An escrow is the deposit of a written instrument or something of value with a third person with instructions to deliver it to another when a stated condition is performed or a specified event occurs. The use of an escrow is most common in real estate sales transactions where the grantee deposits earnest money with the escrow agent to be delivered to the grantor upon consummation of the purchase and sale of the real estate and performance of other specified conditions.

Escrow Agreement for Sale of Real Property and Deposit of Earnest Money

Description

Key Concepts & Definitions

Escrow Agreement: A legal document facilitating the use of a third-party to hold funds in an escrow account during the transaction process of real estate.

Earnest Money: A money deposit made by the buyer as a proof of good faith when entering a contract to buy real estate.

Escrow Account: An account where funds are held in trust while two or more parties complete a transaction.

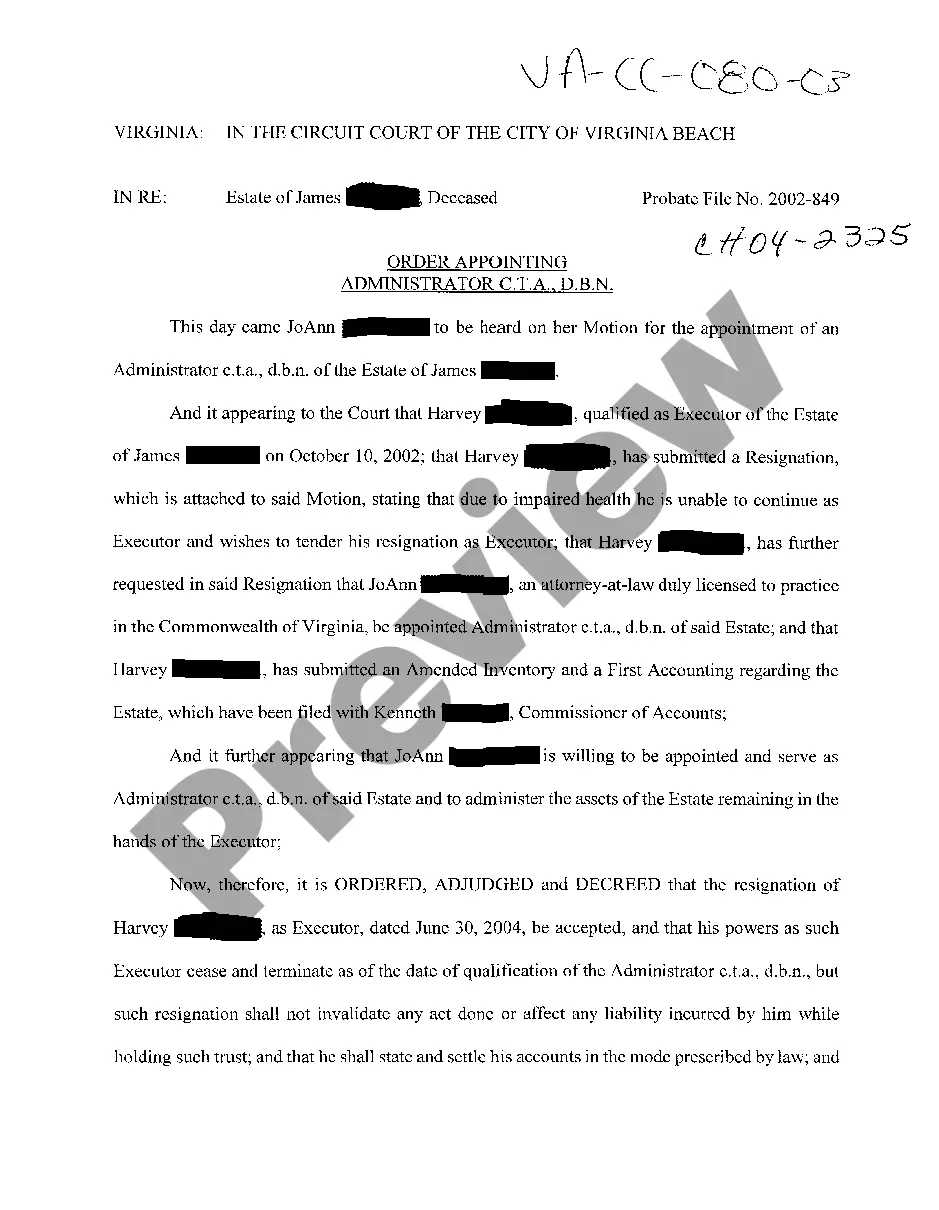

Escrow Agent: The neutral third party responsible for holding and regulating the payment of the funds required for two parties involved in a given transaction.

