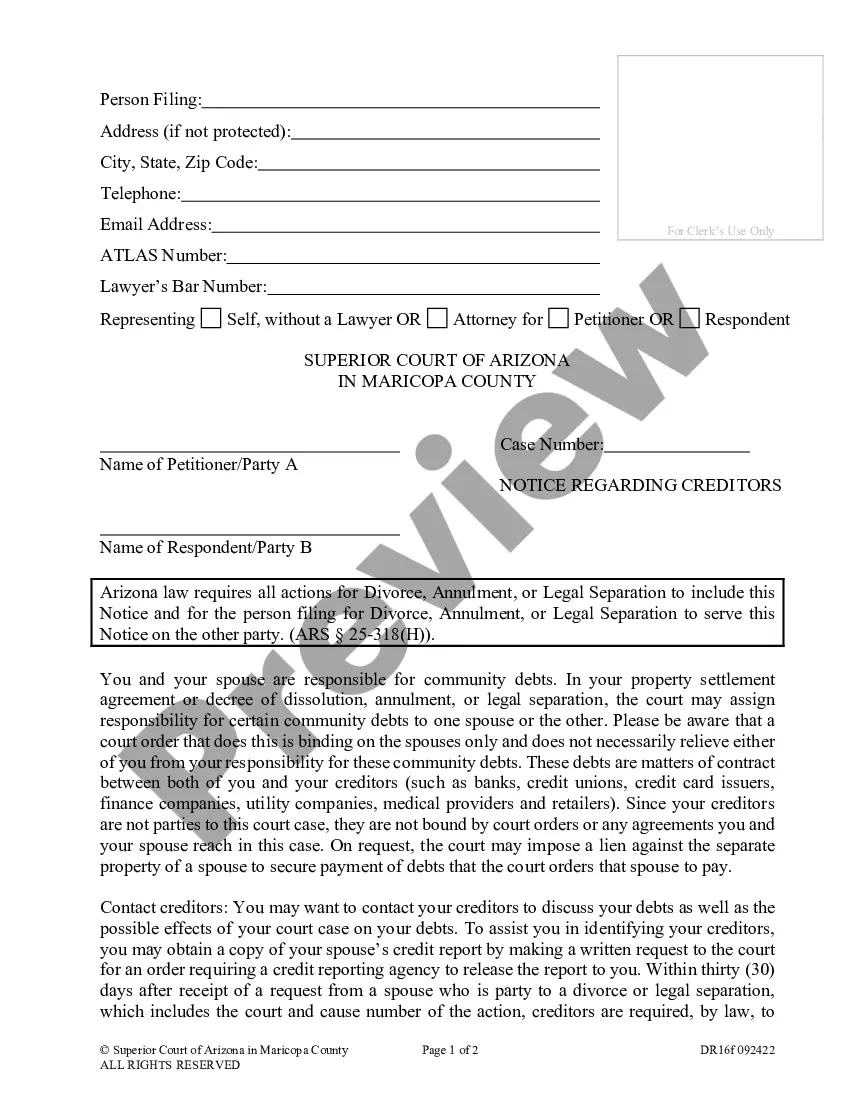

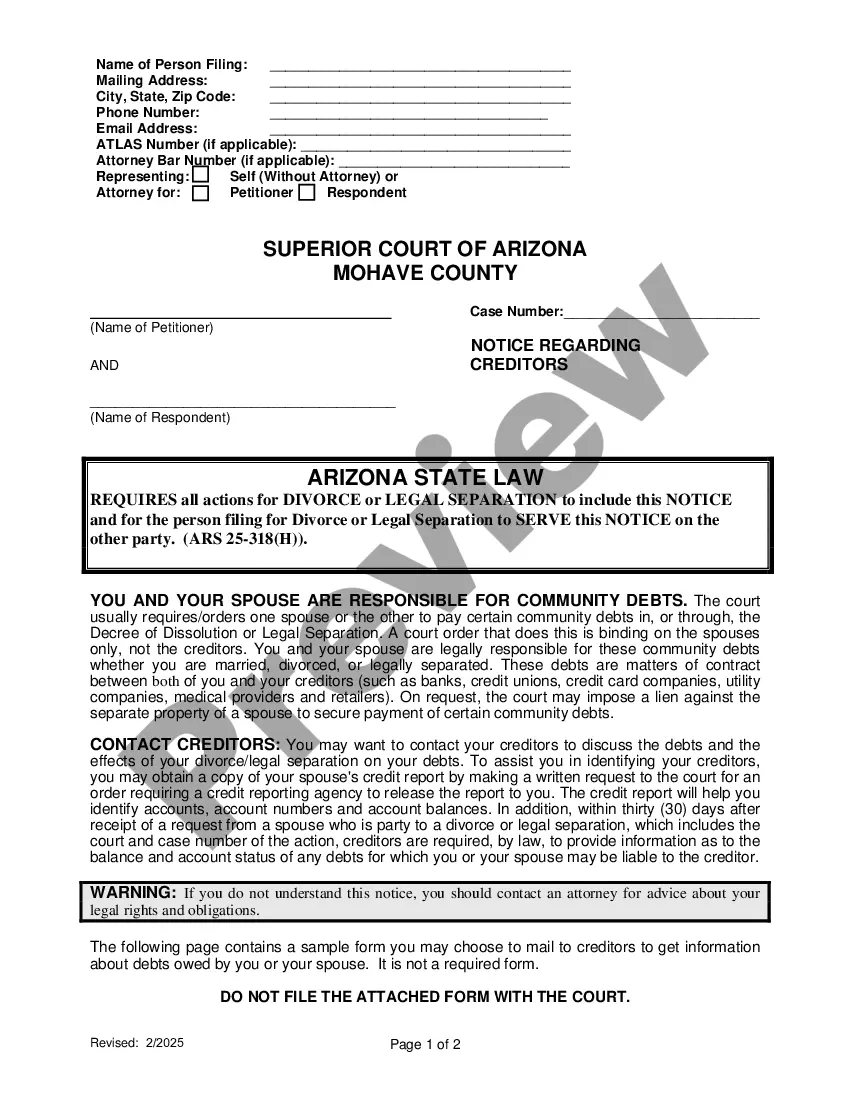

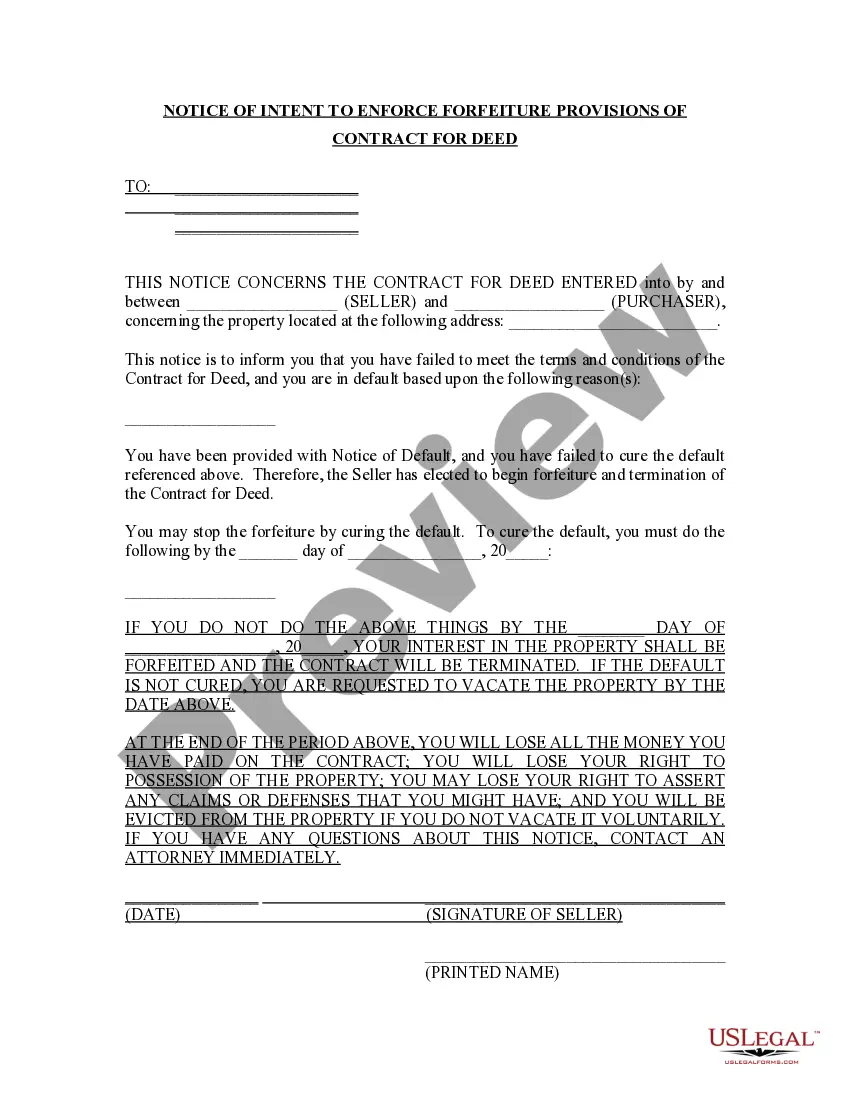

Arizona Notice Regrading Community Debts is a notice that is issued to a debtor in Arizona when a debt is owed to a community organization, such as a homeowners' association, condominium association, or other similar entity. The notice is issued by the Secretary of State