Arkansas Tax Free Exchange Package

About this form package

The Arkansas Tax Free Exchange Package is a collection of essential legal forms designed to assist individuals and businesses in completing a tax-free exchange of like-kind property in Arkansas. This package stands out from others due to its specific focus on facilitating real estate transactions under IRS Section 1031, ensuring compliance with state and federal regulations.

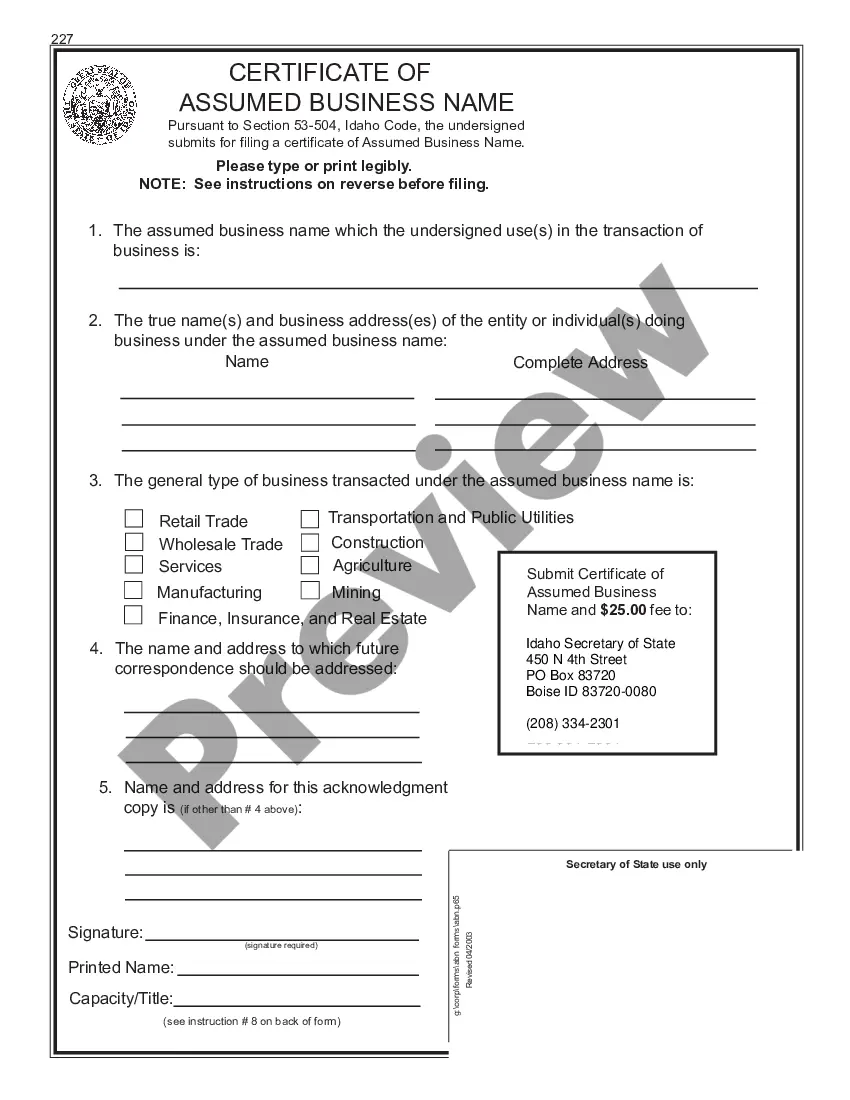

Forms you’ll find in this package

When to use this form package

This form package is necessary when:

- You are planning to exchange real estate or personal property without incurring immediate tax liabilities.

- You need to formalize an agreement between parties regarding the exchange of like-kind properties.

- You wish to ensure compliance with IRS regulations governing the reporting and structure of tax-free exchanges.

Who should use this form package

- Real estate investors looking to defer taxes on the sale of properties.

- Property owners interested in exchanging their current property for a different one.

- Business owners conducting transactions involving like-kind property exchanges.

- Individuals working with qualified intermediaries in real estate transactions.

Steps to complete these forms

- Review the included forms to understand each document's purpose and requirements.

- Identify the parties involved in the transaction and enter their details on the relevant forms.

- Fill out the Exchange Agreement, defining the terms and conditions of the property exchange.

- Use the Exchange Addendum to amend existing purchase contracts as needed.

- Ensure all necessary certifications and tax reporting forms are completed accurately.

- Sign and date the forms, and retain copies for your records.

Do forms in this package need to be notarized?

