Kansas Subcontractor's Agreement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

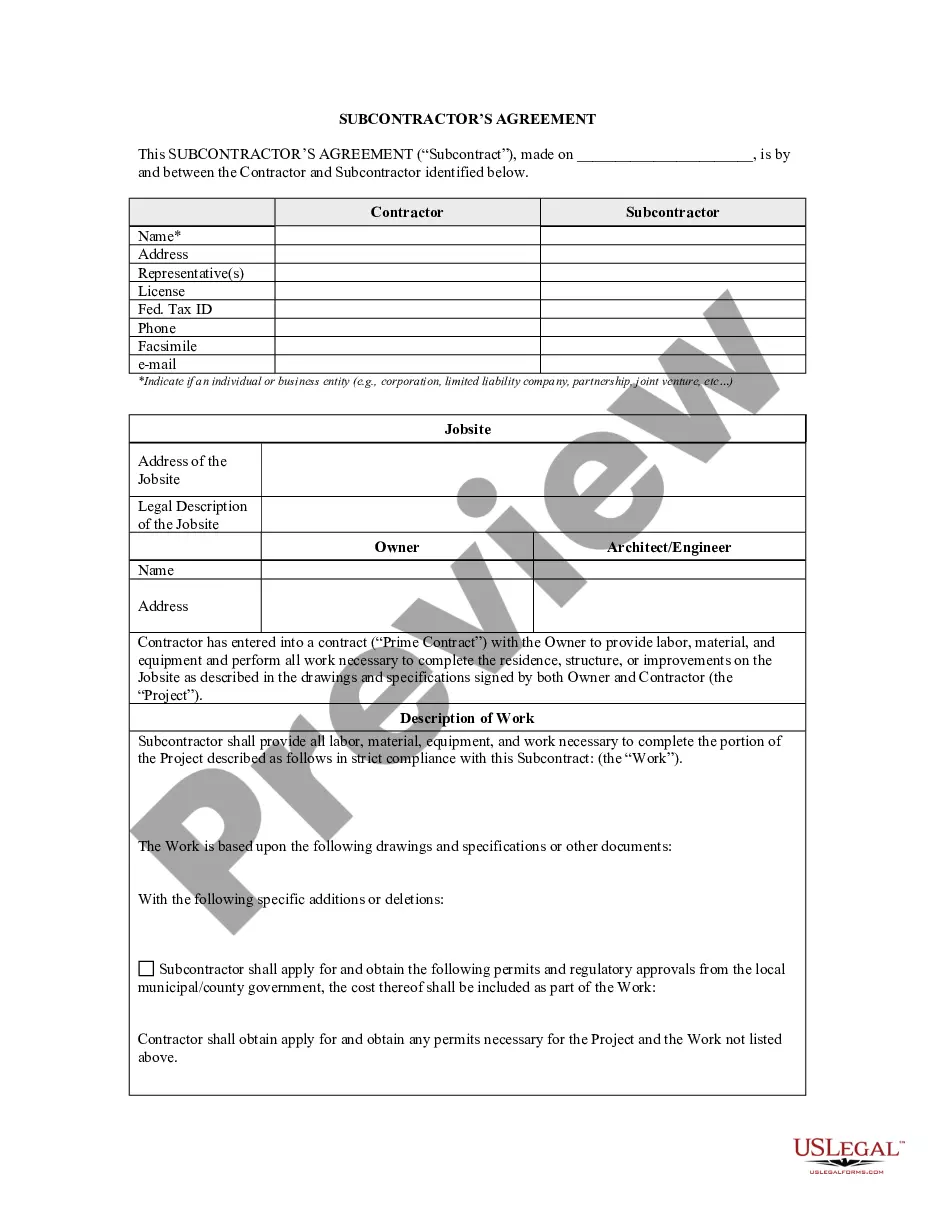

How to fill out Kansas Subcontractor's Agreement?

Searching for a sample of the Kansas Subcontractor's Agreement and completing it may pose a challenge.

To conserve extensive time, expenses, and effort, utilize US Legal Forms to locate the appropriate sample tailored for your state in only a few clicks.

Our legal experts prepare every document, so all you need to do is fill them out. It's truly that simple.

