Kansas Renunciation and Disclaimer of Property received by Intestate Succession

What is this form?

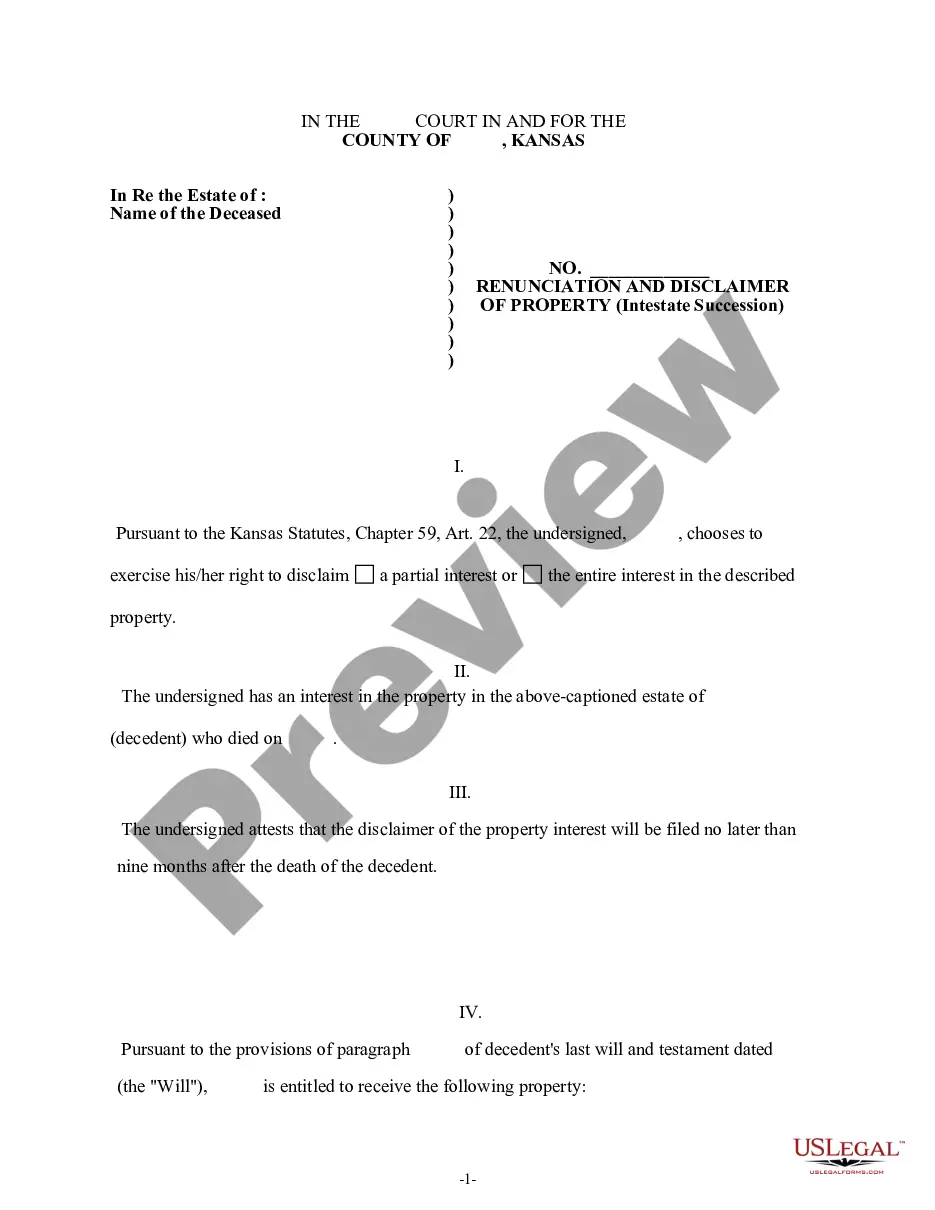

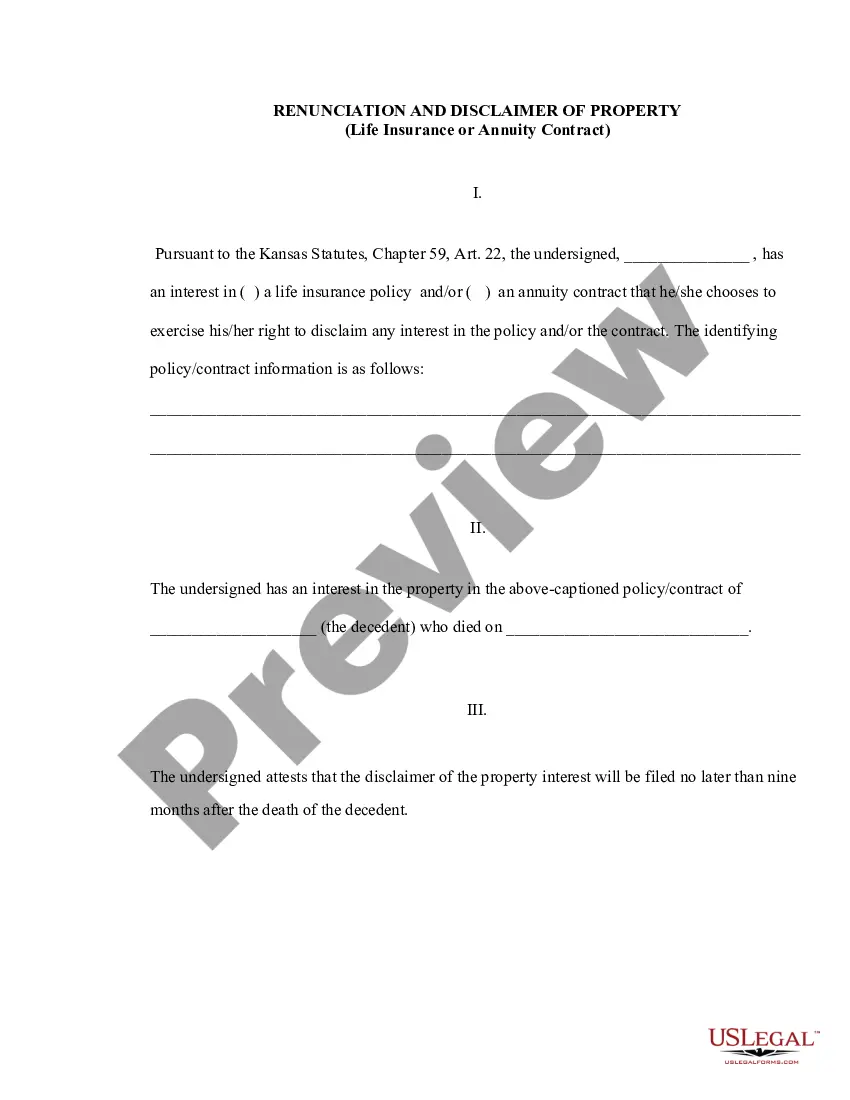

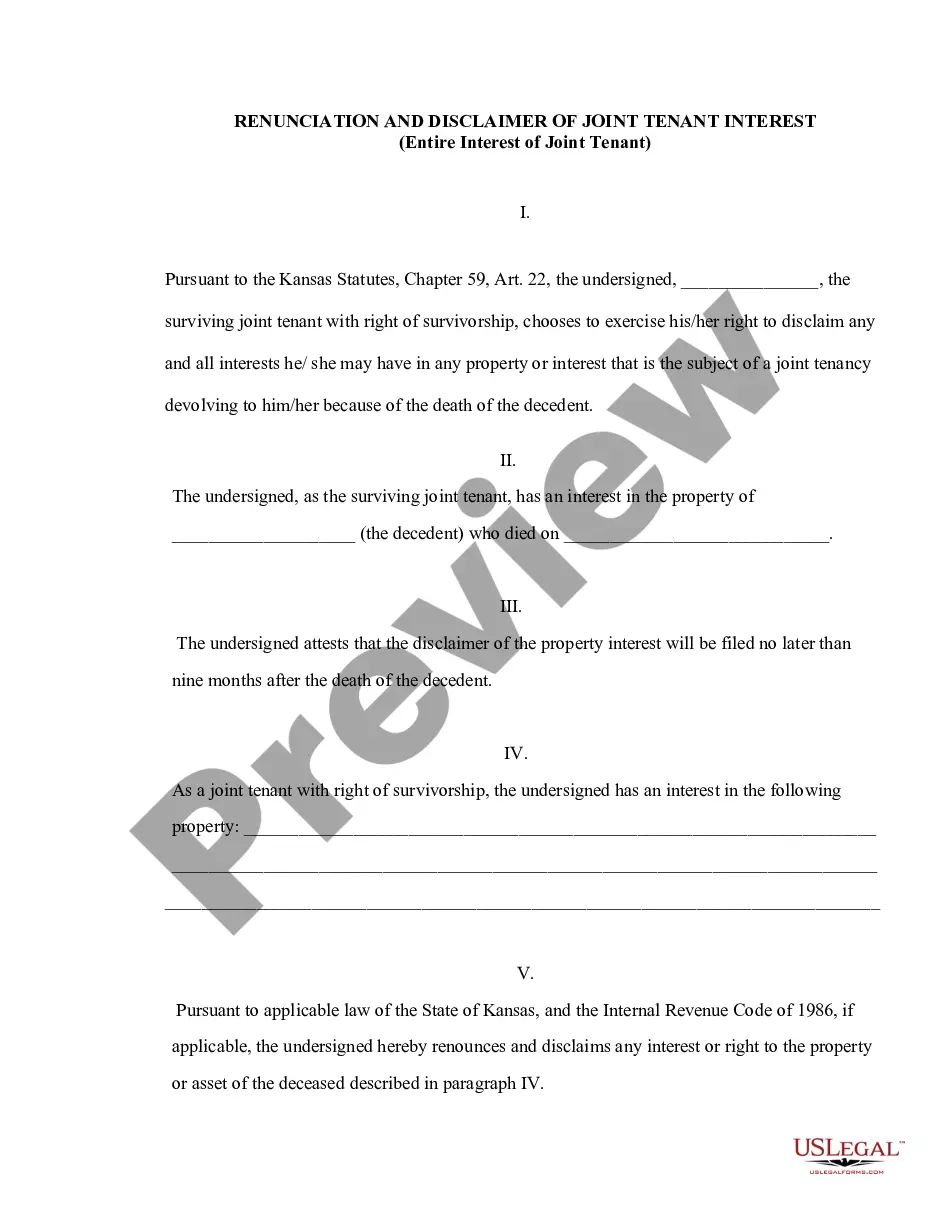

The Kansas Renunciation and Disclaimer of Property received by intestate succession is a legal document that allows a beneficiary to formally refuse a property interest they received when someone passed away without a will. This form is essential because it prevents the beneficiary from inheriting the property, allowing it to pass to other heirs according to Kansas intestacy laws. Unlike a will, this form is utilized after the death of a decedent to clarify the beneficiary's wishes regarding their inheritance.

Key components of this form

- Identification of the decedent and the property being disclaimed.

- A statement affirming the beneficiary's intent to renounce their interest.

- Confirmation that the disclaimer will be filed timely, within nine months of the decedent's death.

- Legal language stating that the property will devolve to others as if the beneficiary had predeceased the decedent.

- A certificate of delivery to verify the submission of the disclaimer.

When to use this form

This form should be used when a beneficiary receives property through intestate succession but wishes to refuse their inheritance. This scenario typically arises when the beneficiary does not want the responsibilities or liabilities that may accompany the property, or if they believe it would be better suited to other heirs of the decedent. Filing this disclaimer ensures that the property is redistributed according to state laws, following the wishes of the beneficiary.

Who needs this form

This form is intended for:

- Beneficiaries who have received property from a decedent who died without a will.

- Those who wish to formally renounce their claim to that property.

- Individuals who want to ensure proper legal process is followed for denying their interest in the property.

