Pennsylvania Limited Liability Company LLC Operating Agreement

What is this form?

The Limited Liability Company (LLC) Operating Agreement is a crucial document used in forming and governing a Limited Liability Company. This form outlines the management structure, member roles, and operational procedures, setting it apart from other business documents. It allows for flexibility in terms of management, enabling members to choose between member-managed or manager-managed structures. Additionally, it provides a framework for adding new members in the future.

Form components explained

- Formation details, including the name and registered office of the LLC.

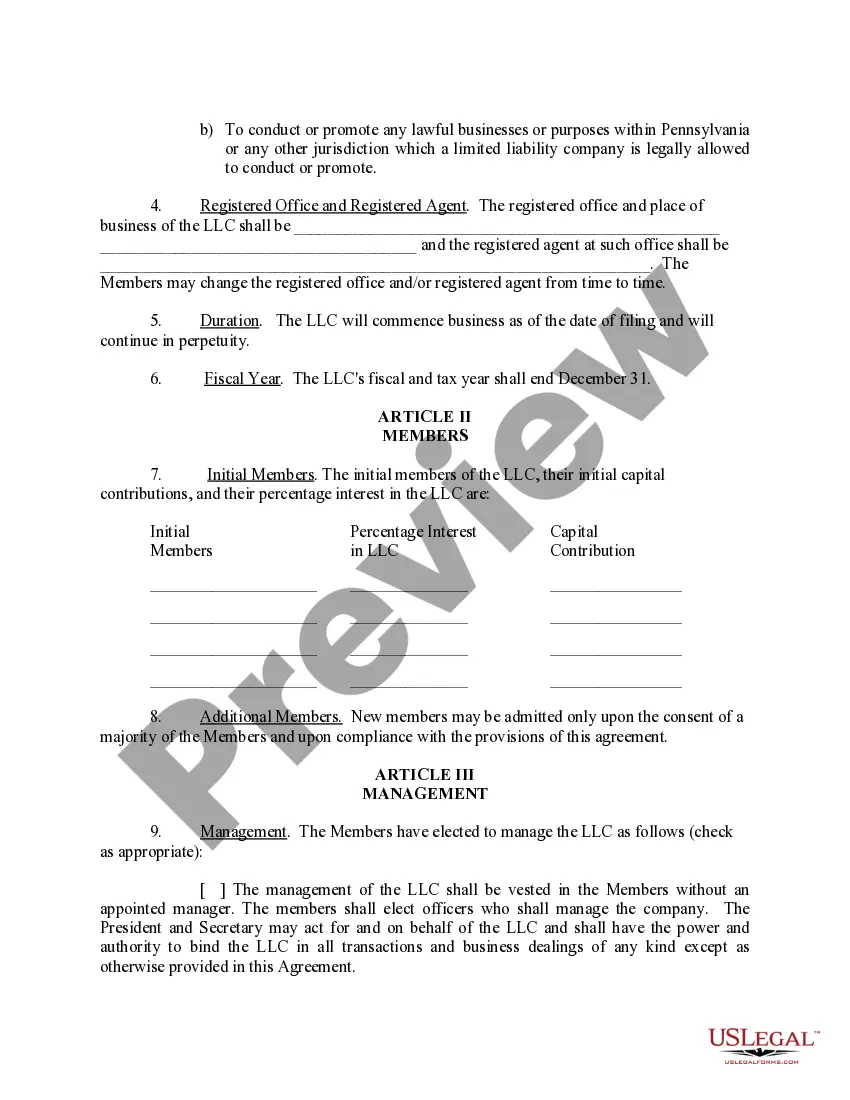

- Management structure, specifying whether the LLC is member-managed or manager-managed.

- Member contributions and ownership percentage, outlining initial and additional contributions.

- Distribution of profits and losses based on member percentage interests.

- Voting requirements for major decisions and meetings.

- Indemnification clauses protecting members and officers from certain liabilities.

When this form is needed

This form is essential when establishing a Limited Liability Company in Pennsylvania. It should be used during the initial formation process to clearly define the rights and responsibilities of each member. You may also need this agreement when adding new members or changing management structures as your business evolves.

Who this form is for

- Entrepreneurs forming a new Limited Liability Company.

- Current LLC members looking to revise or formalize their operating agreement.

- Business partners needing to outline the management structure and member roles.

Completing this form step by step

- Identify and list the initial members of the LLC, including their names and contact information.

- Specify the business name, registered office address, and registered agent information.

- Outline the management structure by selecting whether the LLC will be managed by members or appointed managers.

- Detail the initial capital contributions of each member and indicate their ownership percentage.

- Sign and date the agreement, ensuring all members acknowledge their understanding and consent.

Notarization requirements for this form

This form usually doesn’t need to be notarized. However, local laws or specific transactions may require it. Our online notarization service, powered by Notarize, lets you complete it remotely through a secure video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes

- Failing to include all members in the formation process.

- Not clearly defining the management structure, leading to confusion later.

- Omitting specific details about member contributions and ownership percentages.

Benefits of completing this form online

- Convenience of downloading and customizing the form as needed.

- Access to templates drafted by licensed attorneys ensuring legal compliance.

- Ability to easily edit and update the agreement as business needs change.

Looking for another form?

Form popularity

FAQ

An LLC Operating Agreement is Not Compulsory, but it is Highly Recommended. An LLC operating agreement is not necessarily compulsory, although this depends on the state where your business is based. You could get into a lot of unnecessary strife if situations change in your LLC.

If there is no operating agreement, you and the co-owners will not be suitably equipped to reach any settlements concerning misunderstandings over management and finances. Worse still, your LLC will be required to follow any of your state's default operating conditions.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one.However, a written operating agreement defines in writing how the LLC is run.

An LLC can be structured to be taxed in the same manner as a partnership however the owners or partners of a partnership are jointly and severally liable for the debts and obligations of the partnership.The operating agreement is a separate document and is an agreement between the owners of the LLC.

Pursuant to California Corporation's Code §17050, every California LLC is required to have an LLC Operating Agreement. Next to the Articles of Organization, the LLC Operating Agreement is the most important document in the LLC.

Call, write or visit the secretary of state's office in the state in which the LLC does business. Call, email, write or visit the owner of the company for which you want to see the LLC bylaws or operating agreement.

An operating agreement is a document which describes the operations of the LLC and sets forth the agreements between the members (owners) of the business. All LLC's with two or more members should have an operating agreement. This document is not required for an LLC, but it's a good idea in any case.

Pennsylvania does not require an operating agreement in order to form an LLC, but executing one is highly advisable.The operating agreement does not need to be filed with the state.

Unlike the articles of organization, an operating agreement generally is not required in order to form an SMLLC, nor is it filed with the state. Instead, an operating agreement is optionalthough recommended. If you choose to have one, you'll keep it on file at your business's official location.