Maryland Articles of Incorporation for Professional Corporation

Description

How to fill out Maryland Articles Of Incorporation For Professional Corporation?

You are invited to the largest repository of legal documentation, US Legal Forms. Here you can locate any sample including Maryland Articles of Incorporation for Professional Corporation formats and preserve them (as many as you desire/require). Create formal paperwork within hours, instead of days or weeks, without needing to spend a fortune on a lawyer. Obtain the state-specific form with just a few clicks and feel confident knowing it was prepared by our state-certified attorneys.

If you are already a subscribed member, simply Log Into your account and then click Download next to the Maryland Articles of Incorporation for Professional Corporation you wish. Given that US Legal Forms is an online service, you will always have access to your stored documents, irrespective of the device you are using. View them in the My documents section.

If you don't have an account yet, what are you waiting for? Follow our guidelines below to begin: If this is a state-specific document, verify its validity in your state. Review the description (if available) to ensure it’s the correct format. Explore additional details with the Preview feature. If the document suits your requirements, simply click Buy Now. To create an account, select a pricing option. Utilize a credit card or PayPal to register. Download the file in your desired format (Word or PDF). Print the document and input your/your enterprise’s information. Once you’ve finalized the Maryland Articles of Incorporation for Professional Corporation, submit it to your attorney for confirmation. It’s an additional measure but a crucial one to ensure you are fully protected. Join US Legal Forms today and gain access to a multitude of reusable templates.

Form popularity

FAQ

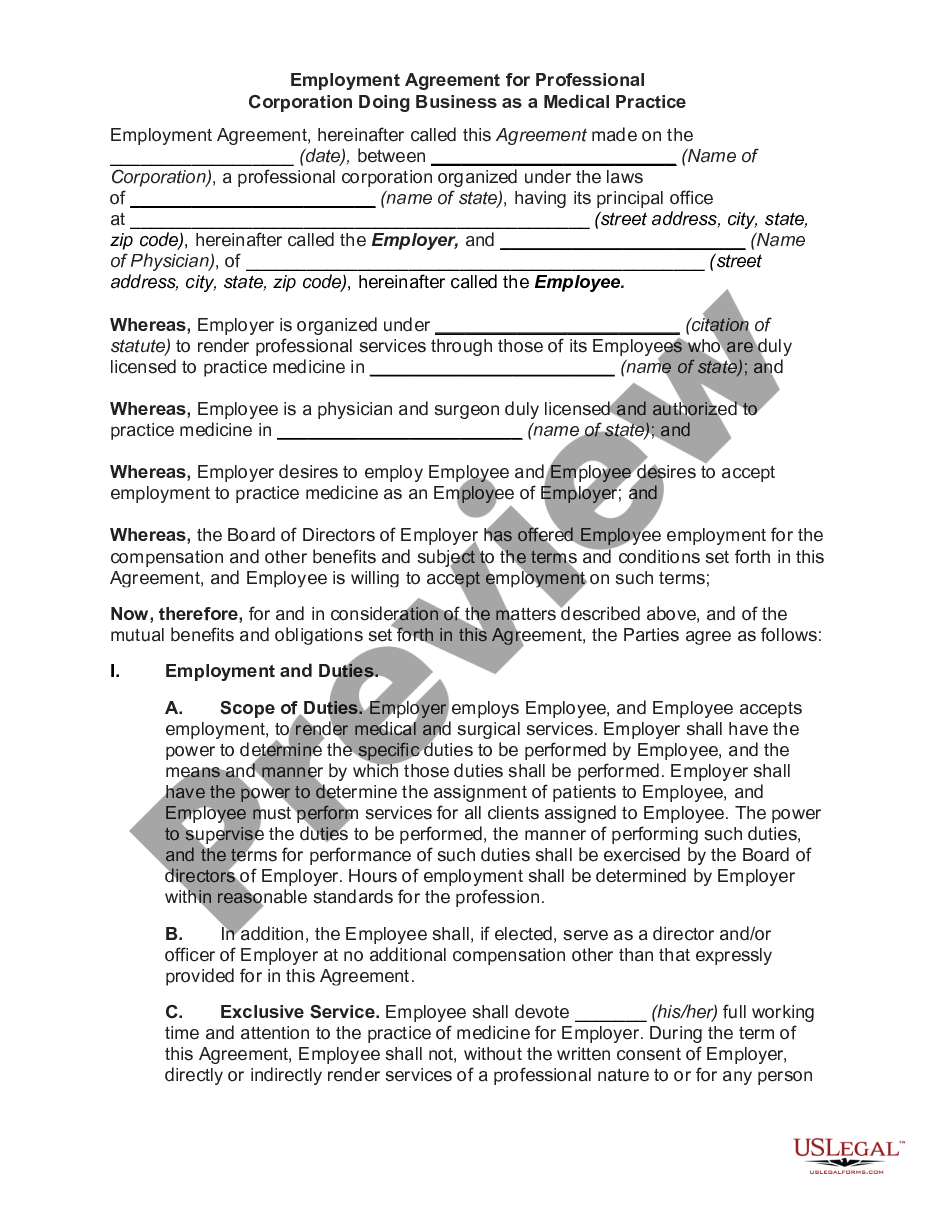

A professional corporation is one that only performs services in one, single profession. It is a specific type of corporation for professionals like doctors, lawyers, accountants, etc. The professional is able to form a corporation, but the professional remains liable for his or her own actions.