Step-by-Step Guide to Creating an Escrow Agreement for Sale of Real Property

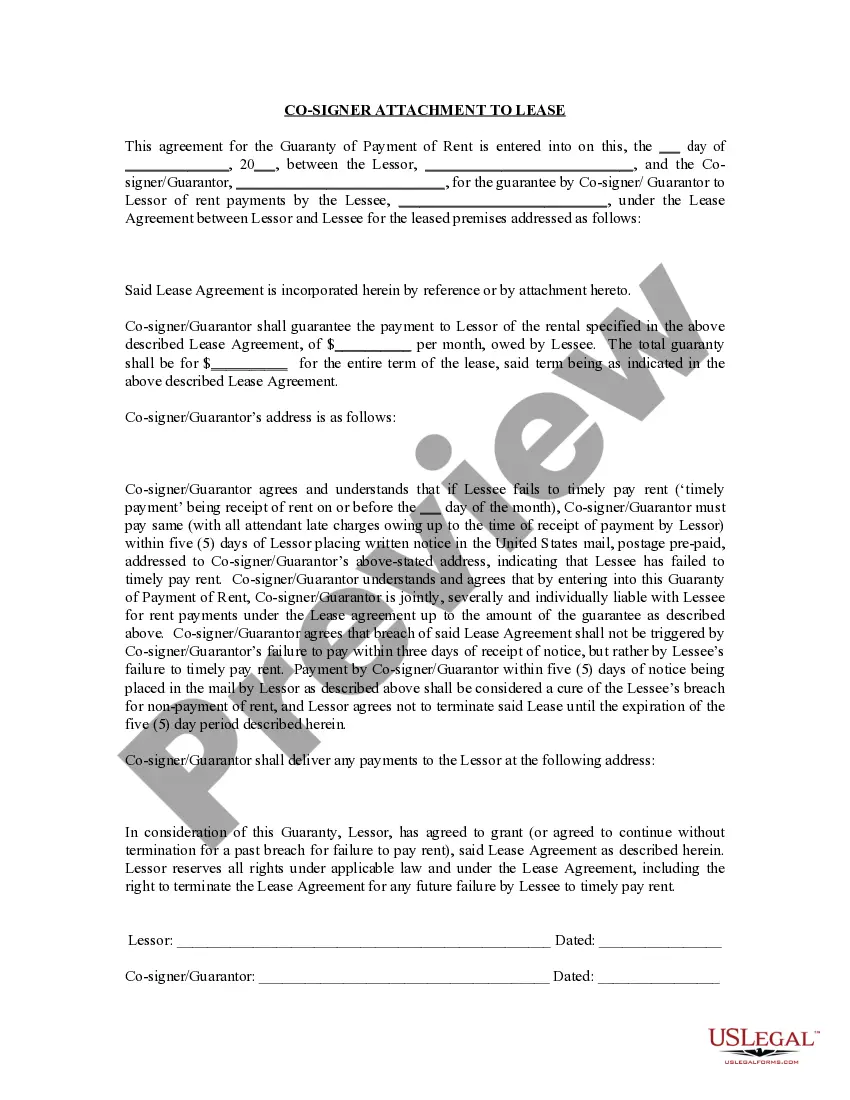

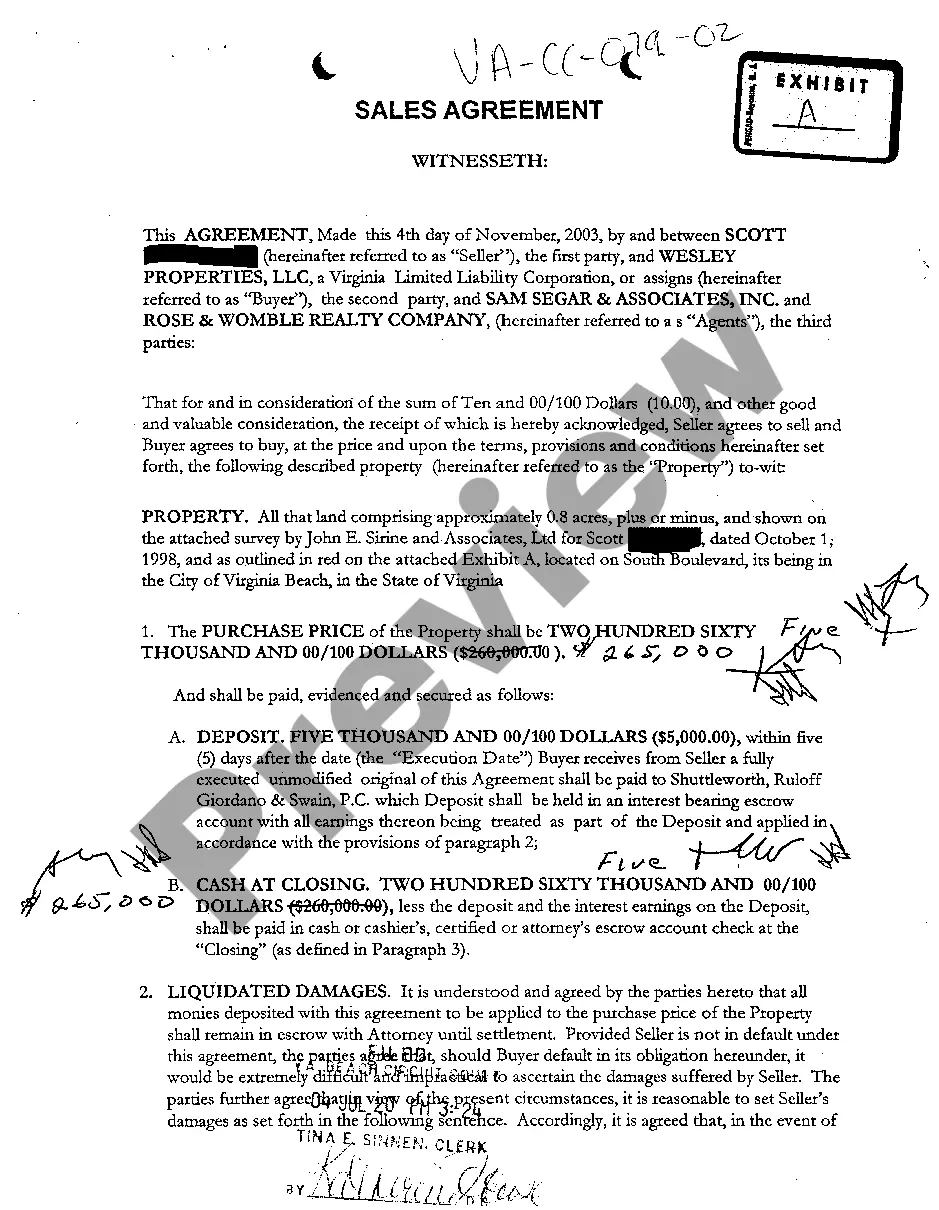

- Identify the Parties: Include the legal names of the seller, buyer, and agreed upon escrow agent.

- Define the Terms: Clearly specify the terms of the real estate sale including the purchase price and property description.

- Deposit Earnest Money: Have the buyer deposit the earnest money into the escrow account to underscore their commitment.

- Set Agreement Clauses: Determine any clauses for inspection, financing, or other contingencies.

- Signatures: Ensure all parties involved sign the escrow agreement to make it legally binding.

- Transfer of Funds and Property: Outline the procedures for the transfer of funds and the property's title upon fulfilling all contract conditions.

