Sample LLC Operating Agreement

Overview of this form

The Sample LLC Operating Agreement is a crucial legal document used to outline the management structure and operational guidelines of a limited liability company (LLC). This form is essential for solidifying the roles and responsibilities of the members and ensuring compliance with state laws. Unlike oral agreements, a written operating agreement provides clarity and helps avoid misunderstandings among members, serving as the foundation for how the LLC will operate and make decisions.

Main sections of this form

- Name: The official name of the LLC.

- Term: Duration of the company's existence.

- Management: Guidelines on how the LLC will be managed.

- Purpose: The specific business activities the LLC will engage in.

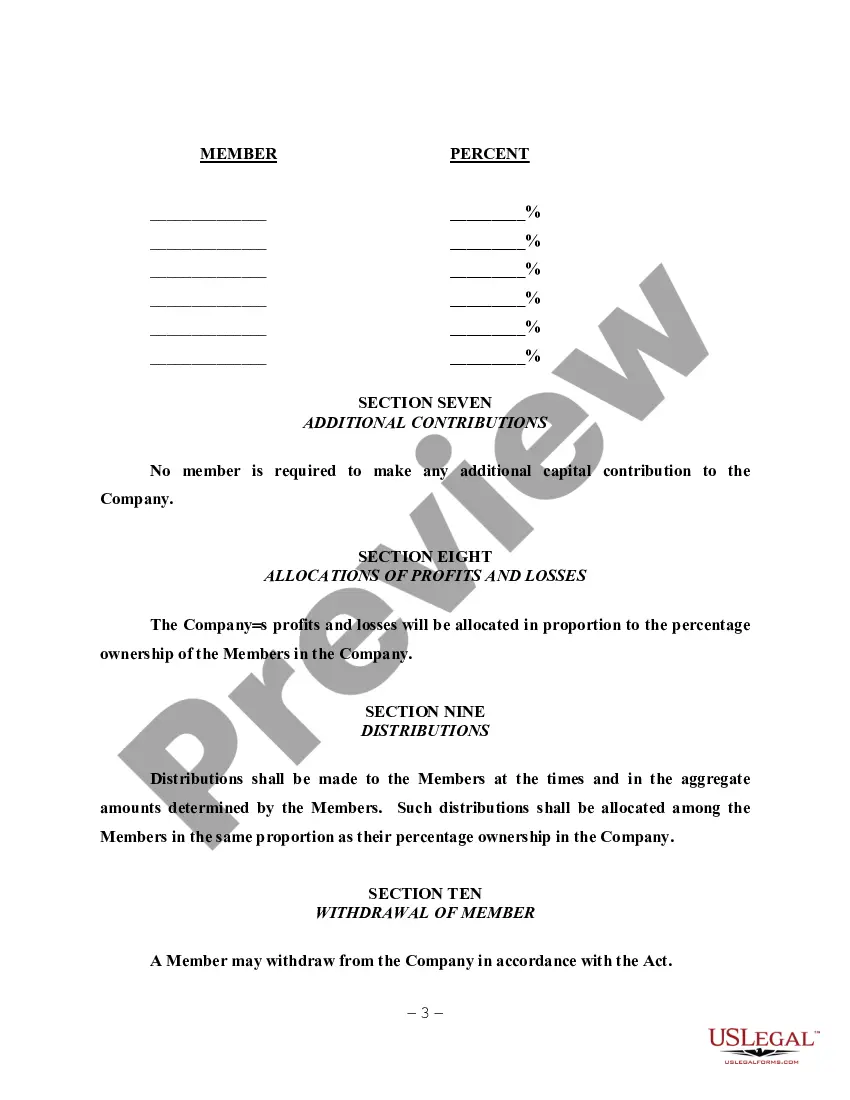

- Company assets: Ownership percentages of the members.

- Allocations of profits and losses: Method of distributing profits and losses among members.

- Withdrawal of member: Process for a member to exit the company.

- Admission of additional members: Rules for adding new members to the LLC.

When to use this document

This form should be used when founding an LLC, either prior to or following the filing of articles of organization. It is essential when there are multiple members to prevent disputes regarding the company's management and profit-sharing. Additionally, it is advisable when the members want to outline specific operational procedures and expectations.

Who should use this form

- Business partners forming a new limited liability company.

- Existing LLC members looking to formalize their agreement.

- Entrepreneurs who wish to clarify the operational framework of their business.

- Investors interested in understanding their rights and responsibilities within the LLC.

How to prepare this document

- Identify the LLC's name and ensure it complies with state naming regulations.

- Specify the members and their respective ownership percentages.

- Outline the management structure and decision-making processes.

- Define the purpose of the LLC and its business activities.

- Document the method for allocating profits and losses among members.

- Include provisions for withdrawal and admission of new members.

Notarization requirements for this form

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to include all members in the agreement.

- Not specifying the management structure clearly.

- Understanding state-specific requirements and forgetting to adhere to them.

- Neglecting to update the agreement when changes occur within the company.

Why use this form online

- Quick and easy access to a professionally drafted document.

- Editable format allows customization to meet specific business needs.

- Downloadable and printable for immediate use.

- Comprehensive guidance helps ensure compliance with legal standards.

Looking for another form?

Form popularity

FAQ

In most states, all member should and must sign the operating agreement.

There is no legal requirement that an Operating Agreement be notarized in California.

Most states do not require LLCs to have this document, so many LLCs choose not to draft one. While it may not be a requirement to have an operating agreement, it's actually in the best interest of an LLC to draft one.However, a written operating agreement defines in writing how the LLC is run.

The core elements of an LLC operating agreement include provisions relating to equity structure (contributions, capital accounts, allocations of profits, losses and distributions), management, voting, limitation on liability and indemnification, books and records, anti-dilution protections, if any, restrictions on

Member Financial Interest. What percentage ownership does each member have? Corporate Governance. Corporate Officer's Power and Compensation. Non-Compete. Books and Records Audit. Arbitration/Forum Selection. Departure of Members. Fiduciary duties.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.

An LLC Operating Agreement is the document wherein a Limited Liability Company memorializes its rules and structure.That said, many states do not require LLCs to create Operating Agreements. In fact, most do not. But that doesn't mean you shouldn't create one.

An operating agreement is a key document used by LLCs because it outlines the business' financial and functional decisions including rules, regulations and provisions. The purpose of the document is to govern the internal operations of the business in a way that suits the specific needs of the business owners.