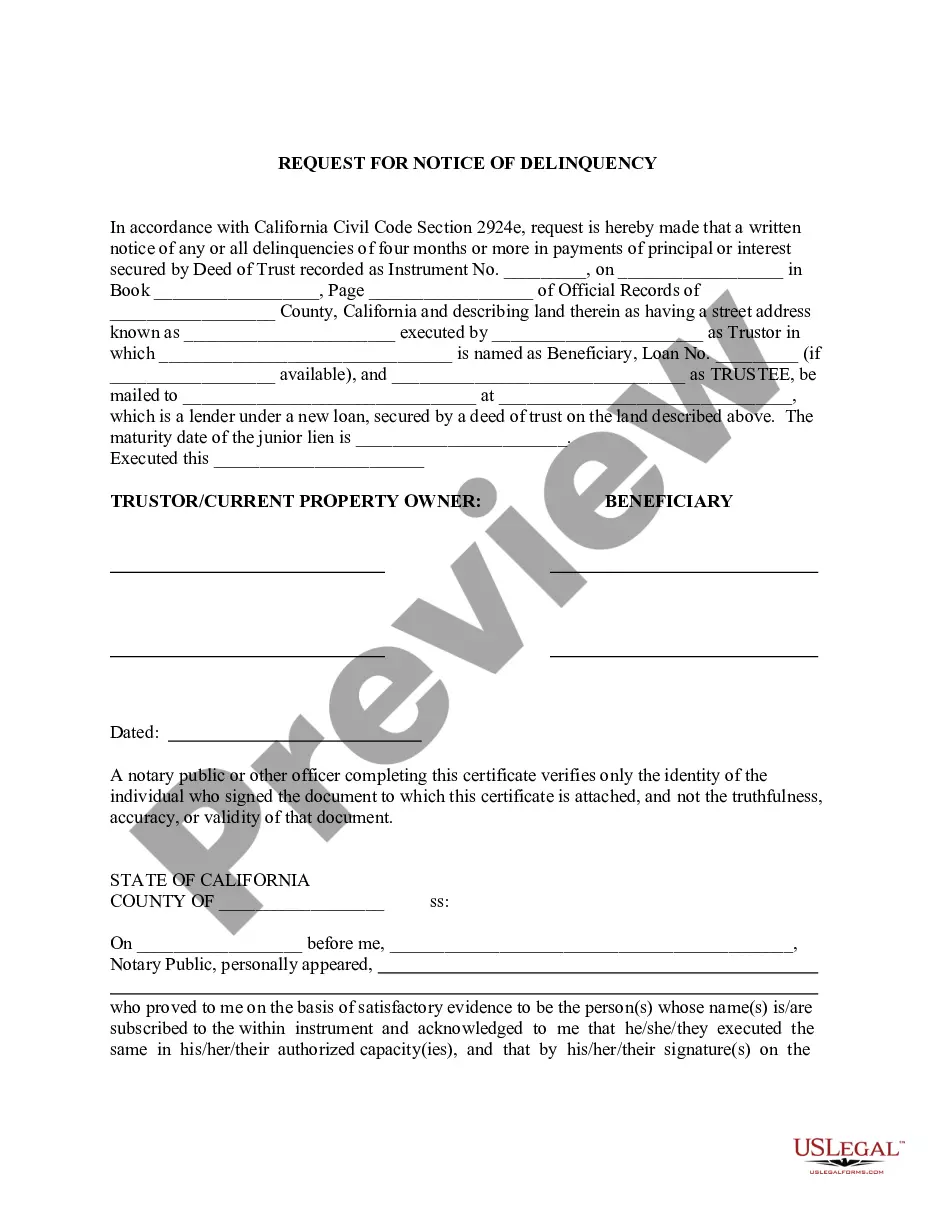

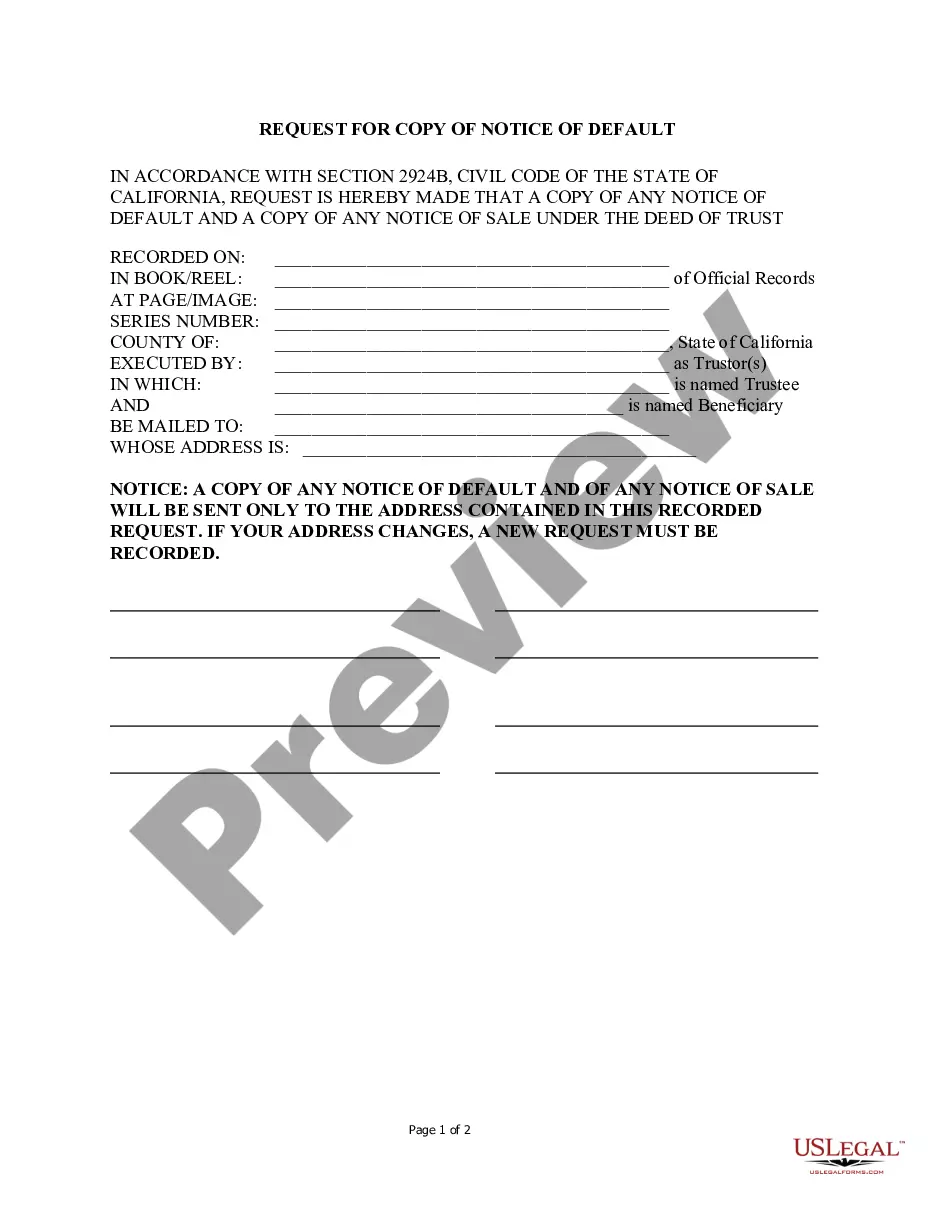

A California Request for Notice of Delinquency (also known as a Notice of Default) is a legal document that is sent by a lender to a borrower when the borrower has not made timely payments on a loan. The notice informs the borrower that they are in default of the loan and provides them with an opportunity to cure the delinquency before the lender initiates foreclosure proceedings. The notice also provides the borrower with the right to reinstate the loan and the option to redeem the loan if foreclosure proceedings are initiated. There are two types of California Request for Notice of Delinquency: the Notice of Default and the Notice of Sale. The Notice of Default informs the borrower that they are in default and must take action to cure the delinquency within 90 days or face foreclosure. The Notice of Sale is sent when the borrower has failed to take action within the 90-day period and informs the borrower that a foreclosure sale will take place within 21 days.

California Request for Notice of Delinquency

Description

How to fill out California Request For Notice Of Delinquency?

Dealing with official paperwork requires attention, precision, and using well-drafted blanks. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your California Request for Notice of Delinquency template from our library, you can be sure it complies with federal and state laws.

Working with our service is simple and fast. To obtain the required paperwork, all you’ll need is an account with a valid subscription. Here’s a brief guide for you to find your California Request for Notice of Delinquency within minutes:

- Make sure to attentively examine the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for an alternative formal blank if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the California Request for Notice of Delinquency in the format you need. If it’s your first time with our service, click Buy now to proceed.

- Register for an account, select your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to save your form and click Download. Print the blank or add it to a professional PDF editor to submit it electronically.

All documents are drafted for multi-usage, like the California Request for Notice of Delinquency you see on this page. If you need them one more time, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and accomplish your business and personal paperwork quickly and in full legal compliance!

