The Missouri Worker Relationship Questionnaire (MORE) is an assessment tool used to measure the quality of working relationships between employers and their employees. It assesses both the employee's perception of the relationship with their employer, and the employer's perception of the relationship with their employee. The MORE consists of four subscales: Respectful Workplace, Job Security, Supportive Supervisor, and Opportunity to Learn and Grow. It can be administered in paper-and-pencil or online formats, and is designed for use in both the public and private sectors. Additionally, there are two versions of the MORE: the Standard version, which is designed to assess the quality of working relationships in general, and the Supervisory version, which is designed to assess the quality of working relationships between supervisors and their employees.

Missouri Worker Relationship Questionnaire

Description

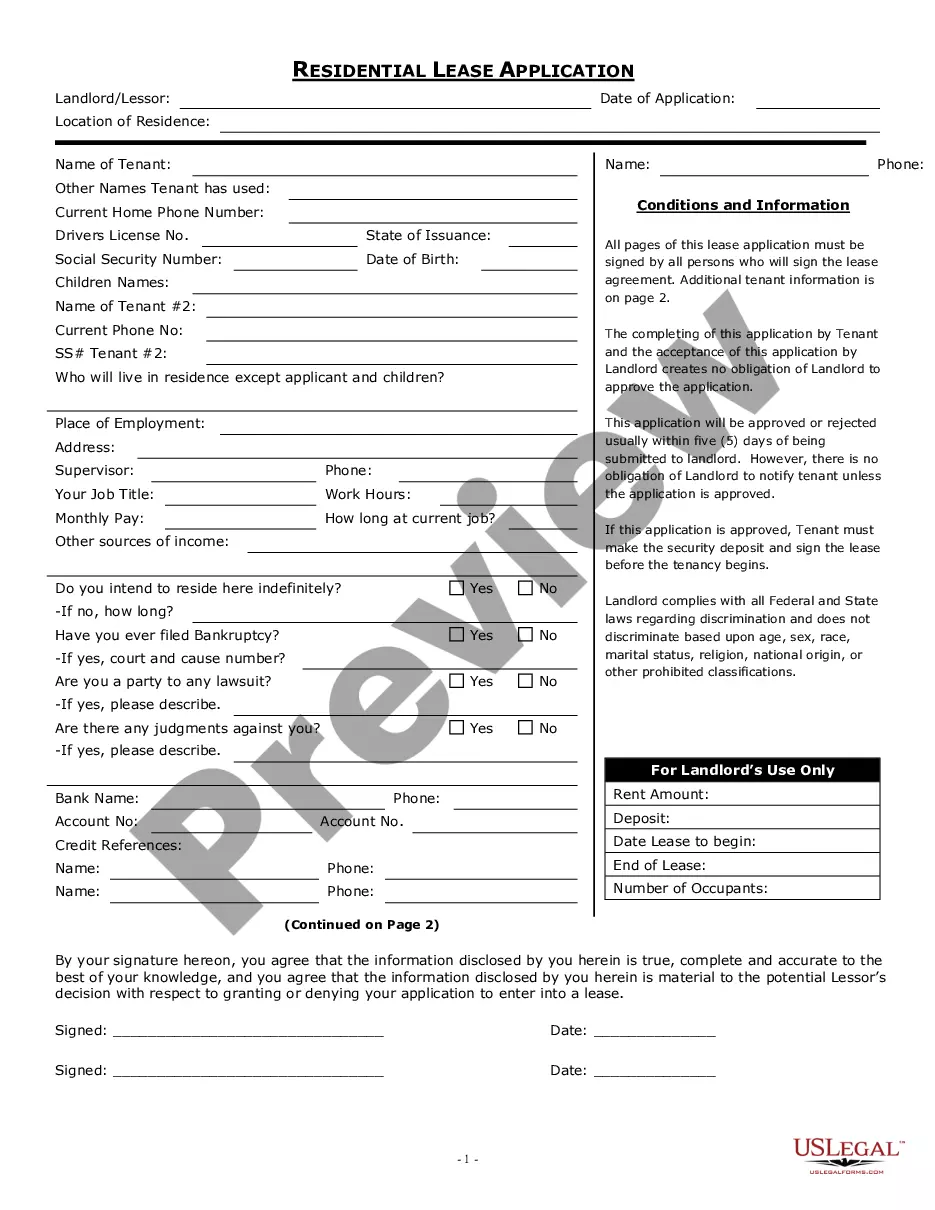

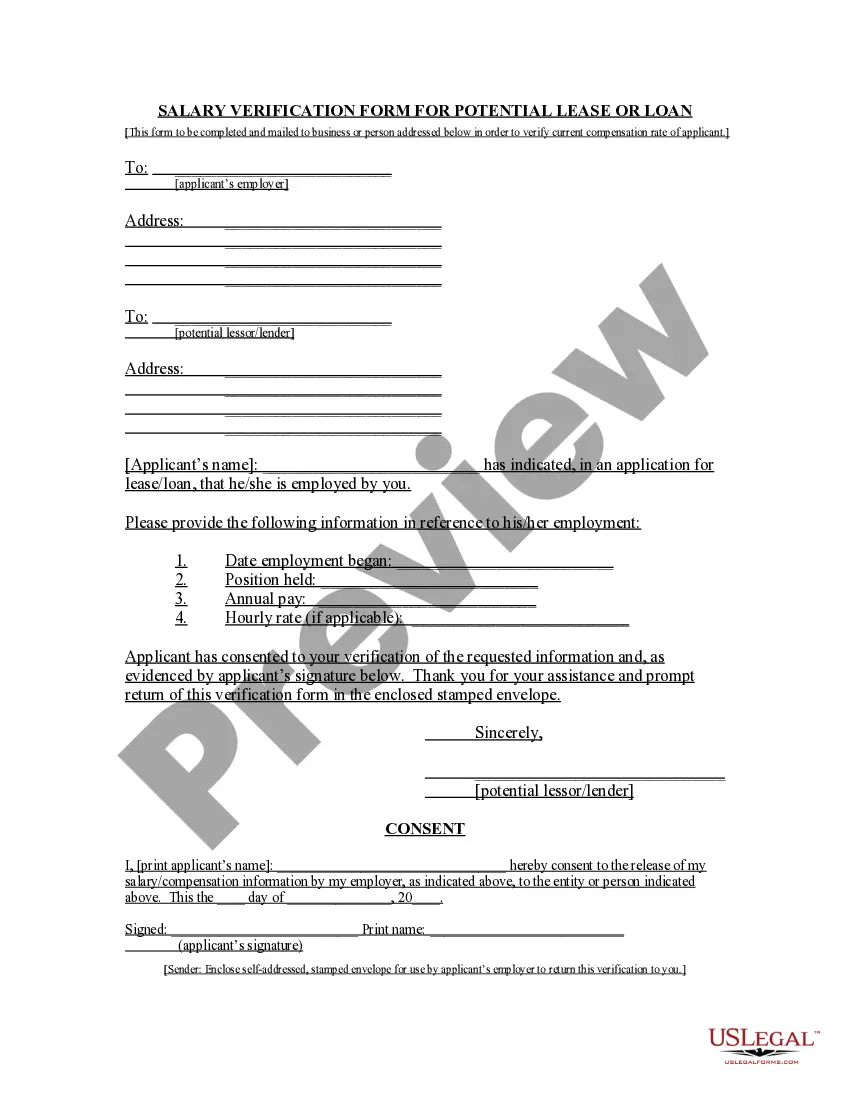

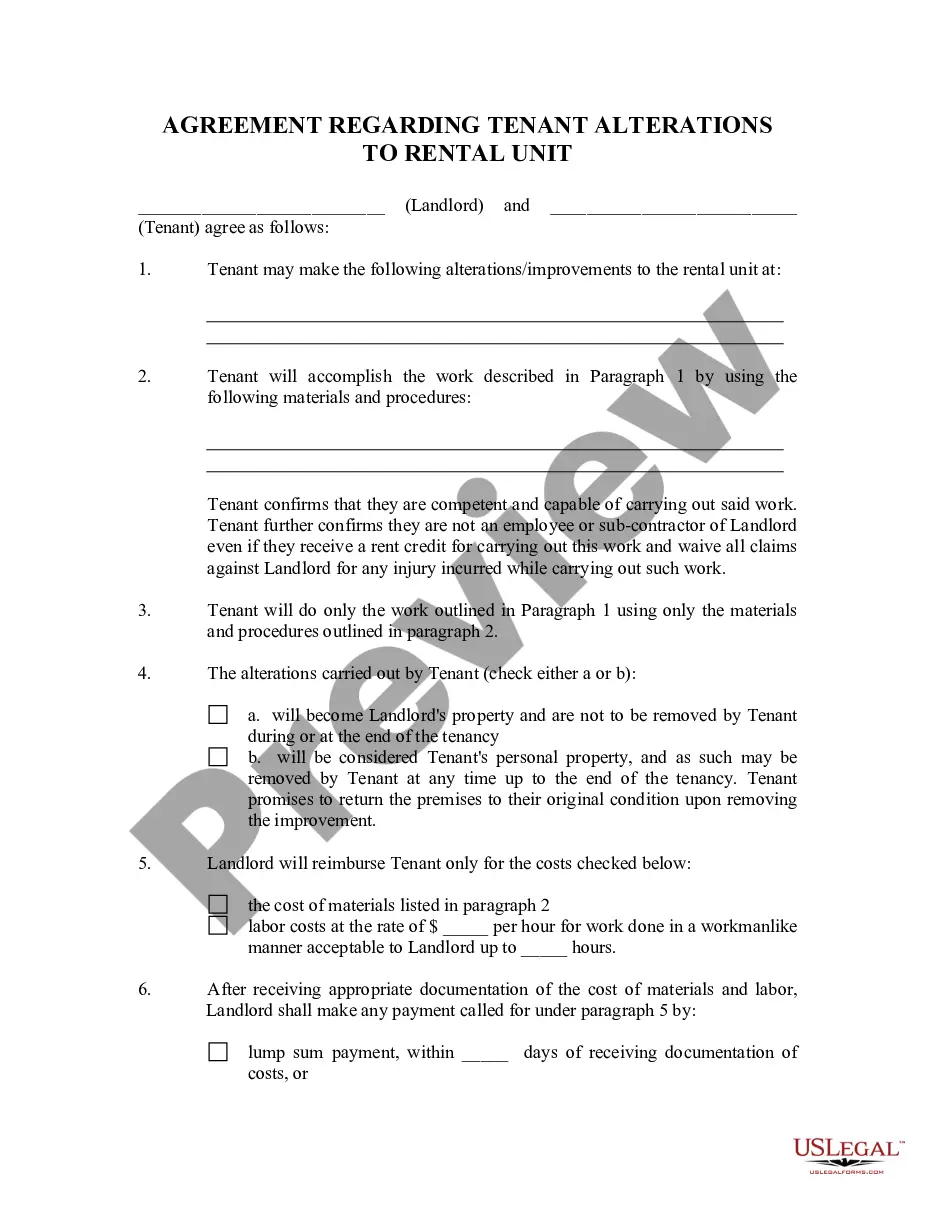

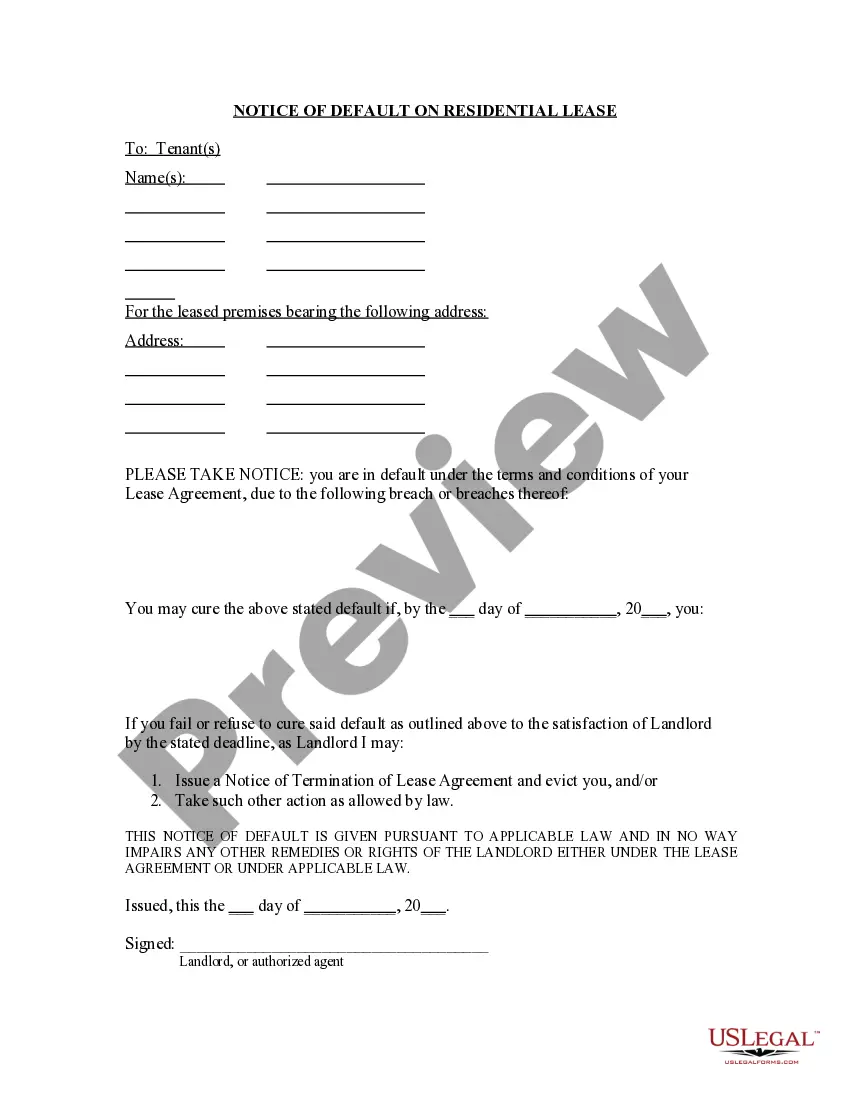

