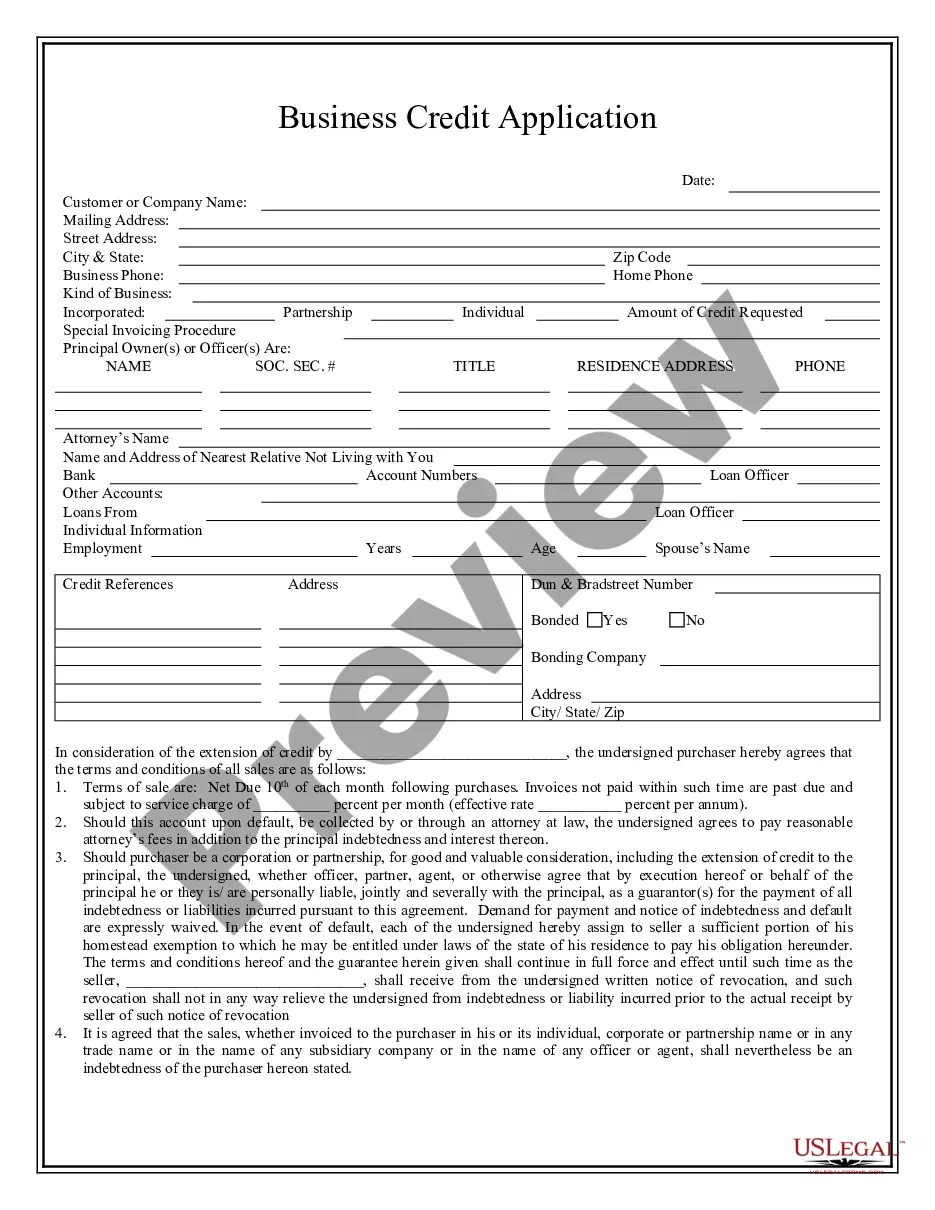

Maryland Business Credit Application

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Business Credit Application?

Greetings to the finest legal documents repository, US Legal Forms. Here, you can discover any template such as Maryland Business Credit Application forms and download them (as numerous as you desire). Prepare formal documents within a few hours, rather than days or even weeks, without spending a fortune on a lawyer. Obtain the state-specific form in a few clicks and rest assured that it was created by our licensed legal experts.

If you are already a registered user, simply sign in to your profile and then click Download next to the Maryland Business Credit Application you need. Since US Legal Forms is a web-based service, you will always have access to your saved documents, regardless of the device you’re utilizing. Find them within the My documents section.

If you don't have an account yet, what are you delaying for? Review our instructions below to get started.

