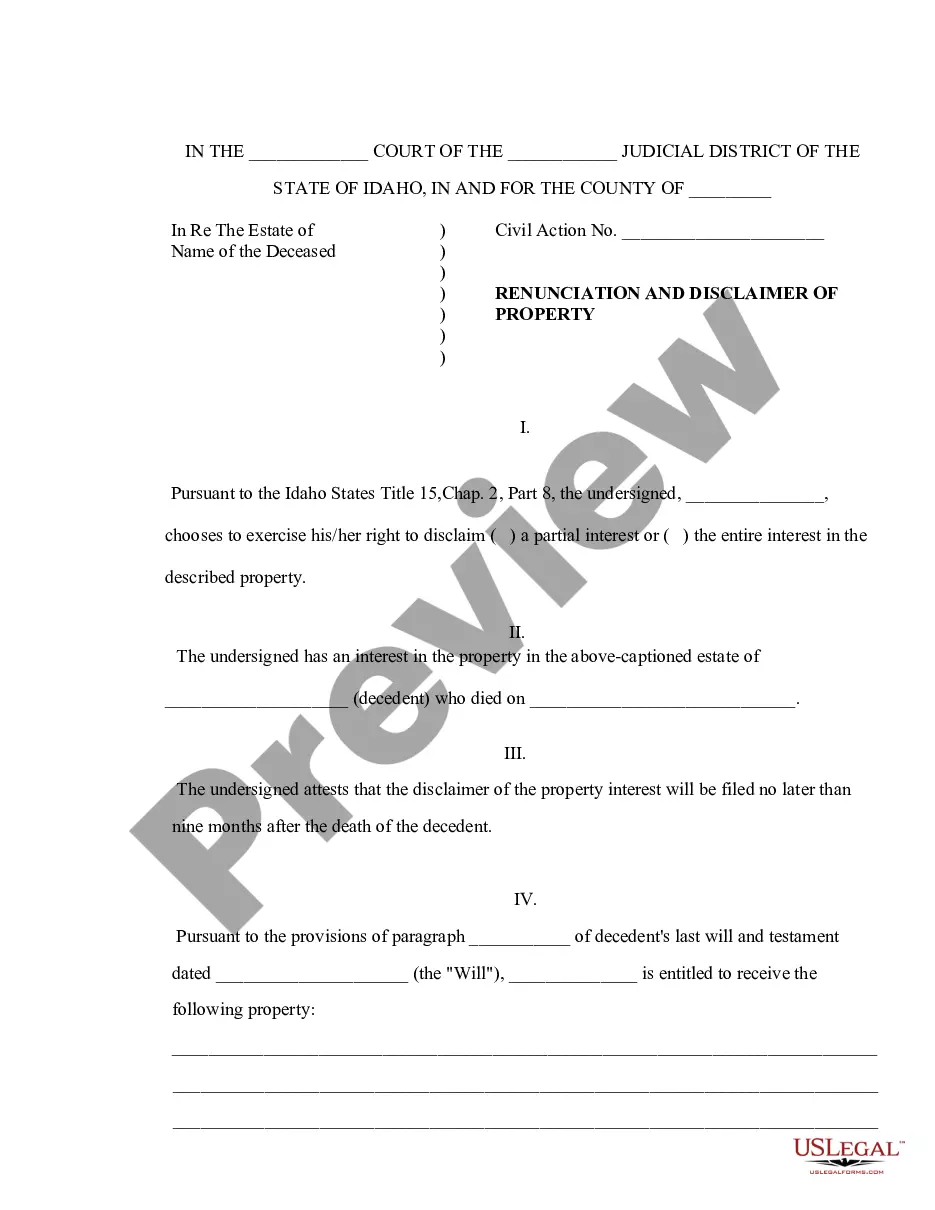

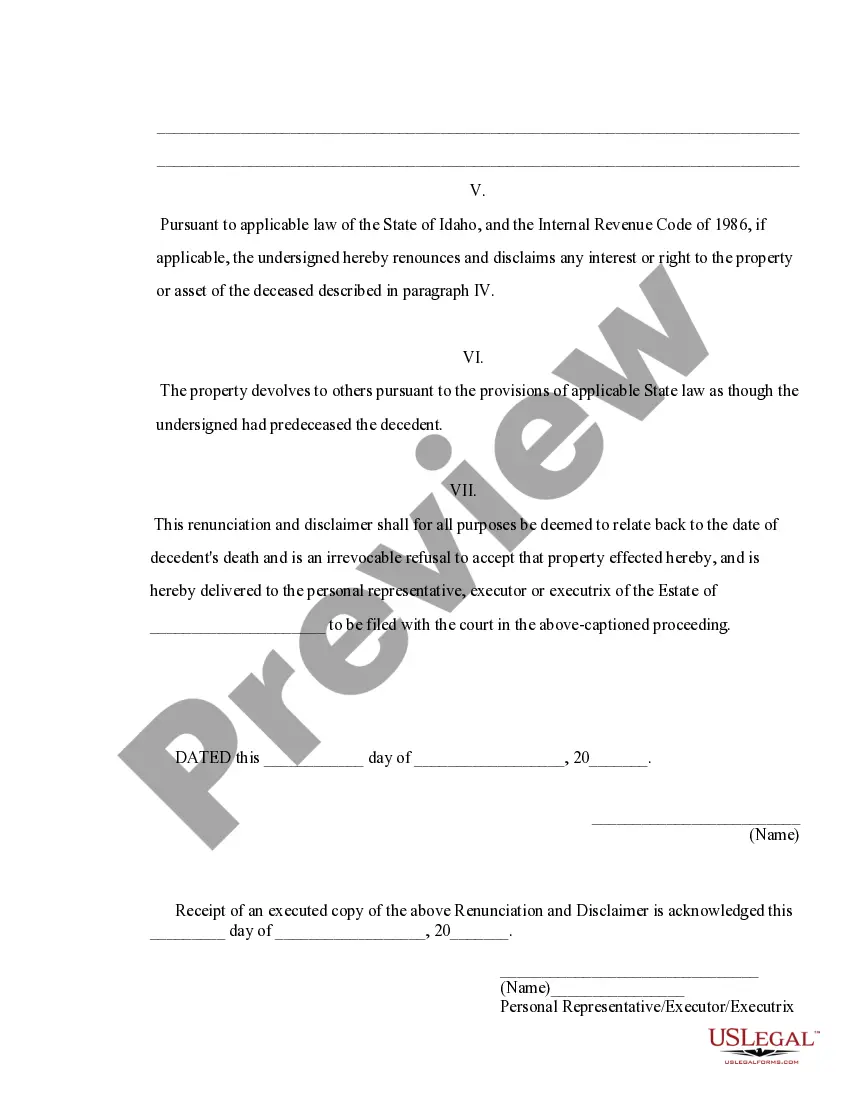

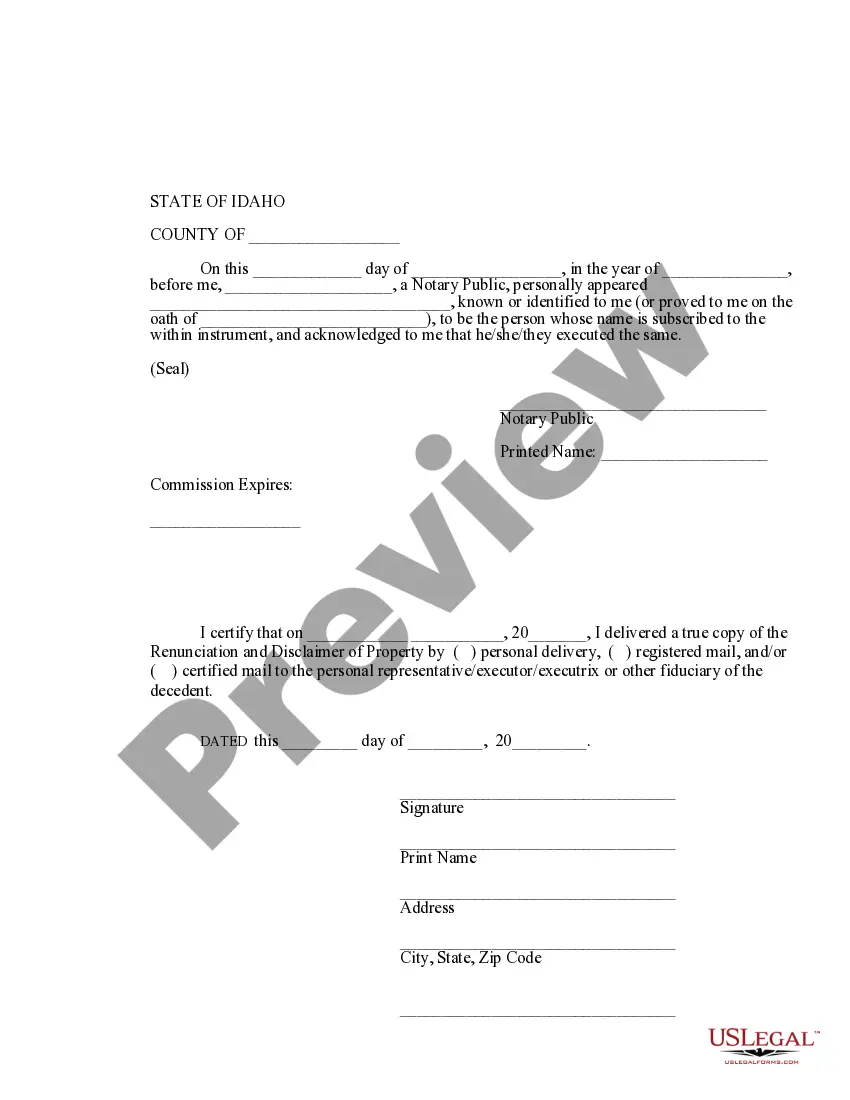

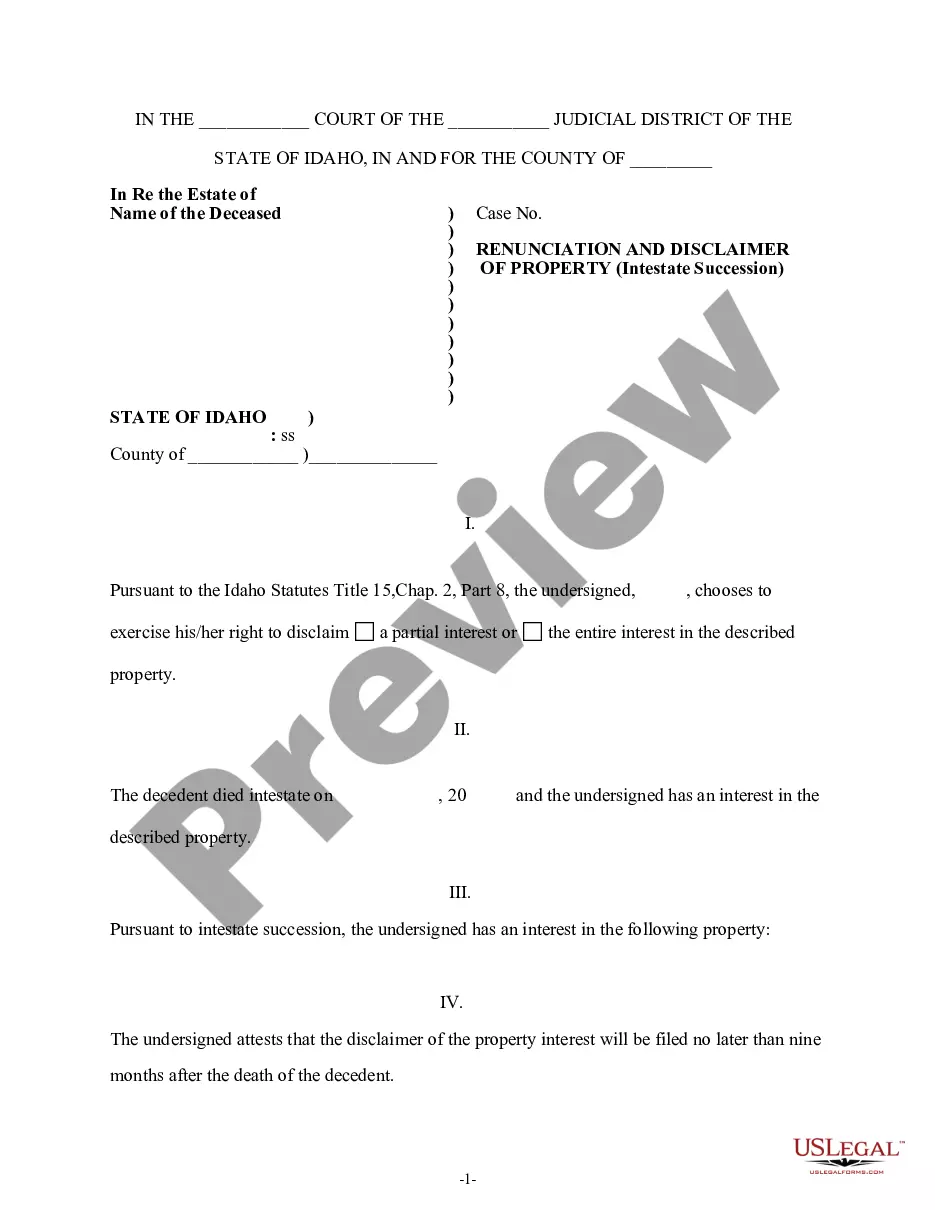

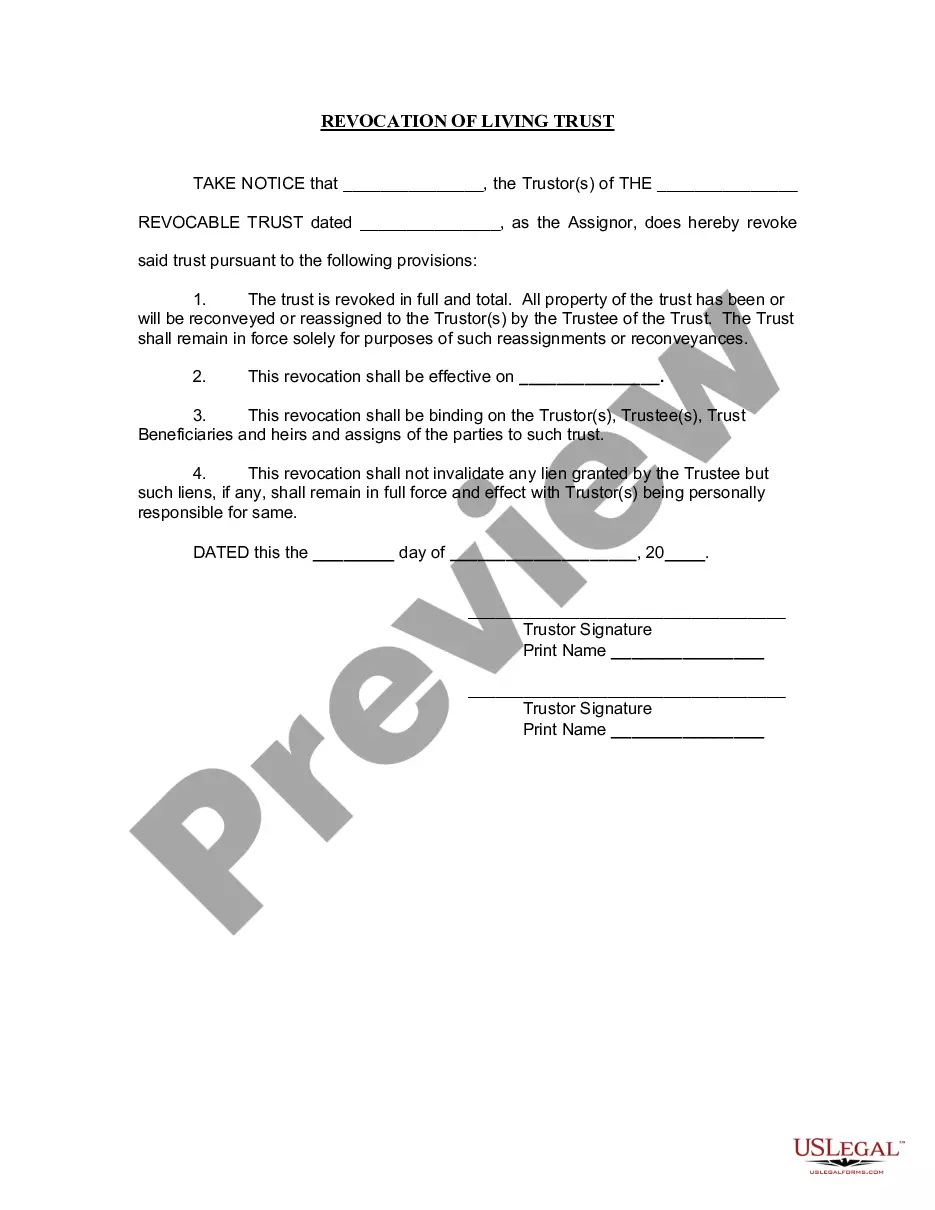

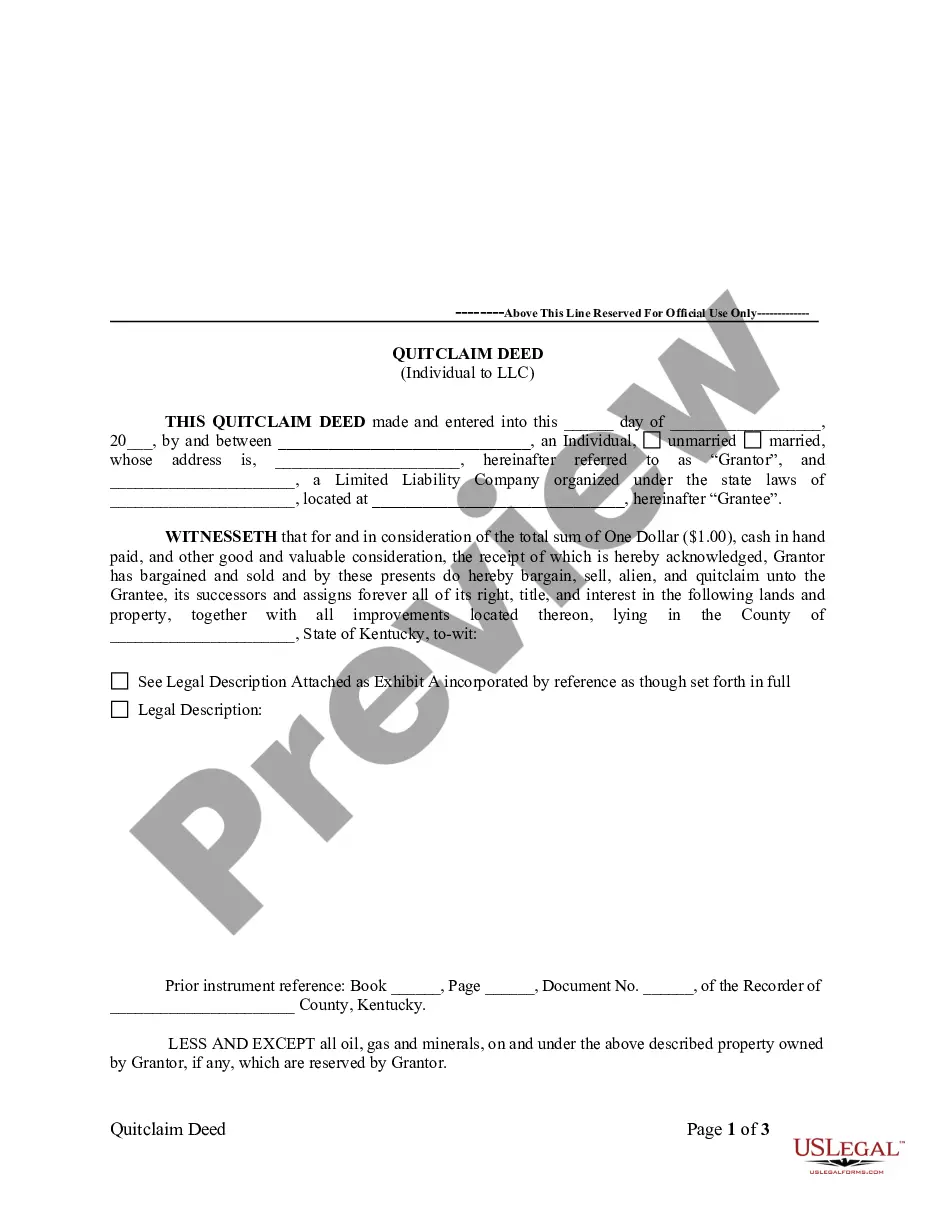

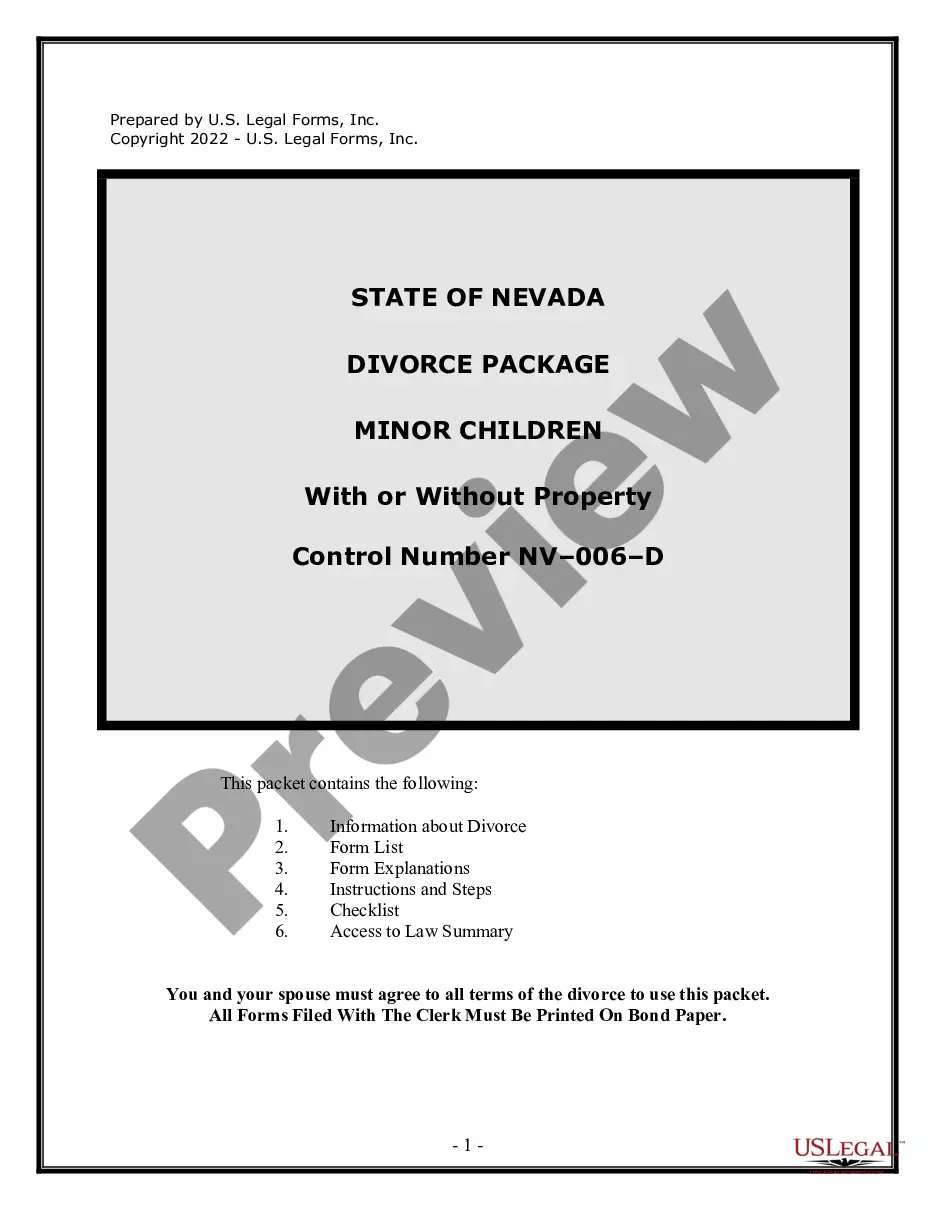

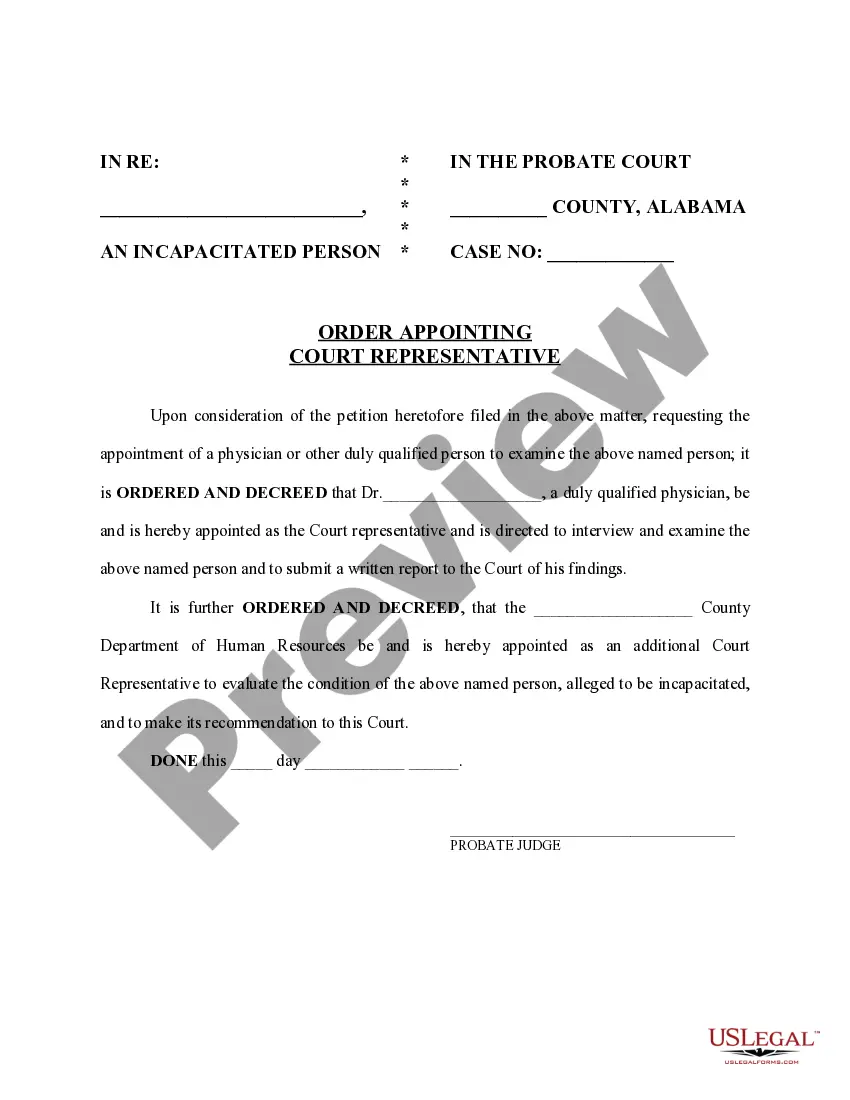

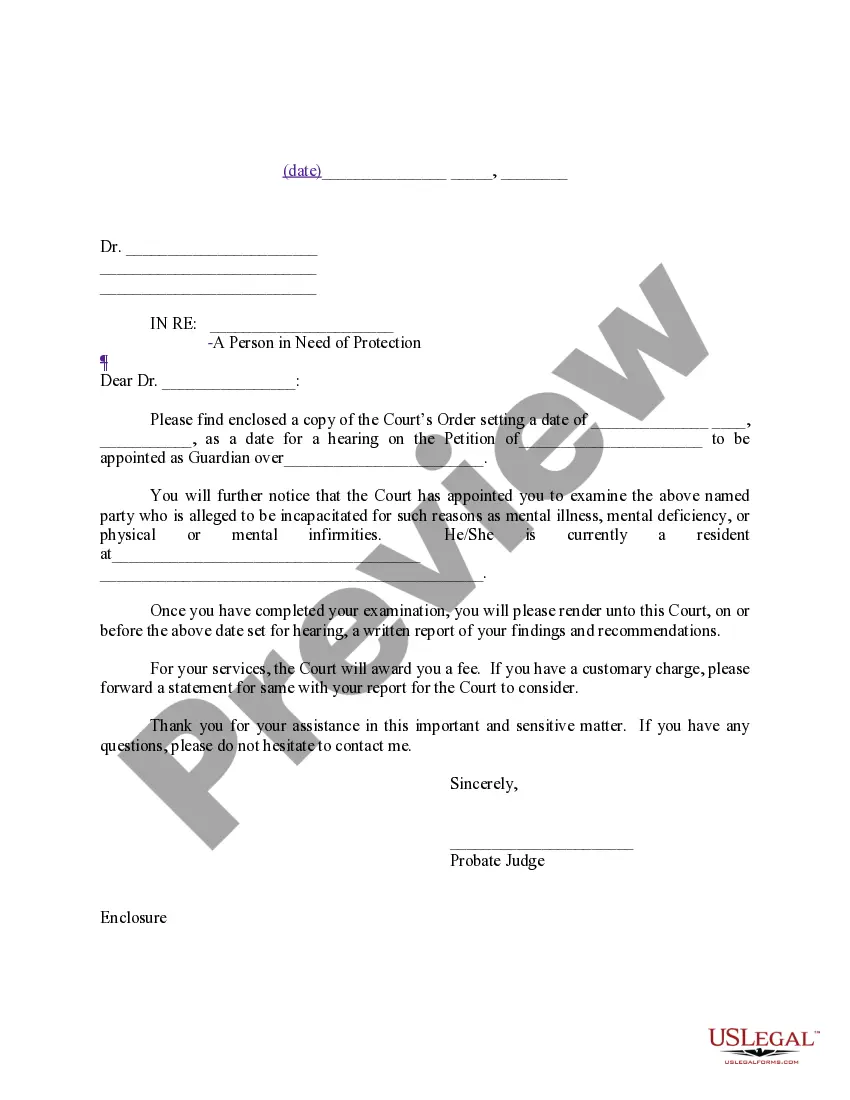

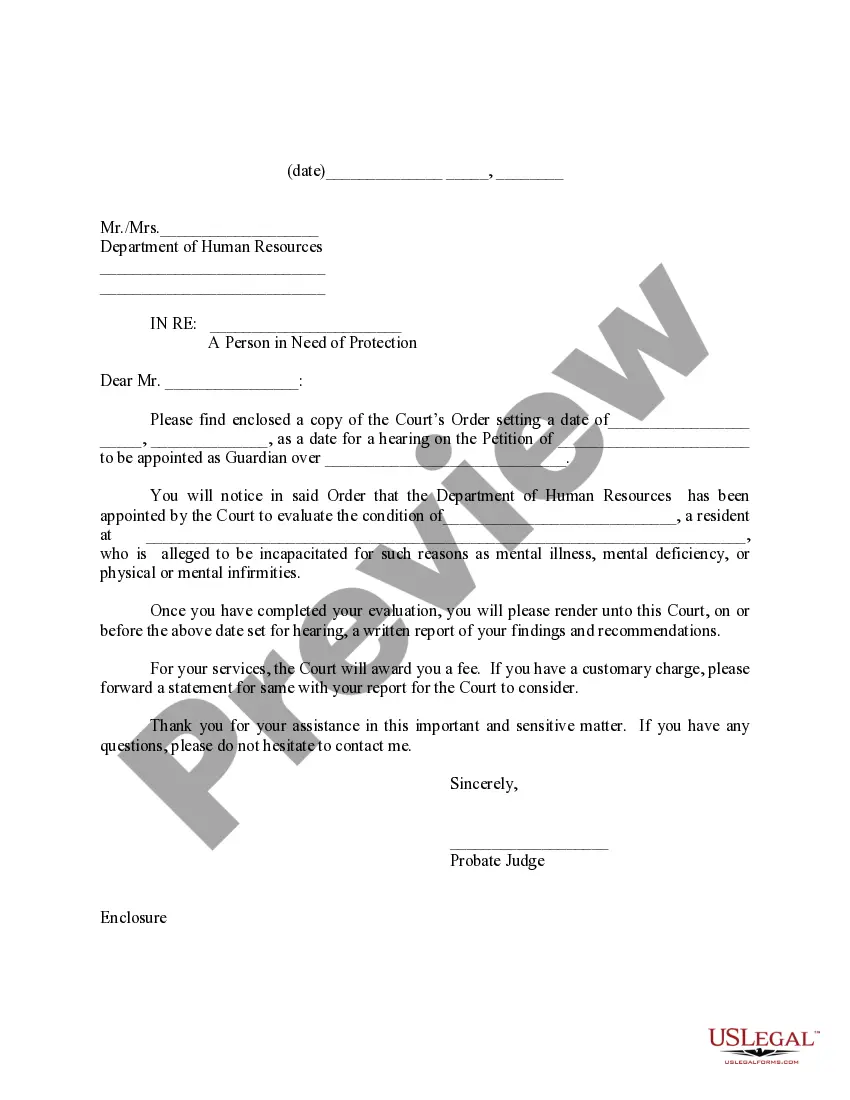

This form is a Renunciation and Disclaimer of Property acquired by the beneficiary through the last will and testament of the decedent. The