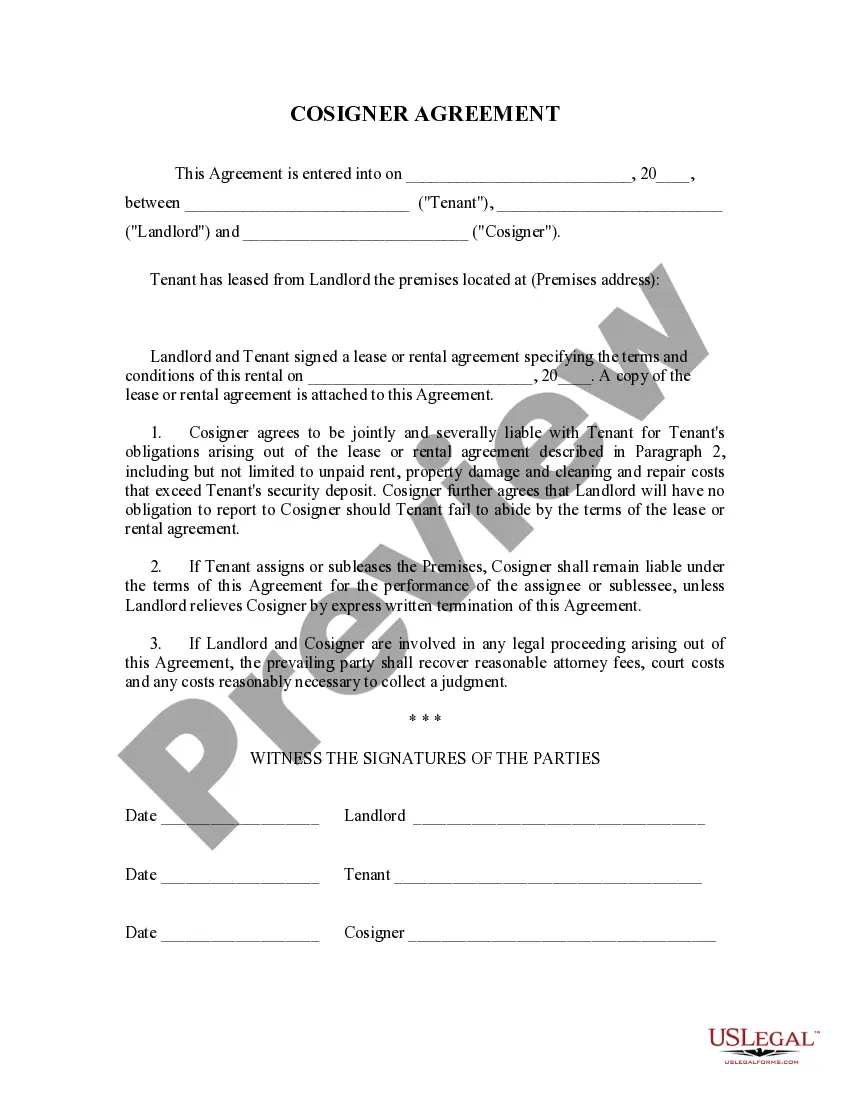

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Missouri Worker Relationship Questionnaire?

US Legal Forms is the easiest and most cost-effective method to locate appropriate formal templates.

It represents the largest online collection of business and personal legal documentation created and verified by attorneys.

