Sample Limited Liability Company LLC Operating Agreement

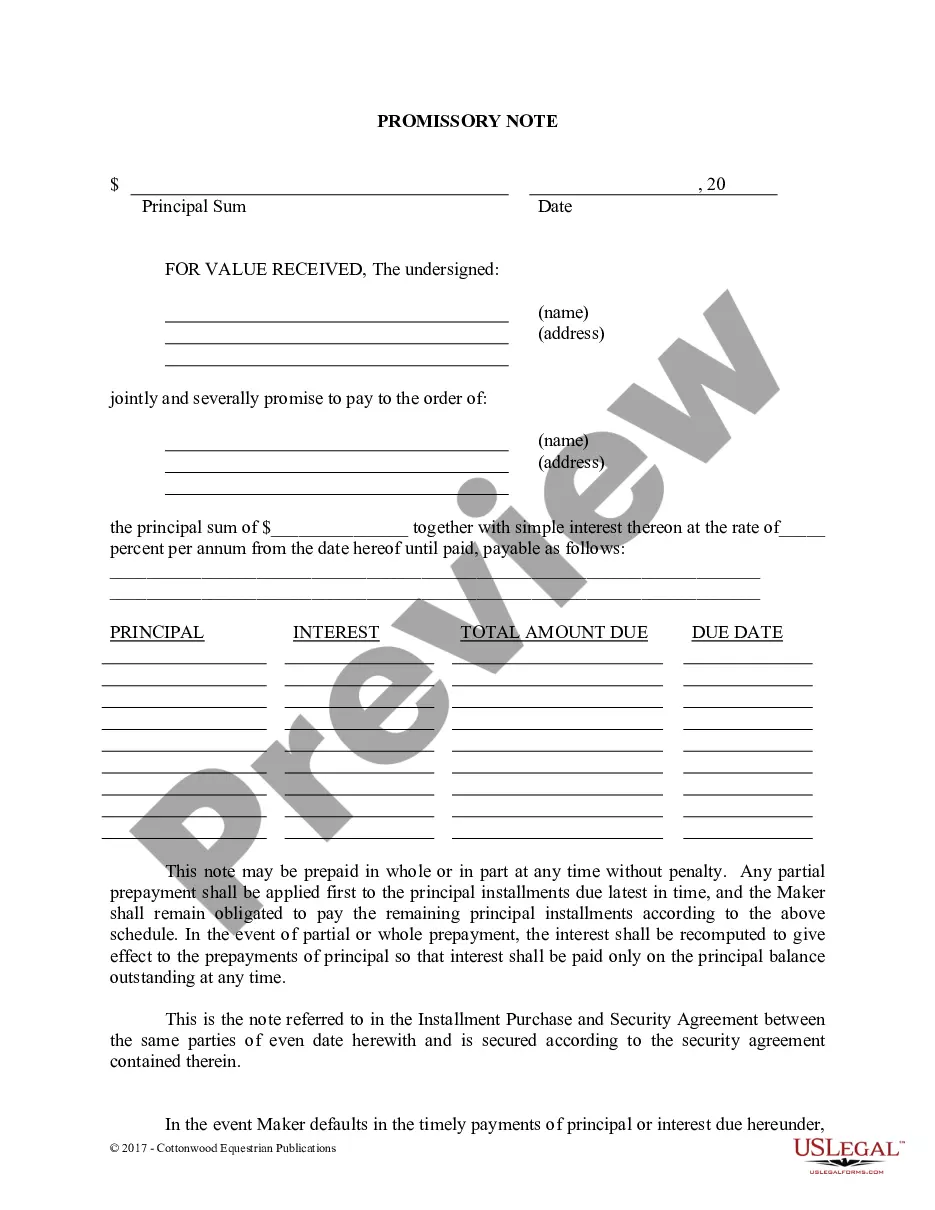

What this document covers

The Sample Limited Liability Company (LLC) Operating Agreement is a crucial legal document that outlines the management structure and operating procedures of an LLC. This agreement establishes the rights and responsibilities of the members (owners) and is essential for maintaining limited liability for the members. Unlike other business structures, an LLC offers the flexibility of partnerships while providing the protection of a corporation.

What’s included in this form

- Name of the Company: The official name under which the LLC operates.

- Term: The duration the LLC will exist unless dissolved.

- Management: Details on how the LLC will be managed by its members.

- Purpose: The primary business activities the LLC will engage in.

- Members: Information about the members and their contributions.

- Profit and Loss Allocation: How profits and losses will be divided among members.

Common use cases

This form should be used when establishing an LLC to ensure all members are on the same page regarding the management and financial structure of the company. It is particularly relevant when forming a new business, adding new members, or needing to clarify the current management and financial sharing routines among existing members.

Who can use this document

- Entrepreneurs starting a new business as an LLC.

- Existing LLC members looking to formalize their operating procedures.

- Business partners who want clear guidelines on management and profit sharing.

Completing this form step by step

- Identify the parties involved by entering the names and addresses of the members.

- Specify the official name of the LLC in the designated field.

- Enter the purpose of the LLC as intended for conducting business.

- Document each member's initial capital contributions accurately.

- Sign and date the agreement to make it legally binding.

Notarization guidance

Notarization is generally not required for this form. However, certain states or situations might demand it. You can complete notarization online through US Legal Forms, powered by Notarize, using a verified video call available anytime.

Typical mistakes to avoid

- Failing to include all members' names in the agreement.

- Not specifying the contributions made by each member.

- Omitting the purpose of the LLC.

- Not signing the agreement, making it unenforceable.

Benefits of using this form online

- Easy access to a professionally drafted legal document.

- Editable sections to customize according to specific business needs.

- Secure storage and download options for future reference.

Legal use & context

- This form provides a legal framework for managing an LLC, protecting member interests and defining responsibilities.

- It is enforceable in a court of law if all members comply with its terms and the laws of the state in which the LLC is formed.

- Inadequate or poorly drafted agreements may lead to disputes or personal liability for members.

What to keep in mind

- The Sample Limited Liability Company Operating Agreement is essential for LLC management.

- It outlines the rights, responsibilities, and financial arrangements of members.

- Completing the form correctly ensures legal protections and operational clarity.

Form popularity

FAQ

Although writing an operating agreement is not a mandatory requirement for most states, it is nonetheless considered a crucial document that should be included when setting up a limited liability company. The document, once signed by each member (owner), acts as a binding set of rules for them to adhere to.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

What Should be Included in an Operating Agreement? Names, addresses, and titles of each member. Ownership percentages. Member rights and responsibilities. Responsibility, liability, and powers of members and/or managers. Profit and loss distribution. Buying and selling rules. Dissolution instructions. Meeting guidelines.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one.

Georgia state law doesn't require you to have an operating agreement.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

Does Florida require an operating agreement for LLCs? No, LLCs formed in Florida are not required to have an operating agreement.

How to Write an Operating Agreement ? Step by Step Step One: Determine Ownership Percentages.Step Two: Designate Rights, Responsibilities, and Compensation Details.Step Three: Define Terms of Joining or Leaving the LLC.Step Four: Create Dissolution Terms.Step Five: Insert a Severability Clause.