Kansas Warranty Deed to Child Reserving a Life Estate in the Parents

What this document covers

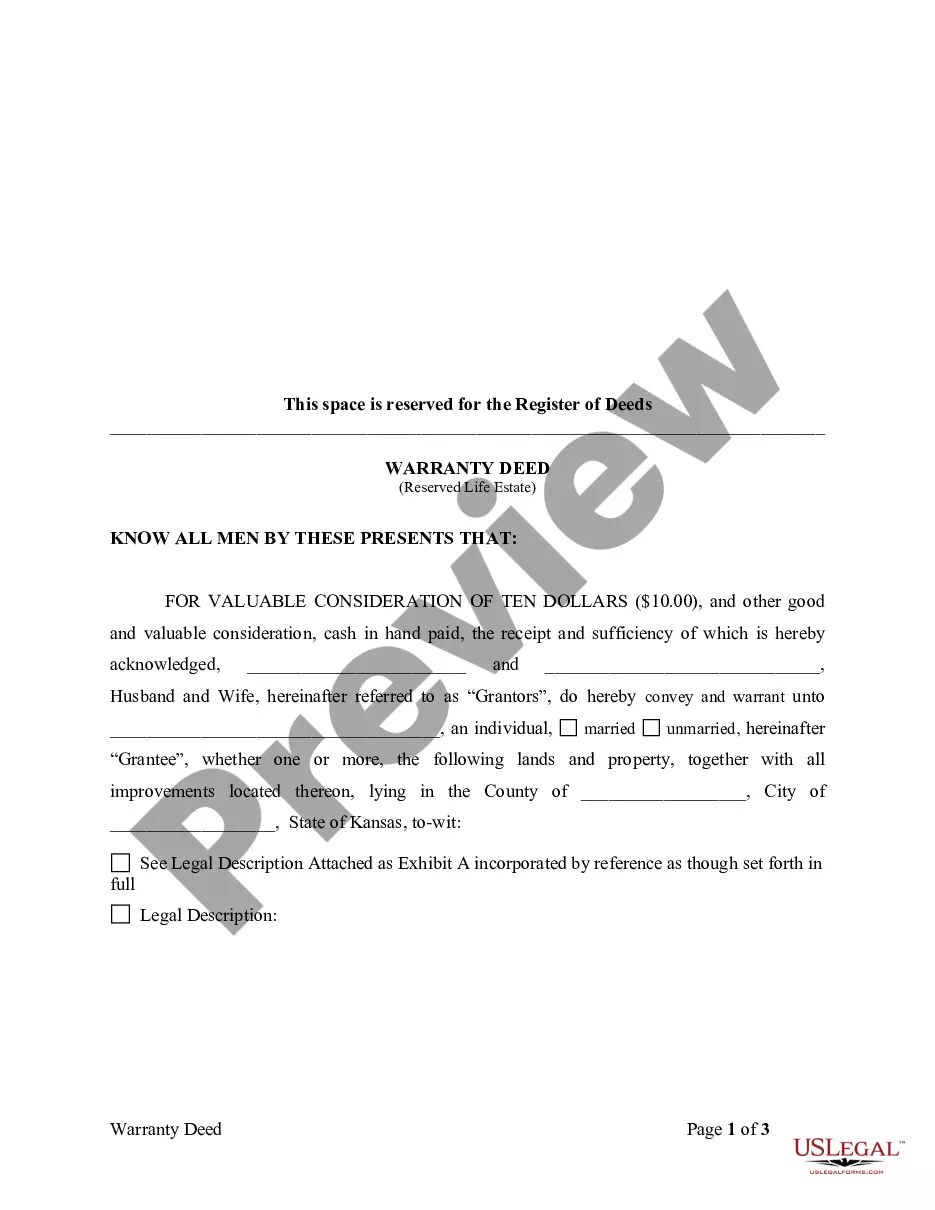

The Warranty Deed to Child Reserving a Life Estate in the Parents is a legal document that allows parents to transfer ownership of property to their child while retaining the right to live on and use the property for the remainder of their lives. This form differs from standard warranty deeds by including a reservation of a life estate, ensuring the parents maintain an interest in the property until their passing.

Key parts of this document

- Parties involved: Identifies both the grantors (parents) and the grantee (child).

- Property description: Clearly outlines the property being transferred.

- Consideration: States the nominal value exchanged, which is typically ten dollars.

