Oregon Revocation of Living Trust

What is this form?

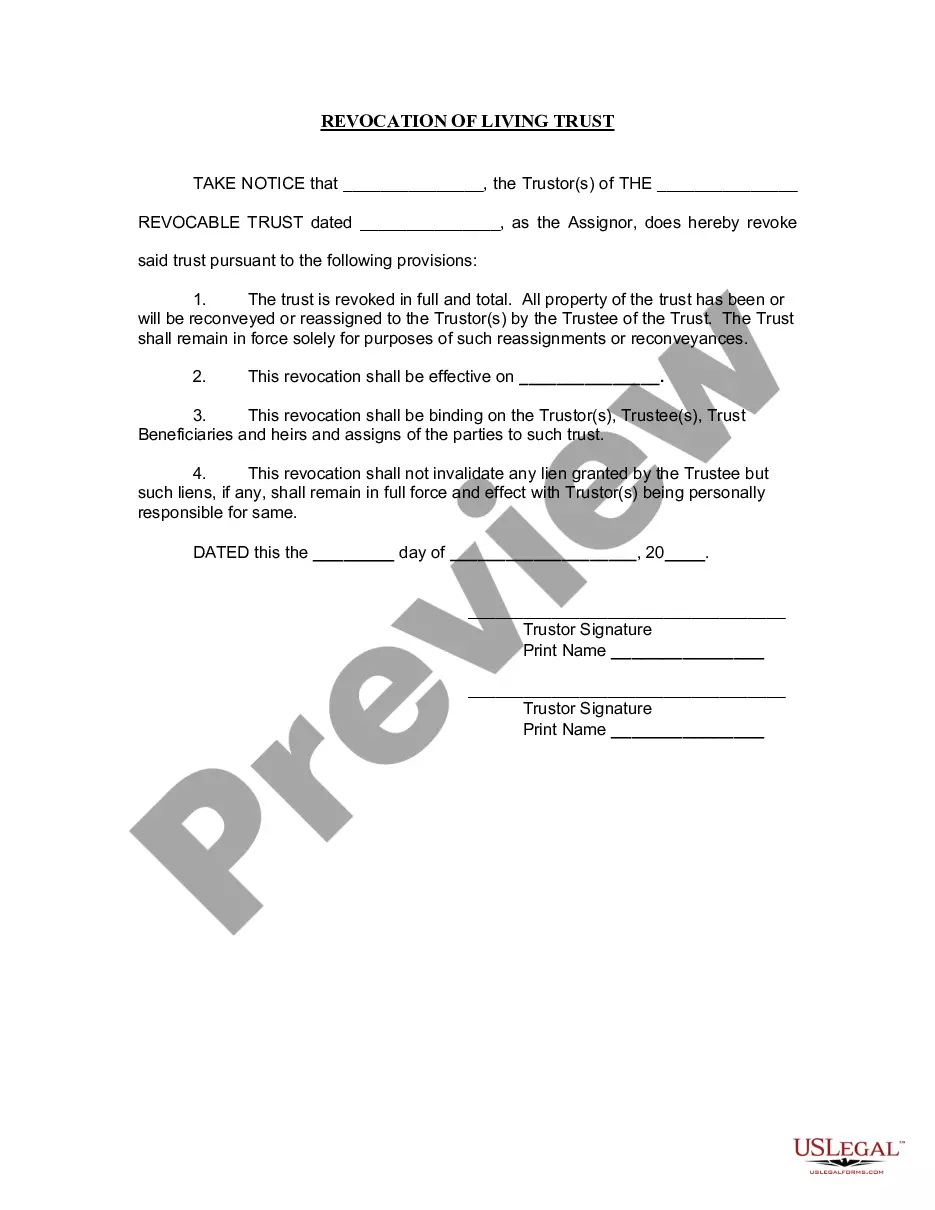

The Revocation of Living Trust form is a legal document used to cancel a living trust that was established during a person's lifetime. This form officially declares the full revocation of a specific living trust, enabling the transfer of trust property back to the original trustors. Unlike other estate planning documents, this form is specifically for terminating a living trust, making it essential when trustors decide to alter their estate plans.