Form popularity

FAQ

In the context of mortgage foreclosure, a notice of default is a formal notice that a lender filed with courts to notify the borrower who has failed to make payments that the lender intends to conduct a sale foreclosure.

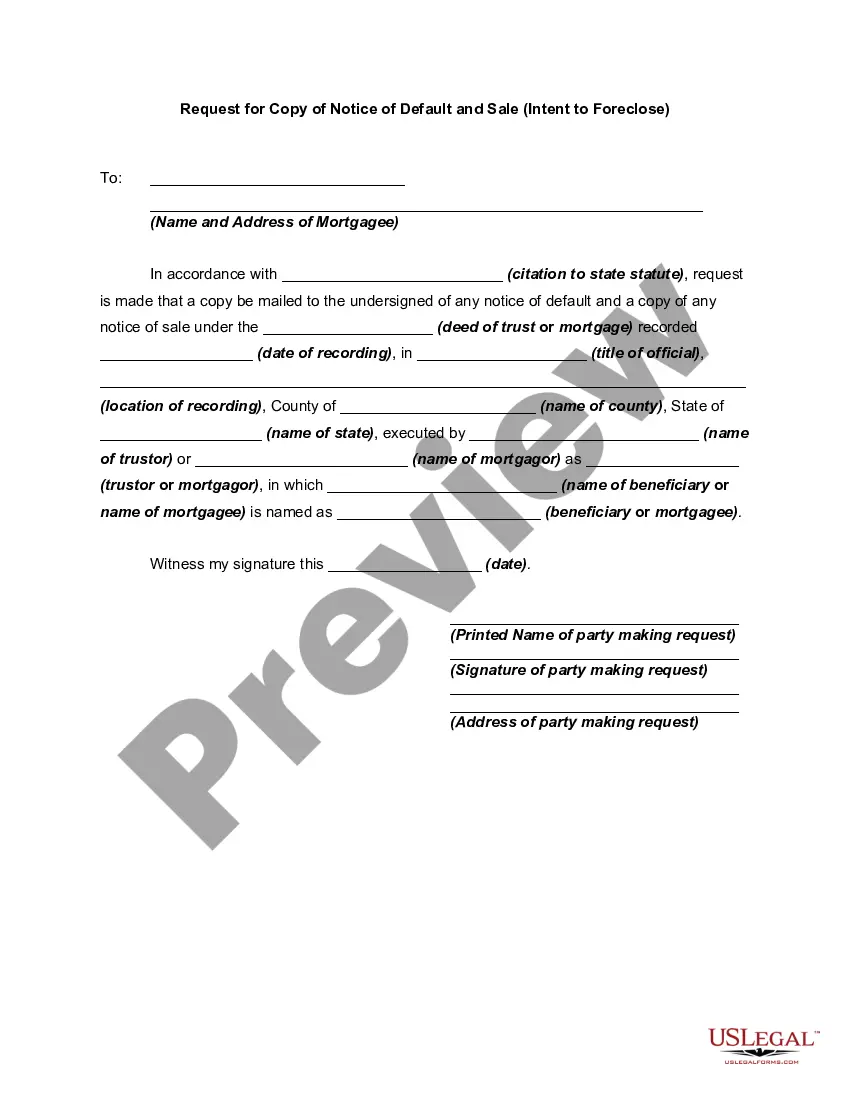

Request for Notice means a written notice given to the City by a Mortgagee specifying the name and address of such Mortgagee and attaching thereto a true and complete copy of the Mortgage held by such Mortgagee.

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

This notice is sent when the Department's records indicate that the taxpayer did not file a return by its due date. There are many versions of the Delinquent Notice, based on tax type.

A document where the current lender agrees to makes their encumbrance deed of trust, subject-to (junior) to another loan. 8. Request for Notice of Default. A document whereby the junior lenders require the senior lender to notify them when the borrower defaults on their loan.

Notice of Trustee Sale ? If you don't pay within 90 days, a Notice of Trustee Sale will be recorded against your property. This Notice tells you the date, time, and place your home will be sold. The Notice of Trustee Sale must be mailed to you at least 20 days before the day they plan to sell your home.

A notice of default is a public notice that a borrower is behind on their mortgage payments. (Also known as being in default on their loan.) It's typically filed with a court and regarded as the first step in the foreclosure process.

Technically speaking, a notice of default is not a foreclosure. Instead, it serves as notice that you are behind in your payments and that your property may be sold as a result of foreclosure if you don't act soon.