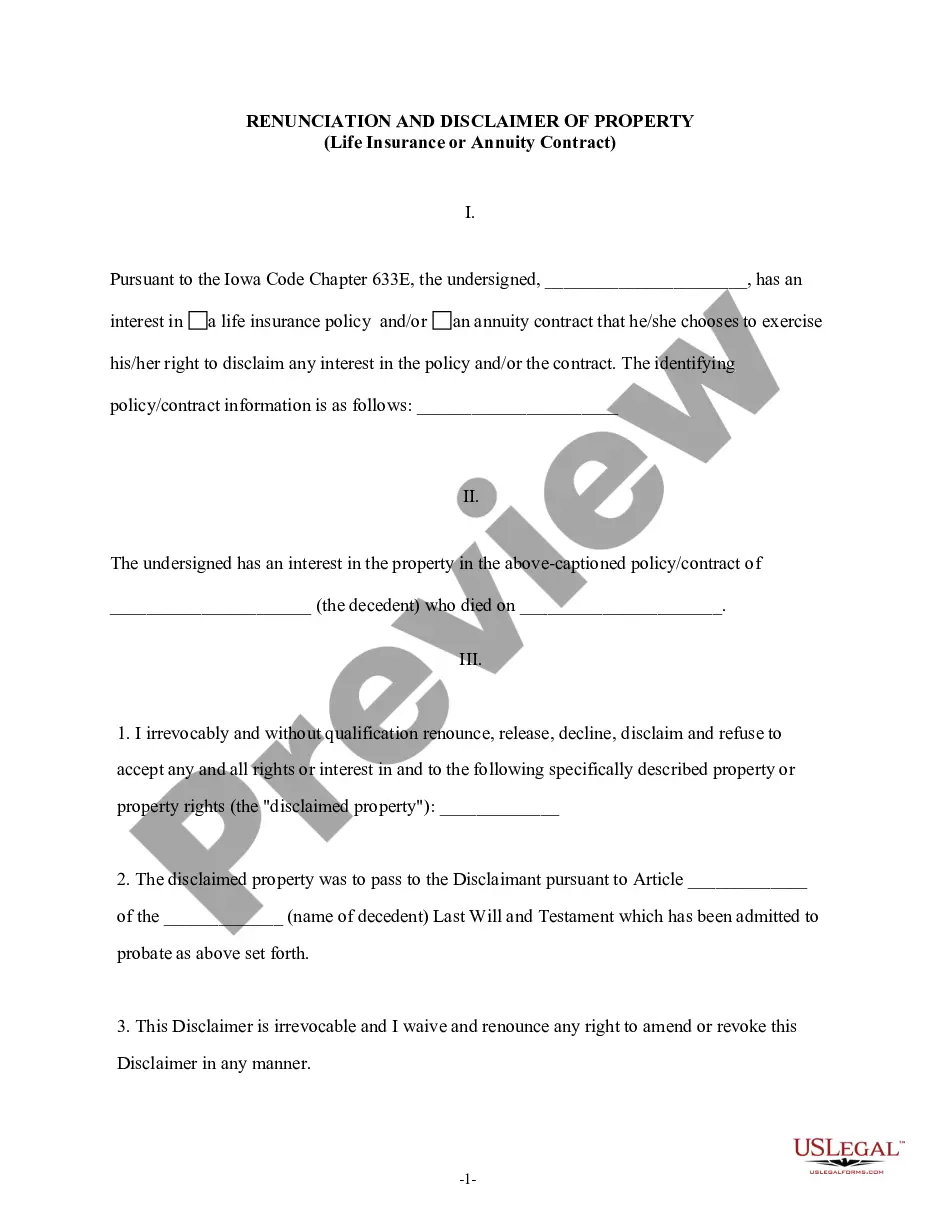

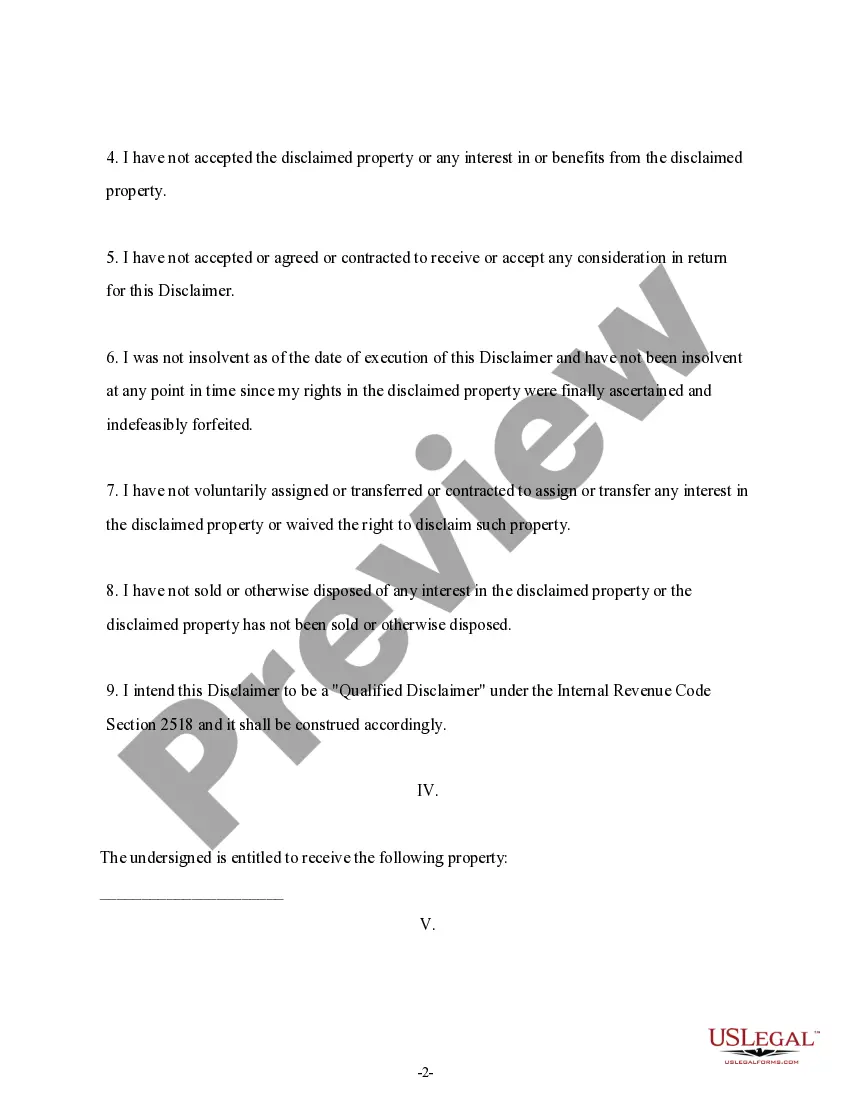

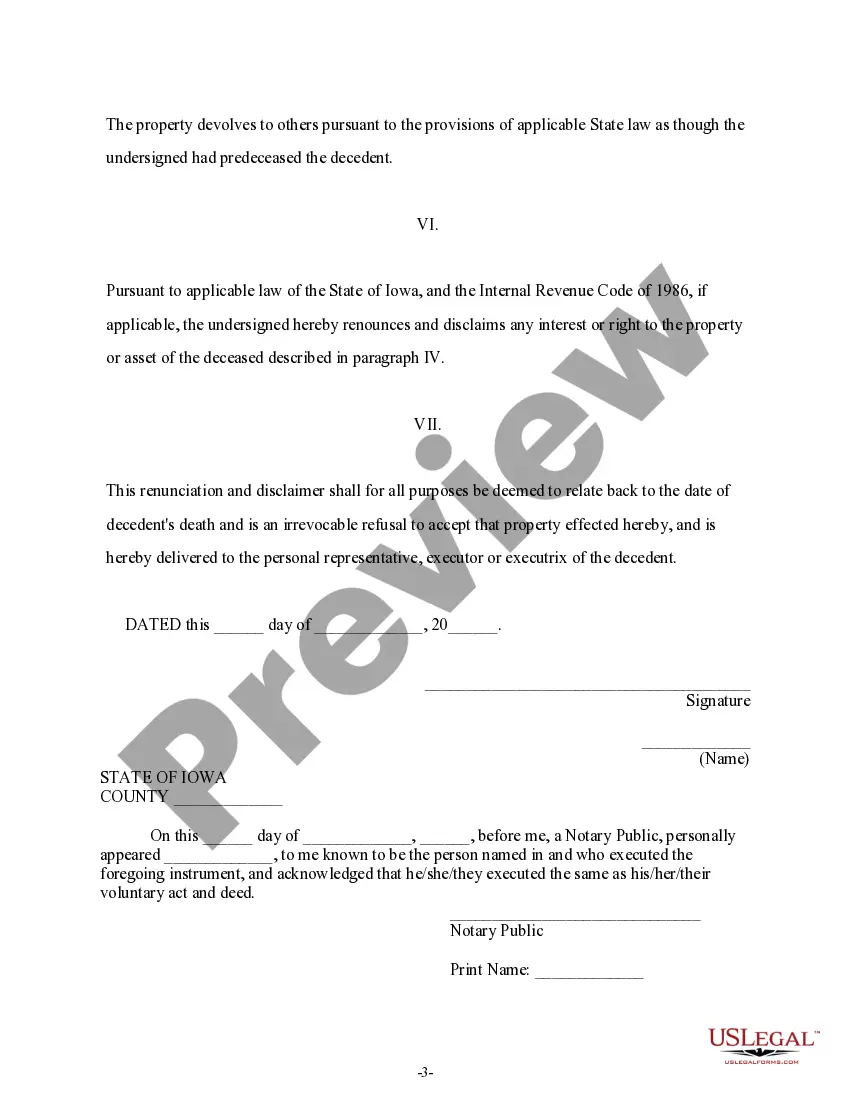

This form is a Renunciation and Disclaimer of the proceeds of a Life Insurance Policy or an Annuity Contract. The beneficiary gained an interest in the proceeds upon the death of the decedent. However, pursuant to the Iowa Code, Chapter 633E, the beneficiary wishes to disclaim his/her interest in the proceeds. The form also includes a state specific acknowledgment and a certificate to verify delivery.

