This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Virgin Islands Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually

Description

How to fill out Promissory Note With No Payment Due Until Maturity And Interest To Compound Annually?

Have you found yourself in a situation where you require documents for either business or personal purposes nearly every day.

There is a vast selection of legal document templates available online, but locating trustworthy ones can be challenging.

US Legal Forms offers a wide array of template forms, including the Virgin Islands Promissory Note with no Payment Due Until Maturity and Interest Compounding Annually, designed to comply with federal and state regulations.

Once you find the correct form, click on Acquire now.

Select the pricing plan you desire, fill in the required details to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you may download the Virgin Islands Promissory Note with no Payment Due Until Maturity and Interest Compounding Annually template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Identify the form you need and ensure it is for the correct city/county.

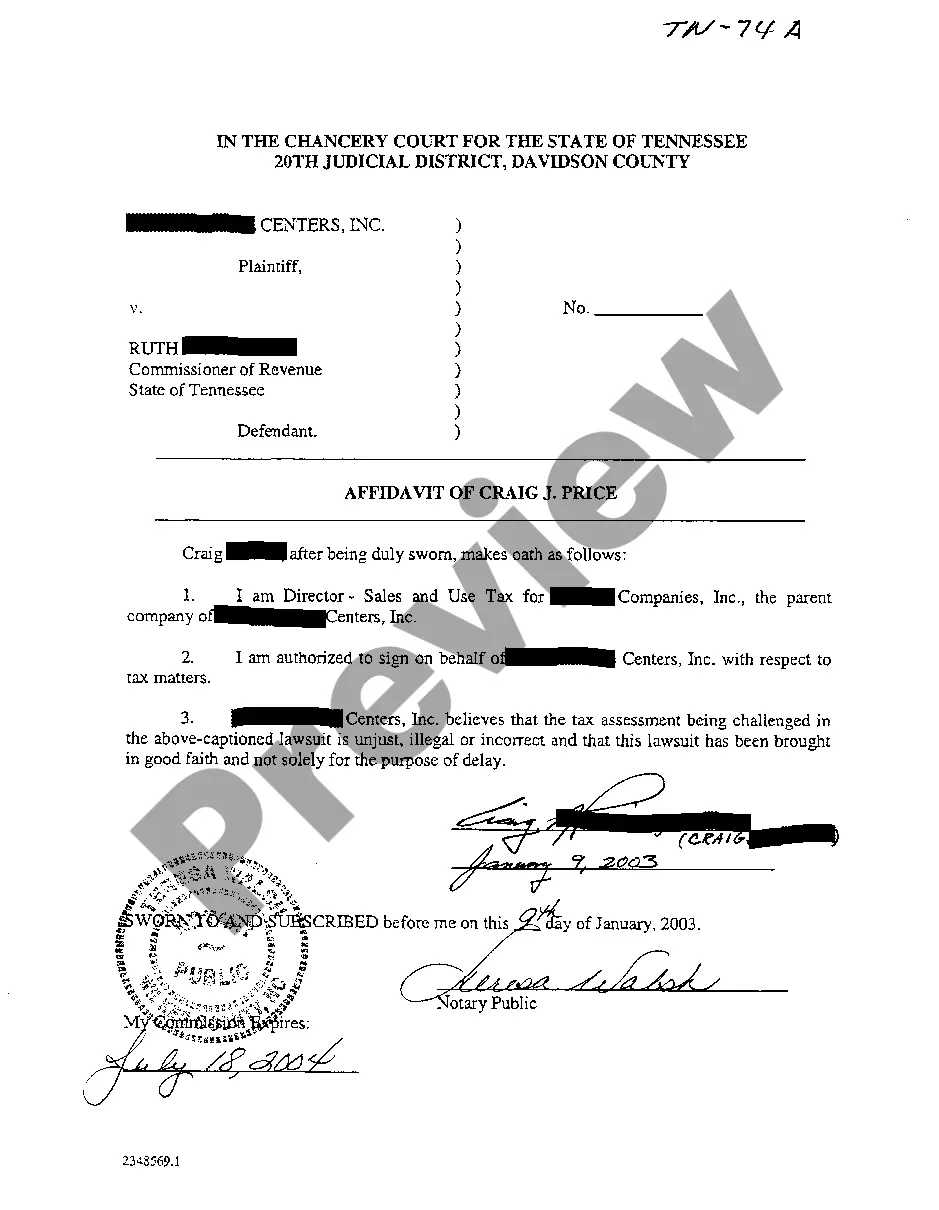

- Utilize the Preview button to review the form.

- Read the description to confirm that you have chosen the correct form.

- If the form does not match your requirements, use the Search field to find the appropriate form that fits your needs.

Form popularity

FAQ

Yes, a promissory note can be created with no interest. This type of note, while less common, is often used in family loans or informal agreements where the lender does not seek financial gain. For a Virgin Islands Promissory Note with no Payment Due Until Maturity, you can choose to omit interest if that meets your needs.

The four main types of promissory notes include secured, unsecured, demand, and installment notes. A secured note is backed by collateral, while an unsecured note relies on the borrower's creditworthiness. Demand notes require repayment upon request, while installment notes allow repayment through scheduled payments over time. Understanding these types can help you choose the right Virgin Islands Promissory Note for your needs.

The maturity value of a Virgin Islands Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually is the total amount that is due at the end of the note's term. This amount includes the principal plus any accrued interest that has compounded annually. Understanding the maturity value is essential for both lenders and borrowers to plan their finances effectively.

For a Virgin Islands Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually to be valid, it must clearly identify the parties involved, outline the amount borrowed, and specify the terms of repayment. The note should also be signed by the borrower, as a signature indicates intent. Additionally, while not mandatory, having a witness or notary public can strengthen its validity.

While promissory notes offer flexibility, they also have disadvantages. One potential risk is that if the borrower defaults, the lender may face challenges in collecting the owed amount. Additionally, a Virgin Islands Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually may grow more expensive over time due to compounded interest. It's important to weigh these factors and consider using tools from US Legal Forms to create a comprehensive agreement that safeguards your interests.

Yes, a promissory note should include a maturity date, which specifies when the borrower must repay the principal amount. For a Virgin Islands Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, this is essential for providing clarity on the repayment timeline. A well-defined maturity date can help both parties plan their finances and avoid misunderstandings. Make sure this detail is clearly stated in your note.

To calculate compound interest on a promissory note, use the formula A = P(1 + r/n)^(nt), where A stands for the total amount, P is the principal, r is the interest rate, n is the number of times interest is compounded per year, and t is the number of years. For a Virgin Islands Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, careful attention to these details will help you manage expectations. This understanding ensures accurate financial planning.

Promissory notes must include essential elements, such as the amount borrowed, interest rate, repayment schedule, and maturity date. Both the lender and borrower should clearly understand the terms laid out in the Virgin Islands Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually. Ensure the document is signed and dated by both parties to confirm its enforceability. Additionally, following local laws can help prevent future disputes.

Yes, you can create a promissory note that has no interest. This type of note is commonly known as a non-interest-bearing promissory note. However, when using a Virgin Islands Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, remember that it typically involves some interest. Make sure to document all agreed-upon terms carefully to avoid confusion.

To fill out a Virgin Islands Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, start by entering the names of the borrower and lender. Include the principal amount, the interest rate, and the terms regarding repayment. Make sure to specify the maturity date, as well as any compounding details. Once complete, both parties should sign and date the document to enforce its legality.