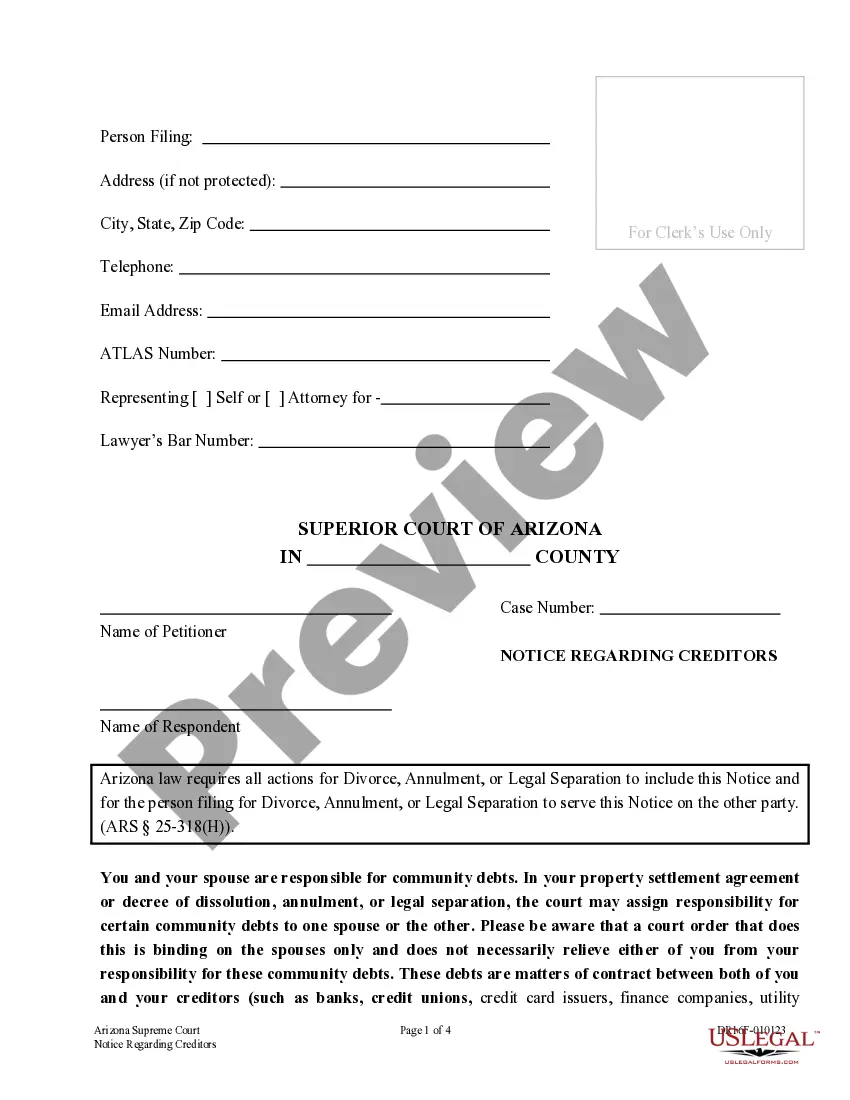

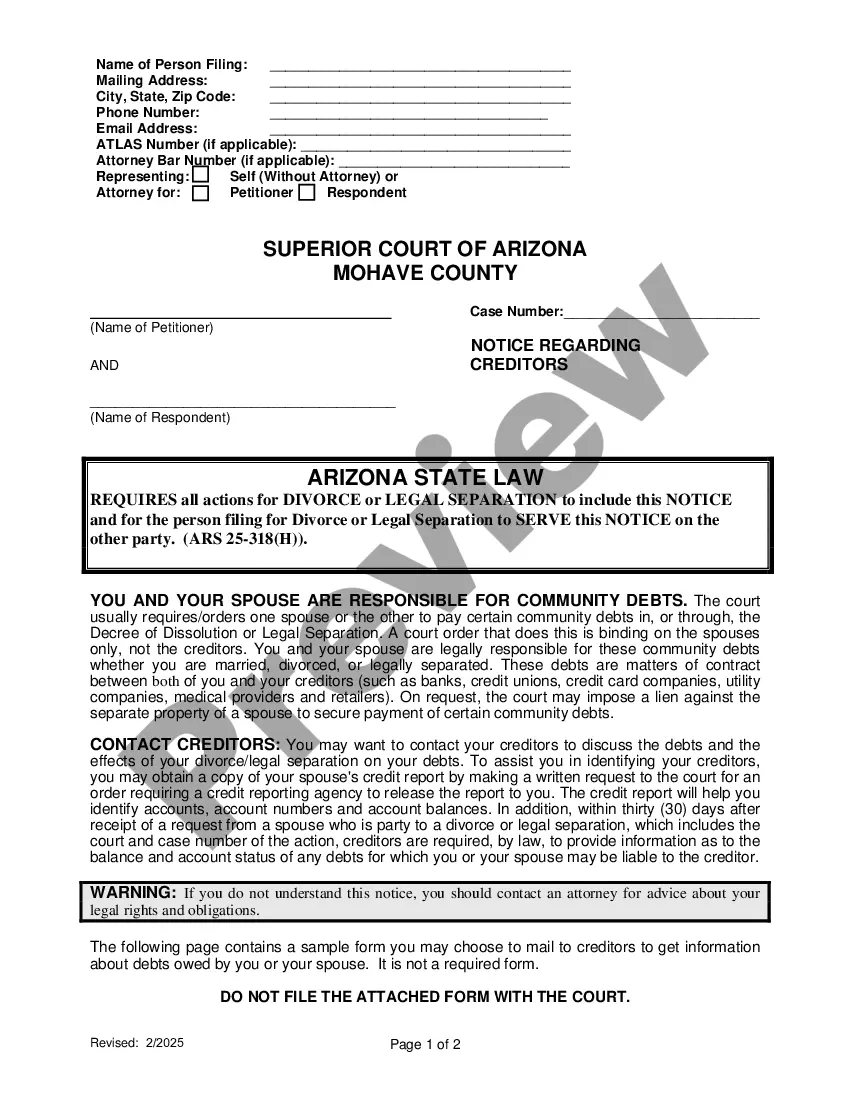

Notice Regarding Creditors: You are required by law to file this form and serve it on your spouse. It contains information about you and your spouses joint debts.

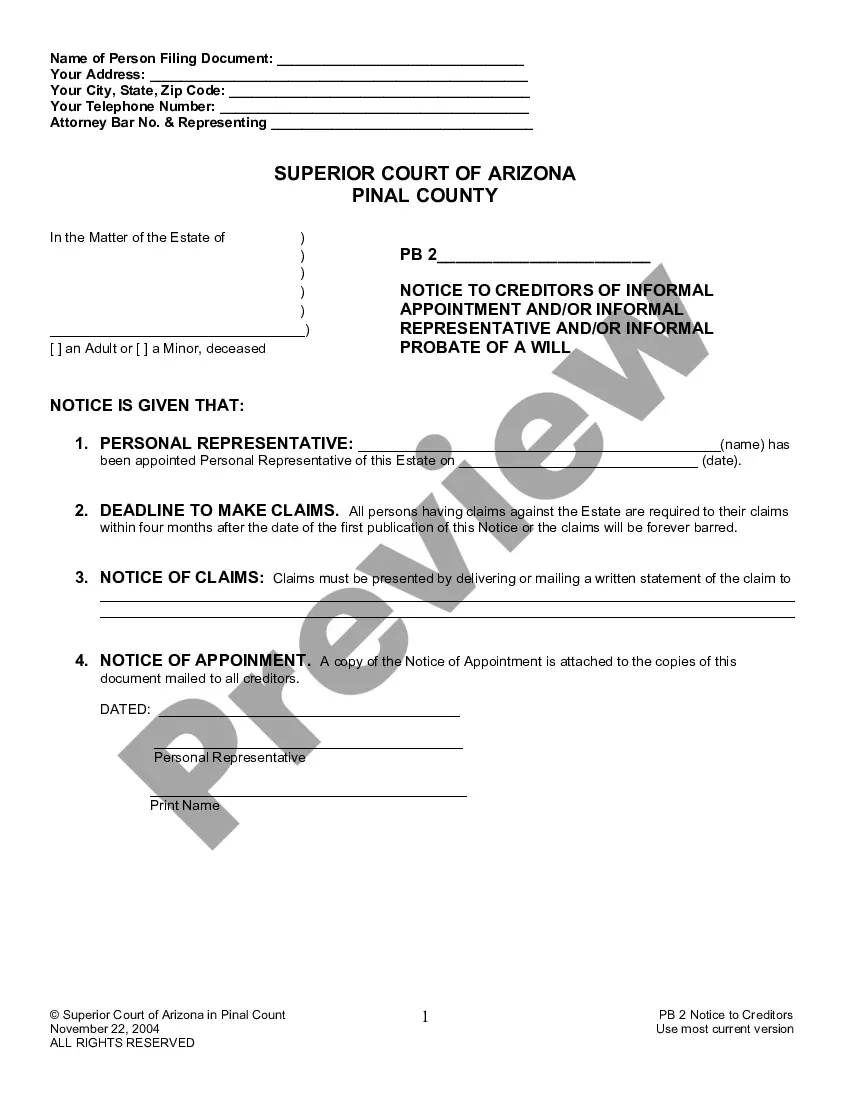

Arizona Notices Regarding Creditors is a document required by the state of Arizona that must be served to creditors of a deceased person in order to notify them of the death and the need to submit any claims against the estate. It includes the deceased person's name, date of death, and contact information for the estate's executor or administrator. There are two types of Arizona Notice Regarding Creditors: Notice of Administration and Notice of Trust. The Notice of Administration is served to creditors when the deceased person left a will or had an intestate estate. The Notice of Trust is served to creditors when the deceased person had a trust. Both types of notices must provide creditors with information about the estate and how to submit a claim for payment.