Maryland Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out Maryland Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

You are invited to the most extensive legal document repository, US Legal Forms. Here, you can obtain any template such as the Maryland Assumption Agreement of Deed of Trust and Release of Original Mortgagors templates and download them (as many of them as you desire/need). Create official paperwork in merely a few hours, instead of days or weeks, without breaking the bank on a lawyer. Acquire your state-specific example in just a few clicks and feel assured knowing it was crafted by our skilled legal experts.

If you’re already a subscribed customer, simply Log Into your account and click Download next to the Maryland Assumption Agreement of Deed of Trust and Release of Original Mortgagors you wish to obtain. Because US Legal Forms is online-based, you’ll typically have access to your saved templates, regardless of the device you’re utilizing. Locate them in the My documents section.

If you haven't created an account yet, what exactly are you waiting for? Review our guidelines below to get started: If this is a state-specific sample, verify its relevancy in the state where you reside. Examine the description (if available) to determine if it’s the correct template. View additional content using the Preview feature. If the document meets all of your requirements, simply click Buy Now. To establish your account, select a pricing plan. Utilize a credit card or PayPal account to subscribe.

- Download the document in your desired format (Word or PDF).

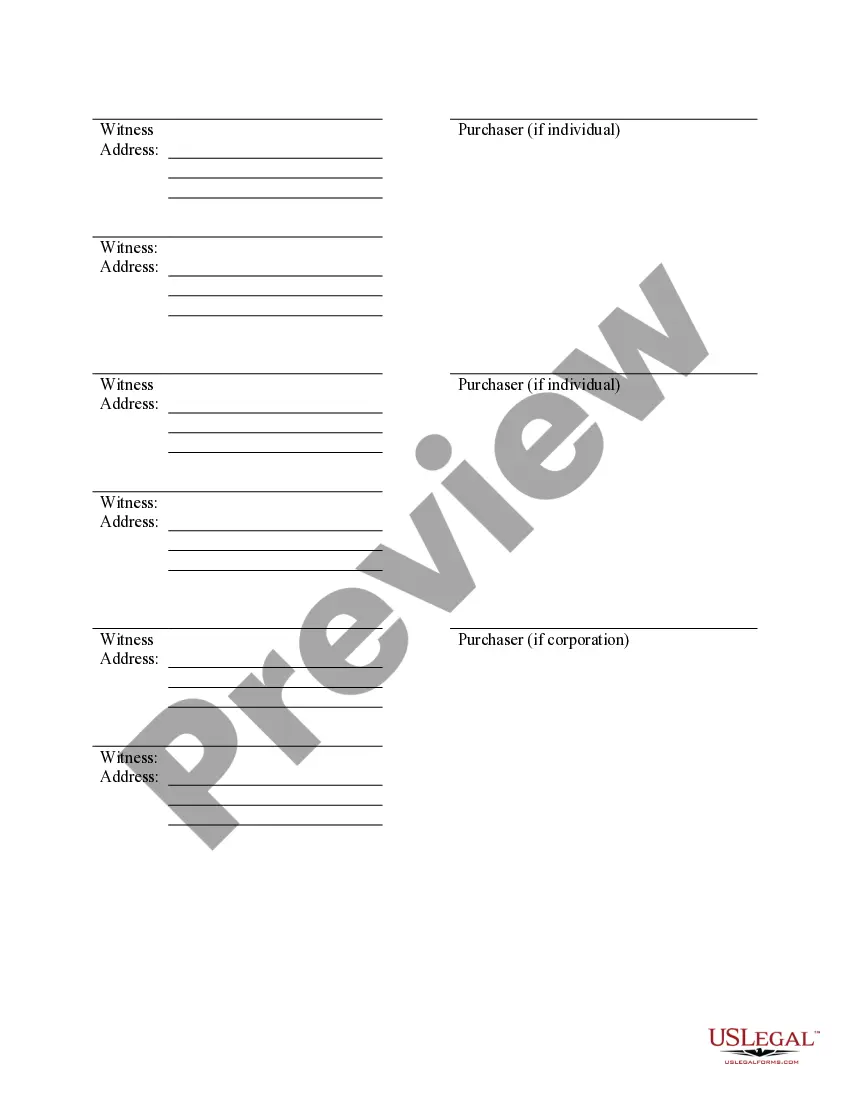

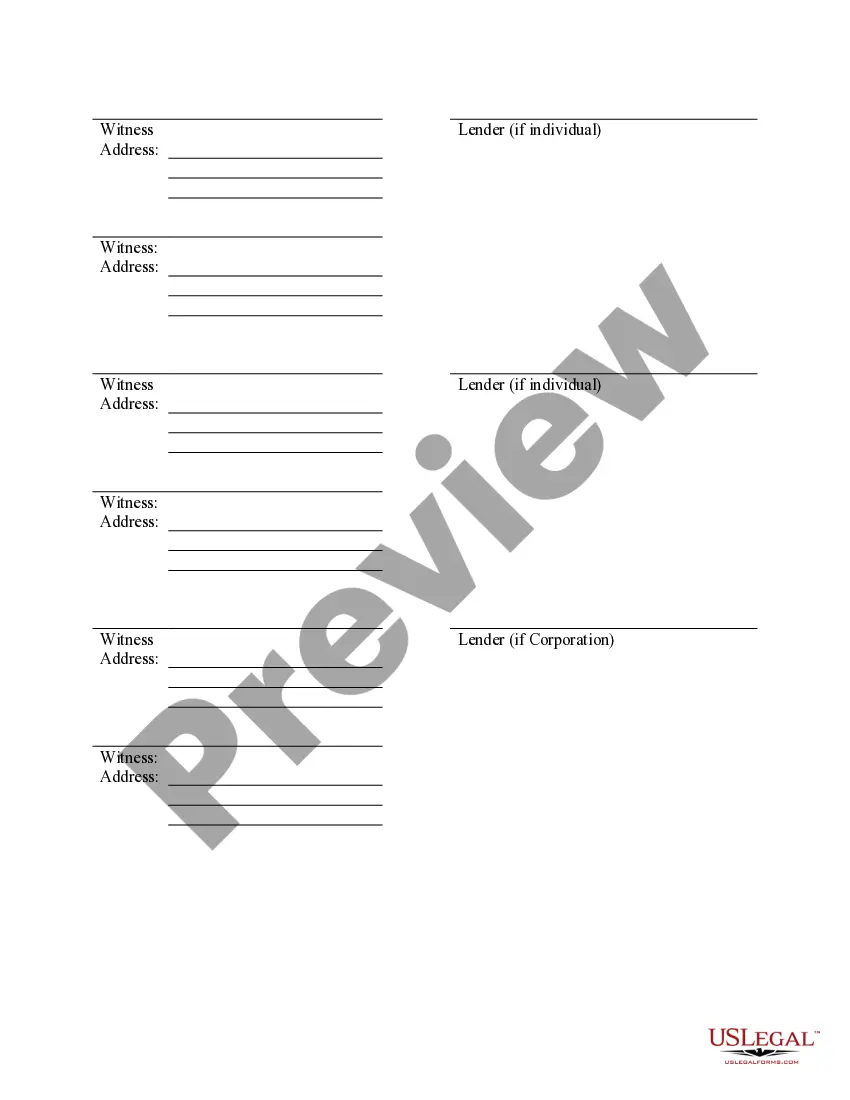

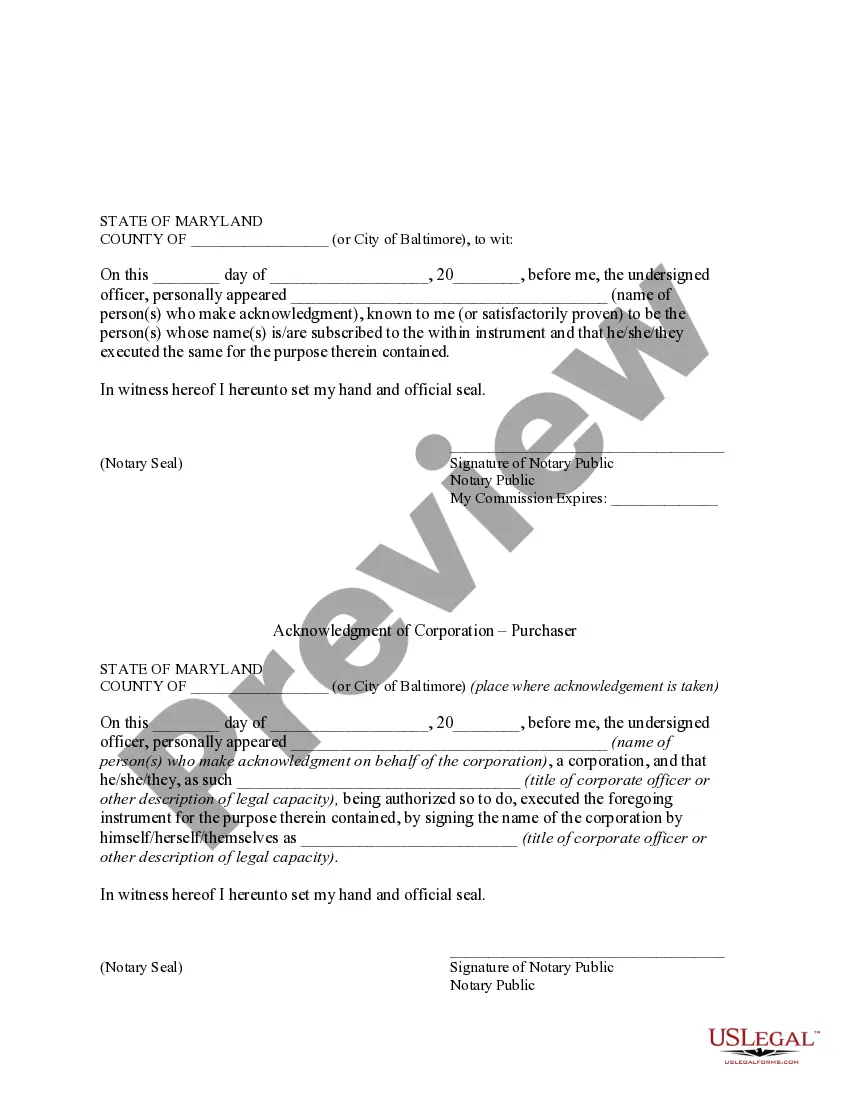

- Print the document and complete it with your/your business’s information.

- Once you’ve filled out the Maryland Assumption Agreement of Deed of Trust and Release of Original Mortgagors, send it to your lawyer for confirmation.

- It’s an extra step but an essential one to ensure you’re fully protected.

- Join US Legal Forms today and gain access to a multitude of reusable samples.

Form popularity

FAQ

An assumable mortgage is an arrangement in where an outstanding mortgage and its terms can be transferred from the current owner to a buyer.

What is a mortgage assumption agreement?A person who assumes a mortgage takes over a payment from the previous homeowner. Basically, the agreement shifts the financial responsibility of the loan to a different borrower.

An assumable mortgage allows a buyer to take over the seller's mortgage. Once the assumption is complete, you take over the payments on a monthly basis, and the person you assume the loan from is released from further liability. If you assume someone's mortgage, you're agreeing to take on their debt.

As you stated in your question, it is recorded among the land records, and your lender keeps the original. When you pay off the loan, the lender will return the deed of trust with the promissory note. This document is rather lengthy and quite legalistic.

Having an assumable loan might give a seller a marketing edge, particularly if mortgage rates have risen since the seller got the loan. For a buyer, assuming a mortgage can save thousands of dollars in interest payments and closing costs but it could require making a big down payment.