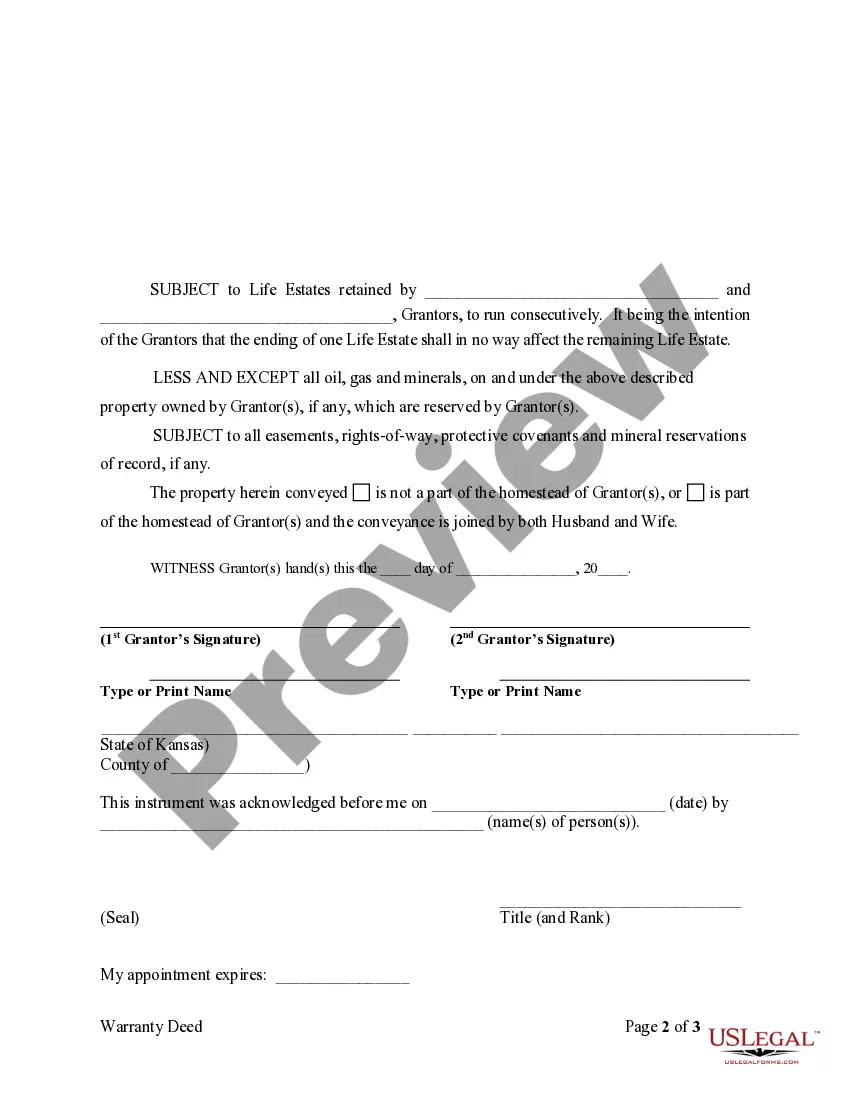

- Reservation of life estate: Specifies that the grantors retain the right to occupy the property for their lifetime.

- Notarization section: Requires acknowledgment by a notary public for legal validity.

When to use this document

This form is used when parents wish to transfer their property to their child while still retaining the right to live in or use the property for the rest of their lives. It is appropriate in cases where parents want to ensure their child receives the property without the delays and costs associated with probate after their death.

Who should use this form

- Parents looking to transfer property to their child while retaining a life interest.

- Individuals planning for estate management and succession.

- Families wanting to simplify their property transfer process and avoid probate.

Instructions for completing this form

- Identify the grantors: Enter the names of the parents who are transferring the property.

- Specify the grantee: Fill in the name of the child receiving the property.

- Describe the property: Provide a detailed description of the property being transferred.

- Indicate consideration: Note the amount of consideration, typically ten dollars.

- Have the grantors sign: Ensure both parents sign the deed in front of a notary public.

- Complete notarization: Fill out the notary section after the deed has been signed.

