Maryland Deed of Conservation Easement for a Lake

Description

How to fill out Maryland Deed Of Conservation Easement For A Lake?

Among numerous paid and complimentary examples that you can discover online, you cannot guarantee their precision and trustworthiness.

For instance, who created them or if they possess the necessary qualifications to fulfill your requirements.

Always stay calm and utilize US Legal Forms! Find Maryland Deed of Conservation Easement for a Lake templates crafted by experienced attorneys and avoid the expensive and lengthy process of searching for a lawyer, then compensating them to draft a document for you that you can easily obtain by yourself.

Once you have registered and paid for your subscription, you can use your Maryland Deed of Conservation Easement for a Lake as many times as you wish, as long as it remains valid in your state. Modify it with your preferred online or offline editor, complete it, sign it, and print it. Achieve more for less with US Legal Forms!

- Ensure that the document you view is valid in your state.

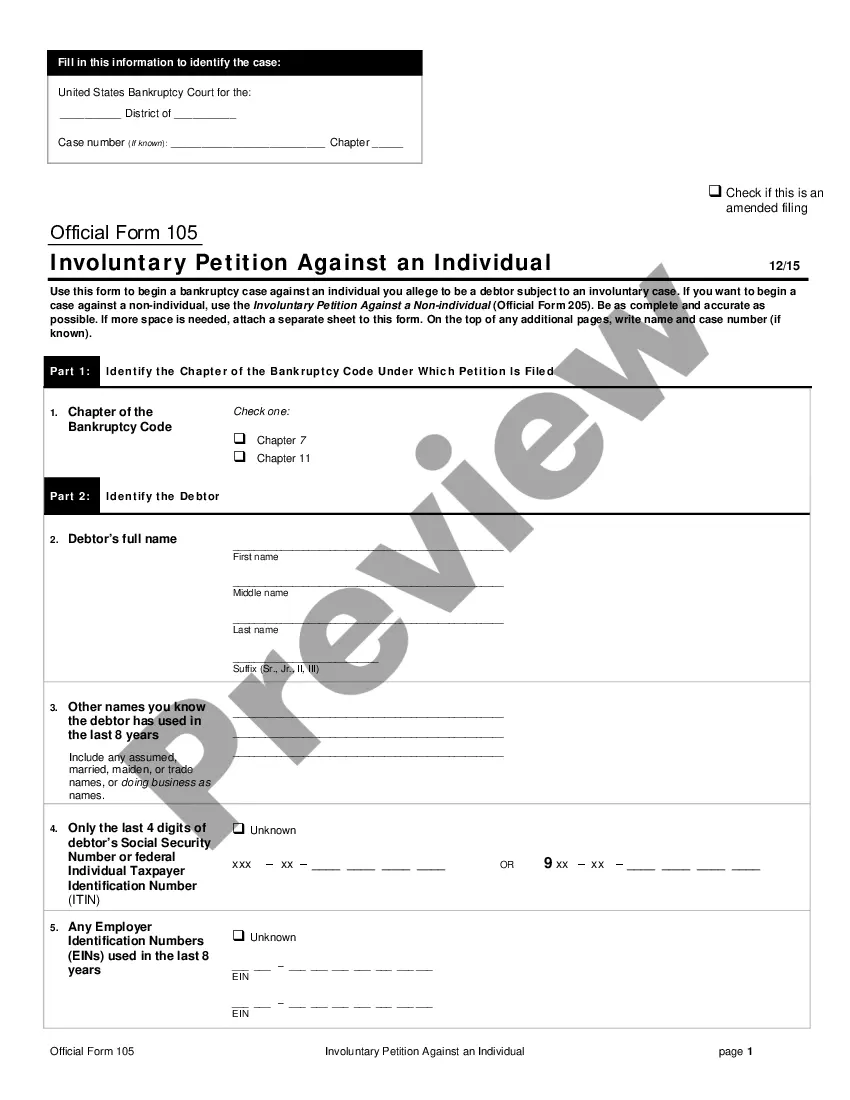

- Examine the template by checking the details using the Preview function.

- Click Buy Now to initiate the ordering process or search for another example using the Search field in the header.

- Select a pricing plan and register for an account.

- Pay for the subscription with your credit/debit card or Paypal.

- Download the form in the desired file format.

Form popularity

FAQ

While no conservation easement will ever be terminated, there are times where it can be amended. Ken says although an amendment can be made to an easement, these are rare and the only way they can happen is if the landowner is willing to donate other retained rights they own.

Decide on your vision. Think about your wishes, needs and objectives for your land. Check out potential partners. Contact land trusts and government agencies that work to assist landowners in your community who are interested in conservation. Get checked out. Take the plunge. Build your partnership.

A conservation easement is a legal agreement between a landowner and a nonprofit land trust or governmental entity that permanently limits the uses of the land in order to protect specified conservation values. It does this by restricting the amount of development and activities that can take place in the future.

Under IRS rules, a conservation easement must achieve at least one of the following purposes: preservation of land for outdoor recreation or education of the general public; preservation of natural habitat for fish, wildlife, or plants; preservation of open space, including farmland or forest; or preservation of a

Conservation easements are a great idea, in theory. Here's the way they work. Basically, if you are willing to donate your property for the public good, and that donation reduces the value of your property, you get to take a tax deduction equal to the reduction in the value of your property.

Syndicated conservation easement transactions basically involve the use of a pass-through entity (for example, a partnership) to acquire property.

The easement places limits on land use to help conserve the property's features. With an easement, the landowner still owns the land and can continues to live on and use it, restrict public access to it, and sell, give or pass the property on to whomever they wish.

When a conservation easement is placed on a property, it typically lowers the property's value for federal estate tax purposes and may decrease estate tax liability. Therefore, easements may help heirs avoid being forced to sell off land to pay estate taxes and enable land to stay in the family.

The value of the donation of a conservation easement is considered a charitable deduction for income tax purposes. The deduction is up to 50% of the donor's charitable contribution base (adjusted gross income, less net operating loss carryback) for the taxable year.