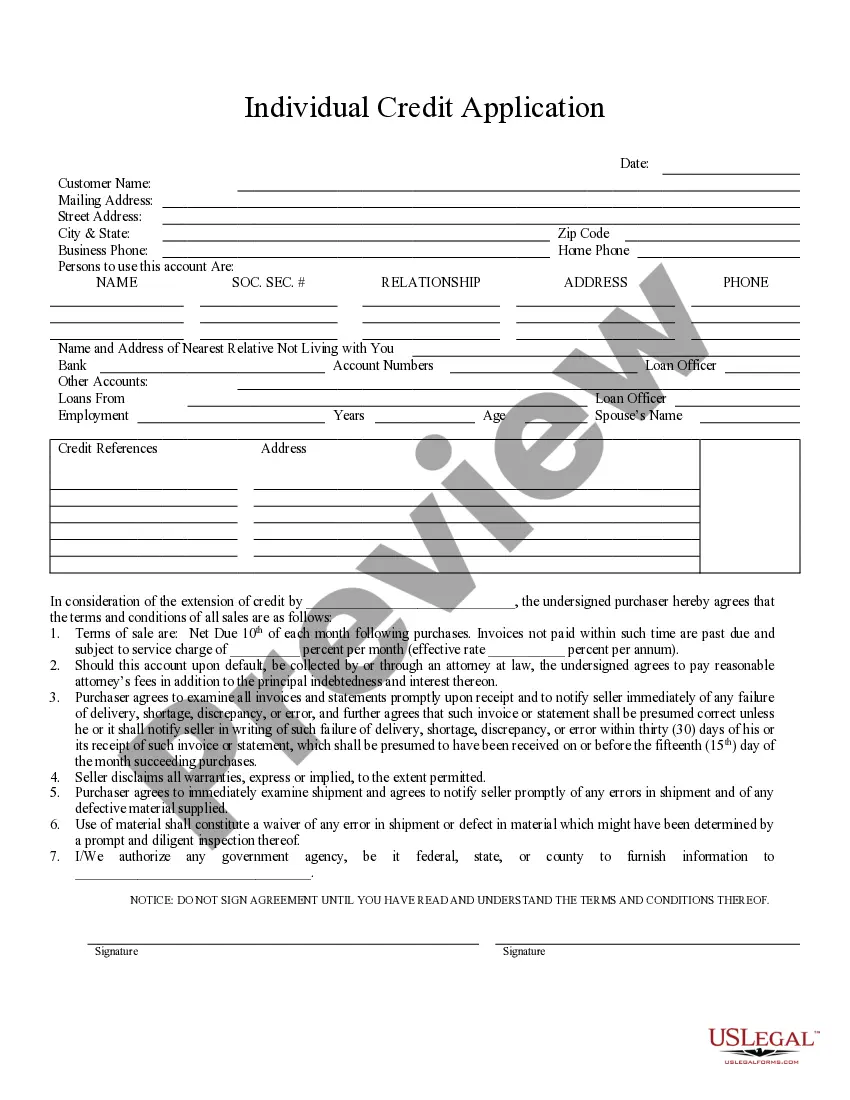

Maryland Individual Credit Application

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Maryland Individual Credit Application?

Greetings to the most extensive legal documents repository, US Legal Forms. Here, you can discover any sample including Maryland Individual Credit Application forms and keep them (as many as you wish or need). Prepare official paperwork within a few hours, instead of days or even weeks, without breaking the bank on a lawyer or attorney.

Obtain your state-specific example with just a few clicks and feel confident knowing that it was created by our experienced legal experts.

If you’re already a registered user, simply Log In to your account and then click Download next to the Maryland Individual Credit Application you need. Since US Legal Forms is an online service, you’ll always have access to your downloaded documents, regardless of the device you’re using. Find them in the My documents section.

- If you don’t have an account yet, what are you awaiting.

- Review our instructions below to get started.

- If this is a specific state document, verify its relevance in your state.

- Examine the description (if available) to ascertain if it’s the correct template.

- Browse additional material using the Preview option.

- If the sample meets all your criteria, just click Buy Now.

- To create an account, select a pricing plan.

- Utilize a credit card or PayPal account to subscribe.

- Download the template in the format you prefer (Word or PDF).

- Print the document and complete it with your or your business’s information.

- After filling out the Maryland Individual Credit Application, send it to your attorney for verification. This is an extra step but an important one for ensuring you're fully protected.

- Join US Legal Forms now and access a large quantity of reusable templates.

Form popularity

FAQ

First, the homeowner(s) must have owned and occupied the property as a principal residence for at least 3 full tax years immediately preceding the razing or the commencement of the substantial improvements.

The State of Maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the basis of gross household income.

If you're eligible to claim Tax Credits you'll need to fill in form TC600. You can get this form by: completing in HMRC's Tax Credit claim form request online, or. calling the Tax Credit helpline on 0345 300 3900 (textphone 0345 300 3909).

The State of Maryland provides a credit for the real property tax bill for homeowners of all ages who qualify on the basis of gross household income. Please go to SDAT's website to review income eligibility information if you have any questions.

Homeowners' Tax Credit The Homeowners' Property Tax Credit Program is available to Maryland homeowners of all ages. The program sets a limit on the amount of property taxes any homeowner must pay based upon household income. The maximum assessment eligible for credit is $300,000.

You may qualify for the full credit only if your modified adjusted gross income is under: In 2020: $400,000 for married filing jointly and $200,000 for everybody else. In 2021: $75,000 for single filers, $150,000 for married filing jointly and $112,500 for head of household filers.

Your combined gross household income cannot exceed $60,000. Example:If your combined household income is $16,000, you see from the chart that your tax limit is $420. You would be entitled to receive a credit for any taxes above the $420.

If you're eligible to claim Tax Credits you'll need to fill in form TC600. You can get this form by: completing in HMRC's Tax Credit claim form request online, or. calling the Tax Credit helpline on 0345 300 3900 (textphone 0345 300 3909).