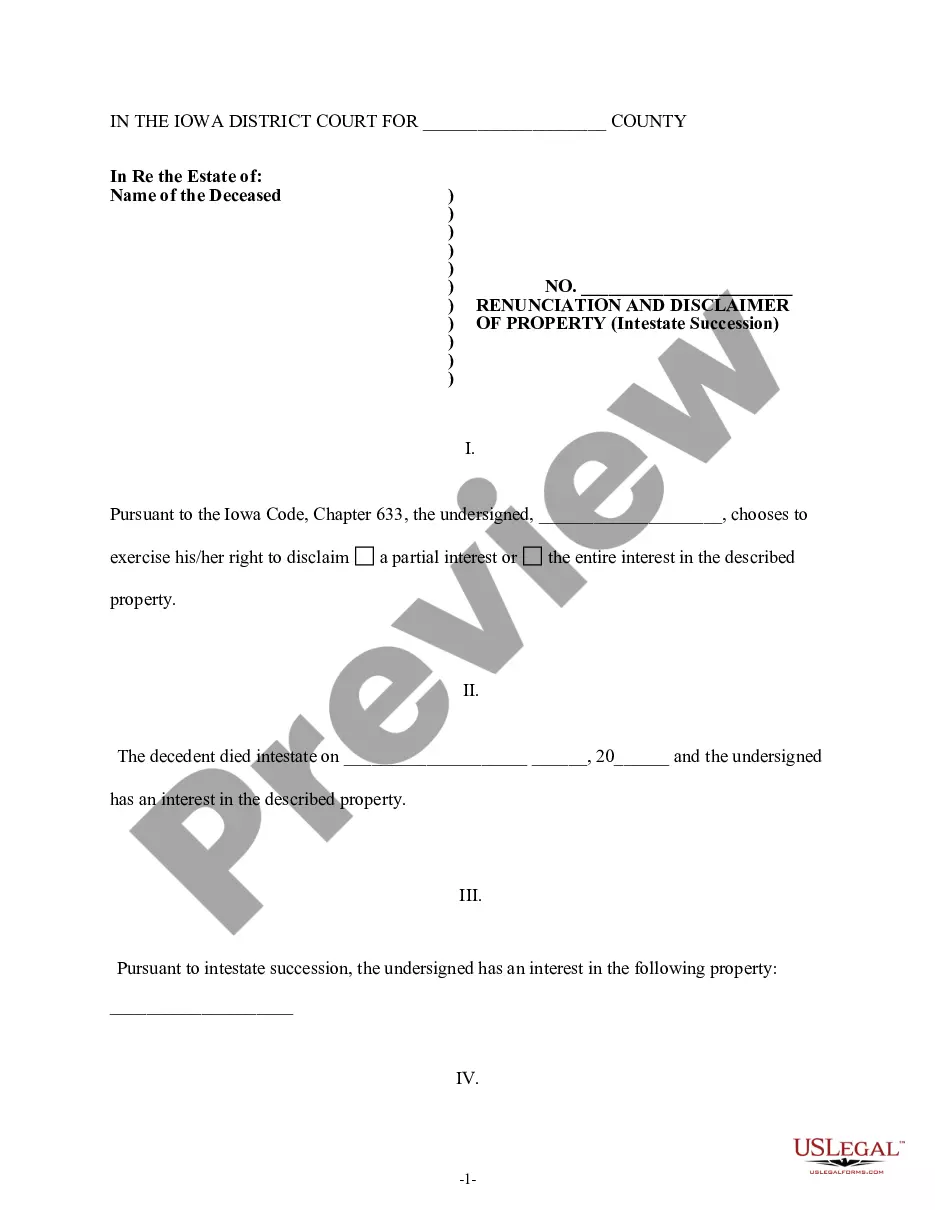

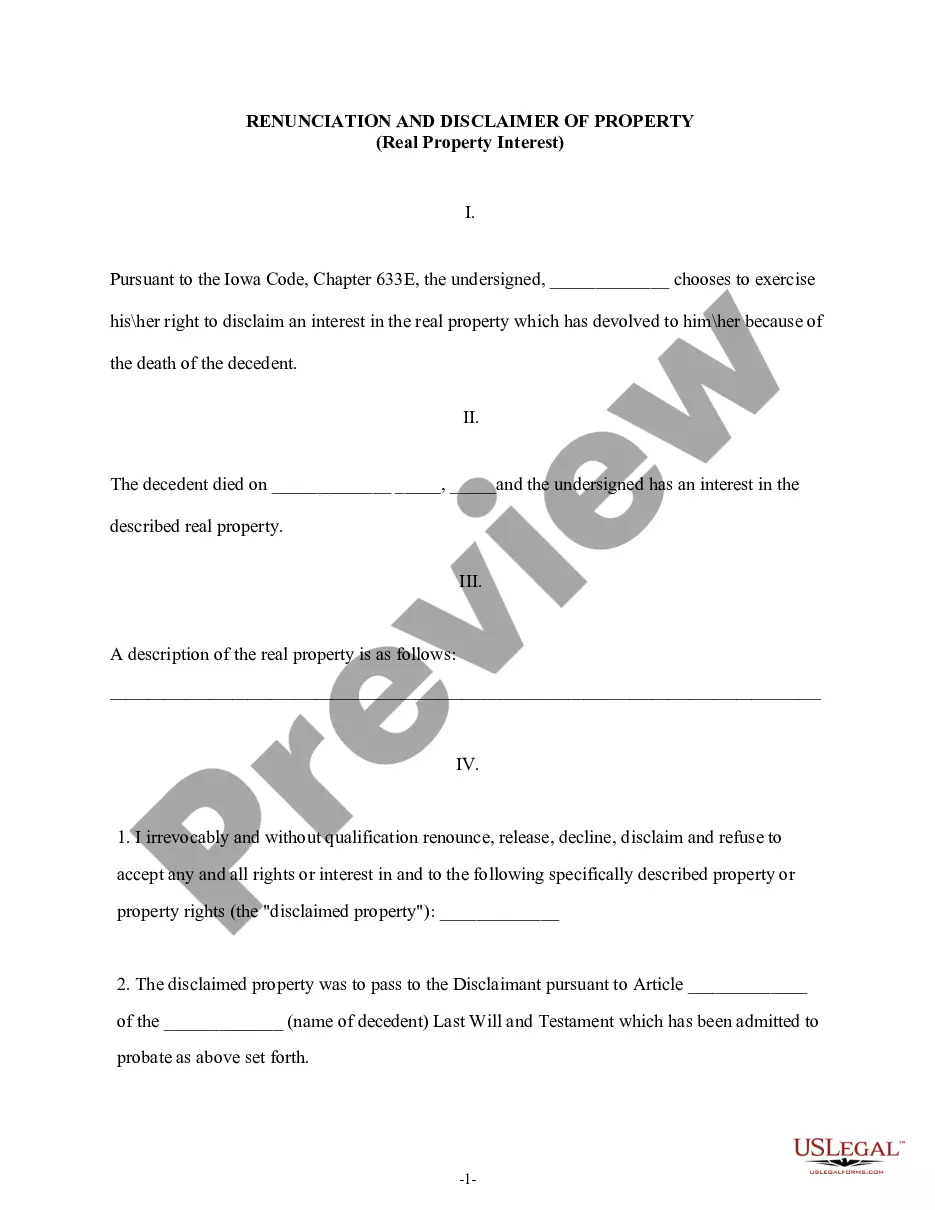

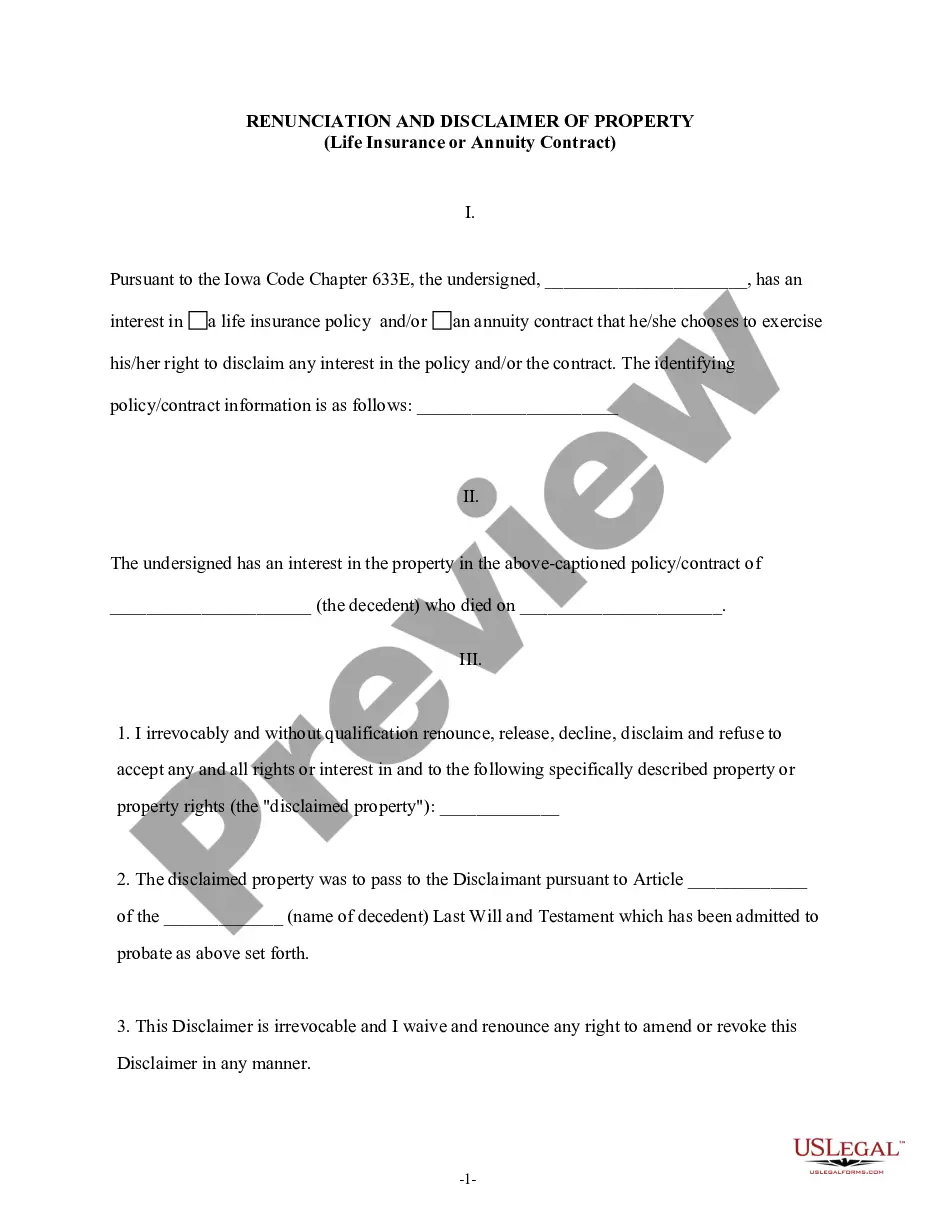

This form is a Renunciation and Disclaimer of Property acquired by the beneficiary through intestate succession. The decedent died intestate (without a will) and the beneficiary gained an interest in the property of the decedent. However, upon learning that he/she has an interest in the decedent's property, the beneficiary has decided to disclaim a portion of or the entire interest in the property. The form also includes a state specific acknowledgment and a certificate to verify delivery.

Iowa Renunciation and Disclaimer of Property received by Intestate Succession

Description

How to fill out Iowa Renunciation And Disclaimer Of Property Received By Intestate Succession?

Access one of the most extensive collections of sanctioned forms.

US Legal Forms serves as a platform where you can discover any state-specific documentation in just a few clicks, including samples of Iowa Renunciation and Disclaimer of Property acquired through Intestate Succession.

