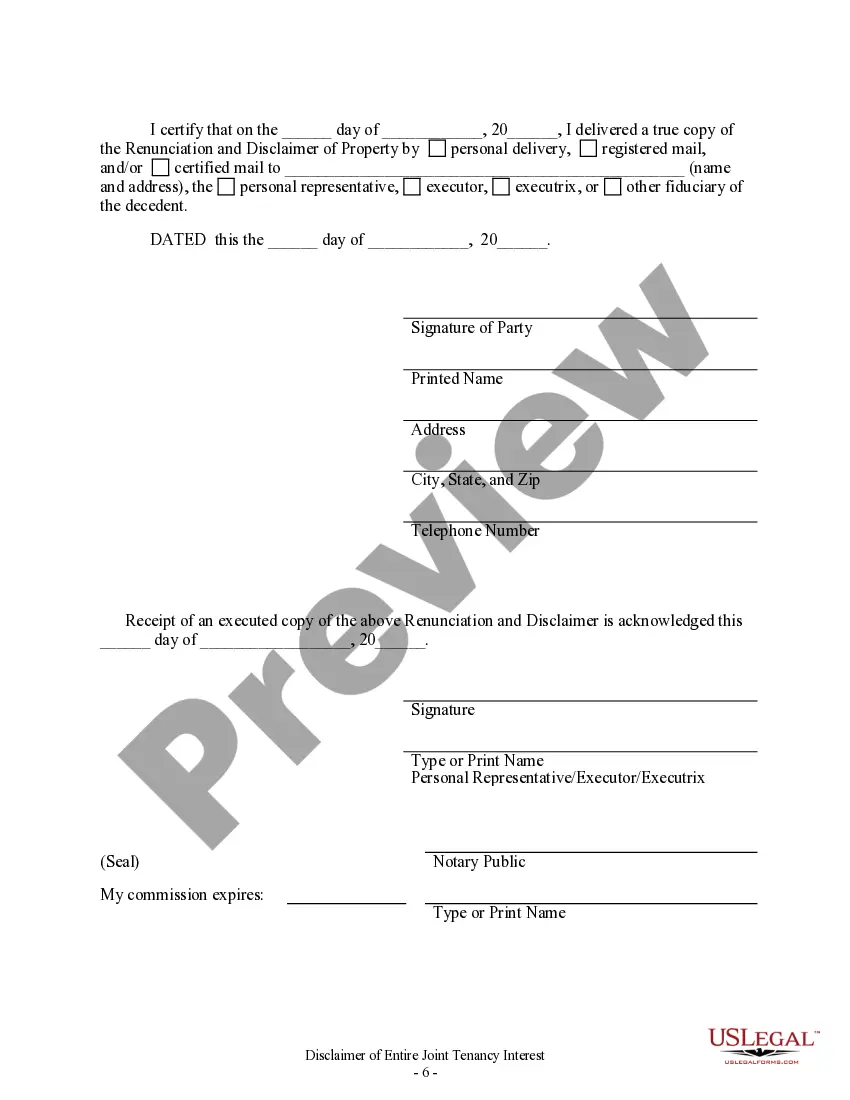

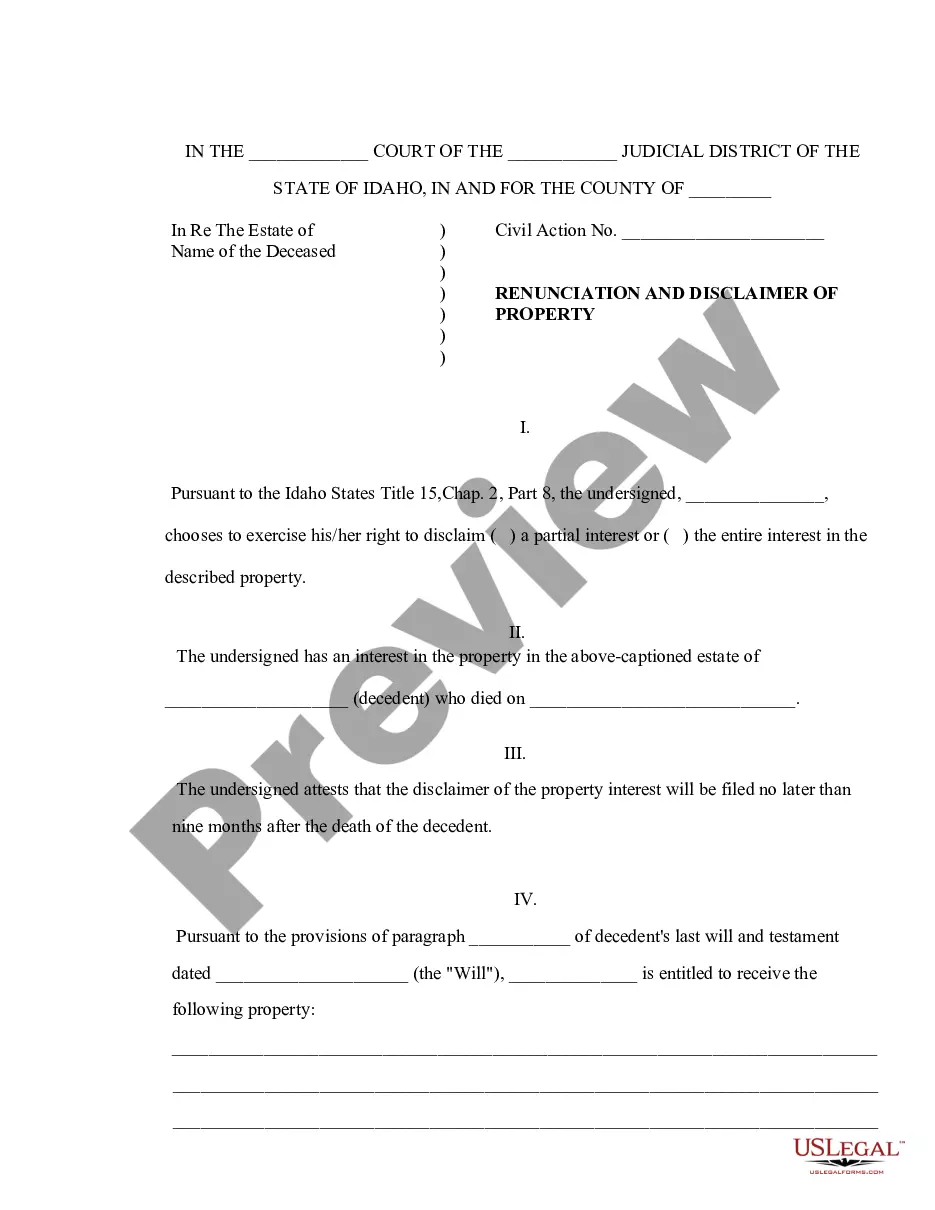

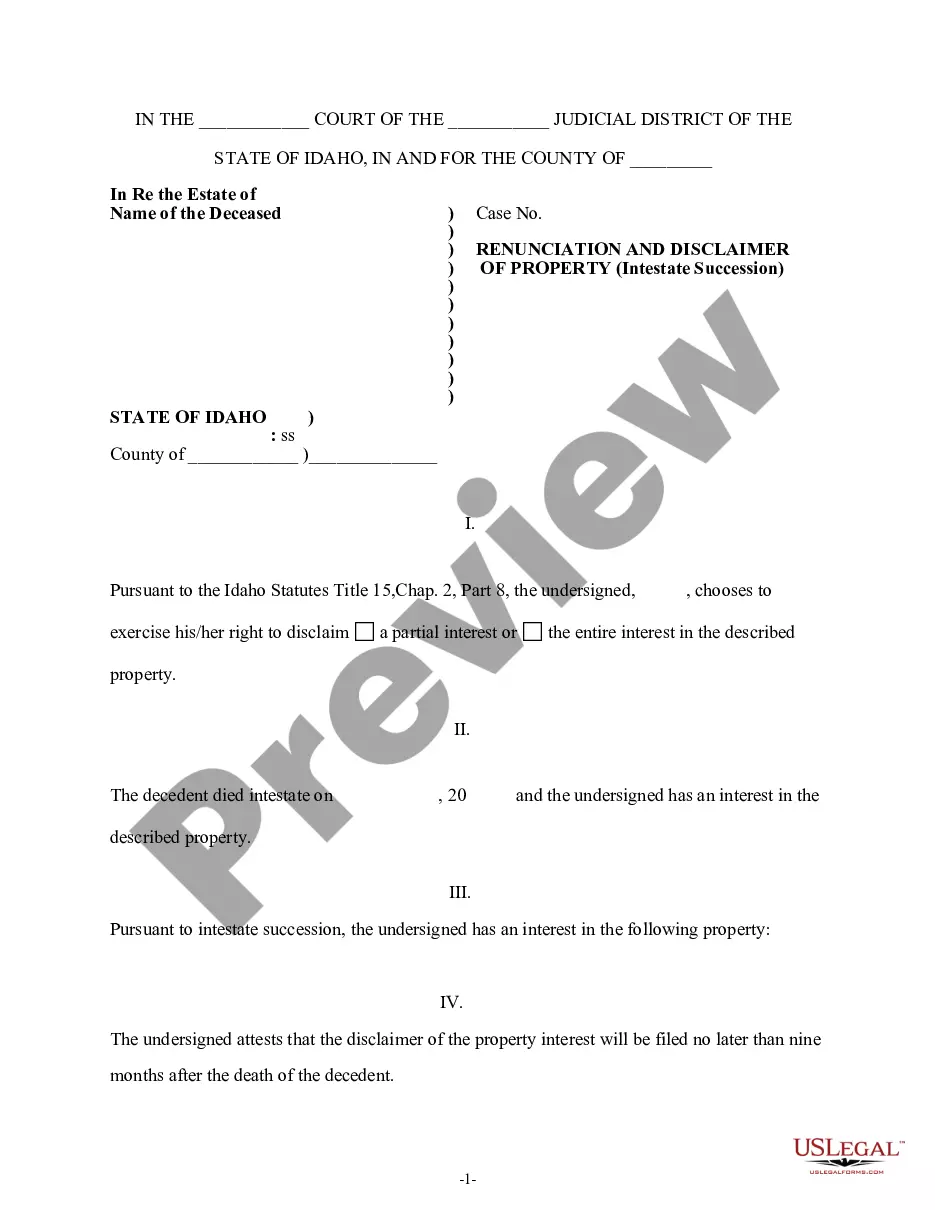

This form is a Renunciation and Disclaimer of a Joint Tenant Interest. The surviving joint tenant gained an interest in the property upon the death of the decedent. However, the surviving joint tenant has decided to disclaim his/her entire right to the property pursuant to the Idaho Statutes Title 15, Chap. 2, Part 8. The surviving tenant attests that he/she will not file the disclaimer no later than nine months after the death of the decedent in order to secure the validity of the disclaimer. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Idaho Renunciation and Disclaimer of Joint Tenant or Tenancy Interest

Description

How to fill out Idaho Renunciation And Disclaimer Of Joint Tenant Or Tenancy Interest?

Obtain entry to the most comprehensive collection of sanctioned forms.

US Legal Forms serves as a platform where you can discover any state-specific document in just a few clicks, such as examples of Idaho Renunciation and Disclaimer of Joint Tenant or Tenancy Interest.

There's no need to squander hours searching for a court-acceptable sample. Our licensed experts guarantee that you receive the latest samples continuously.