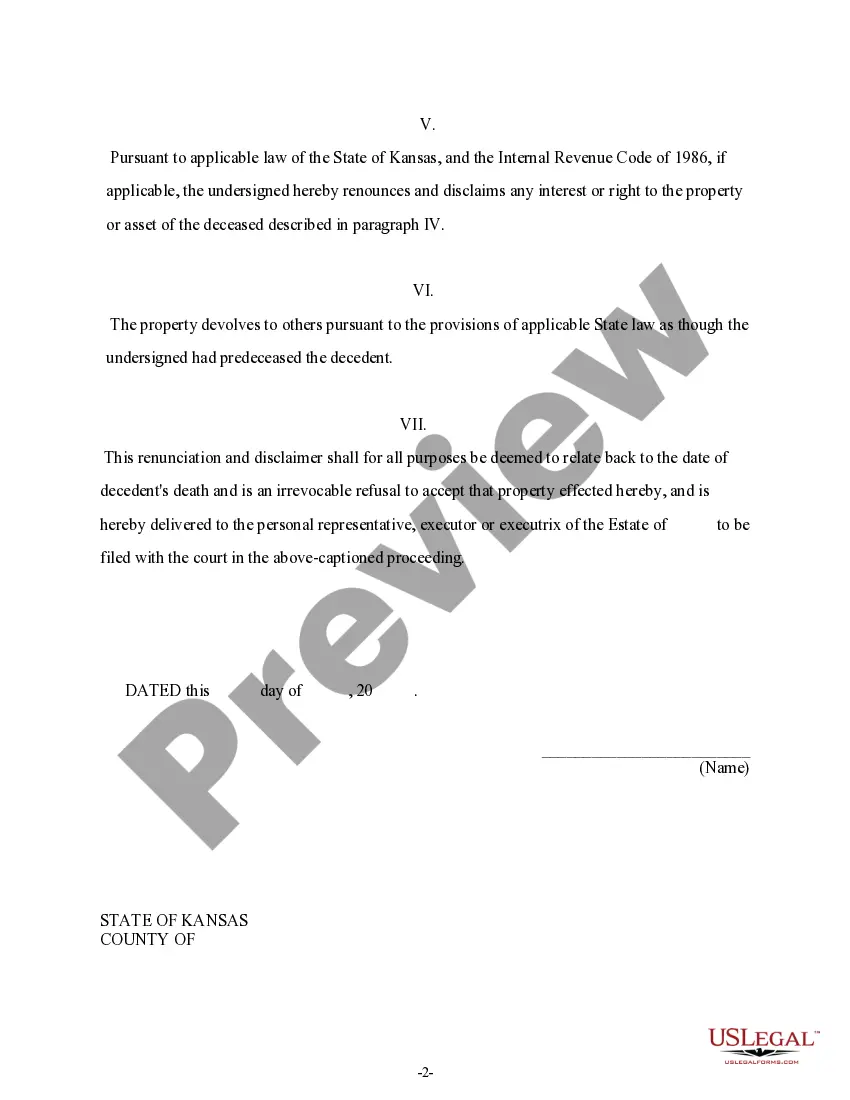

Steps to complete this form

- Identify the decedent by including their full name and date of death.

- Clearly specify the property interest being renounced.

- Complete the declaration affirming your intention to renounce your interest.

- Sign and date the form within the required nine-month period.

- File the form with the appropriate court or government office as required.

- Keep a copy of the form for your records and verification of delivery.

Does this document require notarization?

This form does not typically require notarization to be legally valid. However, some jurisdictions or document types may still require it. US Legal Forms provides secure online notarization powered by Notarize, available 24/7 for added convenience.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

