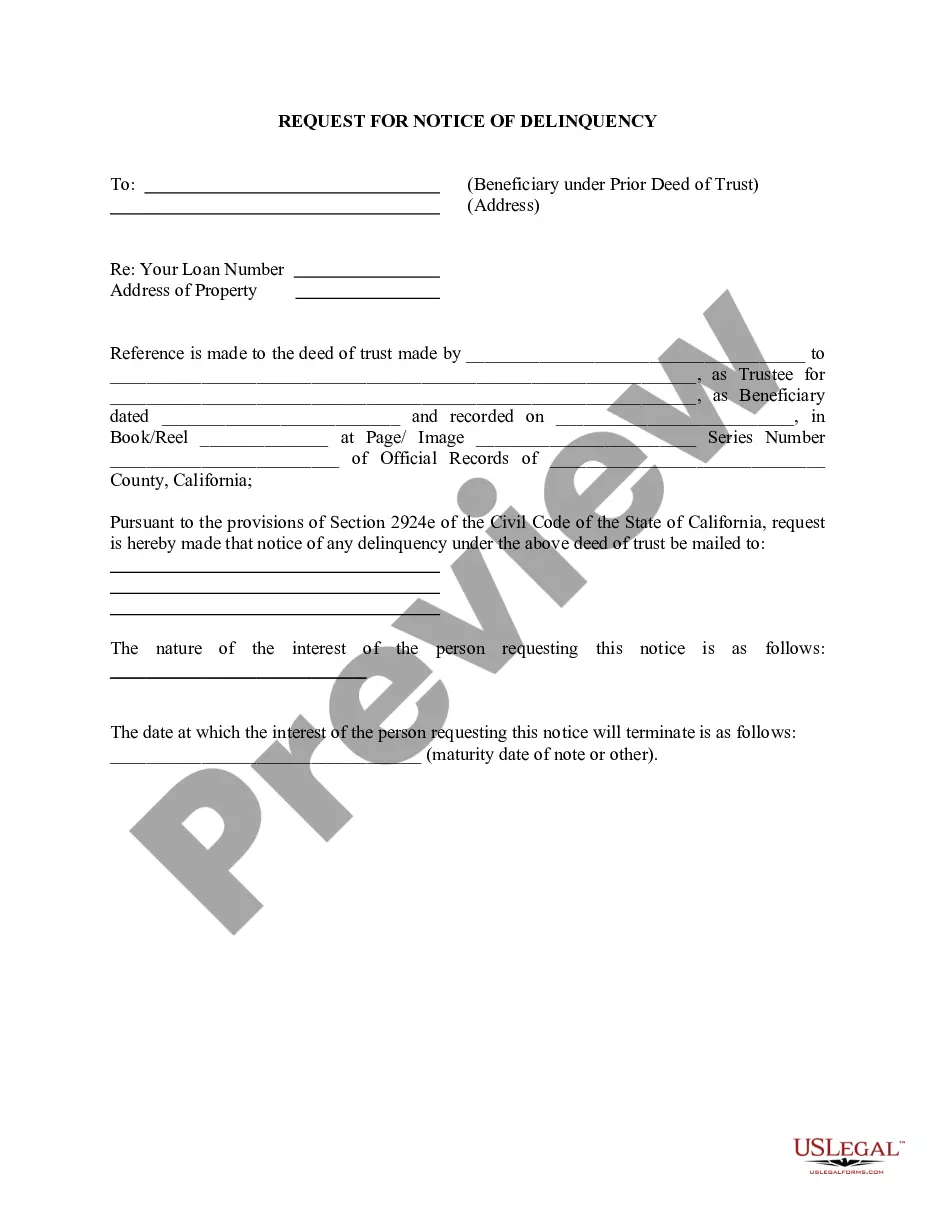

California Request for Notice of Delinquency is a legal document used to request notification of delinquency from a borrower or lender. It can be used in a variety of situations, such as when a loan is in default, when a borrower has missed payments, or when a borrower is delinquent in other financial obligations. There are two main types of California Request for Notice of Delinquency: 1. The Notice of Default: This is a document sent to a borrower who is in default on their loan. It informs the borrower of the default and provides information on how to cure the delinquency. 2. The Notice of Acceleration: This document is sent to a borrower who has missed payments and is in danger of having their loan accelerated. It informs the borrower that the loan is in danger of being accelerated and advises them on how to remedy the delinquency.