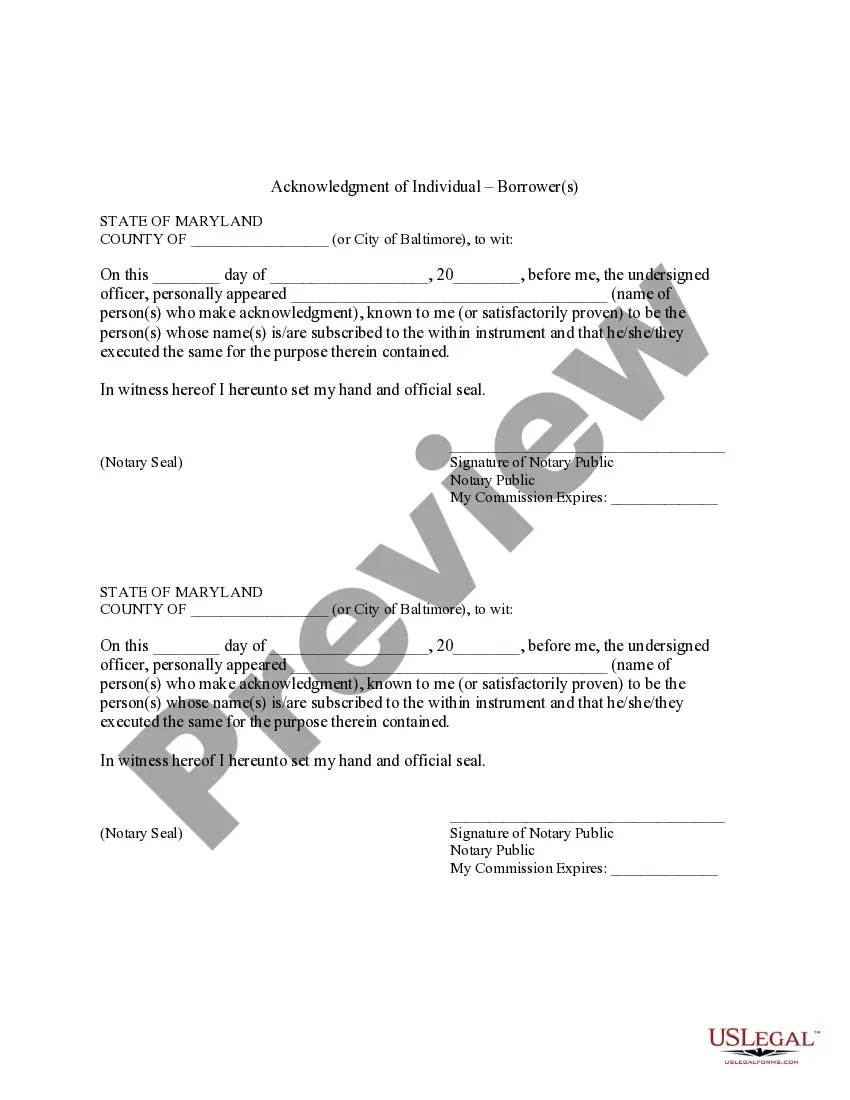

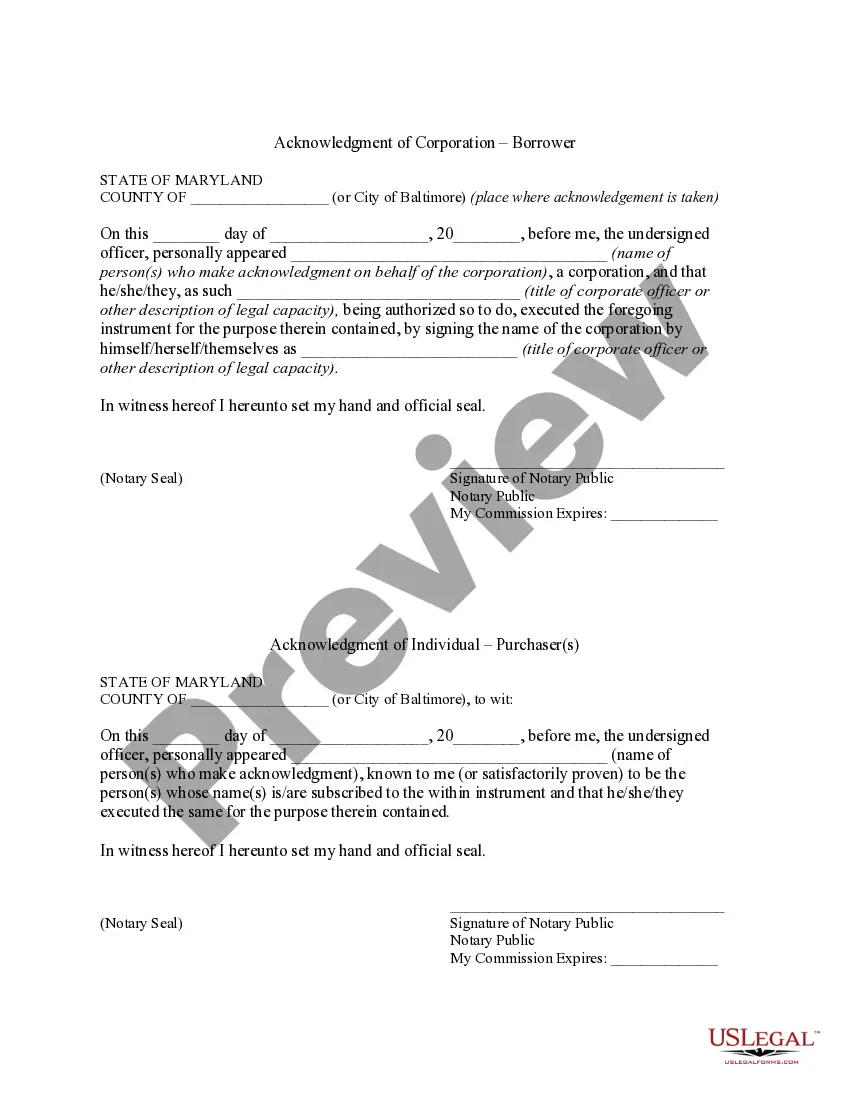

Only until the debt is paid off by the borrower can a deed of reconveyance then be used to clear the deed of trust from the title to the property. The document is signed by the trustee, whose signature must be notarized.

Advantages. If the assumable interest rate is lower than current market rates, the buyer saves money straight away. There are also fewer closing costs associated with assuming a mortgage. This can save money for the seller as well as the buyer.

A deed of release or release deed is a legal document that removes the claim of a person from an immovable property and transfers his/her share to the co-owner. The release deed procedure is executed in the sub-registrars office and both the parties are required to be present for signing it.

A deed of release literally releases the parties to a deal from previous obligations, such as payments under the term of a mortgage because the loan has been paid off. The lender holds the title to real property until the mortgage's terms have been satisfied when a deed of release is commonly entered into.