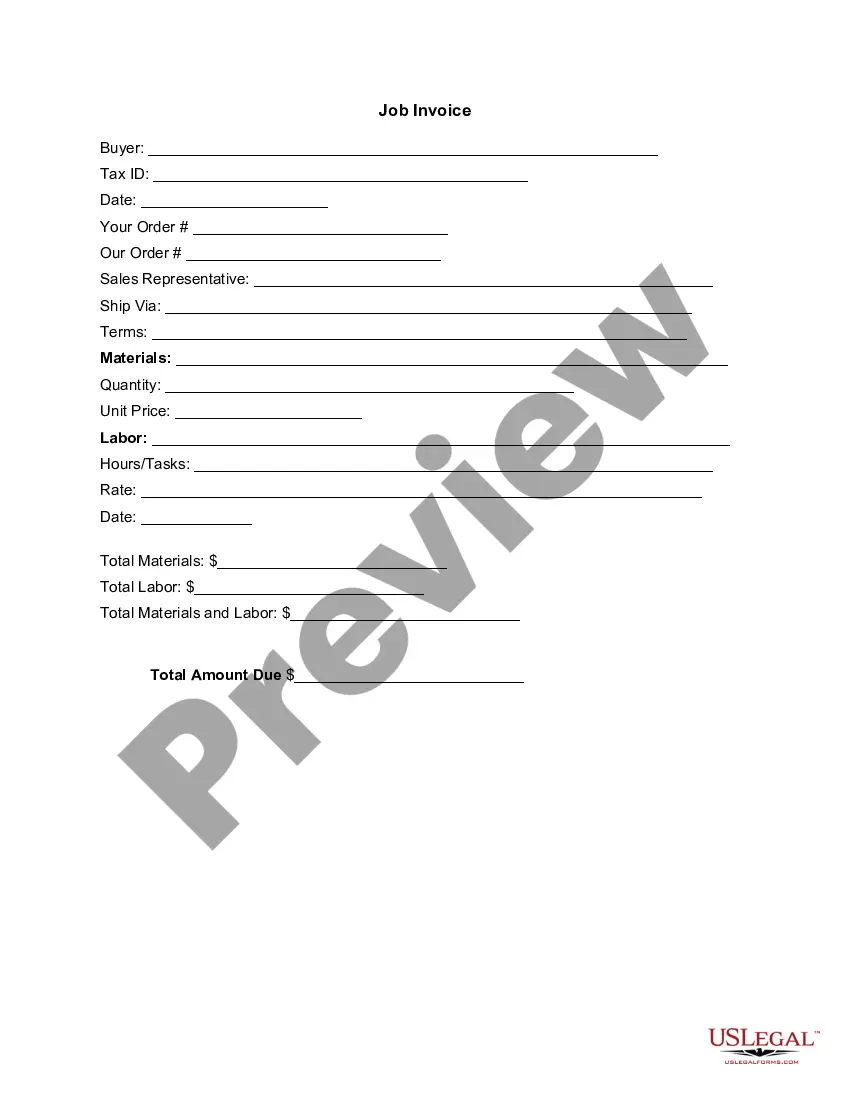

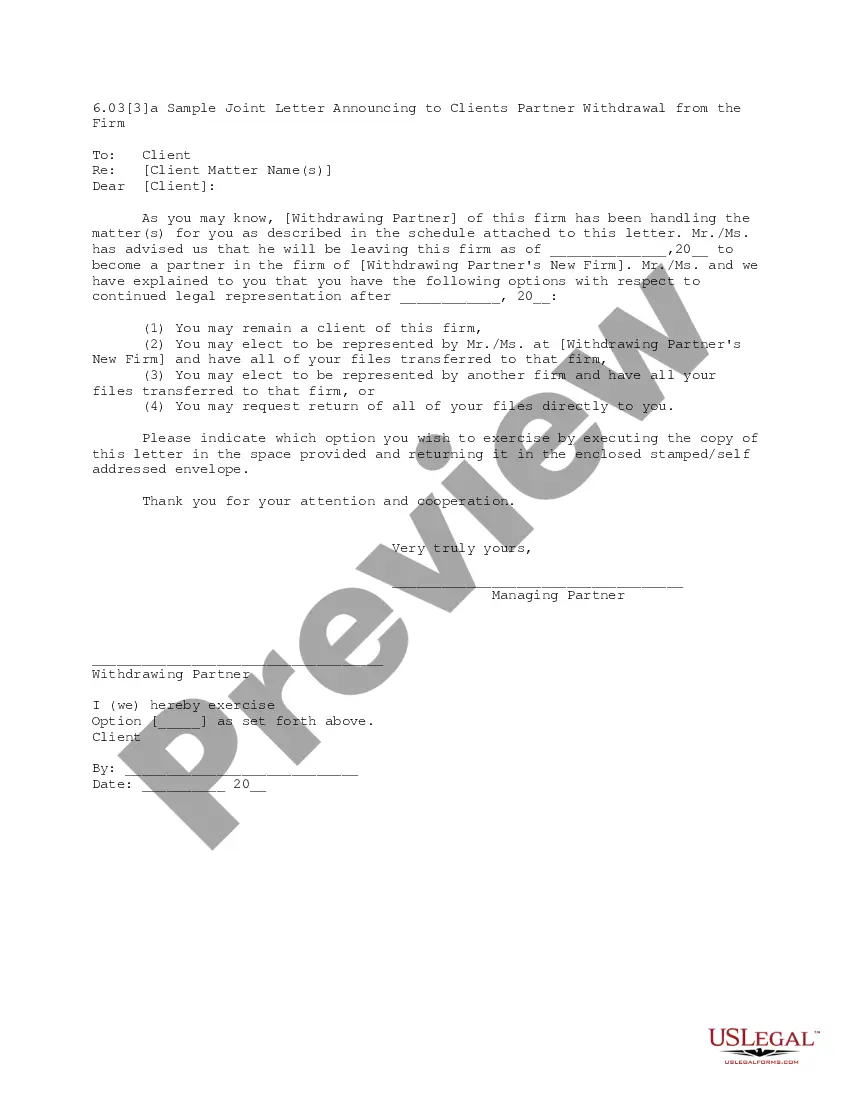

Main sections of this form

- Identification of trustors and the specific trust being revoked.

- Statement declaring the full revocation of the living trust.

- Provisions for reconveyance of trust property to the trustors.

- Effective date of the revocation.