California Request for Notice of Delinquency

Description

Key Concepts & Definitions

Request for Notice of Delinquency: A formal request made by a creditor or a service provider to a borrower or client notifying them of past due payments. This notice is often a preliminary step before taking further legal action to recover the owed amount.

Step-by-Step Guide

- Identify the Delinquency: Review account records to confirm the delinquency status and the amount overdue.

- Prepare the Notice: Draft a formal notice stating the details of the delinquency, including the total amount due and the deadline for payment. Ensure that the notice adheres to any applicable state and federal laws.

- Send the Notice: Send the notice via a method that can be tracked, such as certified mail, to ensure there is proof of delivery.

- Follow-up: If the notice does not result in payment, prepare to take further legal action such as hiring a collection agency or filing a lawsuit.

Risk Analysis

- Legal Compliance Risks: Incorrect or aggressive wording in the notice can violate debt collection laws and lead to legal penalties.

- Reputation Risks: Handling delinquency notices poorly can damage the reputation of a business, affecting customer trust and loyalty.

- Financial Risks: There is a possibility that the costs involved in the notice and follow-up actions might not result in debt recovery, impacting financial stability.

Common Mistakes & How to Avoid Them

- Not Verifying Debt: Always confirm the debt's legitimacy and the details before issuing a notice.

- Ignoring Legal Requirements: Familiarize with local laws concerning debt collection to avoid legal repercussions.

- Poor Record Keeping: Maintain accurate records of all communications and transactions to support potential legal actions.

Key Takeaways

A request for notice of delinquency must be handled carefully to ensure legal compliance and maintain goodwill. Proper management of this process involves verification of debt, adherence to legal guidelines, and maintaining clear records.

