A Deed of Tax Indemnity is a legal document that is signed by two parties, the indemnified and the indemnified. The indemnified promises to indemnify the indemnified party from any losses associated with a tax issue. This document is typically used in situations where one party has assumed responsibility for the payment of taxes due on behalf of another party. There are two main types of Deed of Tax Indemnity: a general deed of tax indemnity and a specific deed of tax indemnity. A general deed of tax indemnity is an agreement between two parties in which the indemnified agrees to pay the indemnified party for any losses that may arise from any tax issues relating to the indemnified party’s business. Thindemnifieder agrees to pay the indemnified party for any losses, even if the indemnified has no involvement with the tax issue. A specific deed of tax indemnity is an agreement between two parties in which the indemnified agrees to pay the indemnified party for any losses that may arise from a specific tax issue. This document is typically used in situations where one party has assumed responsibility for the payment of taxes due on behalf of another party. The indemnified agrees to pay the indemnified party for any losses related to the specific tax issue, even if the indemnified has no involvement with the tax issue.

Deed of Tax Indemnity

Description

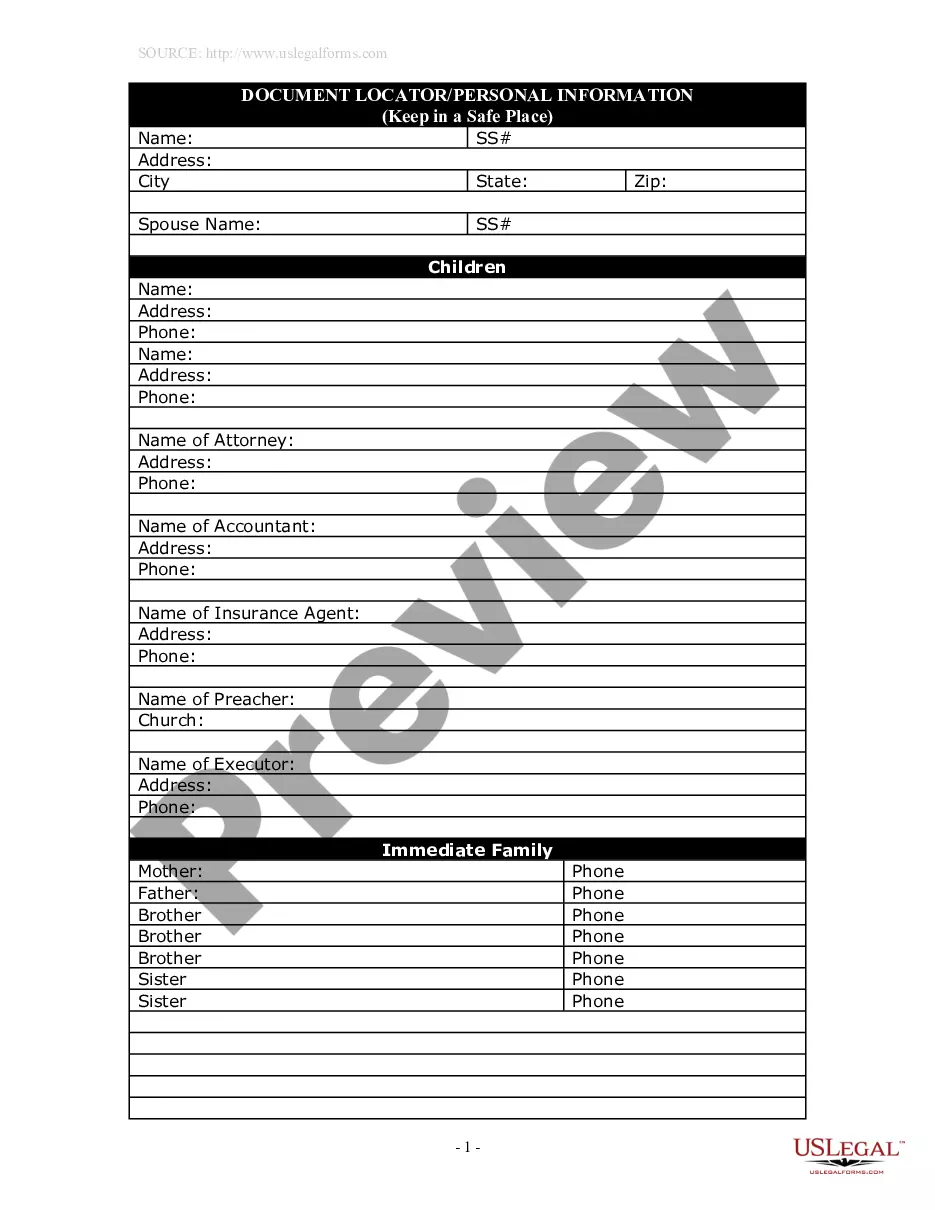

How to fill out Deed Of Tax Indemnity?

Coping with official documentation requires attention, accuracy, and using well-drafted templates. US Legal Forms has been helping people across the country do just that for 25 years, so when you pick your Deed of Tax Indemnity template from our library, you can be sure it meets federal and state regulations.

Working with our service is easy and quick. To obtain the necessary document, all you’ll need is an account with a valid subscription. Here’s a brief guideline for you to get your Deed of Tax Indemnity within minutes:

- Remember to attentively examine the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for another official template if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Deed of Tax Indemnity in the format you need. If it’s your first experience with our website, click Buy now to continue.

- Register for an account, select your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to obtain your form and click Download. Print the blank or upload it to a professional PDF editor to prepare it paper-free.

All documents are created for multi-usage, like the Deed of Tax Indemnity you see on this page. If you need them in the future, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in full legal compliance!

Form popularity

FAQ

From a US tax perspective, there are typically no consequences from indemnification payments. The amount paid to the taxing authority and the amount collected from the seller would generally offset, with no net impact on taxable earnings.

Money you receive as part of an insurance claim or settlement is typically not taxed. The IRS only levies taxes on income, which is money or payment received that results in you having more wealth than you did before.

Income tax indemnifications are contractual arrangements established between two parties whereby one party will reimburse the other for income taxes paid to a taxing authority related to tax positions that arose (typically) prior to a transaction.

What Lawsuit Settlement is not Taxable? Compensation money awarded for visible injuries is considered tax-free, so there is no need to include these settlements in your yearly tax report. As mentioned, settlement awards from personal injury lawsuits that demonstrate ?observable bodily harm? are not taxable by the IRS.

An officer's deed of indemnity is a deed signed by a company that is intended to protect you against claims made by third parties.

The Middle Ground: This provision states that indemnification payments made under the Agreement are to be treated as an adjustment to the Purchase Price for tax purposes, so long as such treatment is allowed by law.

The tax treatment of payments under fixed indemnity health coverage depends on how the premiums are paid. If employees are taxed on the premiums, the fixed indemnity payments are not taxable. Fixed indemnity payments are taxable when premiums are paid by the employer or by employees on a pre-tax basis.

Supplemental health insurance premiums, like hospital indemnity insurance and critical illness insurance, are generally tax deductible, but only as a qualified medical expense.