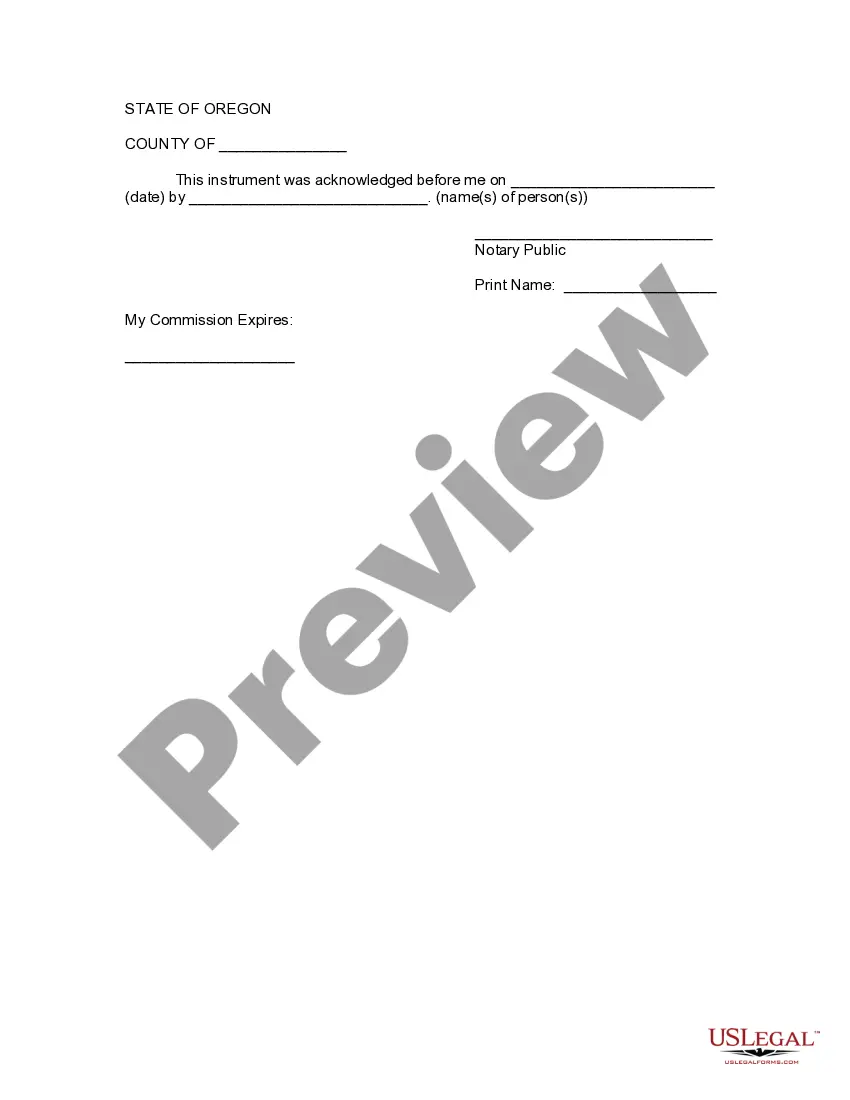

- Space for trustor signatures and a notary acknowledgment section.

Common use cases

This form is needed when trustors want to terminate a living trust for various reasons, such as changes in personal circumstances, the desire to create a new estate planning strategy, or dissatisfaction with the original trust's terms. It is crucial to use this document to ensure that all assets previously held in the trust are legally returned to the trustors, avoiding future disputes or complications.

Who should use this form

- Individuals who have created a revocable living trust.

- Trustors looking to modify their estate planning by revoking an existing trust.

- Anyone seeking to ensure a smooth transition of trust property back to themselves.

- Estate planning professionals assisting clients with trust modifications.

Steps to complete this form

- Identify the trustors by providing their names on the designated lines.

- Specify the name and date of the living trust being revoked.

- Clearly state the effective date of the revocation.

- Have all trustors sign the document in the presence of a notary public.

- Ensure that all relevant parties, such as trustees and beneficiaries, receive copies of the executed document.

Does this form need to be notarized?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to include the effective date of the revocation.

- Not having the document notarized, if required by local law.

- Omitting signatures from all necessary trustors.

- Using incorrect or incomplete information about the trust or trustor.

Benefits of completing this form online

- Convenience of downloading and filling out the form at your own pace.

- Editability allows for personal customization based on your specific needs.

- Reliable templates drafted by licensed attorneys, ensuring legal compliance.

Summary of main points

- The Revocation of Living Trust form is essential for cancelling an existing living trust.

- Completing the form properly will ensure a smooth transition of property back to the trustors.

- Remember to have the form notarized for it to be valid.

Looking for another form?

Form popularity

FAQ