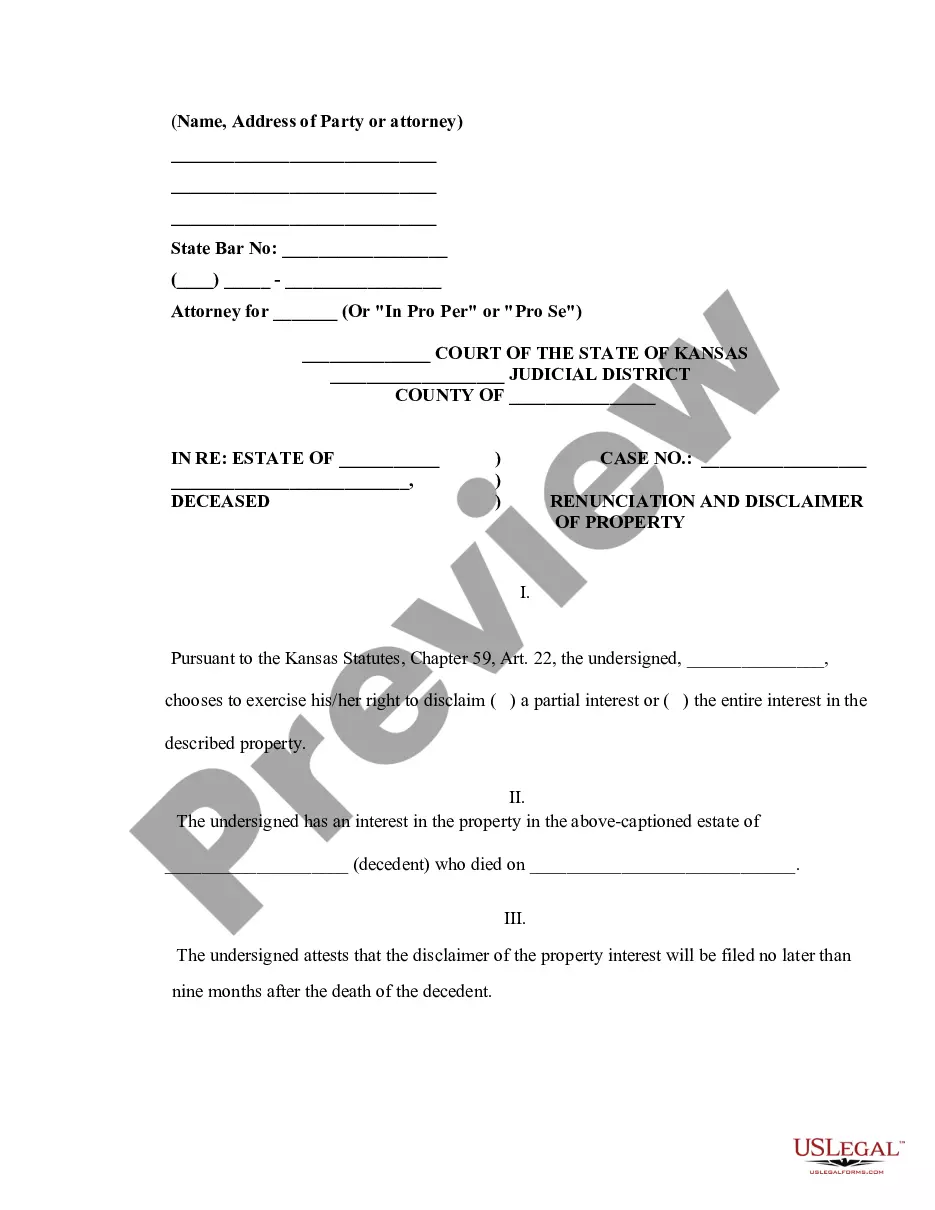

Common mistakes to avoid

- Failing to file the form within the nine-month deadline.

- Not providing the complete details of the property being disclaimed.

- Forgetting to sign or date the form before submission.

- Omitting necessary acknowledgments or certifications required by Kansas law.

Benefits of using this form online

- Convenient access to a legally vetted template, ensuring compliance with Kansas law.

- Editable fields that allow for customization specific to your situation.

- Immediate download for fast processing and peace of mind.

Legal use & context

- The form is legally binding once filed according to Kansas law.

- Using this form protects the beneficiary from unintended consequences of accepting an inheritance.

- It ensures that the property is distributed to the rightful heirs as dictated by intestate succession laws.

What to keep in mind

- This form allows a beneficiary to renounce property obtained through intestate succession.

- It must be filed within nine months of the decedent's death to be valid.

- Proper completion and filing ensure that the property is redistributed according to Kansas law.

Looking for another form?

Form popularity

FAQ

In your disclaimer, cover any and all liabilities for the product or service that you provide. You should warn consumers of any dangers or hazards posed by your product. You should list specific risks while at the same time acknowledging that the list is not exhaustive. For example, you could write, NOTICE OF RISK.

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

A beneficiary of a trust may wish to disclaim their interest in the trust for:Any disclaimer of an interest in a trust by a trust beneficiary must be made to the trustee of that trust. For a disclaimer to be valid, it must be supported by some evidence that the beneficiary is disclaiming their interest.

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor,

When you relinquish property, you don't get any say in who inherits in your place. If you want to control who gets the inheritance, you must accept it and give it to that person. If you relinquish the property and the deceased didn't name a back-up heir, the court will apply state law to decide who inherits.

A beneficiary is always free to refuse to accept benefits under a trust or a will.The beneficiary may be willing to sign a disclaimer as she does not wish to accept the bequest. The disclaimer would protect you as Trustee from a breach of a fiduciary duty by distributing the assets to a different beneficiary.

When you relinquish property, you don't get any say in who inherits in your place. If you want to control who gets the inheritance, you must accept it and give it to that person. If you relinquish the property and the deceased didn't name a back-up heir, the court will apply state law to decide who inherits.

The answer is yes. The technical term is "disclaiming" it. If you are considering disclaiming an inheritance, you need to understand the effect of your refusalknown as the "disclaimer"and the procedure you must follow to ensure that it is considered qualified under federal and state law.

These documents can include the will, death certificate, transfer of ownership forms and letters from the estate executor or probate court.If you received the inheritance in the form of cash, request a copy of the bank statement that reflects the deposit.