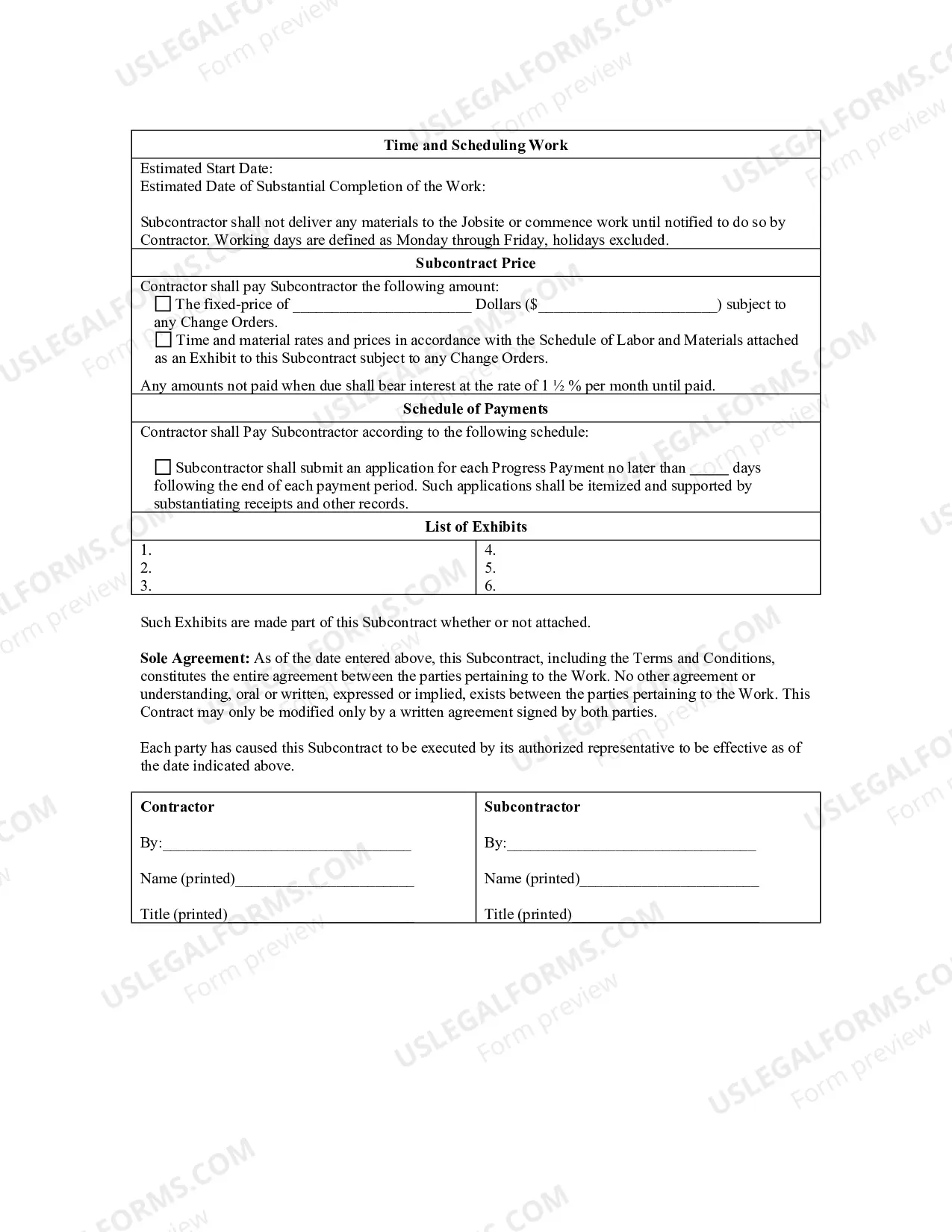

Select your plan on the pricing page and create an account. Choose your payment method either by card or PayPal. Download the sample in your desired file format. You can print the Kansas Subcontractor's Agreement form or fill it out using any online editor. Don’t worry about making mistakes since your sample can be utilized and submitted, as well as printed multiple times as you wish. Explore US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and return to the form's webpage to save the document.

- All your downloaded templates are stored in My documents and are accessible at any time for future use.

- If you haven’t registered yet, you must sign up.

- Review our comprehensive instructions on how to obtain the Kansas Subcontractor's Agreement form in just a few minutes.

- To obtain a valid sample, verify its applicability for your state.

- Examine the sample using the Preview option (if available).

- If there’s a description, read it to understand the key details.

- Click on the Buy Now button if you find what you are looking for.

Form popularity

FAQ

Start with procurement standards. Execute all subcontracts prior to starting your projects. Help those who help you. Award the job to the lowest fully qualified bidder. Use contract scope checklists. Make sure you have tight clauses. Meet to review the proposed subcontract.

