New York Tax Free Exchange Package

Understanding this form package

The New York Tax Free Exchange Package includes essential forms designed to facilitate the tax-free exchange of like-kind property. This package is tailored to help users navigate the complexities of real estate exchanges in accordance with Section 1031 of the Internal Revenue Code, making it distinct from other real estate transaction packages.

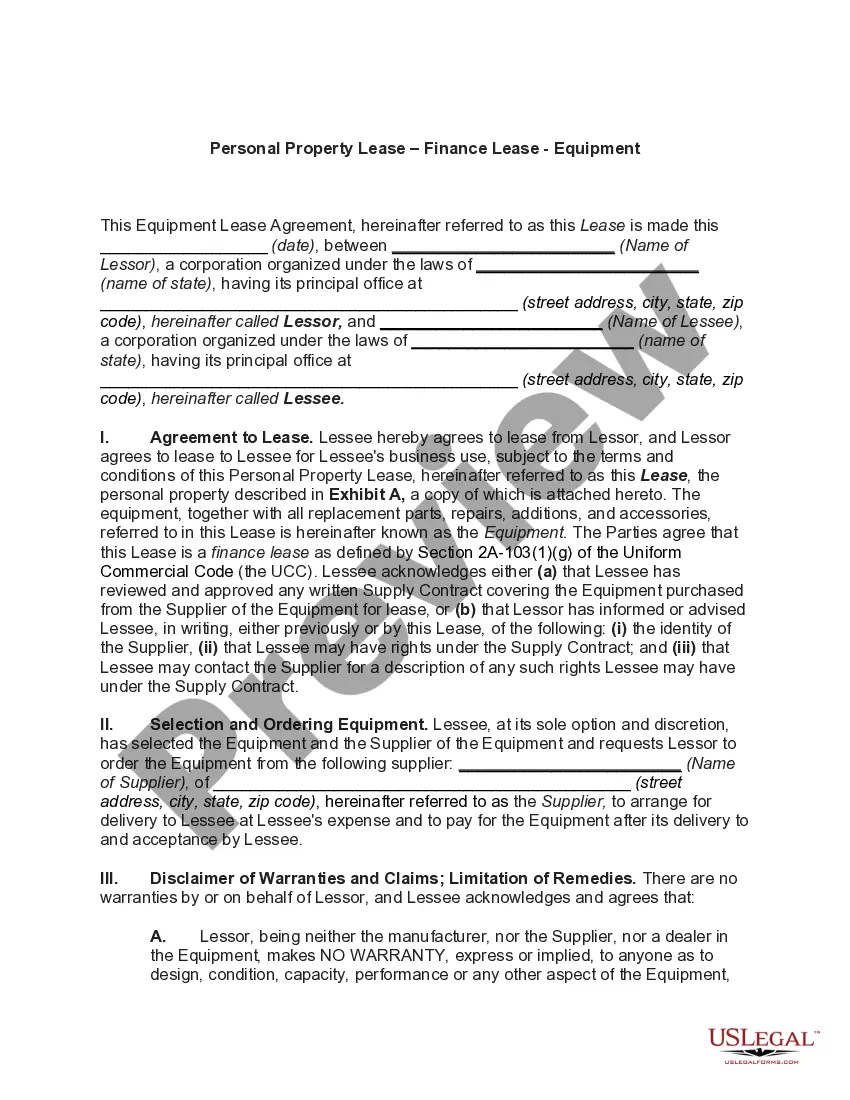

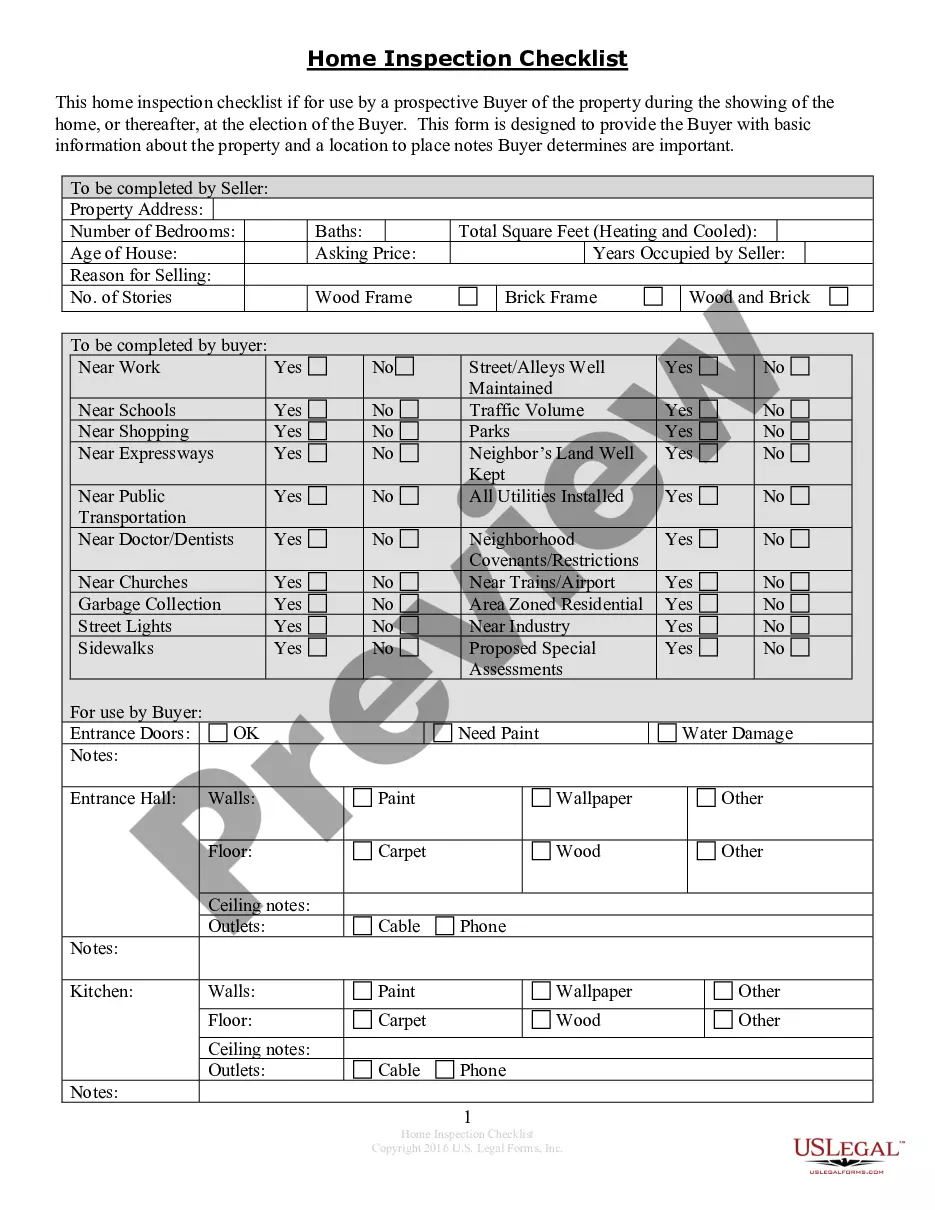

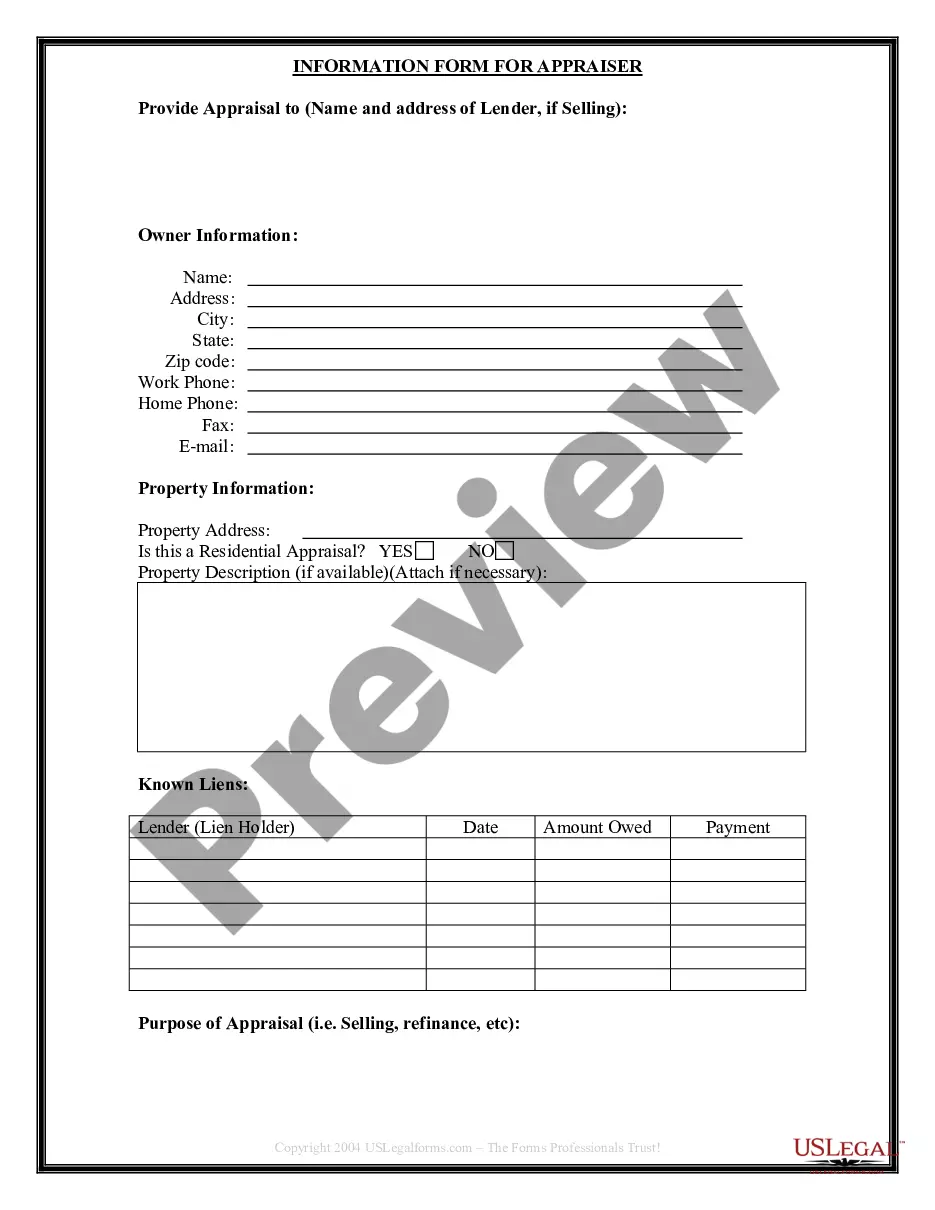

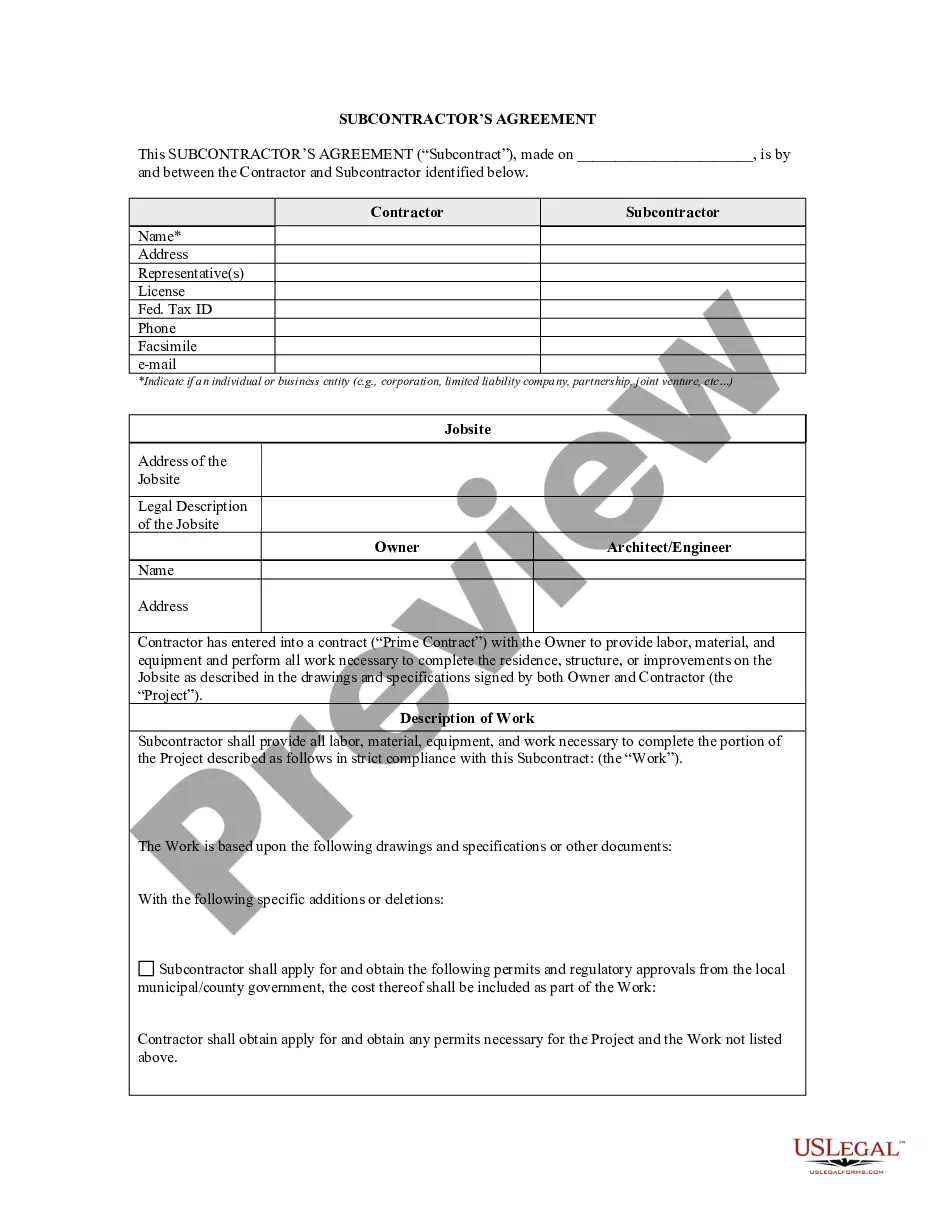

Forms you’ll find in this package

Common use cases

This form package should be used when:

- You are planning to exchange a property for another property of similar value.

- You want to defer capital gains taxes on the sale of investment or business property.

- You need to amend existing real estate contracts to include an exchange.

- You aim to document the exchange for IRS reporting requirements.

Who can use this document

- Real estate investors looking to defer capital gains taxes.

- Property owners considering an exchange to upgrade or downsize their property.

- Business owners selling business property and seeking a tax-deferral option.

- Real estate agents advising clients on tax-free exchanges.

