Massachusetts Living Trust Property Record

Overview of this form

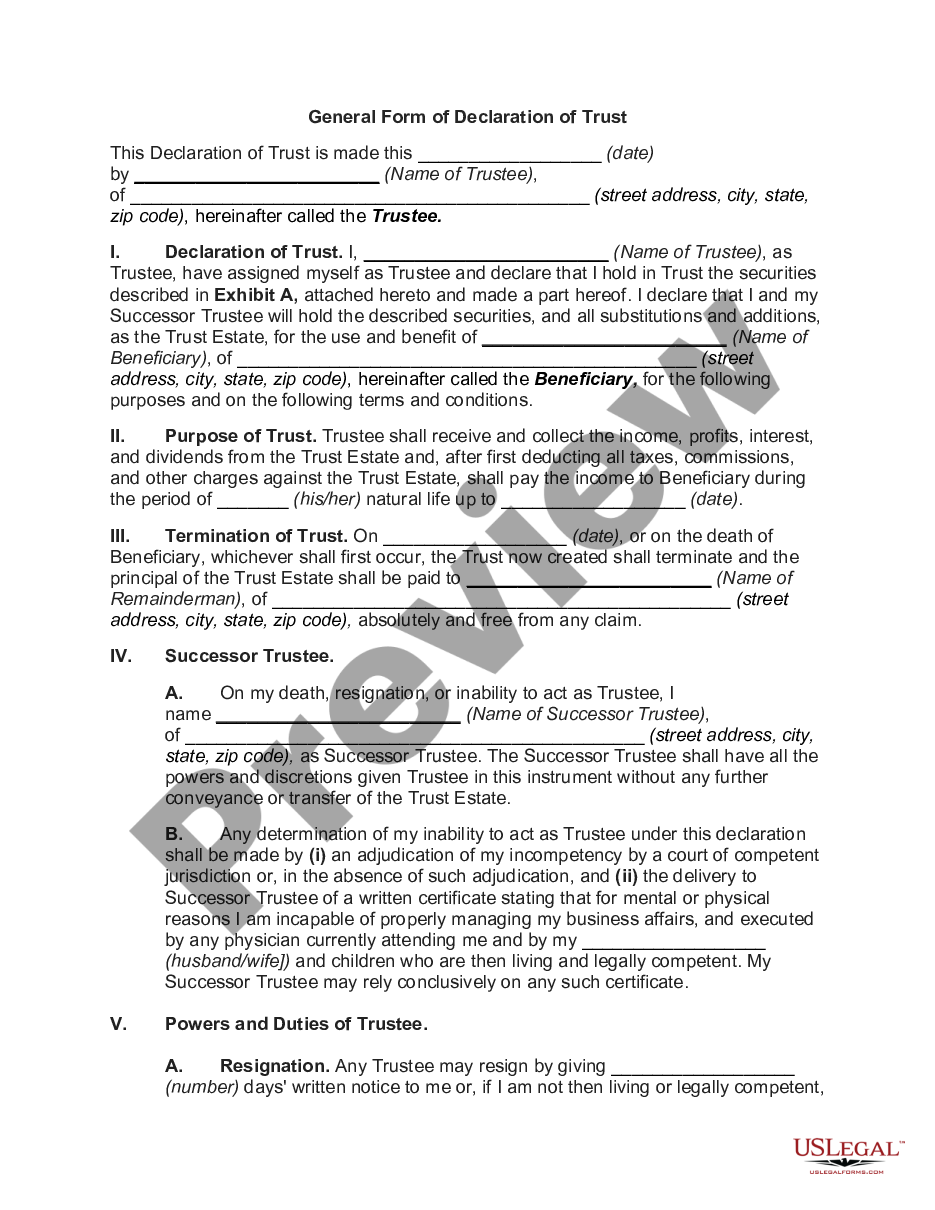

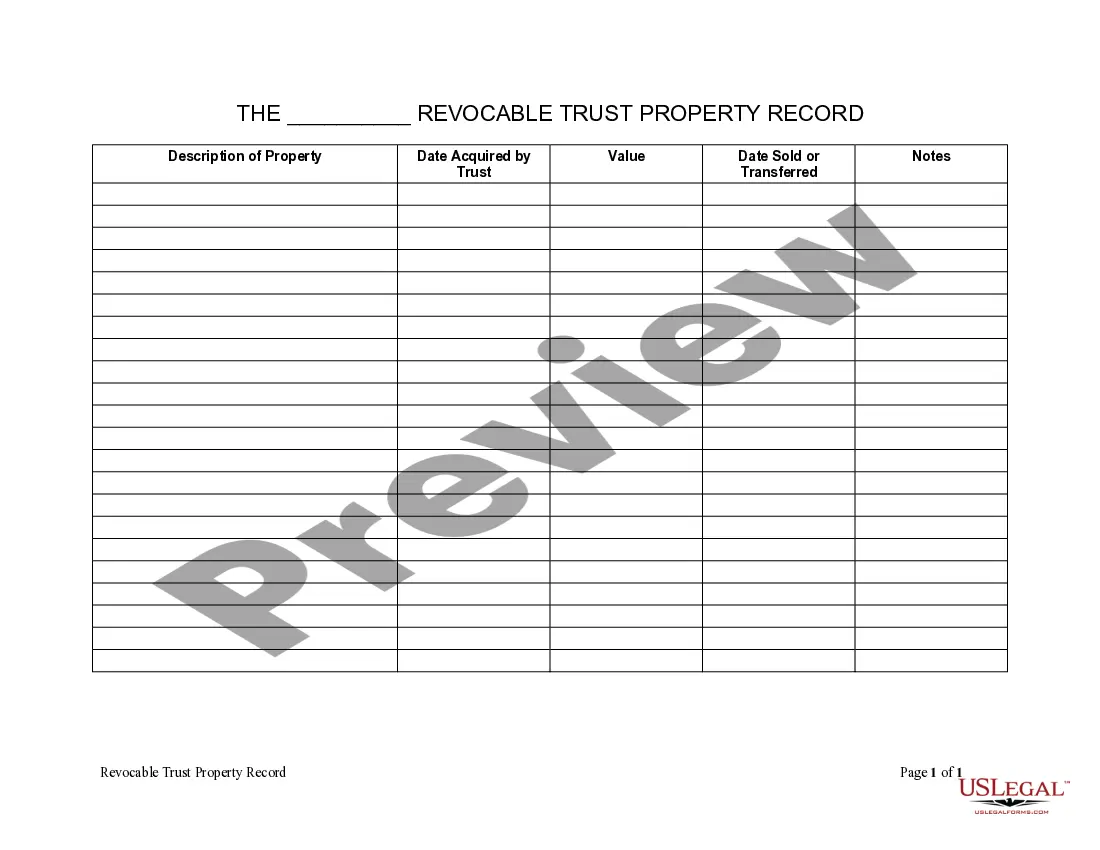

The Living Trust Property Record form is designed to help trustees maintain a clear and organized inventory of assets held within a living trust. A living trust is established during a person's lifetime and can be utilized for effective estate planning. This form serves a crucial purpose by allowing trustees to accurately document every piece of property included in the trust, ensuring that all real, personal, or intellectual property is accounted for in one comprehensive record.

What’s included in this form

- Description of property

- Date acquired by the trust

- Current value of the asset

- Date sold or transferred

- Type of property (real, personal, or intellectual)

When this form is needed

This form is useful in scenarios where a trustee needs to create or update an inventory of assets within a living trust. It can be utilized when establishing a new trust, making changes to existing assets, or transferring properties in and out of the trust. Keeping an accurate property record is essential to adhere to your estate planning objectives and facilitate a smooth transition of assets upon the trustor's passing.

Who needs this form

- Trustees managing a living trust

- Individuals involved in estate planning

- Beneficiaries of a trust wanting to understand the trust's assets

- Legal representatives overseeing estate matters

Steps to complete this form

- Begin by identifying and describing each property included in the trust.

- Enter the date on which the trust acquired each asset.

- Document the current value of each property to reflect its worth accurately.

- If any assets have been sold or transferred, include the relevant dates.

- Organize the information clearly for easy reference in future estate planning or distribution activities.

Does this form need to be notarized?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to update the inventory after acquiring new assets.

- Omitting important details such as the value of properties.

- Not including all types of property (real, personal, intellectual).

- Neglecting to specify dates for sold or transferred assets.

Benefits of completing this form online

- Convenience of downloading and filling out the form at your own pace.

- Editability allows you to update property records as needed.

- Access to legally vetted templates ensures compliance with applicable laws.

Key takeaways