When a trust dissolves, all income and assets moving to its beneficiaries, it becomes an empty vessel. That's why no income tax return is required it no longer has any income. That income is charged to the beneficiaries instead, and they must report it on their own personal tax returns.

A revocable trust, or living trust, is a legal entity to transfer assets to heirs without the expense and time of probate.A living trust also can be revoked or dissolved if there is a divorce or other major change that can't be accommodated by amending the trust.

How can I dissolve my trust? You can dissolve a trust by bringing forward its final distribution date. This can be done by the trustees or settlor if the trust deed says they can, or by the combined consent of the beneficiaries.

Read the Documents Carefully. Some agreements contain language that allows a trustee to dissolve the trust if its purpose is no longer feasible. Petition the Court. In some cases, a court agrees to break an irrevocable trust if the trustee or beneficiaries petition for assistance. Dispose of the Trust's Assets.

The trust may be revoked if it was obtained by undue influence or any fraudulent activity. If the execution of the trust is under a fundamental mistake or misapprehension as to its effect8. The author of the trust may also revoke illusory trusts9.

Whether your trust closes immediately after your death or lives on for a while to serve your intentions, it must eventually close. This typically involves payment of any outstanding debts or taxes before the trustee distributes the trust's assets and income to your named beneficiaries.

A revocable trust, or living trust, is a legal entity to transfer assets to heirs without the expense and time of probate.A living trust also can be revoked or dissolved if there is a divorce or other major change that can't be accommodated by amending the trust.

You can change your living trust, usually without incurring lawyer bills.Because you and your spouse made the trust together, you should both sign the amendment, and when you sign it, get your signatures notarized, just like the original. Another way to go is to create a "restatement" of your trust.

Key Takeaways. Revocable trusts, as their name implies, can be altered or completely revoked at any time by their grantorthe person who established them. The first step in dissolving a revocable trust is to remove all the assets that have been transferred into it.