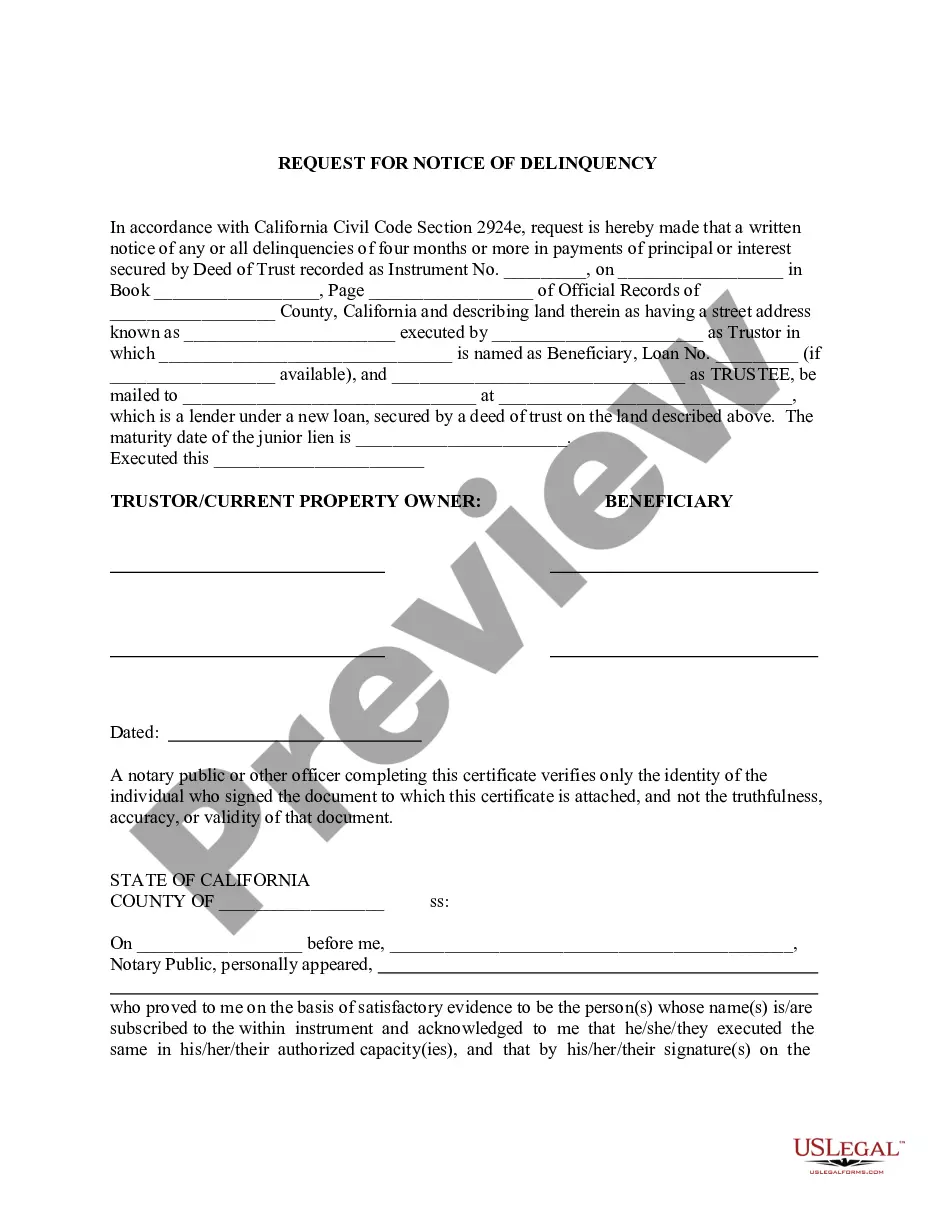

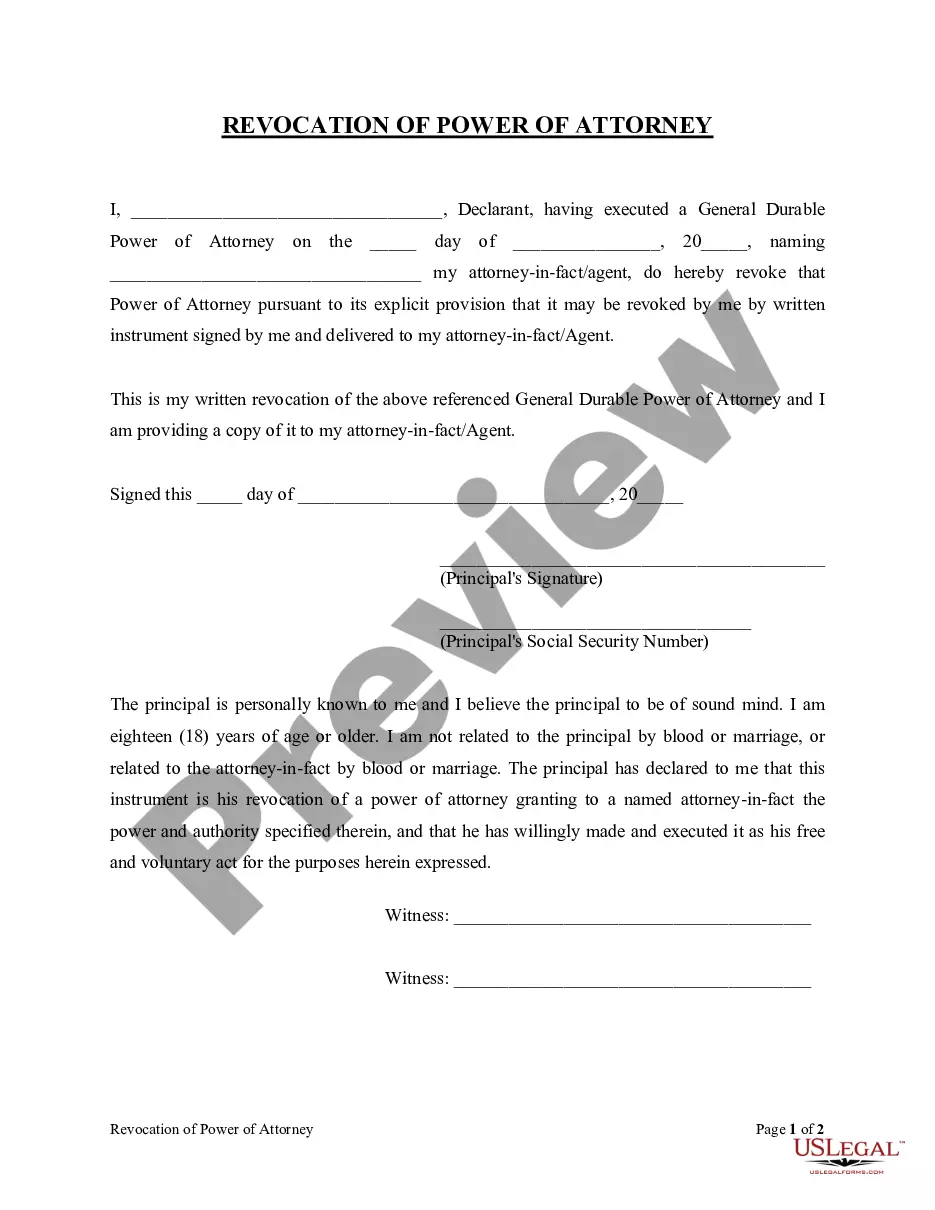

How to fill out California Request For Notice Of Delinquency?

Working with official documentation requires attention, accuracy, and using properly-drafted blanks. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your California Request for Notice of Delinquency template from our library, you can be sure it complies with federal and state regulations.

Dealing with our service is simple and fast. To obtain the required document, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to obtain your California Request for Notice of Delinquency within minutes:

- Remember to attentively look through the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Look for an alternative official template if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the California Request for Notice of Delinquency in the format you prefer. If it’s your first time with our service, click Buy now to proceed.

- Create an account, select your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or upload it to a professional PDF editor to submit it paper-free.

All documents are drafted for multi-usage, like the California Request for Notice of Delinquency you see on this page. If you need them in the future, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in full legal compliance!