- The Living Trust Property Record helps trustees to maintain accurate records of trust assets.

- Use the form to document acquisitions, sales, and transfers relevant to the trust.

- It is crucial for effective estate planning and ensuring a smooth transition of assets.

Looking for another form?

Form popularity

FAQ

Trusts in Massachusetts are governed by the Massachusetts Uniform Trust Code, codified at G.L.c. 203E.The trustee's certificate is recorded either immediately upon the trust's acquisition of real property, or when the trustee acts upon the title 1.

If you can't find original living trust documents, you can contact the California Bar Association for assistance. Trusts aren't recorded anywhere, so you can't go to the County Recorder's office in the courthouse to ask to see a copy of the trust.

Today clients who have living trusts normally keep the original copy. Having the attorney keep the original copy of the trust is not as important as keeping the original will used to be. At death, a copy of the trust generally suffices for all parties in place of the original.

If you can't find original living trust documents, you can contact the California Bar Association for assistance. Trusts aren't recorded anywhere, so you can't go to the County Recorder's office in the courthouse to ask to see a copy of the trust.

Since the Schedule of Beneficiaries to a trust is not recorded with the Declaration of Trust at the Registry of Deeds, the identity of the Beneficiaries is not a matter of public record.There are two types of Trusts in Massachusetts.

Trusts aren't public record, so they're not usually recorded anywhere. Instead, the trust attorney determines who is entitled to receive a copy of the document, even if state law doesn't require it.

Anyone can look up a particular parcel of real estate in the local land records office (often called the county recorder or registry of deeds, depending on where you live) and find out who owns it. (Often, other information is also available, such as the amount of property taxes paid each year.)

What happens if you have lost your Trust?If a Trust is lost, and the decedent has assets titled in the name of the Trust, the court will require that the heirs/Successor Trustees spend a significant amount of time and money searching for the Trust and documenting the search process.

Trusts created during your lifetime, known as living trusts, do not go into the public record after you die. With rare exceptions, trusts remain private regardless of whether you have an irrevocable or revocable trust at the time of your death.