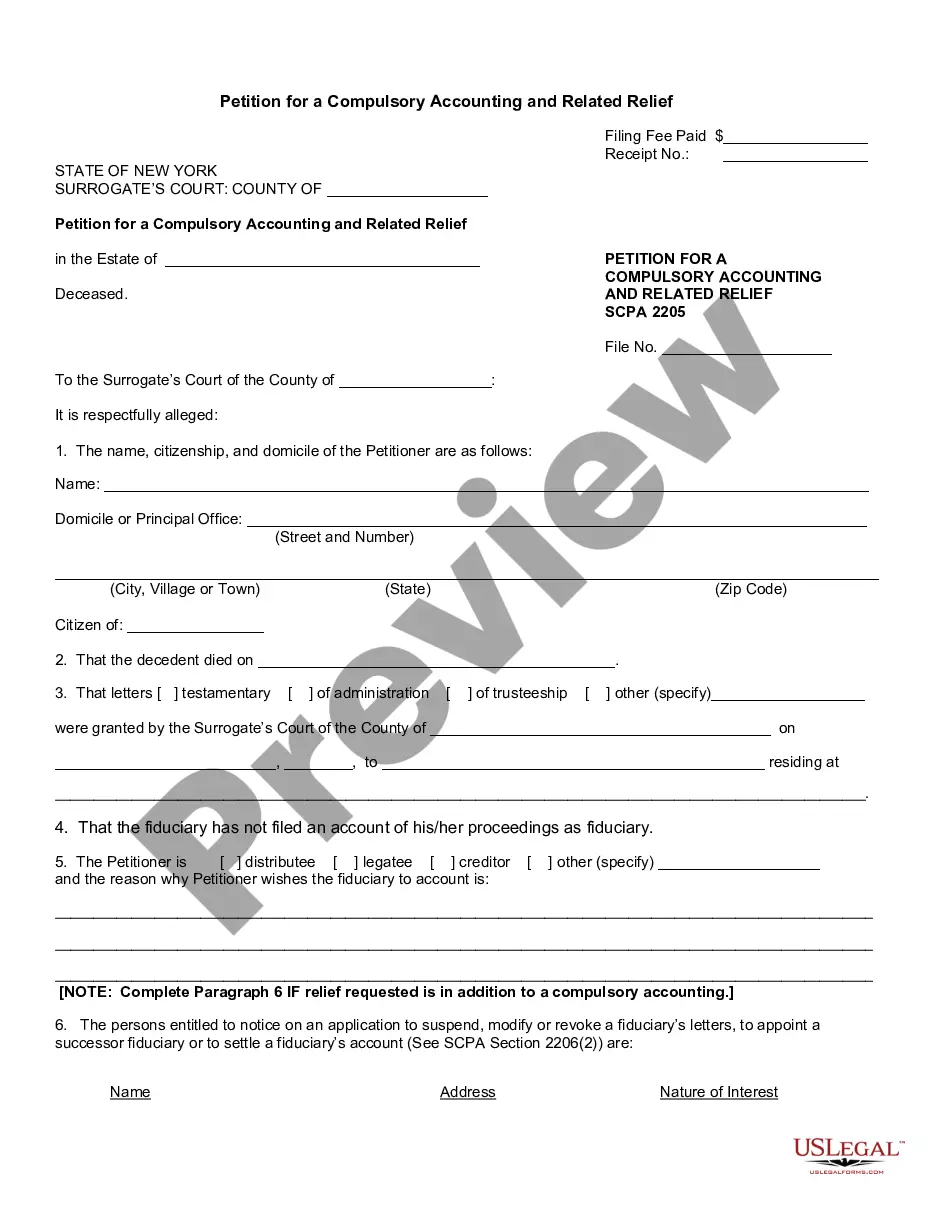

Professional Corporation Taxes A PC must file a professional corporation tax return and pay taxes on its earnings.PCs are subject to a 35% flat federal tax rate on their corporate earnings, which can be a disadvantage since C corporations are taxed at 15 to 34% for their earnings below $100,000.

The IRS categorizes professional corporations as C corporations. They are considered taxpayers and must pay income taxes at the corporate rate. In some states, physicians are not allowed to form professional corporations and must instead establish professional associations.

Do the Articles of Organization need to be notarized? Some states require that you have your Articles of Organization documents notarized. For your state's notarization requirements, choose your state from the drop-down list above.

Option 1: Create an online account or log in to the Maryland Business Express website. Then, select Maryland Limited Liability Company on the Register a New Business page. Option 2: Access the Articles of Organization PDF from the Maryland State Department of Assessments and Taxation website.

Option 1: Create an account to file your Articles of Organization on the Maryland Business Express website. Once logged in, select Start a New Filing, and then Register a Business. Option 2: Access the Articles of Organization PDF from the Maryland State Department of Assessments and Taxation website.

To form an LLC in Maryland you will need to file the Articles of Organization with the Maryland Department of Assessments and Taxation, which costs $100. You can apply online, by mail, or in-person. The Articles of Organization is the legal document that officially creates your Maryland Limited Liability Company.

Professional corporations or professional service corporation (abbreviated as PC or PSC) are those corporate entities for which many corporation statutes make special provision, regulating the use of the corporate form by licensed professionals such as attorneys, architects, engineers, public accountants and physicians

The name of the LLC. The names of the members and managers of the LLC. The address of the LLC's principal place of business.