North Carolina Revocation of Living Trust

Understanding this form

The Revocation of Living Trust form is a legal document used to officially revoke a living trust that a person has established. Unlike other estate planning tools, a living trust allows for the management of assets during a person's lifetime and the distribution of those assets after death. This revocation form serves to declare the total annulment of a specific living trust and ensures the return of any trust property to the original trustor(s). It is critical to sign this document in the presence of a notary public to ensure its legality.

Form components explained

- Identification of the Trustor(s) and the specific living trust being revoked.

- A clear statement of the total revocation of the trust.

- Details about the reconveyance or reassignment of trust property to the Trustor(s).

- An effective date for the revocation to take place.

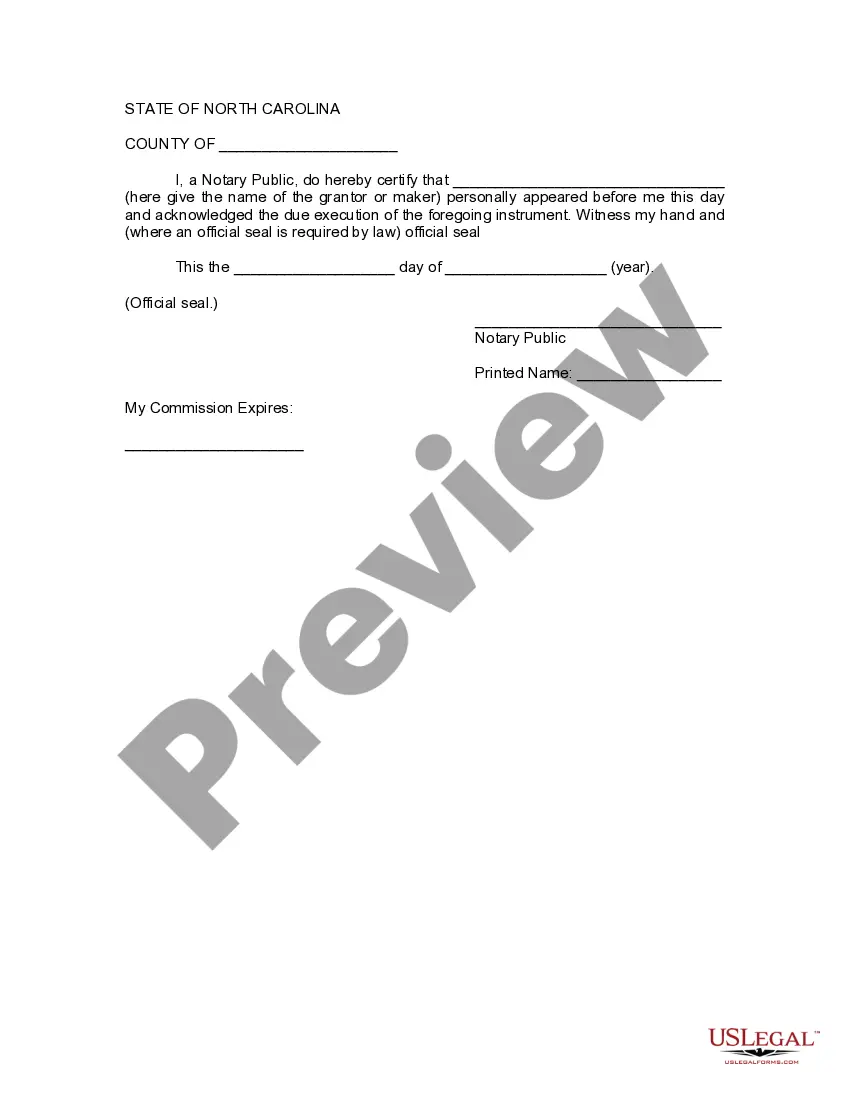

- Signature lines for the Trustor(s) along with a notary section for validation.

Common use cases

This form should be used when the trustor wishes to completely revoke a living trust they have previously established. Common scenarios include changes in personal circumstances, such as divorce, the passing of a beneficiary, or the decision to revert to a simpler estate planning strategy. Using this form is necessary to ensure that the revocation is legally recognized and that all assets are properly returned to the trustor.

Who can use this document

- Individuals who have created a living trust and wish to revoke it completely.

- Trustors looking to change their estate plans or simplify asset management.

- Anyone ensuring that their property and assets are returned to them following a trust revocation.

Completing this form step by step

- Identify the Trustor(s) and the name of the living trust being revoked.

- Clearly state the revocation of the trust in full.

- Outline how trust property will be returned to the Trustor(s).

- Enter the effective date for the revocation.

- Both Trustor(s) must sign the document in the presence of a notary public.

Does this document require notarization?

Yes, this form must be notarized to be legally valid. This ensures that the signatures are authentic and the document is recognized by legal authorities. US Legal Forms offers integrated online notarization through secure video calls, making it convenient and accessible at any time.

Mistakes to watch out for

- Failing to have the form notarized, which may invalidate the revocation.

- Not clearly identifying the specific living trust being revoked.

- Leaving out the effective date, creating ambiguity about when the revocation applies.

Advantages of online completion

- Immediate access to a legally vetted template that can be customized to meet your needs.

- Convenient editing options that allow you to tailor the document to your personal circumstances.

- Reliable format ensuring compliance with applicable laws and regulations.

Main things to remember

- The Revocation of Living Trust form is essential for terminating a living trust.

- Proper signatures and notarization are critical for its legal enforceability.

- Utilizing this form ensures that trust property is properly returned to the trustors.

Form popularity

FAQ

The first step in dissolving a revocable trust is to remove all the assets that have been transferred into it. The second step is to fill out a formal revocation form, stating the grantor's desire to dissolve the trust.

This can take as long as 18 months or so if real estate or other assets must be sold, but it can go on much longer. How long it takes to settle a revocable living trust can depend on numerous factors.

EXAMPLE: Yvonne and Andre make a living trust together. Step 1: Transfer ownership of trust property from yourself as trustee back to yourself. Step 2: A revocation prints out with your trust document. Step 3: Complete the Revocation of Trust by filling in the date, and then sign it in front of a notary public.

The terms of an irrevocable trust may give the trustee and beneficiaries the authority to break the trust. If the trust's agreement does not include provisions for revoking it, a court may order an end to the trust. Or the trustee and beneficiaries may choose to remove all assets, effectively ending the trust.

A revocable trust, or living trust, is a legal entity to transfer assets to heirs without the expense and time of probate.A living trust also can be revoked or dissolved if there is a divorce or other major change that can't be accommodated by amending the trust.

Termination by Trustee. If a trust has less than $50,000 in assets, the trustee may terminate the trust without getting court approval. Termination With Consent of Beneficiaries. Termination by the Court.

Whether your trust closes immediately after your death or lives on for a while to serve your intentions, it must eventually close. This typically involves payment of any outstanding debts or taxes before the trustee distributes the trust's assets and income to your named beneficiaries.

How can I dissolve my trust? You can dissolve a trust by bringing forward its final distribution date. This can be done by the trustees or settlor if the trust deed says they can, or by the combined consent of the beneficiaries.

Key Takeaways. Revocable trusts, as their name implies, can be altered or completely revoked at any time by their grantorthe person who established them. The first step in dissolving a revocable trust is to remove all the assets that have been transferred into it.