or the Arizona Superior Court and informs the debtor of the amount of the debt they owe, the legal basis for the debt, and the consequences of failing to pay the debt in full. The notice will also inform the debtor of the right to dispute the debt or any portion of it. There are two types of Arizona Notice Regrading Community Debts: a default notice and a demand notice. A default notice is issued when the debtor has failed to pay the debt within the given time frame. A demand notice is issued when the debtor has failed to make a payment after the initial default notice and provides the debtor with additional time to pay the debt.

Arizona Notice Regrading Community Debts

Description

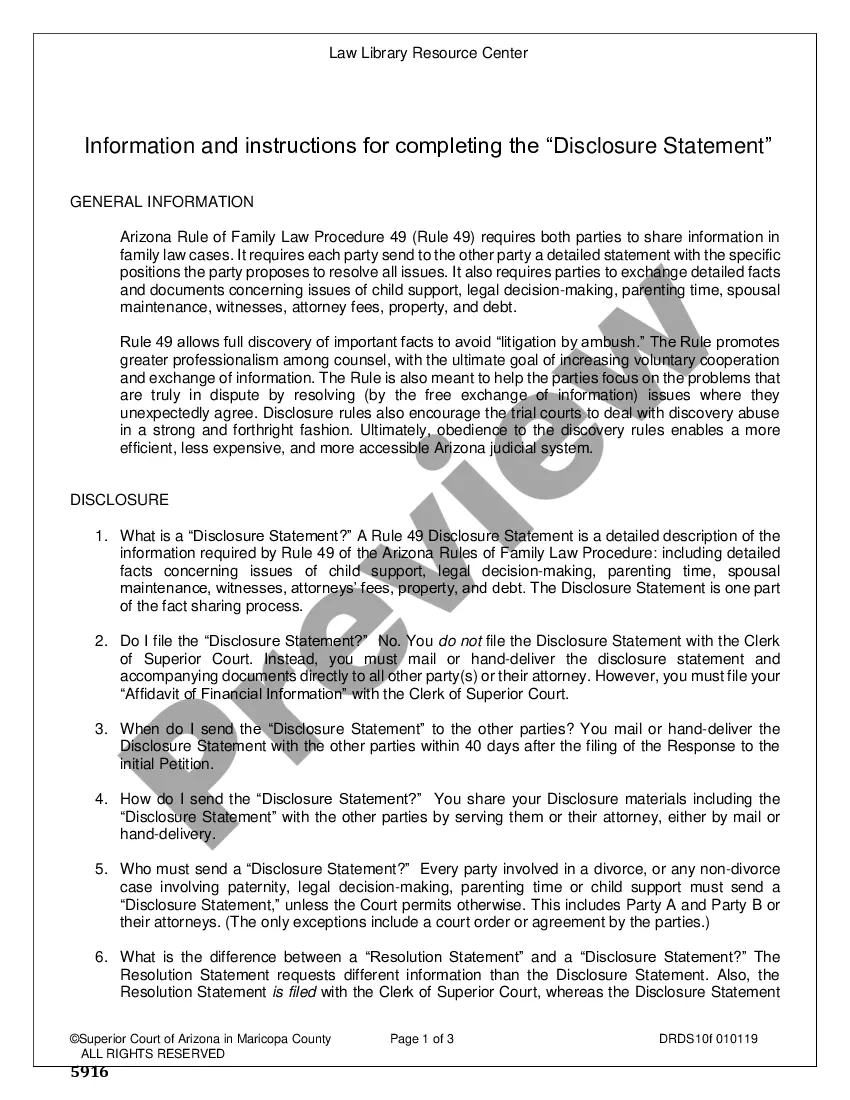

How to fill out Arizona Notice Regrading Community Debts?