beneficiary has gained an interest in the described property of the decedent. However, pursuant to the Idaho Statutes Title 15, Chap. 2, Part 8, the beneficiary has chosen to disclaim a portion of or the entire interest in the property. The beneficiary attests that he/she will file the disclaimer no later than nine months after the death of the decedent in order to secure the validity of the disclaimer. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Idaho Renunciation and Disclaimer of Property from Will by Testate

Description

How to fill out Idaho Renunciation And Disclaimer Of Property From Will By Testate?

Obtain one of the most comprehensive collections of authorized documents.

US Legal Forms is truly a resource where you can locate any state-specific paperwork in moments, such as Idaho Renunciation and Disclaimer of Property from Will by Testate examples.

No need to waste your time searching for a court-admissible template.

After choosing a pricing plan, create your account. Pay by credit card or PayPal. Download the example to your device by clicking Download. That's all! You should submit the Idaho Renunciation and Disclaimer of Property from Will by Testate form and verify it. To confirm that everything is accurate, reach out to your local legal advisor for assistance. Register and easily browse over 85,000 useful documents.

- To access the document library, select a subscription and create your account.

- If you've created it, just Log In and click on the Download button.

- The Idaho Renunciation and Disclaimer of Property from Will by Testate example will automatically be stored in the My documents tab (a tab for all documents you've downloaded from US Legal Forms).