Instructions for completing these forms

- Review all included forms to understand their purpose and requirements.

- Gather relevant information pertaining to the properties involved in the exchange.

- Carefully complete the Exchange Agreement and the Exchange Addendum.

- Fill out the Certification Of No Info Reporting On Sale Of Exchange form.

- Ensure compliance with IRS requirements using the Like-Kind Exchanges form.

- Consult a tax professional for guidance on reporting the Sale of Business Property.

Notarization details for included forms

Notarization is not commonly needed for forms in this package. However, if your state’s laws require it, our notarization service, powered by Notarize, allows you to finalize documents online 24/7 without in-person visits.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to properly complete the Exchange Agreement, which may cause legal issues.

- Not understanding the implications of Section 1031, leading to potential tax liabilities.

- Overlooking the need to report the exchange correctly to the IRS.

- Not retaining proper documentation throughout the exchange process.

Why complete this package online

- Convenience of downloading forms instantly from anywhere.

- Editability allows for adjustments as needed without reprinting entire forms.

- Access to legal forms drafted by licensed attorneys to improve accuracy.

- Secure digital storage options for easy access and organization of important documents.

Looking for another form?

Form popularity

FAQ

A 1031 exchange gets its name from Section 1031 of the Internal Revenue Code. This tax-deferral strategy is part of the FEDERAL tax code. Whether or not you can defer the state gain varies by state. Several states have no state income tax so there is no need to report the exchange on a state return.

Section 1031 is a federal tax code, so it is recognized in all states, so you can exchange from state to state.

The Tax Law exempts purchases for resale; most sales to or by the federal and New York State governments, charitable organizations, and certain other exempt organizations; sales of most food for home consumption; and sales of prescription and nonprescription medicines. Sales tax also does not apply to most services.

Internal Revenue Code (IRC) Section 1031 applies to all citizens or residents of the United States (US) or non-resident aliens subject to US federal income taxes. Many Exchangors are not aware that international property is eligible for 1031 exchange tax treatment.

Although NYC does not have any restrictions on 1031 exchanges, it does have a levy that many real estate professionals overlook: transfer taxes.

You may be required to collect sales tax on the products or services that you sell. For example, if you sell items at a retail store or food establishment, or perform services such as auto repairs, pool cleaning, or lawn care, you must collect sales tax from your customers.

The Tax Law exempts purchases for resale; most sales to or by the federal and New York State governments, charitable organizations, and certain other exempt organizations; sales of most food for home consumption; and sales of prescription and nonprescription medicines. Sales tax also does not apply to most services.

File Form ST-119.2, Application for an Exempt Organization Certificate. Submit the required documentation described in the Instructions for Form ST-119.2. Provide a copy of your 501(c)(3) determination letter when applying (if your organization applied for and received federal income tax exemption from the IRS)

There are also states that have withholding requirements if the seller of a piece of property in these states is a non-resident of any of the following states: California, Colorado, Hawaii, Georgia, Maryland, New Jersey, Mississippi, New York, North Carolina, Oregon, West Virginia, Maine, South Carolina, Rhode Island,