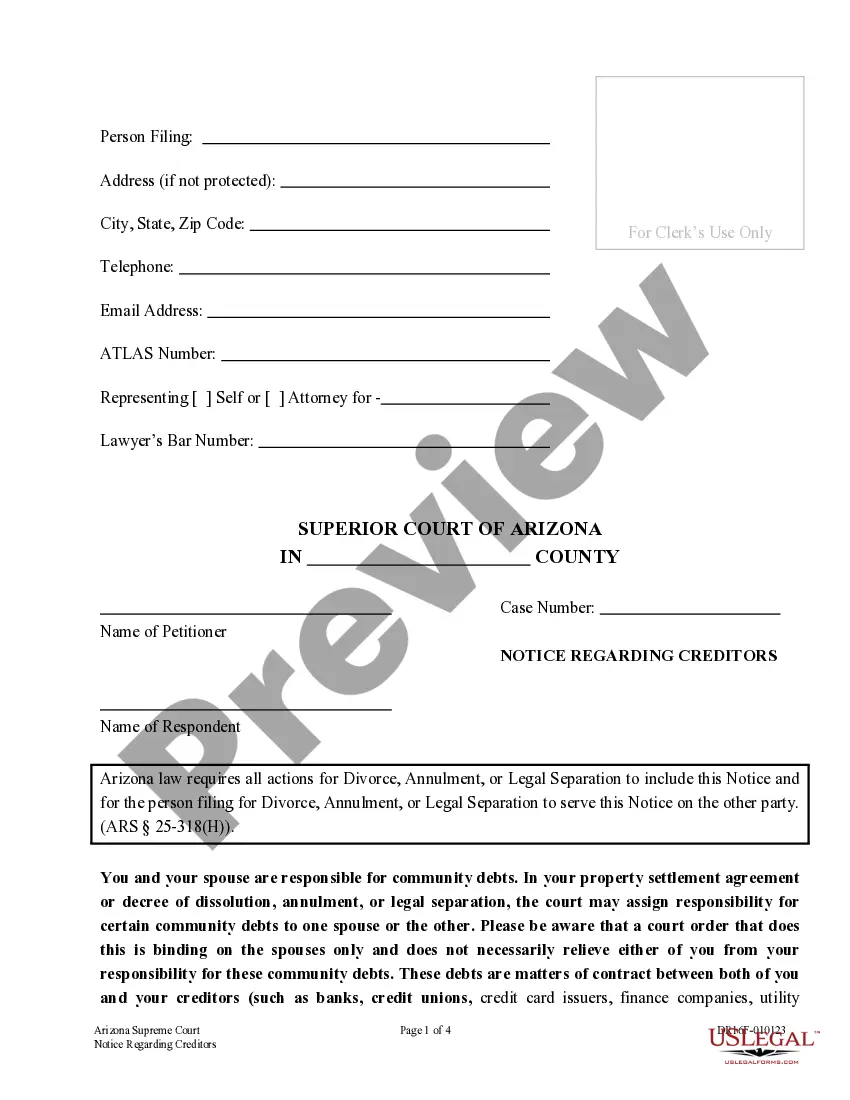

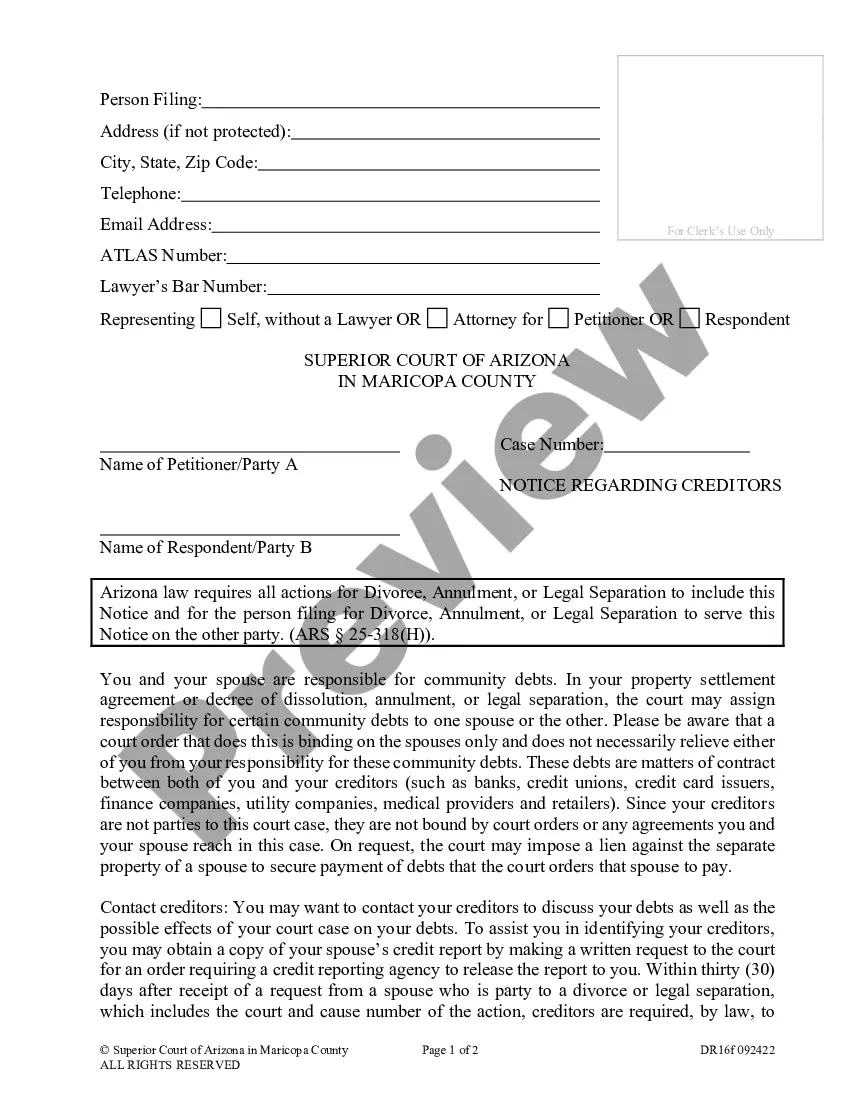

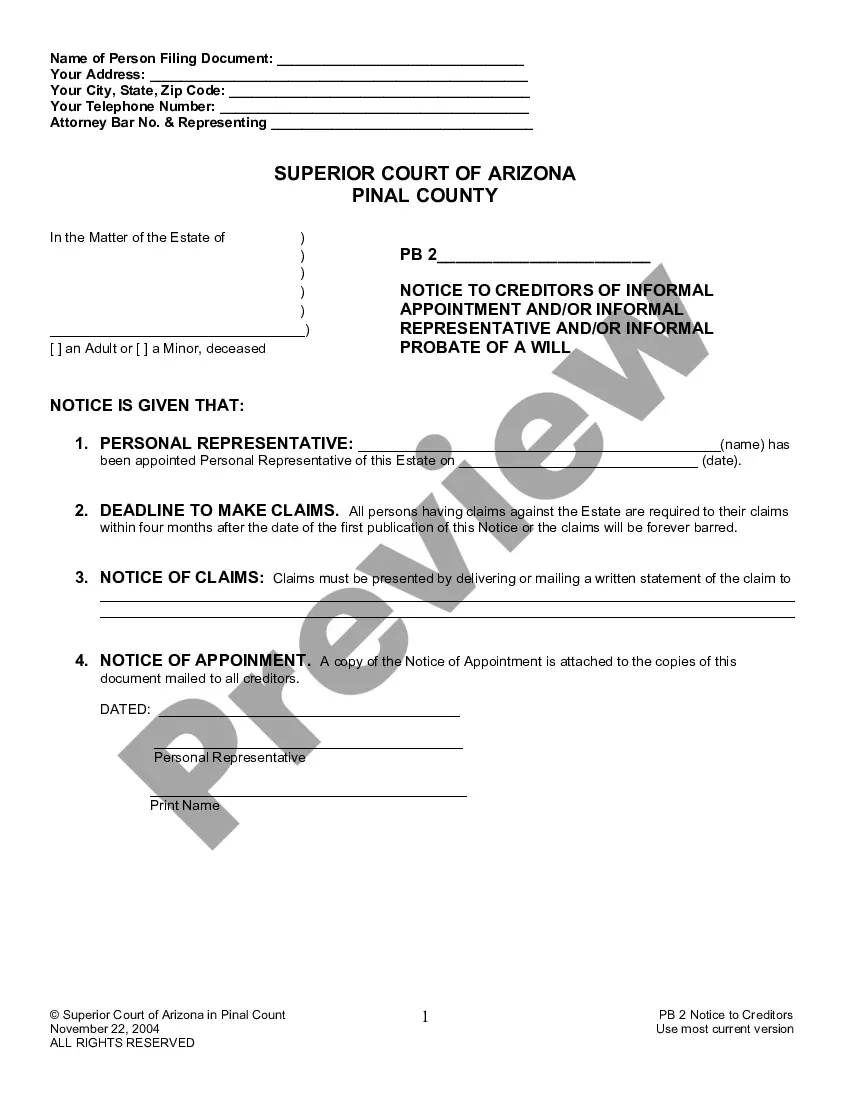

The Arizona Notice Regarding Creditors is a document issued by the state of Arizona to notify creditors of the death of a person who was an Arizona resident. It is important for creditors to be aware of this notice in order to protect their rights and to ensure that they receive payment for any money owed to them. There are two types of Arizona Notice Regarding Creditors: the first is the Notice of Creditors' Rights, which is sent to creditors to inform them of their rights and obligations; the second is the Notice of Claim Against an Estate, which is sent to creditors who have made a claim against the estate of the deceased person. Both of these notices are important for creditors to understand, as the information contained in them can be used in court to prove that the creditor has a valid claim against the estate.

Arizona Notice Regarding Creditors

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arizona Notice Regarding Creditors?

Drafting legal documents can be quite a challenge if you lack accessible fillable templates. With the US Legal Forms digital library of official paperwork, you can trust the forms you receive, as they all align with federal and state regulations and are reviewed by our specialists.

Obtaining your Arizona Notice Regarding Creditors from our collection is as simple as 1-2-3. Existing users with an active subscription just need to Log In and click the Download button once they locate the right template. Later, if necessary, users can access the same form from the My documents section of their account. However, if you are new to our platform, registering with a valid subscription will only require a few minutes. Here's a brief step-by-step guide for you.

