Arkansas Declaration of Election by Lessor to Convert Royalty Interest to Working Interest

Description

How to fill out Declaration Of Election By Lessor To Convert Royalty Interest To Working Interest?

Are you presently within a place that you require documents for either company or specific purposes almost every day time? There are plenty of authorized file themes available on the Internet, but finding versions you can trust is not effortless. US Legal Forms gives thousands of form themes, such as the Arkansas Declaration of Election by Lessor to Convert Royalty Interest to Working Interest, which are written in order to meet federal and state requirements.

When you are currently knowledgeable about US Legal Forms internet site and get an account, basically log in. After that, you can download the Arkansas Declaration of Election by Lessor to Convert Royalty Interest to Working Interest design.

If you do not come with an bank account and would like to start using US Legal Forms, follow these steps:

- Get the form you want and make sure it is for the proper town/region.

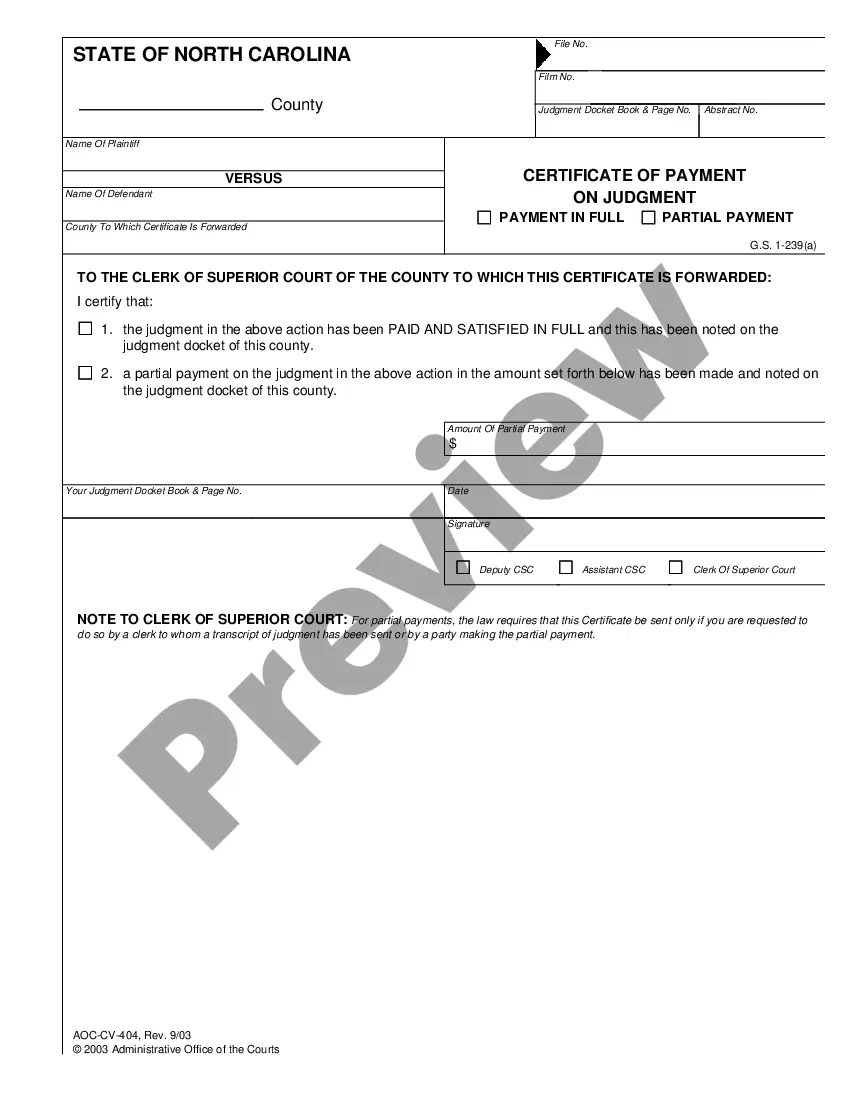

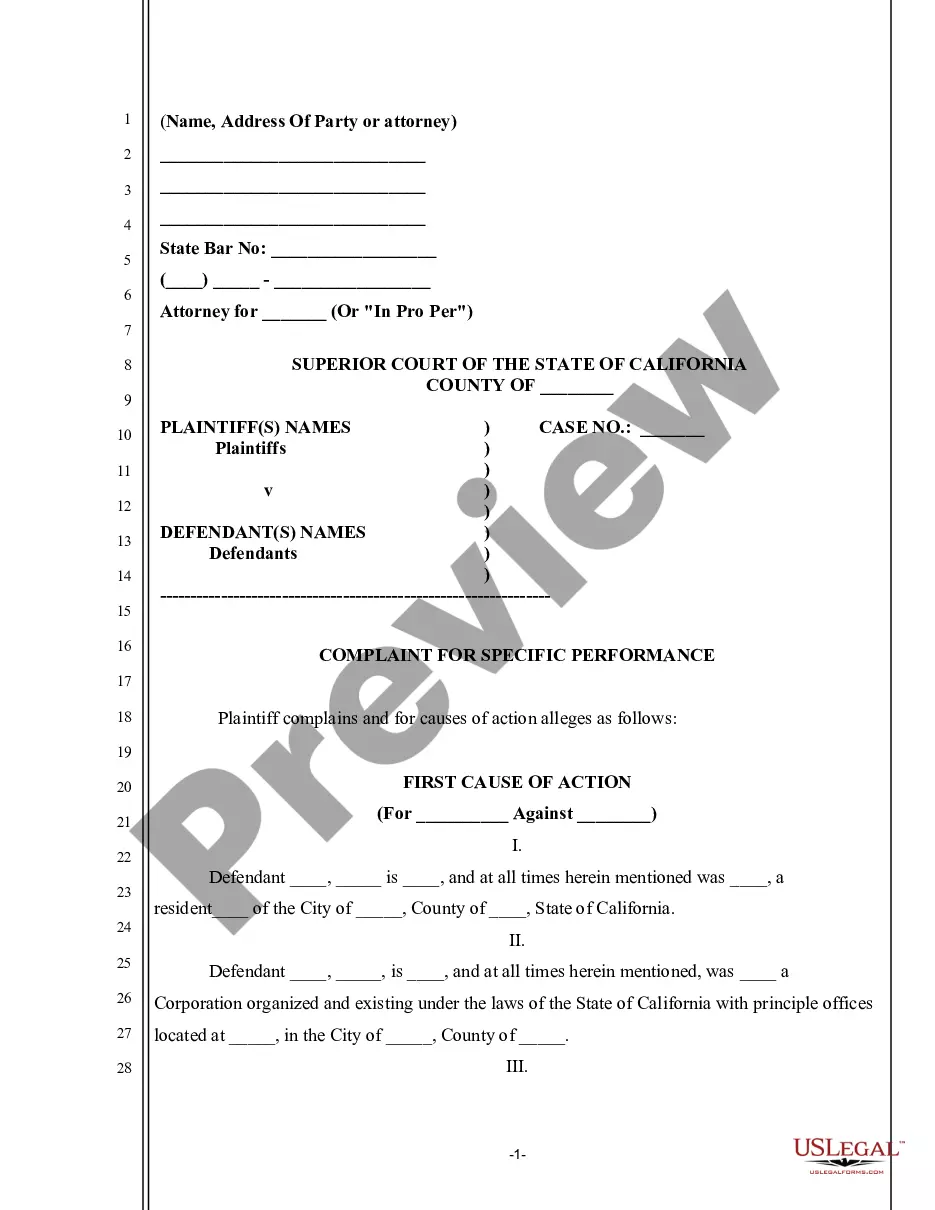

- Use the Preview option to review the form.

- Browse the outline to actually have selected the appropriate form.

- In the event the form is not what you`re looking for, use the Look for industry to find the form that meets your needs and requirements.

- If you obtain the proper form, just click Buy now.

- Opt for the prices program you want, submit the necessary info to produce your bank account, and pay for the transaction using your PayPal or bank card.

- Select a hassle-free document formatting and download your duplicate.

Get all of the file themes you have purchased in the My Forms food selection. You can get a further duplicate of Arkansas Declaration of Election by Lessor to Convert Royalty Interest to Working Interest anytime, if needed. Just select the necessary form to download or print the file design.

Use US Legal Forms, by far the most substantial assortment of authorized kinds, to save lots of efforts and stay away from faults. The support gives skillfully produced authorized file themes which you can use for an array of purposes. Make an account on US Legal Forms and begin creating your life a little easier.

Form popularity

FAQ

The owner of a working interest, also called an operating interest, bears the costs of developing and operating the natural resource property. The most common form of working interest is a leasehold estate held by an operator that exploits another person's property.

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.

In contrast to a royalty interest, a working interest refers to an investment in an oil and gas operation where the investor does bear some costs for exploration, drilling and production. An investor holding a royalty interest bears only the cost of the initial investment and isn't liable for ongoing operating costs.

A leasehold interest is essentially working interest; therefore, the interest owner is responsible for drilling and operating the well and paying all expenses. In exchange for taking on the risk and expenses, the leasehold interest owner is entitled to significant tax benefits.

What Is Working Interest? Working interest is a term for a type of investment in oil and gas drilling operations in which the investor is directly liable for a portion of the ongoing costs associated with exploration, drilling, and production.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

A working interest is considered a real property interest whereas a royalty interest is not. What is the difference? It is the Exchangor's rights and obligations to access the property. A working interest is the exclusive right to enter land and extract oil, gas and minerals.