- To establish a new profile, follow the brief guidelines provided below.

- If you're planning to use a state-specific document, ensure that you specify the correct state.

- If possible, review the description to understand all details of the document.

- Use the Preview feature if it's available to examine the document's content.

- If everything is accurate, click Buy Now.

Form popularity

FAQ

The answer is yes. The technical term is "disclaiming" it. If you are considering disclaiming an inheritance, you need to understand the effect of your refusalknown as the "disclaimer"and the procedure you must follow to ensure that it is considered qualified under federal and state law.

The beneficiary can disclaim only a portion of an inherited IRA or asset, allowing some to flow to the contingent beneficiary(s). Partial disclaiming is either a specific dollar or percentage amount as of the date of death.The balance will go to the next beneficiary(s).

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

Yes, a fiduciary can disclaim an interest in property if the will, trust or power of attorney gives the fiduciary that authority or if the appropriate probate court authorizes the disclaimer.The primary reason an executor or trustee might disclaim property passing to an estate or trust is to save death taxes.

You can head off an inheritance by renouncing or disclaiming it. This involves notifying the executor or personal representative of the estate the individual charged with guiding it through the probate process and settling it that you don't want the gift. You must do so in writing, and it's an irrevocable decision.

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property.

Disclaim Inheritance, DefinitionDisclaiming means that you give up your rights to receive the inheritance. If you choose to do so, whatever assets you were meant to receive would be passed along to the next beneficiary in line.

Disclaim the asset within nine months of the death of the assets' original owner (one exception: if a minor beneficiary wishes to disclaim, the disclaimer cannot take place until after the minor reaches the age of majority, at which time they will have nine months to disclaim the assets).