Haven't you explored US Legal Forms yet? Sign up for our service today to access any official documentation promptly and effortlessly whenever you require, and maintain your paperwork in order!

- Document compliance verification. You should carefully review the content of the document you intend to use and ensure that it meets your requirements and complies with your state regulations. Previewing your document and checking its general overview will assist you in achieving this.

- Alternative search (optional). If you encounter any discrepancies, navigate the library using the Search tab above until you find an appropriate form, and click Buy Now once you identify the one you need.

- Account creation and document acquisition. Create an account with US Legal Forms. After confirming your account, Log In and choose your desired subscription plan. Complete the payment process to continue (PayPal and credit card options are available).

- Template download and subsequent usage. Select the file format for your Arizona Notice Regarding Creditors and click Download to store it on your device. Print it out to finalize your documents manually, or utilize a comprehensive online editor to craft an electronic version more swiftly and effectively.

Form popularity

FAQ

The statute of limitations for creditors in Arizona typically lasts for six years for most debts. This means creditors have a limited time to take legal action to collect a debt before the borrower can assert that the debt is too old to be enforced. Understanding this timeframe is crucial, especially when dealing with an Arizona Notice Regarding Creditors, as it can significantly impact your financial obligations. If you need assistance navigating these laws, US Legal Forms offers resources and templates that can help simplify the process.

In Arizona, there is no strict timeline to settle an estate, but it is recommended to do so within one year. The Arizona Notice Regarding Creditors plays a vital role in this process by identifying claims that need resolution. Prolonged settlement may lead to complications, such as additional legal fees. Utilizing platforms like USLegalForms can help streamline estate settlement and ensure compliance with all requirements.

The statute of limitations for contesting a will in Arizona is generally set at two years from the date the will is admitted to probate. This is important for individuals who wish to challenge the validity of an Arizona will. The Arizona Notice Regarding Creditors emphasizes the need to be timely with such contests. By understanding this timeline, you can take appropriate legal action if necessary.

In Arizona, creditors have a specific time frame to file a claim against an estate. Typically, they must do so within four months after receiving the Arizona Notice Regarding Creditors. If the notice is not received, creditors have up to two years from the date of death. This timeline is crucial for ensuring that all outstanding debts are addressed during the probate process.