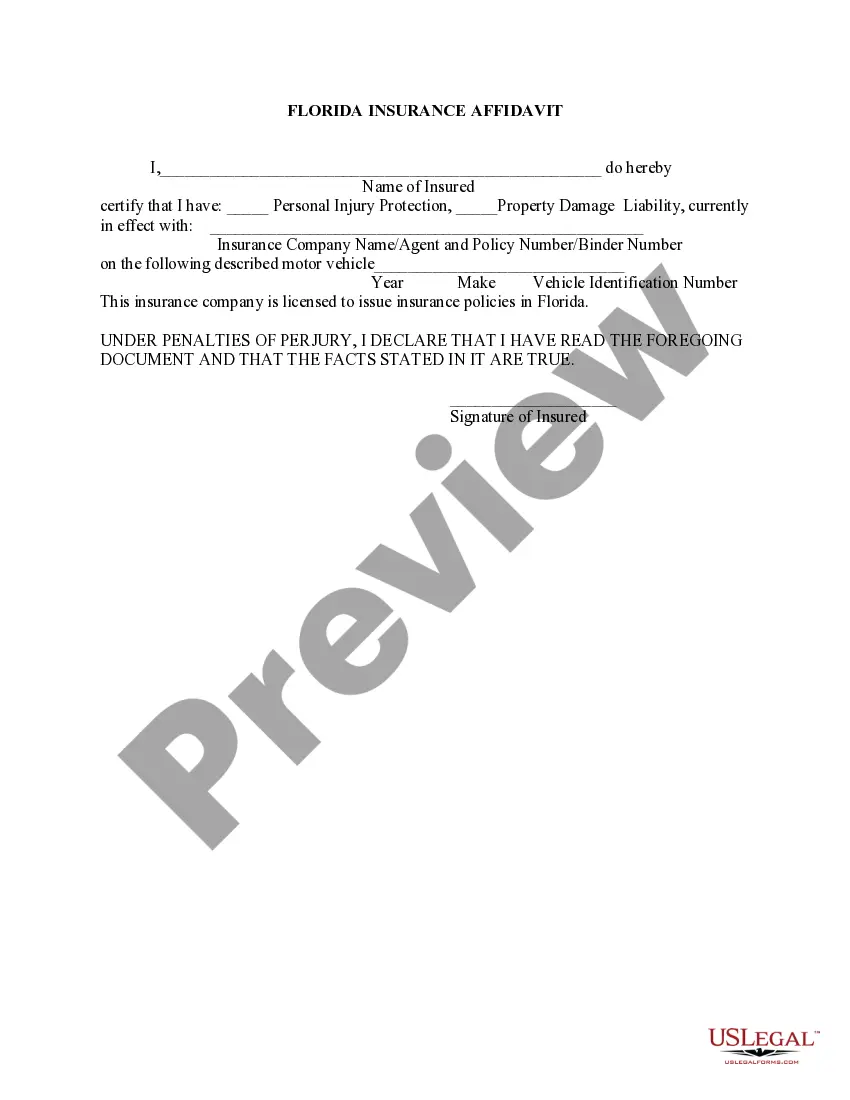

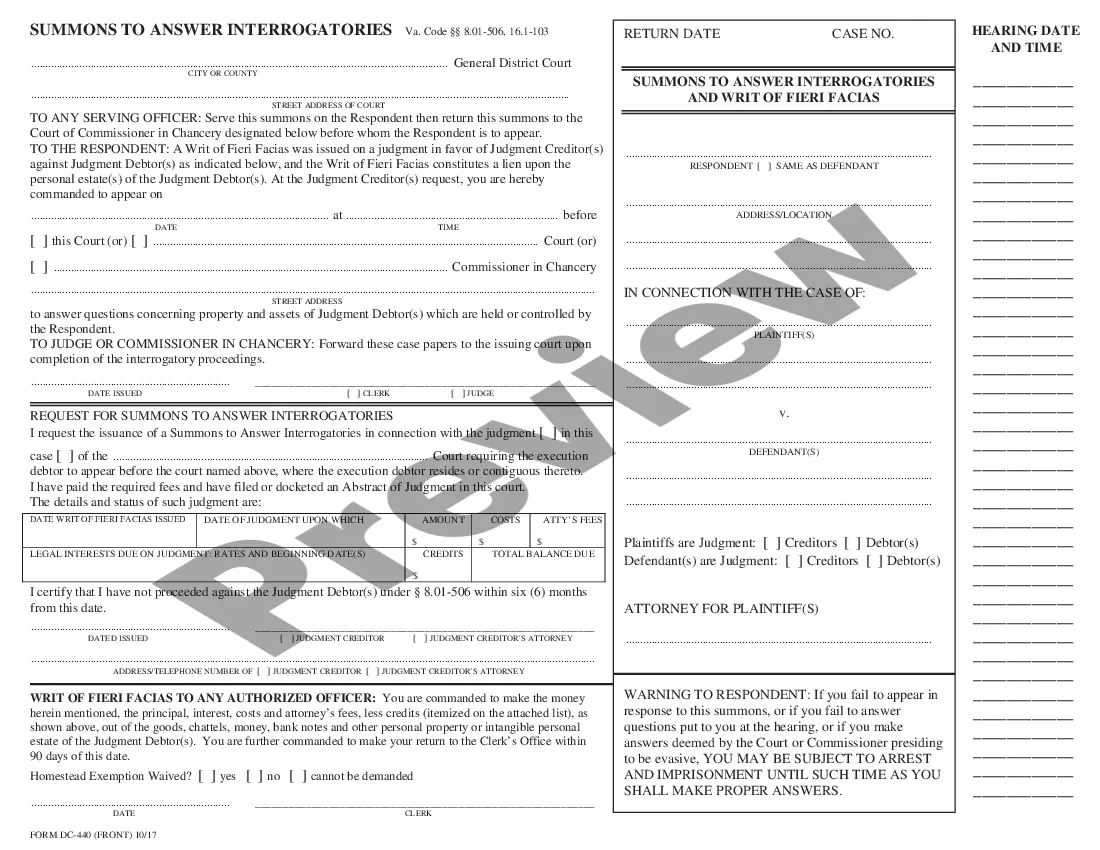

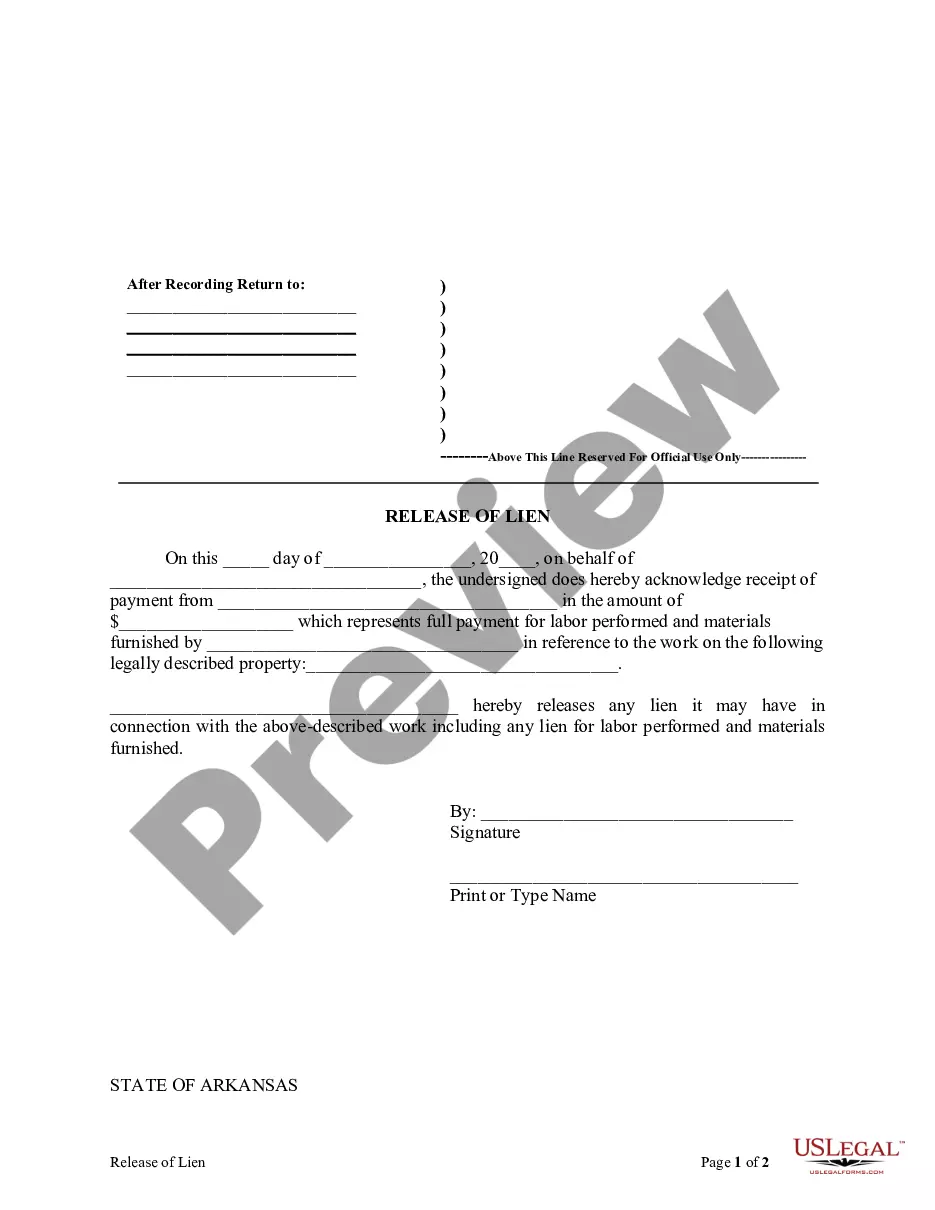

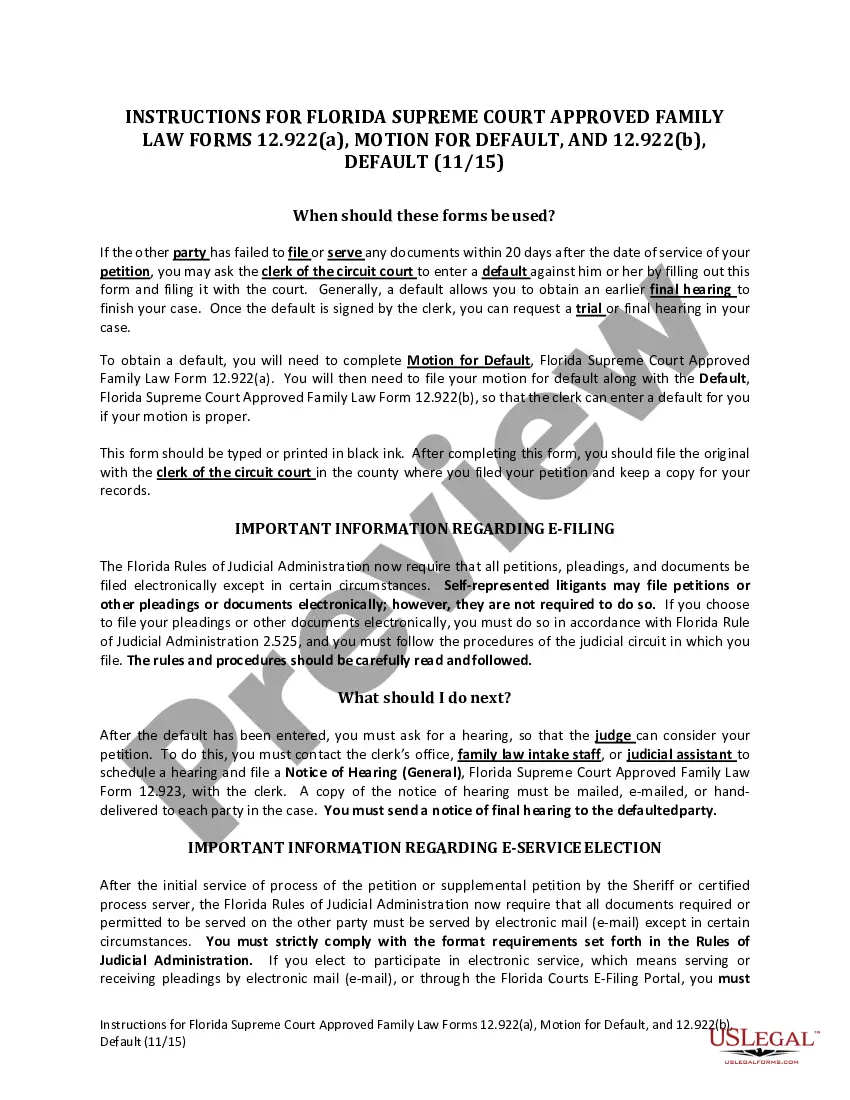

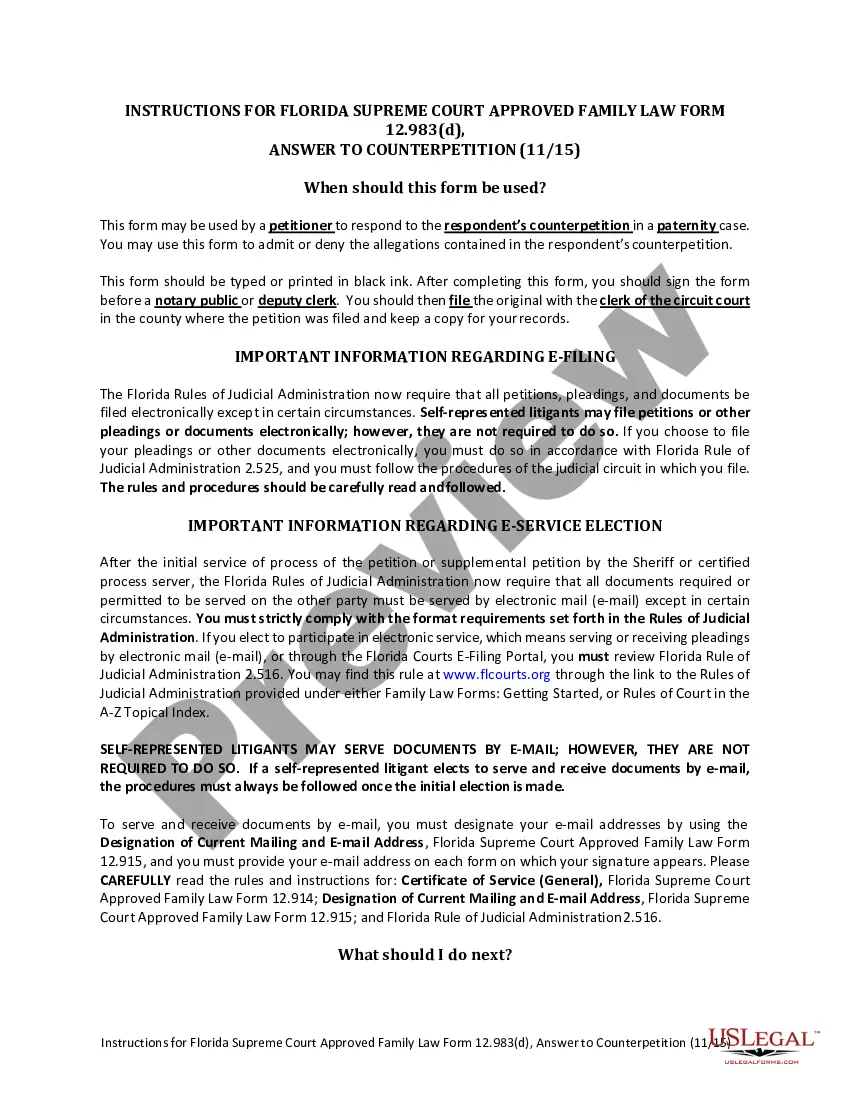

Here, you can access printable and fillable templates that adhere to federal and state laws - just like your Missouri Worker Relationship Questionnaire.

Review the form description or preview the document to ensure you’ve located the one that meets your needs, or find another using the search tab above.

Click Buy now when you’re confident about its compliance with all the necessary requirements, and select the subscription plan that suits you best.

- Acquiring your template involves just a few straightforward steps.

- Users who already possess an account with an active subscription only need to Log In to the web service and download the document onto their device.