Risk Analysis in Escrow Agreements

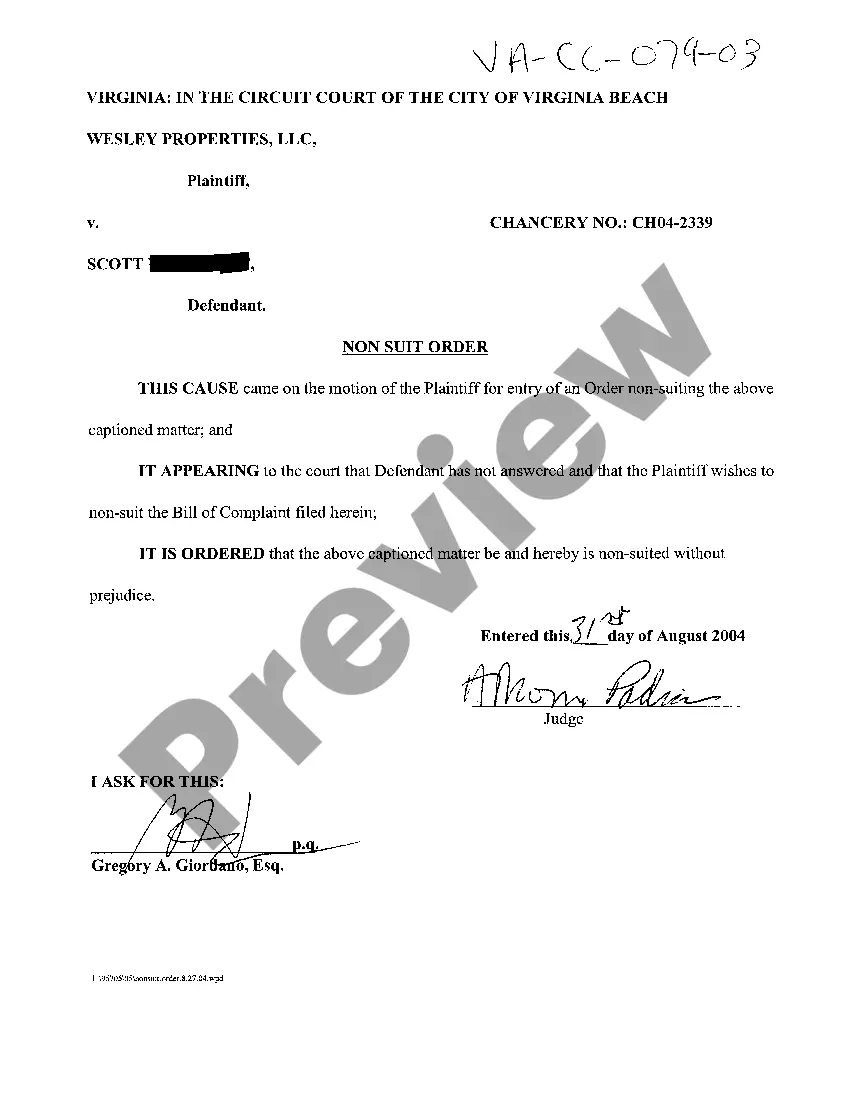

- Default Risk: Risk that one of the parties fails to fulfil the contractual obligations which can lead to disputes or legal action.

- Mismanagement of Funds: Involves the mishandling or misappropriation of the funds held in the escrow account.

- Third Party Risk: Issues might arise from the misconduct or bankruptcy of the escrow agent.

Common Mistakes & How to Avoid Them

- Not Reviewing the Agreement: Always review the details of the escrow agreement before signing. Consider legal consultation to avoid pitfalls.

- Poor Choice of Escrow Agent: Choose a reputable and competent escrow agent by checking reviews or asking for peer recommendations.

- Failing to Address All Contingencies: Ensure all possible situations are covered in the agreement to avoid future disputes.