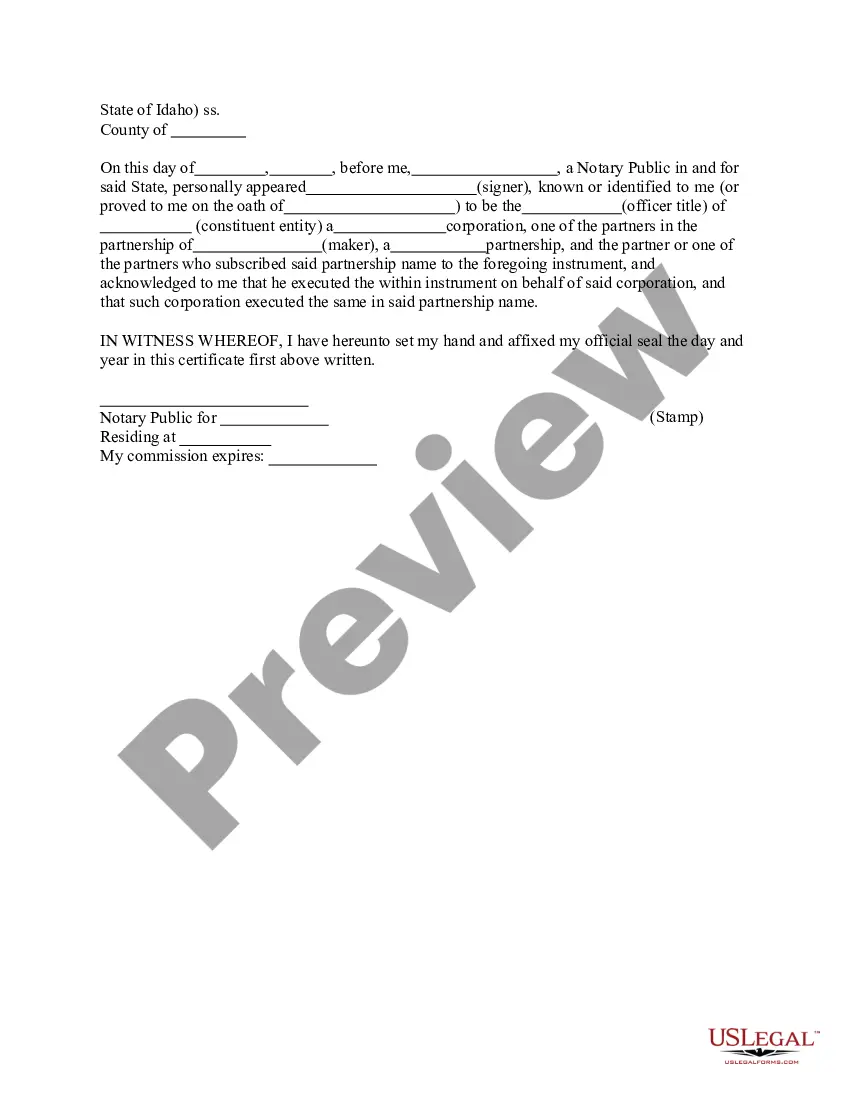

Some forms in this package need notarization to be legally binding. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to use the correct form for the type of exchange being conducted.

- Not fully understanding the implications of Section 1031 exchanges.

- Overlooking the need for signatures from all parties involved.

- Forgetting to complete tax reporting forms that may be required by the IRS.

Why use this package online

- Convenience of downloading and completing forms from the comfort of your home.

- Editability allows for easy adjustments and updates to the forms as needed.

- Access to reliable, attorney-drafted forms that comply with Arkansas laws.

Looking for another form?

Form popularity

FAQ

8.) Can I purchase a computer tax exempt during the Sales Tax Holiday? Computers, periphery equipment, nor software qualify for the exemption and therefore cannot be purchased tax exempt.

The Arkansas sales tax is 6.5% of the gross receipts from the sales of tangible personal property and certain selected services.

What items are eligible? Tax -free shopping is available for clothing priced at less than $100 per item, personal computers and computer peripheral devices of up to $1,500 and school supplies of up to $50. Purchases of up to $150 for graphing calculators and $350 for computer software are also exempt from sales tax.

Clothing and Shoes: Includes diapers, coats, backpacks and uniforms. Under $100 per item. Excludes jewelry, purses, luggage, wallets, skates, and skis.

Beginning at a.m. on Saturday August 1, 2020, and ending at p.m. on Sunday August 2, 2020, the State of Arkansas will hold its sales tax holiday allowing shoppers the opportunity to purchase certain School Supplies, School Art Supplies, School Instructional Materials, and clothing free of state and local

Some goods are exempt from sales tax under Arkansas law. Examples include prescription drugs, purchases made with food stamps, and some farming equipment.

Beginning at a.m. on Saturday August 1, 2020, and ending at p.m. on Sunday August 2, 2020, the State of Arkansas will hold its sales tax holiday allowing shoppers the opportunity to purchase certain School Supplies, School Art Supplies, School Instructional Materials, and clothing free of state and local

Clothing and footwear under $100 per item. Clothing accessories and equipment under $50 per item. School supplies of any price. School art supplies of any price. School instructional materials (textbooks, workbooks and maps).

What items are eligible? Tax -free shopping is available for clothing priced at less than $100 per item, personal computers and computer peripheral devices of up to $1,500 and school supplies of up to $50. Purchases of up to $150 for graphing calculators and $350 for computer software are also exempt from sales tax.