Form popularity

FAQ

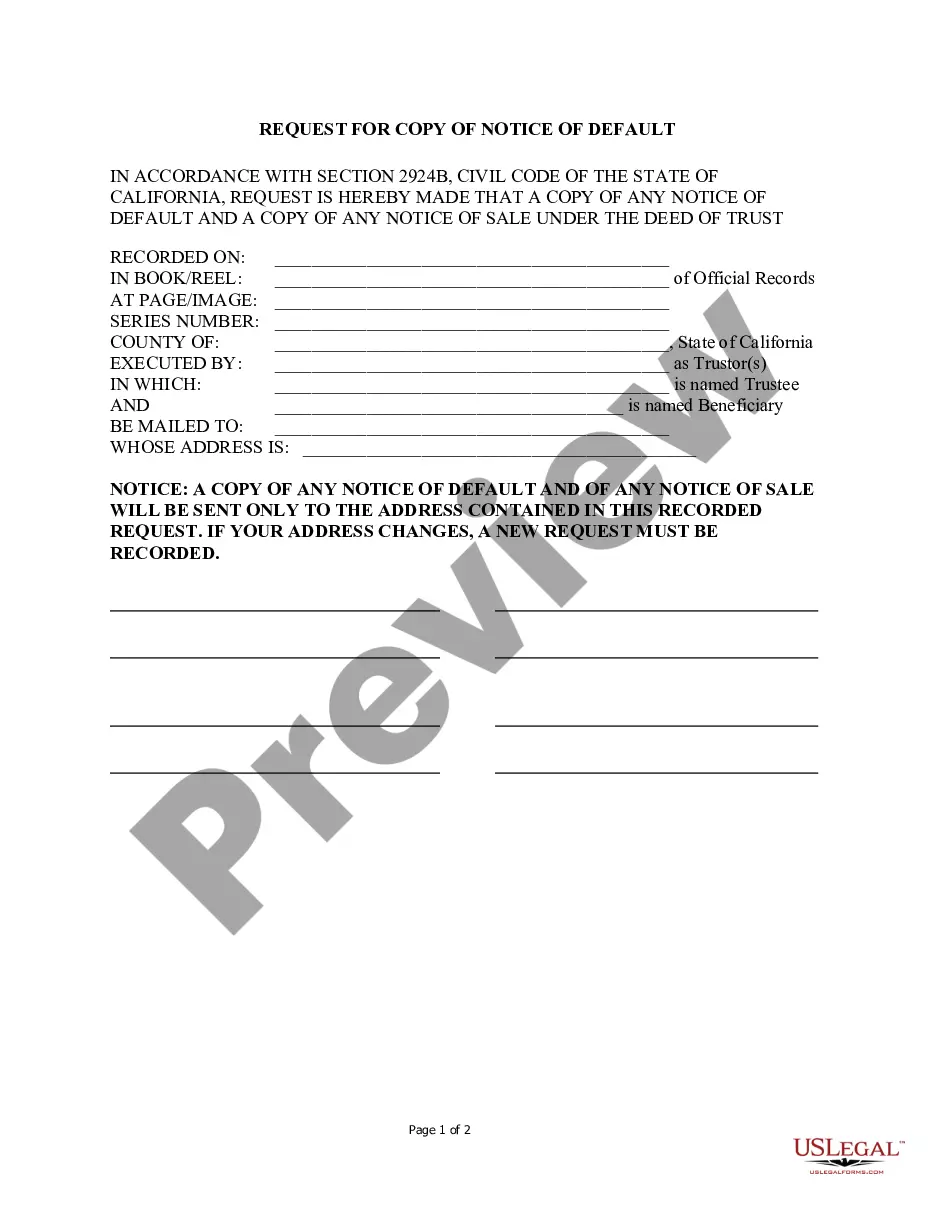

A notice of default is a public notice that a borrower is behind on their mortgage payments. (Also known as being in default on their loan.) It's typically filed with a court and regarded as the first step in the foreclosure process.

Request for Notice means a written notice given to the City by a Mortgagee specifying the name and address of such Mortgagee and attaching thereto a true and complete copy of the Mortgage held by such Mortgagee.

It is a pre-lien notice, which means that it is sent before a mechanics lien is formally recorded in California. Note that the Notice of Intent to Lien is not a required pre-lien notice in California. It is an entirely optional notice that you can serve on the property owner before you record your mechanics lien.

A document where the current lender agrees to makes their encumbrance deed of trust, subject-to (junior) to another loan. 8. Request for Notice of Default. A document whereby the junior lenders require the senior lender to notify them when the borrower defaults on their loan.

You have 90 days from the date the Notice of Default is recorded to pay what you owe to the lender. If you pay the amount on the Notice of Default, the lender cannot sell your home. Notice of Trustee Sale ? If you don't pay within 90 days, a Notice of Trustee Sale will be recorded against your property.

This notice is sent when the Department's records indicate that the taxpayer did not file a return by its due date. There are many versions of the Delinquent Notice, based on tax type.