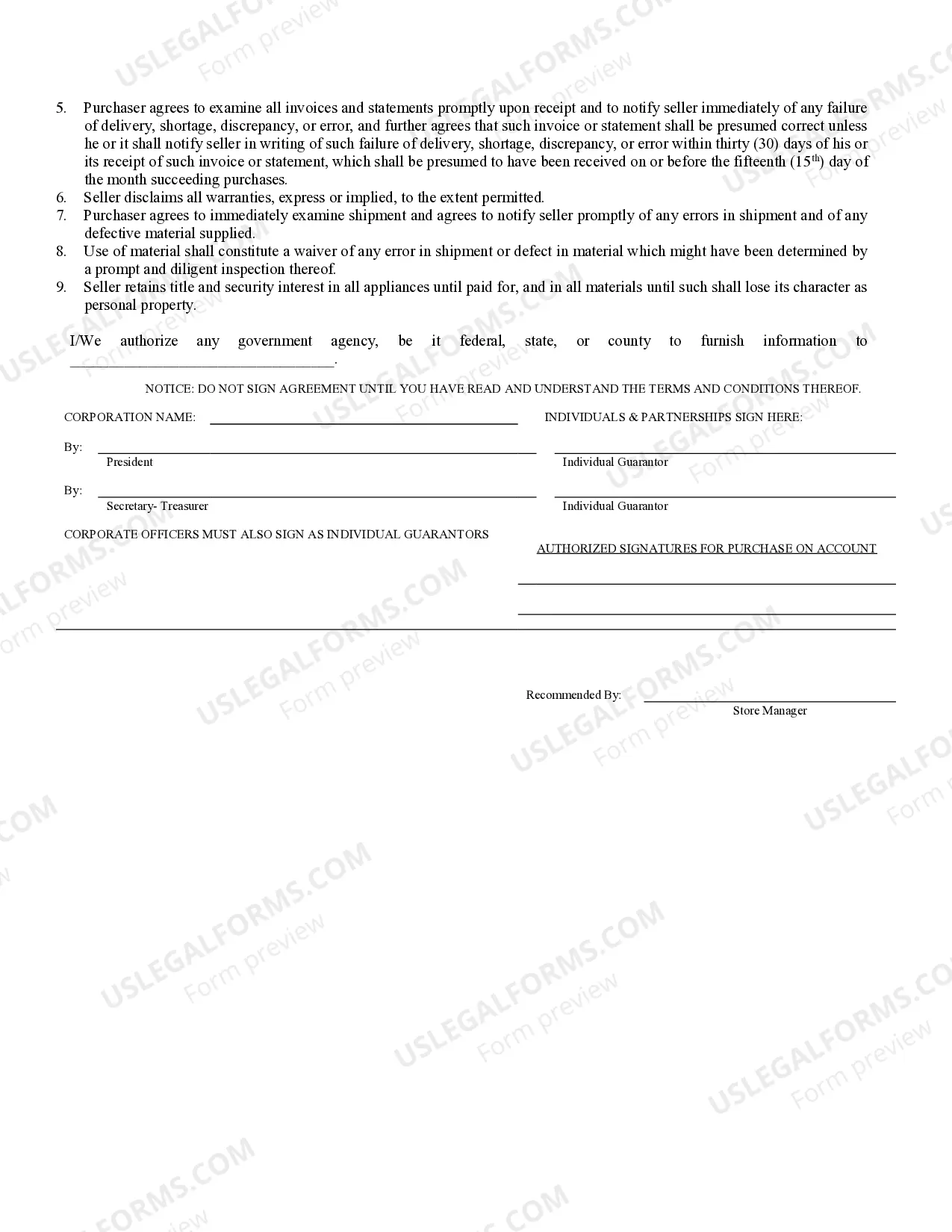

After you’ve filled in the Maryland Business Credit Application, forward it to your lawyer for verification. It’s an additional step but a crucial one for ensuring you’re fully protected. Enroll in US Legal Forms today and acquire a vast array of reusable templates.

- If this is a state-specific template, verify its accuracy in your state.

- Examine the description (if available) to determine if it’s the correct template.

- View more details with the Preview feature.

- If the document meets all your requirements, simply click Buy Now.

- To create your account, choose a pricing option.

- Utilize a credit card or PayPal account to register.

- Download the template in the format you prefer (Word or PDF).

- Print the document and complete it with your/your company's details.

Form popularity

FAQ

To file, you must download and print the Annual Personal Property Return form from the Secretary of State website. Then, complete it mail in to the Maryland State Department of Assessments and Taxation along with the filing form.

Choose a Name for Your LLC. Appoint a Registered Agent. File Articles of Organization. Prepare an Operating Agreement. Comply With Other Tax and Regulatory Requirements. File Annual Reports.

Register Your Business in Maryland. Obtain a Federal Tax ID Number from the IRS. Apply for Maryland Tax Accounts and Insurance. Obtain Licenses or Permits. Purchase Business Insurance.

Forms and fees. The filing fee for the Articles of Organization is about $100. Expedited processing services are available for a minimal fee of $50. Fees can change, check with the Maryland Department of Assessments and Taxation for the most current fees.

The filing fee for the Articles of Organization is about $100. Expedited processing services are available for a minimal fee of $50. Fees can change, check with the Maryland Department of Assessments and Taxation for the most current fees. Timeline.

Maryland businesses must register using the Maryland Business Express200b portal, administered by the Department of Assessments and Taxation. The portal offers a step-by-step process to register a business online. Many businesses require permits or licenses to operate.

Choose a business name. File an application to register a trade name with the Department of Assessments and Taxation. Obtain licenses, permits, and zoning clearance. Obtain an Employer Identification Number.

Note that this report defines small businesses as firms with fewer than 500 employees. Note: Median income represents earnings from all sources. Unincorporated self-employment income includes unpaid family workers, a very small percent of the unincorporated self-employed.

To form an LLC in Maryland you will need to file the Articles of Organization with the Maryland Department of Assessments and Taxation, which costs $100. You can apply online, by mail, or in-person. The Articles of Organization is the legal document that officially creates your Maryland Limited Liability Company.