- Subsequently, they can locate it in their profile under the My documents tab.

- And here’s how to obtain a professionally prepared Missouri Worker Relationship Questionnaire if you are utilizing US Legal Forms for the first time.

Form popularity

FAQ

An employee works for an employer who hires, supervises and pays workers. An independent contractor can hire, supervise and pay assistants under a contract that requires him or her to provide materials and labor and to be responsible only for the result.

The Division of Employment Security is responsible for the administration of the unemployment insurance benefit and tax program. The Division collects tax contributions from employers and pays unemployment benefits to individuals who are determined eligible under the law.

About Labor Standards The Division of Labor Standards consists of three sections: Wage and Hour, On-Site Safety and Health Consultation Program, and Mine and Cave Safety. The Division determines and enforces Missouri's Child Labor Law and Minimum Wage Law.

You may be disqualified from receiving UI benefits if you've been discharged for misconduct connected with work, quit for reasons not attributable to work or your employer, refused a suitable work offer, or are not able or available to work.

? 1. The word "employee" as used in this chapter shall be construed to mean every person in the service of any employer, as defined in this chapter, under any contract of hire, express or implied, oral or written, or under any appointment or election, including executive officers of corporations.

The Department of Labor and Industrial Relations is responsible for administering programs that provide an income for workers to offset the loss of a job because of an injury or layoff; collecting unemployment contributions from employers and paying unemployment benefits to those who lost their job due to no fault of

Payments made to an employee for income replacement due to sickness or disability would be wages unless made under a workers' compensation law award. In the case of such payments, if the third party who made the payments to the employee makes an accounting to the employer, the employer must report the amounts.

Employers covered by the state's approved UI program are required to pay 6.0% on wages up to $7,000 per worker per year to the Federal UI program.