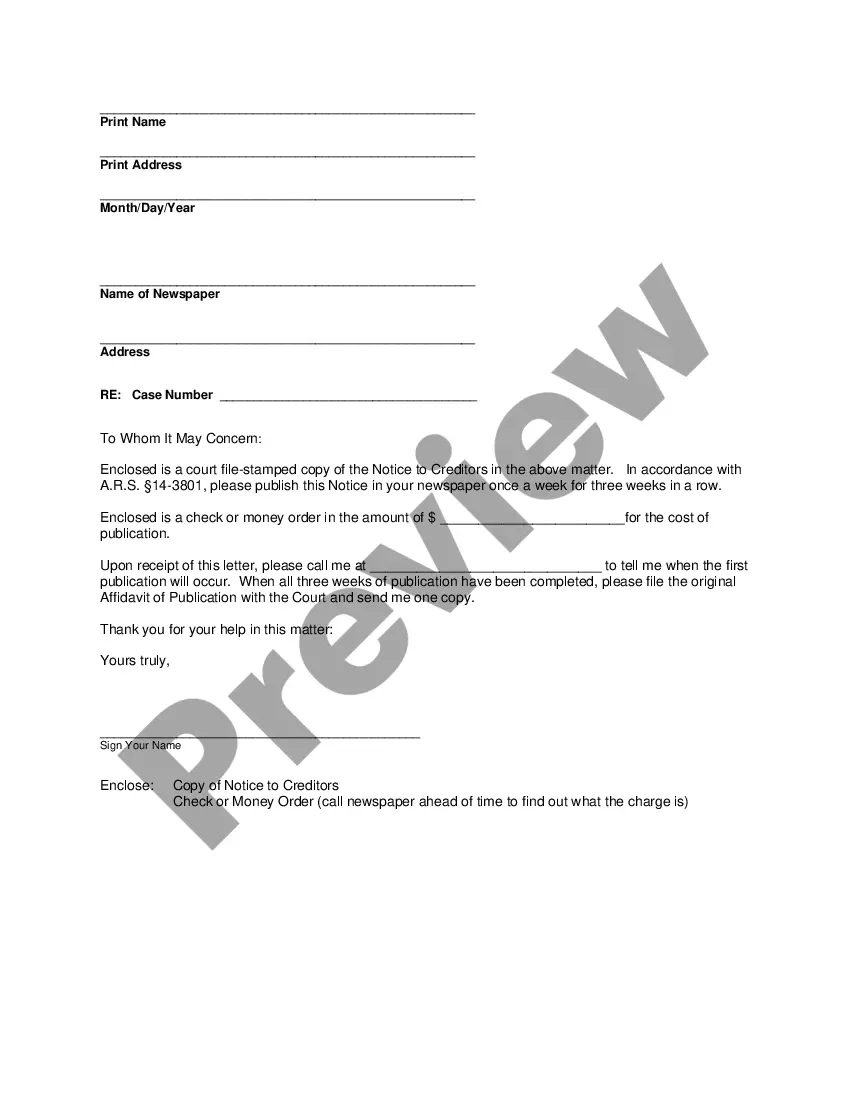

Rule 51 in probate in Arizona deals with the requirements surrounding the Arizona Notice Regarding Creditors. This rule mandates that personal representatives must give notice to known creditors and publish a notice in a local newspaper. This step ensures that creditors have the opportunity to present their claims against the estate. By following Rule 51, you can help facilitate a smoother probate process.

Yes, it is possible to lose your house in a lawsuit in Arizona if a judgment against you allows creditors to enforce a lien. However, certain protections exist that can shield your home from creditors. Being informed about the Arizona Notice Regarding Creditors will empower you to navigate these challenges effectively.

Creditors in Arizona typically have a limited time frame, often six years, to pursue collections for unsecured debts. This period starts from when the debt first became due, but timelines can vary depending on the nature of the debt. The Arizona Notice Regarding Creditors provides essential information that can help you understand your situation better.

To publish a notice to creditors in Arizona, you need to file the Arizona Notice Regarding Creditors with a local newspaper. The notice must run for at least three consecutive weeks to adequately inform creditors of the estate's claims period. Following this process ensures proper legal notification, aiding in timely debt resolution.

The notice sent to creditors in Arizona is known as the Arizona Notice Regarding Creditors. This document informs creditors of the decedent's passing and outlines the timeline for filing claims against the estate. It helps ensure all parties are aware of their rights and responsibilities in the estate settlement process.

Certain assets are protected from creditors in Arizona, including retirement accounts, life insurance proceeds, and your primary home under specific conditions. The Arizona Notice Regarding Creditors can clarify which assets are exempt and how they’re protected during debt collection processes. Knowing your rights can significantly affect your financial security.