This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Wyoming Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually

Description

How to fill out Promissory Note With No Payment Due Until Maturity And Interest To Compound Annually?

If you intend to finalize, retrieve, or create sanctioned document formats, utilize US Legal Forms, the most extensive collection of sanctioned templates available online.

Employ the site's straightforward and user-friendly search functionality to find the documents you need.

Various templates for commercial and personal purposes are organized by categories and states, or keywords.

Step 4. After you have found the form you require, click on the Buy now option. Choose the pricing plan you prefer and provide your details to sign up for the account.

Step 5. Process the transaction. You can use your Visa or MasterCard or PayPal account to complete the purchase.

- Utilize US Legal Forms to secure the Wyoming Promissory Note with no Payment Due Until Maturity and Interest compounding Annually in just a few clicks.

- If you are already a US Legal Forms subscriber, Log In to your account and click on the Download option to locate the Wyoming Promissory Note with no Payment Due Until Maturity and Interest compounding Annually.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

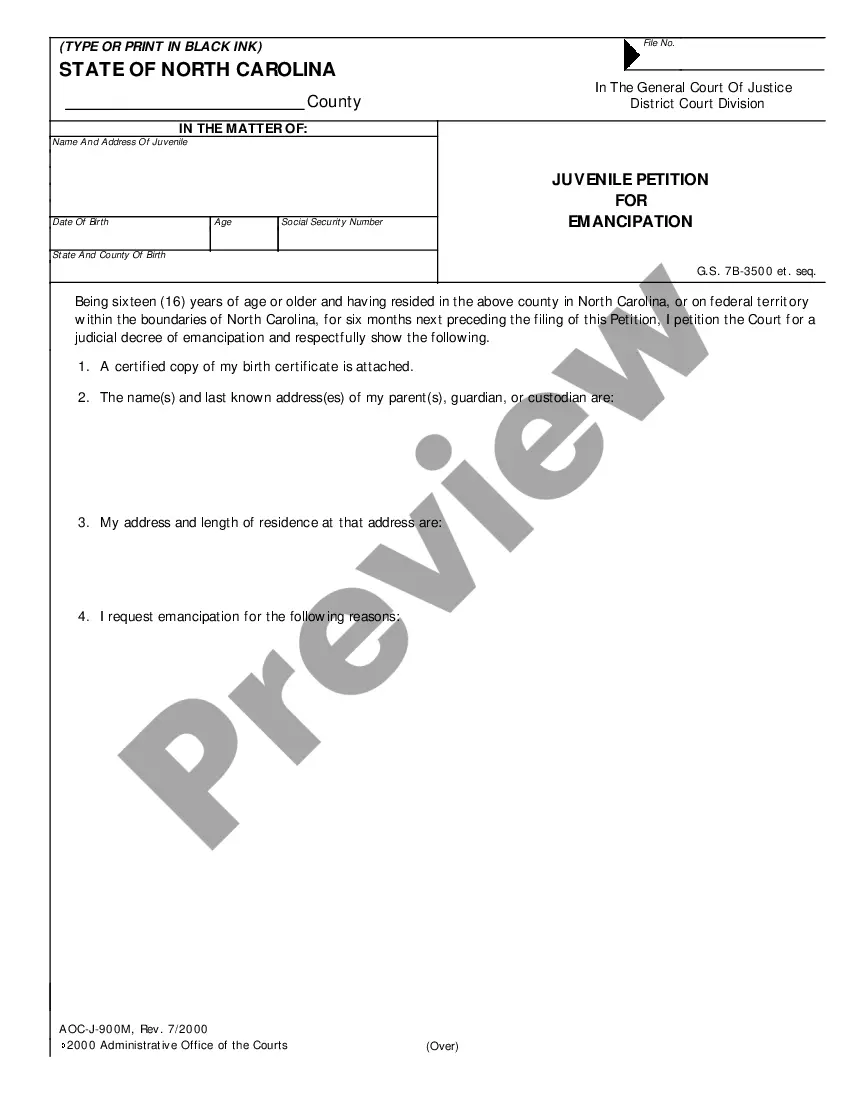

- Step 1. Ensure you have selected the form for your specific city/state.

- Step 2. Use the Review option to examine the form’s content. Don't forget to read the summary.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to locate other versions of the legal form template.

Form popularity

FAQ

Interest on a promissory note is typically calculated based on the principal amount, the interest rate, and the time period involved. In the case of a Wyoming Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, the interest compounds on an annual basis. To determine the total amount due, you would apply the compound interest formula, taking into account the compounding frequency. This method ensures borrowers understand their financial obligations clearly, making it easier to plan for repayment.

A Wyoming Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually typically uses compound interest. This means that your interest accumulates over time, based on both the original principal and the interest that has already been added. Therefore, the total amount you owe grows more significantly than with simple interest. This structure can be beneficial for both lenders and borrowers, as it aligns with long-term financial strategies.

A maturity date is not always required for a promissory note, but it typically enhances clarity and structure. When considering a Wyoming Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, you have the option to create a flexible timeframe. However, clearly stating the expectations can help both parties feel secure in the arrangement.

Yes, a promissory note can lack a maturity date, creating a flexible repayment arrangement. This type of Wyoming Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually allows borrowers to manage payments on their own terms. It's essential to clearly outline this lack of a maturity date in the note to avoid misunderstandings.

For a promissory note to be valid, it must include specific elements such as the names of parties, the principal amount, an interest rate, repayment terms, and clear language regarding maturity. Using a Wyoming Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually can meet these requirements effectively. Make sure to document everything accurately to ensure enforceability.

Yes, interest can compound on a promissory note. When you create a Wyoming Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, the interest accumulates over time, increasing the overall amount owed. This feature can enhance your investment, as it allows you to gain more interest without immediate payments.

One significant disadvantage of a promissory note relates to the lack of security for the lender, especially if it is unsecured. Additionally, if the borrower fails to repay, it can lead to legal challenges requiring trust and accountability. Utilizing a Wyoming Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually can help you navigate these risks by clearly defining terms and expectations, reducing potential disputes.

The four primary types of promissory notes include demand notes, installment notes, balloon notes, and non-interest bearing notes. Each type serves different purposes and repayment structures. The Wyoming Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually typically aligns with the non-interest bearing option, thereby offering flexibility in repayment without immediate financial strain.

Promissory notes must include key elements, such as the principal amount, interest rate, maturity date, and the signatures of both the borrower and lender. They must be clear and comprehensive to ensure that both parties understand their obligations. Utilizing a Wyoming Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually can benefit from a structured format and legal backing, offering security for lenders and borrowers alike.

Yes, you can have a promissory note without interest, though it may be less common. This type of note, often referred to as a zero-interest note, allows the borrower to repay only the principal amount without any additional fees. However, if you're considering terms like a Wyoming Promissory Note with no Payment Due Until Maturity and Interest to Compound Annually, it's essential to evaluate how the absence of interest might affect your financial planning.