Massachusetts Fiduciary Deed for use by Executors, Trustees, Trustors, Administrators and other Fiduciaries

Overview of this form

A fiduciary deed is a legal document that allows grantors, such as executors, trustees, administrators, or conservators, to transfer property on behalf of another party. This form is specifically designed to convey real estate held in trust or under fiduciary duty, ensuring that the interests of the beneficiaries are protected. Unlike a traditional warranty deed, a fiduciary deed is used when a fiduciary is acting in their official capacity, making it critical for estate management and trust administration.

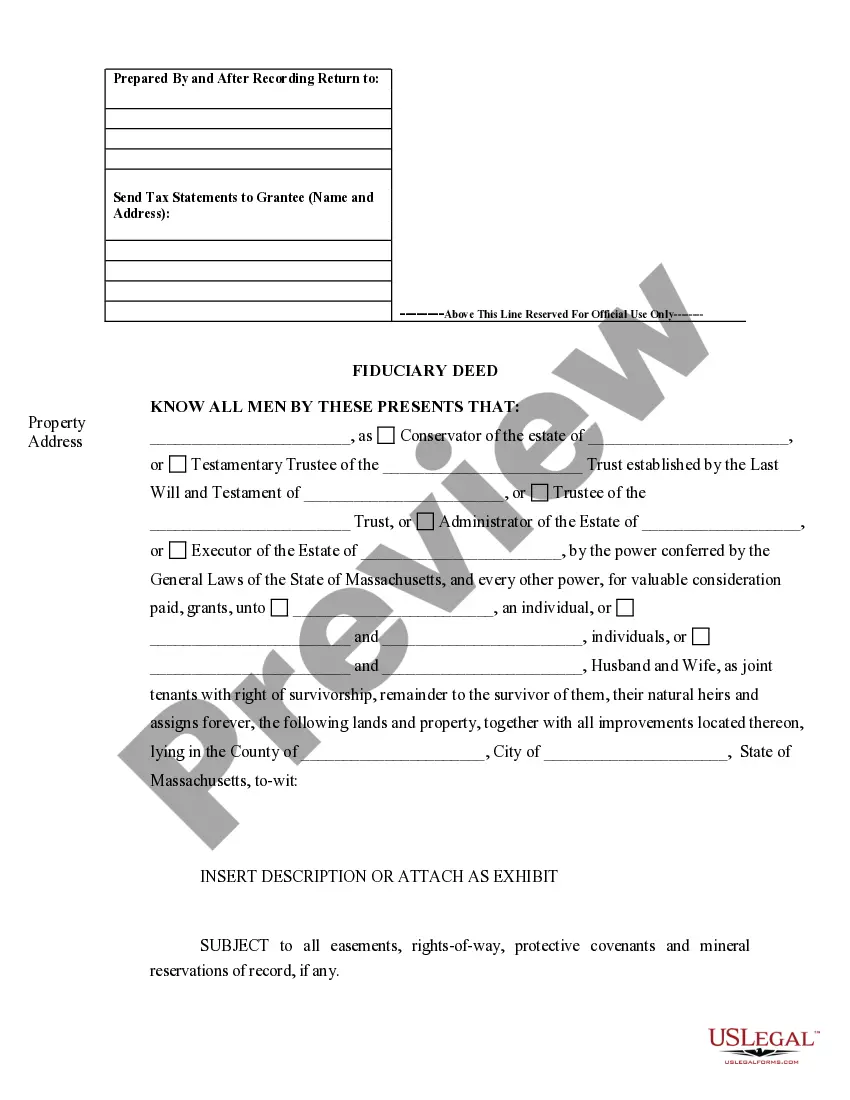

Form components explained

- Grantor Information: Details about the fiduciary, including name and official capacity.

- Grantee Information: Identification of the person or entity receiving the property.

- Property Description: A detailed description of the property being transferred.

