Maryland Individual Credit Application

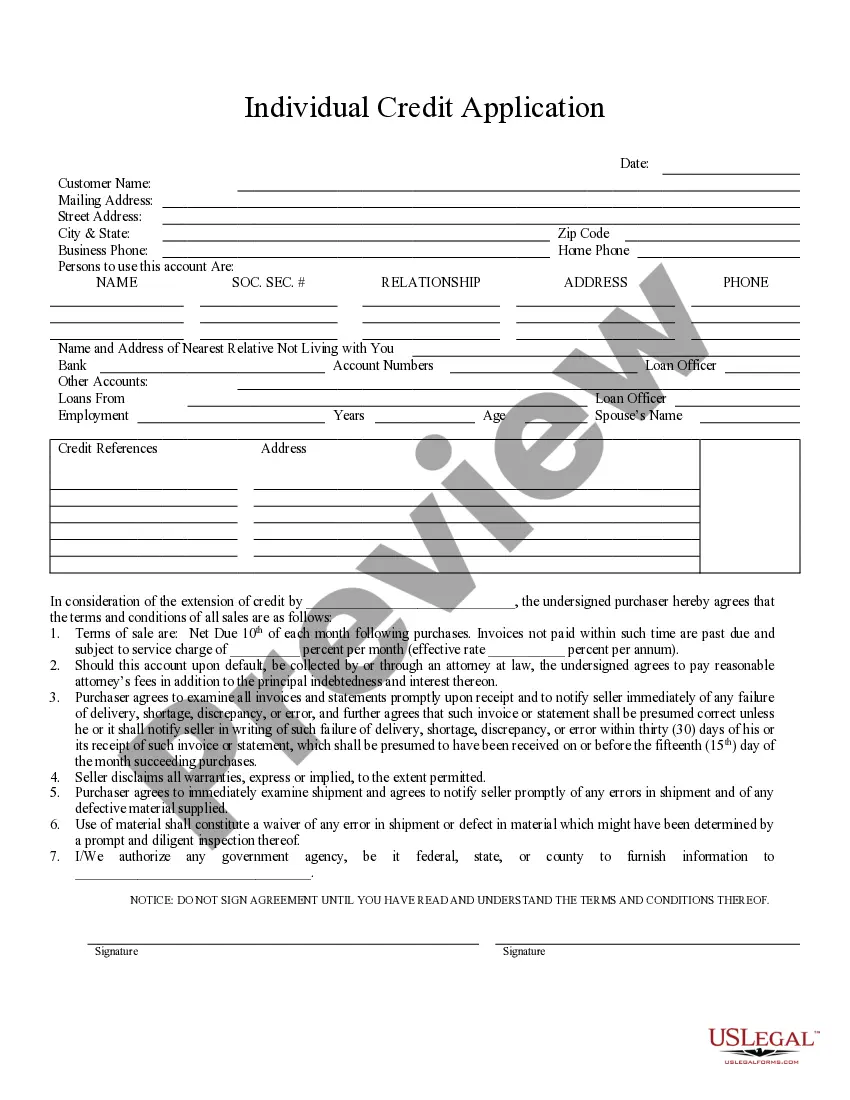

About this form

The Individual Credit Application is a legal document used by individuals who wish to apply for credit for a purchase. This form outlines the terms of repayment, conditions for default, and authorizes the seller to obtain personal information from government agencies. This application differs from other credit forms by providing specific terms related to repayment and seller warranties.

Form components explained

- Details of the purchaser and seller.

- Terms of sale, including payment due dates and interest rates.

- Conditions for default and attorney's fees.

- Disclaimer of warranties regarding the product sold.

- Authorization for the seller to obtain personal information for credit assessment.

Situations where this form applies

This form should be used when an individual is seeking credit from a seller for a purchase. It is ideal in situations where the seller requires specific terms for repayment and wants to establish conditions regarding defaults and warranties. Examples include applications for credit in retail, automotive, or other financing scenarios.

Who should use this form

This form is suitable for:

- Individuals applying for credit for a personal purchase.

- Sellers or businesses offering credit to customers.

- Individuals who need to understand their obligations in a credit transaction.

Instructions for completing this form

- Identify and enter the names of the purchaser and seller.

- Specify the terms of sale, including payment due date and interest rate.

- Review and understand the conditions related to default and attorney fees.

- Sign the application to acknowledge understanding of the terms.

- Submit the completed application to the seller for processing.

Is notarization required?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to read and understand all terms before signing.

- Not specifying the correct due dates or interest rates.

- Overlooking the requirement to notify the seller of discrepancies promptly.

Advantages of online completion

- Convenient access to the form from anywhere, at any time.

- Edit and customize the template to fit your specific needs.

- Quick download for immediate use in your credit application process.

Quick recap

- The Individual Credit Application is essential for establishing clear repayment terms.

- Always read the terms thoroughly before signing.

- Utilize the form to protect both parties in a credit transaction.

Looking for another form?

Form popularity

FAQ

First, the homeowner(s) must have owned and occupied the property as a principal residence for at least 3 full tax years immediately preceding the razing or the commencement of the substantial improvements.

The State of Maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the basis of gross household income.

If you're eligible to claim Tax Credits you'll need to fill in form TC600. You can get this form by: completing in HMRC's Tax Credit claim form request online, or. calling the Tax Credit helpline on 0345 300 3900 (textphone 0345 300 3909).

The State of Maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the basis of gross household income. Please go to SDAT's website to review income eligibility information if you have any questions.

Homeowners' Tax Credit The Homeowners' Property Tax Credit Program is available to Maryland homeowners of all ages. The program sets a limit on the amount of property taxes any homeowner must pay based upon household income. The maximum assessment eligible for credit is $300,000.

You may qualify for the full credit only if your modified adjusted gross income is under: In 2020: $400,000 for married filing jointly and $200,000 for everybody else. In 2021: $75,000 for single filers, $150,000 for married filing jointly and $112,500 for head of household filers.

Your combined gross household income cannot exceed $60,000. Example:If your combined household income is $16,000, you see from the chart that your tax limit is $420. You would be entitled to receive a credit for any taxes above the $420.

If you're eligible to claim Tax Credits you'll need to fill in form TC600. You can get this form by: completing in HMRC's Tax Credit claim form request online, or. calling the Tax Credit helpline on 0345 300 3900 (textphone 0345 300 3909).