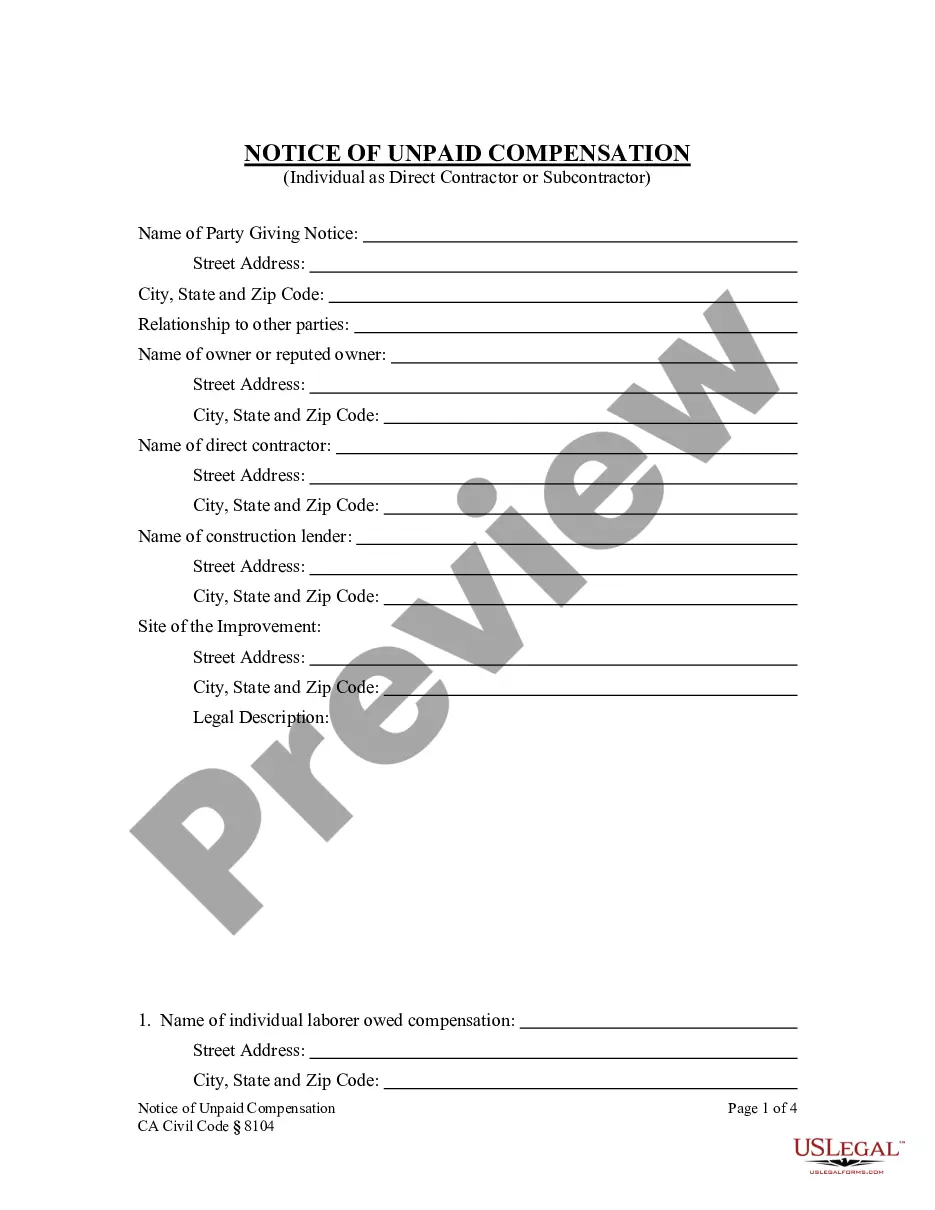

How to fill out Escrow Agreement For Sale Of Real Property And Deposit Of Earnest Money?

Aren't you tired of choosing from countless samples every time you need to create a Escrow Agreement for Sale of Real Property and Deposit of Earnest Money? US Legal Forms eliminates the wasted time countless American citizens spend browsing the internet for ideal tax and legal forms. Our skilled crew of lawyers is constantly updating the state-specific Templates library, so it always has the appropriate files for your situation.

If you’re a US Legal Forms subscriber, simply log in to your account and then click the Download button. After that, the form are available in the My Forms tab.

Users who don't have a subscription need to complete quick and easy actions before having the capability to download their Escrow Agreement for Sale of Real Property and Deposit of Earnest Money:

- Use the Preview function and read the form description (if available) to be sure that it is the correct document for what you’re trying to find.

- Pay attention to the validity of the sample, meaning make sure it's the right sample for your state and situation.

- Make use of the Search field on top of the webpage if you have to look for another file.

- Click Buy Now and choose an ideal pricing plan.

- Create an account and pay for the service utilizing a credit card or a PayPal.

- Download your file in a required format to complete, print, and sign the document.

As soon as you have followed the step-by-step recommendations above, you'll always be capable of sign in and download whatever document you require for whatever state you require it in. With US Legal Forms, completing Escrow Agreement for Sale of Real Property and Deposit of Earnest Money samples or any other official files is easy. Begin now, and don't forget to look at the examples with accredited lawyers!

Form popularity

FAQ

If the deal falls through, the seller has to relist the home and start all over again, which could result in a big financial hit. Earnest money protects the seller if the buyer backs out. It's typically around 1% 3% of the sale price and is held in an escrow account until the deal is complete.

Go to the Banking menu and click Transfer Funds. In the Transfer Funds window, select the account from which you want to transfer the funds. Select the account to which you want to transfer the funds. Enter the amount that you want to transfer. Save the transaction.

Go to the Banking menu and click Transfer Funds. In the Transfer Funds window, select the account from which you want to transfer the funds. Select the account to which you want to transfer the funds. Enter the amount that you want to transfer. Save the transaction.

When is the earnest money check cashed? Once your offer is accepted, the earnest money check is usually deposited into an escrow account, where it is held until closing. That money is collateral that guarantees your promise to purchase the house.

If the earnest money check had been deposited and you also PAID (additional check made payable to owners) for an option (time in which to do inspections) in the contract, you likely have the unrestricted right to cancel the contract FOR ANY REASON, but you have to do it through the correct process.

During the home sales process, the buyer puts up a predetermined amount of cash (usually between 1% and 3% of the total home sales price) in an escrow account after an offer is accepted by the homeowner, and is held by a bank or other financial institution in an escrow account until the sale is finalized.

You'll typically use a third-party escrow agent such as the title company, to hold your earnest money deposit in an escrow account. You should avoid giving the deposit directly to the seller. If the transaction doesn't close and the seller cannot return the money, you may have to pursue legal action, costing you more.

Escrow companies will accept a cashier's check or wire, or a personal check for the earnest money deposit. Just keep in mind, we will cash your check right away.

When escrow fails to close due to the nonperformance of either the buyer or the seller a breach of the underlying purchase agreement any funds held in escrow are to be disbursed within 30 days after the person entitled to the funds demands them.