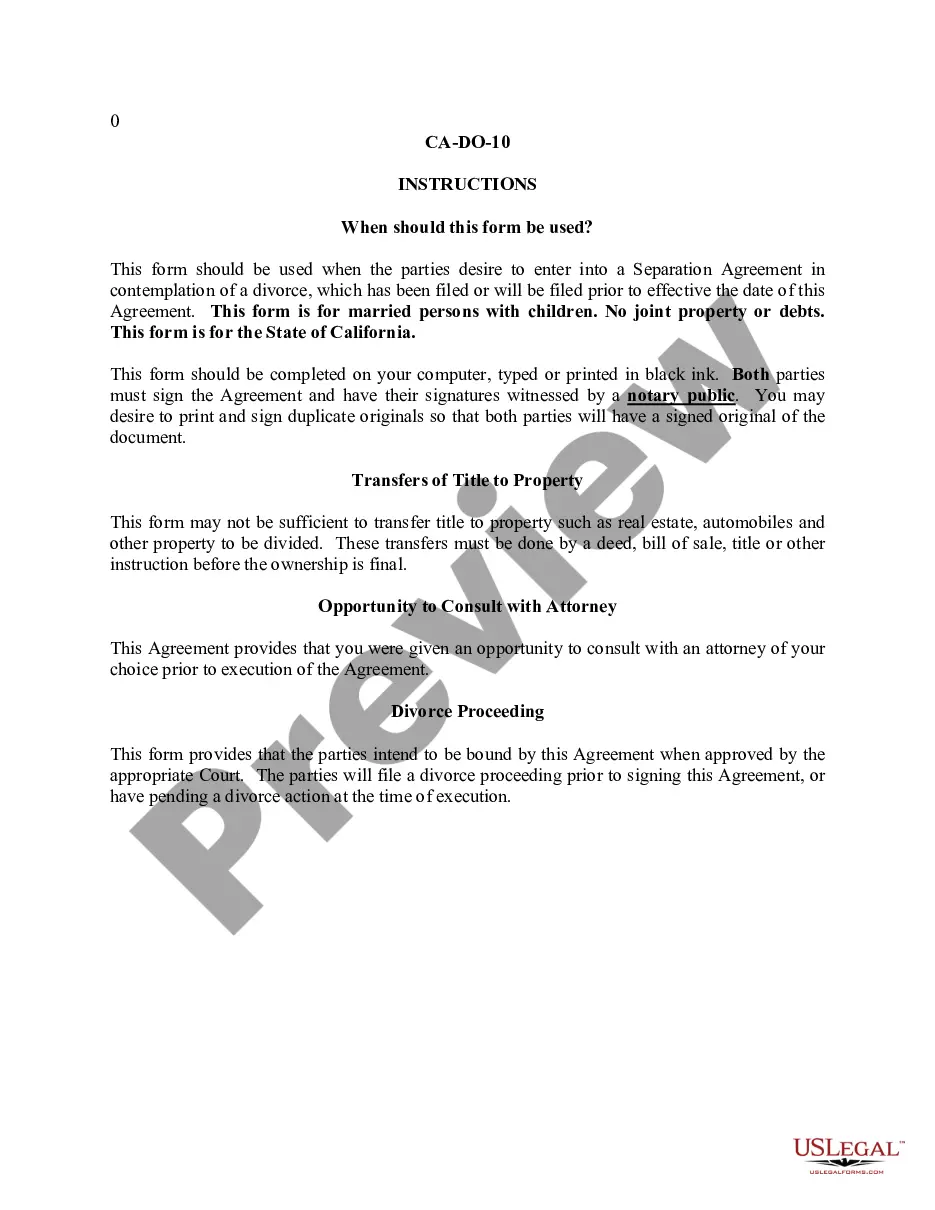

Notarization guidance

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Mistakes to watch out for

- Failing to properly describe the property, which can lead to legal disputes.

- Not including the life estate reservation, which is essential for maintaining interest.

- Omitting signatures or notarization, rendering the document invalid.

Benefits of using this form online

- Convenient access: Download the form anytime, reducing time delays.

- Editability: Customize the form as needed before finalizing the transfer.

- Reliability: Forms are prepared by licensed attorneys, ensuring legal compliance.

Looking for another form?

Form popularity

FAQ

This life estate deed is a document that transfers ownership of real property, while reserving access and use of the property for the duration of the grantor's life. It allows the original owner (grantor) to remain on the premises with full access to and benefits from the property.

A life estate deed allows you to transfer property while reserving an interest during your lifetime or during the lifetime of someone else. Once the person who holds the life estate passes away, the Grantee fully owns the property.

Can a life estate deed be changed? It is challenging to modify or change a life estate deed. The grantor cannot change the life estate as he or she has no power to do so after creating the life estate deed unless all of the future tenants agree. It requires the permission or consent of every one of the beneficiaries.

Reservation of the present interest allows the owner to retain ownership for a period of time measured by the life of one or more individuals, by a term of years, or by a combination of the two.

A warranty deed guarantees that: The grantor is the rightful owner of the property and has the legal right to transfer the title.The title would withstand third-party claims to ownership of the property. The grantor will do anything to ensure the grantee's title to the property.

A person owns property in a life estate only throughout their lifetime. Beneficiaries cannot sell property in a life estate before the beneficiary's death. One benefit of a life estate is that property can pass when the life tenant dies without being part of the tenant's estate.

This life estate deed is a document that transfers ownership of real property, while reserving access and use of the property for the duration of the grantor's life. It allows the original owner (grantor) to remain on the premises with full access to and benefits from the property.

A life estate deed permits the property owner to have full use of their property until their death, at which point the ownership of the property is automatically transferred to the beneficiary.