US Legal Forms is the easiest and most lucrative method to find appropriate official templates.

It serves as the largest online collection of business and personal legal documents crafted and reviewed by legal experts.

Here, you can discover printable and fillable forms that adhere to national and regional regulations - just like your Arizona Notice Regarding Community Debts.

Review the form details or preview the document to ensure it meets your requirements, or discover another option by utilizing the search bar above.

Click Buy now when you’re confident about its alignment with all criteria, then select your preferred subscription plan.

- Acquiring your template involves just a few uncomplicated steps.

- Users who already possess an account with an active subscription simply need to Log In to the platform and download the document onto their device.

- After downloading, they can find it in their profile under the My documents section.

- And if you are accessing US Legal Forms for the first time, here's how you can secure a professionally prepared Arizona Notice Regarding Community Debts.

Form popularity

FAQ

In Arizona, a lien can indeed be placed on your property for your spouse's debts under certain conditions. Specifically, if the debt was incurred during the marriage and is considered a community debt, creditors may have the right to pursue your shared assets. This situation highlights the importance of understanding the Arizona Notice Regarding Community Debts, which can clarify your responsibilities. You may want to consult with a legal expert or explore resources like US Legal Forms to address your specific circumstances effectively.

In Arizona, you may be liable for your spouse’s credit card debt if it was incurred during the marriage. Arizona follows community property rules, which means shared responsibility for debts acquired while married. Understanding the Arizona Notice Regarding Community Debts will provide you with clarity on what you're responsible for. For assistance, consider using the uslegalforms platform to access legal resources tailored to your needs.

To protect yourself from your husband's debt in Arizona, consider maintaining separate accounts and assessing the debt incurred during the marriage. Being aware of the Arizona Notice Regarding Community Debts can help you understand the implications of shared financial responsibilities. Additionally, discussing your situation with a legal advisor can guide you in making informed decisions and safeguarding your assets.

In Arizona, debt collectors usually have six years to collect most types of debts, based on the statute of limitations. This timeline can vary for certain debts, so knowing the specifics is crucial for your legal standing. If you're facing debt collection, you may want to explore the provisions related to an Arizona Notice Regarding Community Debts to understand your responsibilities and options better.

In Arizona, a wife may be held responsible for her husband's debts incurred during the marriage. This responsibility typically arises from community property laws, which mean debts acquired while married are generally considered shared. Therefore, it is essential for you to understand your rights and obligations under an Arizona Notice Regarding Community Debts. Consulting with a legal expert can help clarify your situation.

The statute of limitations for most debts in Arizona is six years; however, this duration may vary depending on the type of debt. This time limit is crucial for both creditors and debtors as it defines how long a creditor can legally pursue a debt collection. Understanding the statute of limitations, as mentioned in the Arizona Notice Regarding Community Debts, can help individuals know their rights and responsibilities regarding debt resolution. Being informed empowers you to manage debt effectively.

In Arizona, several types of property are exempt from creditors, including certain personal property, wages, pensions, and a portion of your home equity. This exemption plays a vital role in protecting families from losing essential resources during financial hardships. The Arizona Notice Regarding Community Debts outlines these exemptions, helping individuals understand what assets they can retain, even in debt situations. Knowing your exemptions can ease financial pressures during challenging times.

In Arizona, an estate must be valued at more than $75,000 to require probate; however, this does not include property such as real estate. If the estate's value is below this threshold, a simpler collection process can take place. Understanding this limit is crucial when dealing with the Arizona Notice Regarding Community Debts. By clarifying these values, individuals can navigate the probate process more effectively.

In Arizona, creditors typically have a four-month period to present claims against an estate after the notice of the estate’s opening is published. This time frame allows creditors to settle debts against the estate in a timely manner. If a creditor fails to present a claim during this period, they may lose their ability to collect. This relates directly to the Arizona Notice Regarding Community Debts, which informs creditors about their rights and timelines.

The community debt law in Arizona mandates that both spouses are equally responsible for debts acquired during the marriage unless stated otherwise. This principle ensures that creditors can pursue either spouse for repayment. It's essential to stay informed about these laws, as they relate directly to the Arizona Notice Regarding Community Debts, ensuring you understand your legal standing.