Iowa Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract

Description

How to fill out Iowa Renunciation And Disclaimer Of Property From Life Insurance Or Annuity Contract?

Access the most comprehensive directory of legal documents.

US Legal Forms serves as a resource to locate any jurisdiction-specific form with just a few clicks, including Iowa Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract instances.

No need to waste your valuable time hunting for a court-admissible template. Our knowledgeable professionals ensure that you receive current examples consistently.

After selecting a payment plan, create an account. Make the payment using a card or PayPal. Download the document to your computer by clicking Download. That's it! You should complete the Iowa Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract template and verify it. To confirm that everything is accurate, consult your local legal advisor for assistance. Sign up and effortlessly browse over 85,000 valuable samples.

- To utilize the forms repository, select a subscription and create an account.

- If you have already done this, simply Log In and click on the Download button.

- The Iowa Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract file will promptly be saved in the My documents section (a section for all documents you save on US Legal Forms).

- To create a new account, follow the quick instructions outlined below.

- If you're required to use a jurisdiction-specific template, ensure you specify the correct state.

- If possible, review the description to grasp all of the details of the form.

- Utilize the Preview function if it is available to examine the document's details.

- If everything appears correct, click Buy Now.

Form popularity

FAQ

A beneficiary might want to disclaim property for various reasons, such as tax implications or personal financial decisions. By using the Iowa Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract, they can relinquish inheritance that may lead to unwanted tax burdens. This option also allows the property to pass directly to other beneficiaries and maintain the intended distribution of the estate. It's always wise to consult with a legal professional when considering a disclaimer.

A beneficiary disclaimer is a legal document in which an individual rejects their right to inherit property or assets from a deceased person's estate. Under the Iowa Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract, this process protects the individual from potential tax consequences while allowing the assets to transfer to other beneficiaries. Understanding the implications of a disclaimer as part of your estate planning is crucial. Legal advice can be invaluable to navigate these choices.

A disclaimer example could involve a person who inherits property from a deceased relative but prefers not to accept it due to potential tax burdens. They can file a disclaimer through the Iowa Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract, thus officially rejecting the inheritance. This action prevents the property from being included in their taxable estate while allowing it to pass to another designated beneficiary. Consulting with a legal professional may help in this decision-making process.

An example of a disclaimer of inheritance rights is when a beneficiary formally refuses their share of an estate left by a deceased relative. Using the Iowa Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract, they can file a written disclaimer to relinquish their claim. This process allows the disclaimed assets to pass directly to the next beneficiary rather than becoming part of the beneficiary's estate. It is a strategic decision that can help minimize tax liability and better align with the beneficiary's wishes.

A beneficiary may choose to disclaim an IRA for several reasons, including tax implications or personal financial planning. By utilizing the Iowa Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract, a beneficiary can avoid increasing their taxable income from inherited assets. This strategy may be beneficial in preserving long-term wealth or if the inheritance does not align with their current financial goals. Always consult with a financial advisor to understand the implications of your decision.

You can disclaim life insurance proceeds under Iowa law. By using the Iowa Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract, you can choose not to accept the benefits from a life insurance policy. This action allows the proceeds to transfer to the next beneficiary in line. Ensure you follow the specific procedures for disclaiming to protect your interests properly.

Yes, you can disclaim inherited property, including assets from an estate or trust. In Iowa, beneficiaries can utilize the Iowa Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract to formally refuse an inheritance. This legal process ensures that the property does not pass to you and may instead go to the next eligible beneficiary. Remember, acting quickly is essential, as disclaiming property typically involves strict deadlines.

A qualified disclaimer enables you to refuse property that you would otherwise inherit, such as from a life insurance policy or an annuity contract. This process ensures that the property does not transfer to you and instead moves directly to the next beneficiary. By using the Iowa Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract, you can effectively manage your estate planning. To navigate this complex process smoothly, consider utilizing US Legal Forms, which provides comprehensive resources and assistance.

Yes, a beneficiary can disclaim an interest in a trust under Iowa law. This requires a formal written disclaimer, similar to that of an inheritance, which must explicitly renounce your interest. Utilizing resources like US Legal Forms can help you draft a compliant disclaimer, aligning with the Iowa Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract.

The rules for disclaiming inheritance in Iowa require the disclaimer to be in writing and submitted within nine months post-death. Importantly, you cannot attach conditions to your disclaimer; it must be absolute. Understanding these regulations is critical when considering the Iowa Renunciation and Disclaimer of Property from Life Insurance or Annuity Contract, as compliance will ensure your disclaimer is legally recognized.