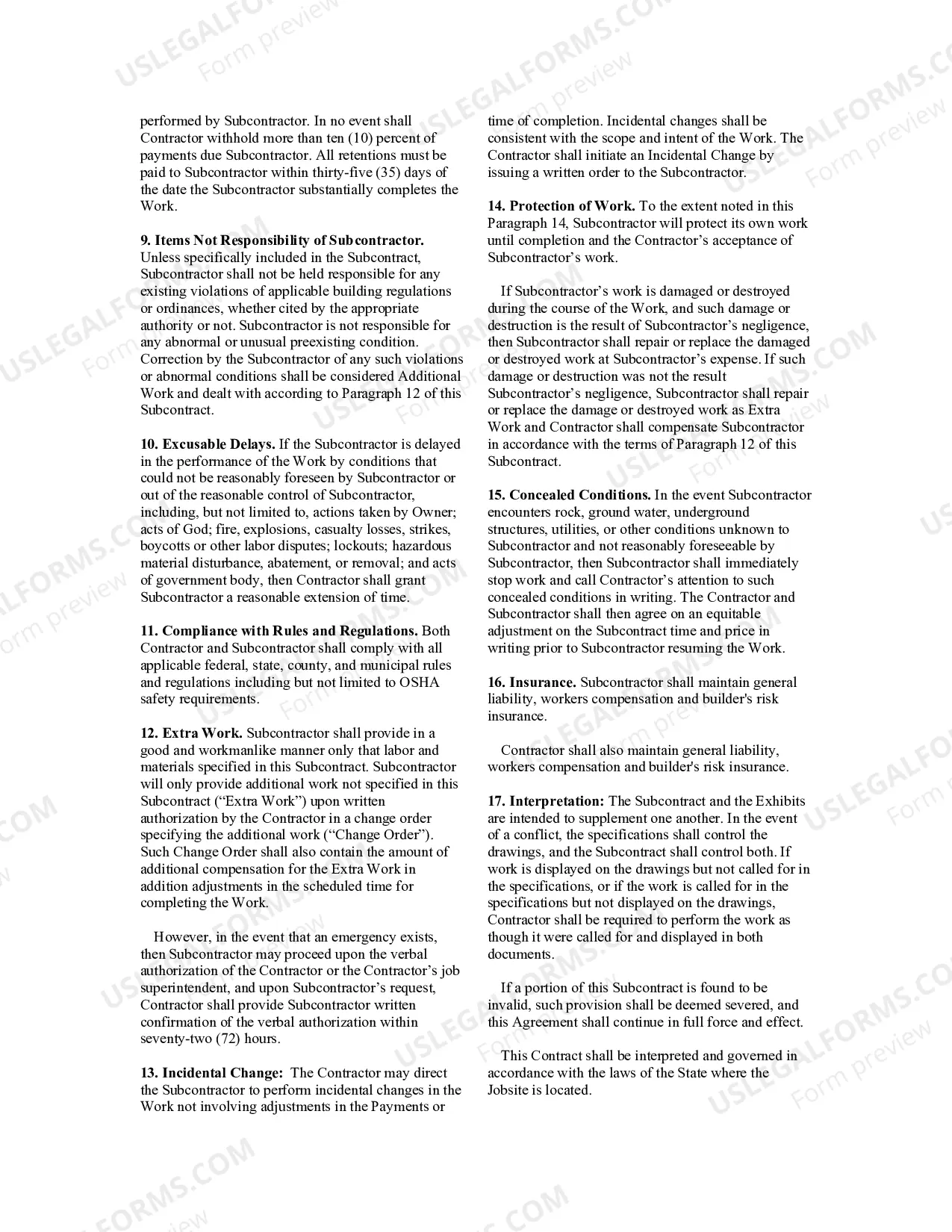

Subcontractor agreements outline the responsibilities of each party, to ensure that if a claim were to arise, the responsible party is accountable. A subcontractor agreement provides protection to the company that hired the vendor or subcontractor by transferring the risk back to the party performing the work.

Each subcontractor should complete Form W-9 before they begin any work. On the form, the subcontractor identifies their business structure type (sole proprietorship, corporation, etc.). Form W-9 also asks for the subcontractor's name and Taxpayer Identification Number (TIN).

A subcontractor agreement is a contract between contractors or project managers and subcontractors. This solidifies any agreement between the two parties and assures work. Subcontractors should read the subcontractor agreement and assure specifics to protect themselves from unfair risk.

A subcontractor is a worker who is not your employee. You give a Form 1099 to a subcontractor showing the amounts you paid him. The subcontractor is responsible for keeping his or her own records and paying his or her own income and self-employment taxes.

This Master Agreement is a written understanding between Contractor and Subcontractor containing contract clauses applying to future subcontracts (hereafter "Subcontracts") between Contractor and Subcontractor for the furnishing of construction and construction related services, which may include, but not be limited to

Scope of the Project. Timing for Completion: Duration of Work Clause. Payment and Billing Clause. Independent Contractor Notice. Non-Disclosure Agreement. Non-Complete Clause. Work for Hire Inclusion. Responsibilities for Insurance for Accidental Damages.

A subcontractor agreement is a contract between contractors or project managers and subcontractors. This solidifies any agreement between the two parties and assures work. Subcontractors should read the subcontractor agreement and assure specifics to protect themselves from unfair risk.

A subcontractor has a contract with the contractor for the services provided - an employee of the contractor cannot also be a subcontractor.