If everything looks correct, click the Buy Now button. After selecting a pricing plan, register your account. Pay with a credit card or PayPal. Download the document to your device by clicking the Download button. That's it! You should fill out the Idaho Renunciation and Disclaimer of Joint Tenant or Tenancy Interest form and verify it. To ensure accuracy, consult your local legal advisor for assistance. Register and conveniently browse through around 85,000 useful templates.

- To utilize the document library, choose a subscription, and create an account.

- Once you've done that, just Log In and click Download.

- The Idaho Renunciation and Disclaimer of Joint Tenant or Tenancy Interest template will instantly be saved in the My documents tab (a section for all forms you save on US Legal Forms).

- To establish a new profile, follow the simple instructions outlined below.

- If you're planning to use a state-specific document, make sure to specify the correct state.

- If possible, review the description to understand all intricacies of the document.

- Use the Preview feature if available to inspect the details of the document.

Form popularity

FAQ

Disclaim, in a legal sense, refers to the renunciation of an interest in, or an acceptance of, inherited assets, such as property, by way of a legal instrument. A person disclaiming an interest, right, or obligation is known as a disclaimant.

In the law of inheritance, wills and trusts, a disclaimer of interest (also called a renunciation) is an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust.A disclaimer of interest is irrevocable.

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

Disclaim Inheritance, Definition In a nutshell, it means you're refusing any assets that you stand to inherit under the terms of someone's will, a trust or, in the case of a person who dies intestate, the inheritance laws of your state.

If you refuse to accept an inheritance, you will not be responsible for inheritance taxes, but you'll have no say in who receives the assets in your place. The bequest passes either to the contingent beneficiary listed in the will or, if that person died without a will, according to your state's laws of intestacy.

Disclaiming means that you give up your rights to receive the inheritance. If you choose to do so, whatever assets you were meant to receive would be passed along to the next beneficiary in line.

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor,

A beneficiary of an estate, whether by Will or the laws of intestacy is perfectly within their rights to reject their inheritance. Beneficiaries may wish to vary dispositions of property following death in order to redirect benefits to other family members who are more in need or less well provided for and to save tax.

When you relinquish property, you don't get any say in who inherits in your place. If you want to control who gets the inheritance, you must accept it and give it to that person. If you relinquish the property and the deceased didn't name a back-up heir, the court will apply state law to decide who inherits.