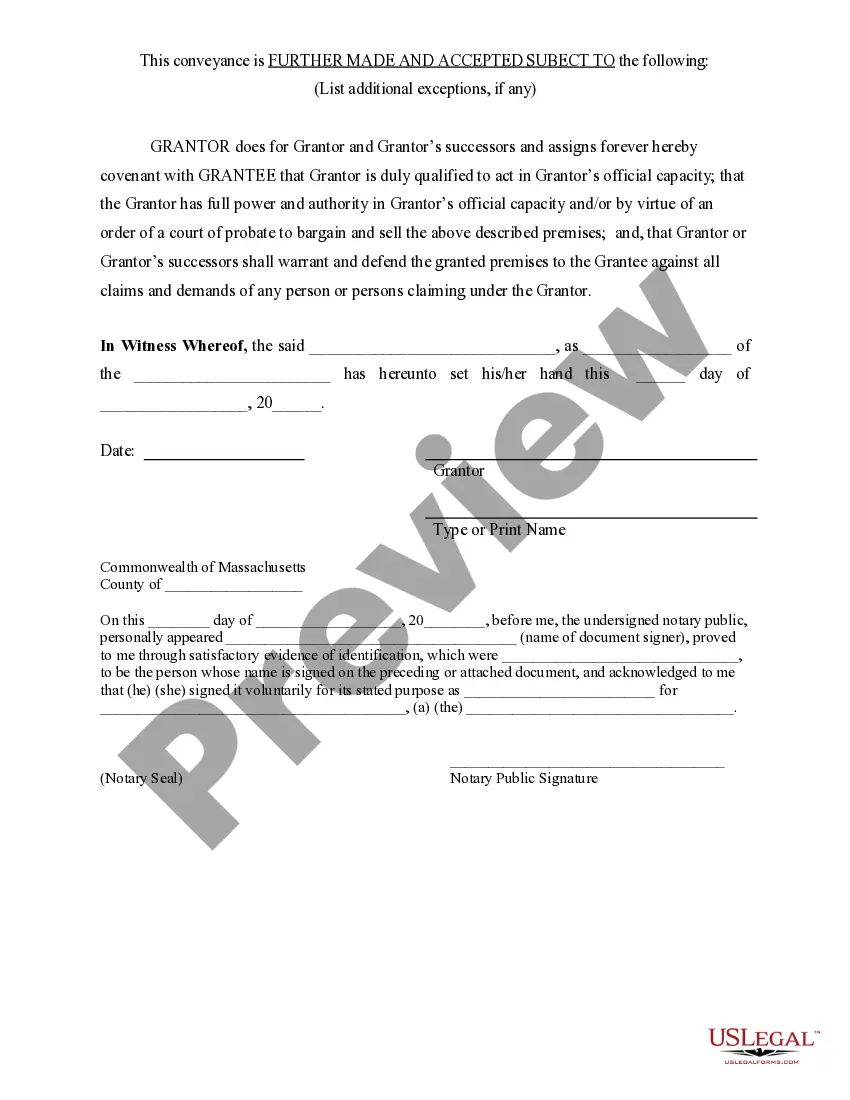

- Legal Covenants: Assertions regarding the authority to transfer the property and warranties to the grantee.

- Notarization Section: Space for the notary public to acknowledge the document's execution.

When to use this document

You should use this fiduciary deed when you need to transfer property that is part of an estate, a trust, or under the management of a fiduciary. This includes situations where an executor is managing an estate following a will, or a trustee is handling trust assets. It may also be used by conservators managing an individualâs property due to incapacity. Using this form ensures that the transfer is legally recognized and conducted appropriately.

Intended users of this form

- Executors of a will who are responsible for administering an estate.

- Trustees managing a trust and needing to transfer trust property.

- Administrators of an estate where a person has died without a will.

- Guardians or conservators appointed to manage someone's assets.

Steps to complete this form

- Identify the grantor by including their name and official title as executor, trustee, or administrator.

- Specify the granteeâs name and details, ensuring accurate identification of the receiving party.

- Provide a complete description of the property being transferred, including boundaries and any legal references.

- Sign the document in the designated area, ensuring all required signatures are included.

- Obtain notarization by having the document acknowledged by a licensed notary public.

Is notarization required?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to provide a complete and accurate property description.

- Not signing or incorrectly signing the document.

- Not obtaining notarization, which can nullify the deed's validity.

- Using the wrong type of deed for the transaction.

Advantages of online completion

- Convenience of filling out the form from home at your own pace.

- Editability allows for easy corrections before finalizing the document.

- Access to reliable legal templates drafted by licensed attorneys.

- Secured document storage and easy downloading after completion.

Key takeaways

- The Fiduciary Deed is essential for fiduciaries transferring property.

- Proper completion and notarization of the form are critical for legal validity.

- This form specifically addresses the rights and responsibilities of fiduciaries in Massachusetts.

Looking for another form?

Form popularity

FAQ

When you're ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you'll need to prepare, sign, and record a deed. That's the document that transfers title to the property from you, the trustee, to the new owner.

The Trustees can be the author, domestic members or associates, professionals such as accountants, attorneys, etc. a panel of banks or a Trust company, or any mixture of these people.

Two documents are needed to transfer California real property from a trust to beneficiaries of the trust; a deed and an 'affidavit of death of trustee. ' An 'affidavit death of trustee' is a declaration, under oath, by the successor trustee.

A quitclaim deed can be used to transfer property from a trust, but a Special Warranty Deed seems to be a more common way to do this.

Distribute trust assets outright The grantor can opt to have the beneficiaries receive trust property directly without any restrictions. The trustee can write the beneficiary a check, give them cash, and transfer real estate by drawing up a new deed or selling the house and giving them the proceeds.

California Property TaxesTransferring real property to yourself as trustee of your own revocable living trust -- or back to yourself -- does not trigger a reassessment for property tax purposes. (Cal. Rev. & Tax Code § 62(d).)

The personal representative and the trustee named in such wills are sometimes the same person. In the case of a revocable trust containing a testamentary trust, the trustee continues on as the trustee of the trust after your affairs are settled and the trusts are funded.

How to sign as a Trustee. When signing anything on behalf of the trust, always sign as John Smith, Trustee. By signing as Trustee, you will not be personally liable for that action as long as that action is within the scope of your authority under the trust.