There’s no need to squander your time searching for a court-acceptable template. Our experienced professionals guarantee that you receive current documents at all times.

After choosing a pricing plan, register your account. Process your payment via card or PayPal. Download the document to your device by clicking the Download button. That’s it! You should fill out the Iowa Renunciation and Disclaimer of Property obtained through Intestate Succession template and verify it. To ensure accuracy, consult with your local legal advisor for assistance. Sign up and conveniently explore over 85,000 useful forms.

- To utilize the document library, select a subscription and create an account.

- If you have already registered, simply Log In and then click Download.

- The Iowa Renunciation and Disclaimer of Property acquired via Intestate Succession sample will be automatically saved in the My documents section (the area for all forms you download on US Legal Forms).

- To establish a new account, refer to the brief instructions provided below.

- If you intend to use a state-specific template, ensure that you select the correct state.

- If possible, review the description to understand all the details of the form.

- Utilize the Preview feature if available to check the document's information.

- If everything looks correct, click Buy Now.

Form popularity

FAQ

When you disclaim an inheritance, you must inform the IRS of your decision, especially if the property involves credit or tax implications. The IRS allows people to disclaim property without incurring tax liabilities under certain conditions. Ensure that you comply with Iowa's intestate succession laws and file any necessary forms to confirm your disclaimer, as recognized under the Iowa Renunciation and Disclaimer of Property received by Intestate Succession. Consulting experts or using platforms like US Legal Forms can help navigate IRS requirements related to disclaiming an inheritance.

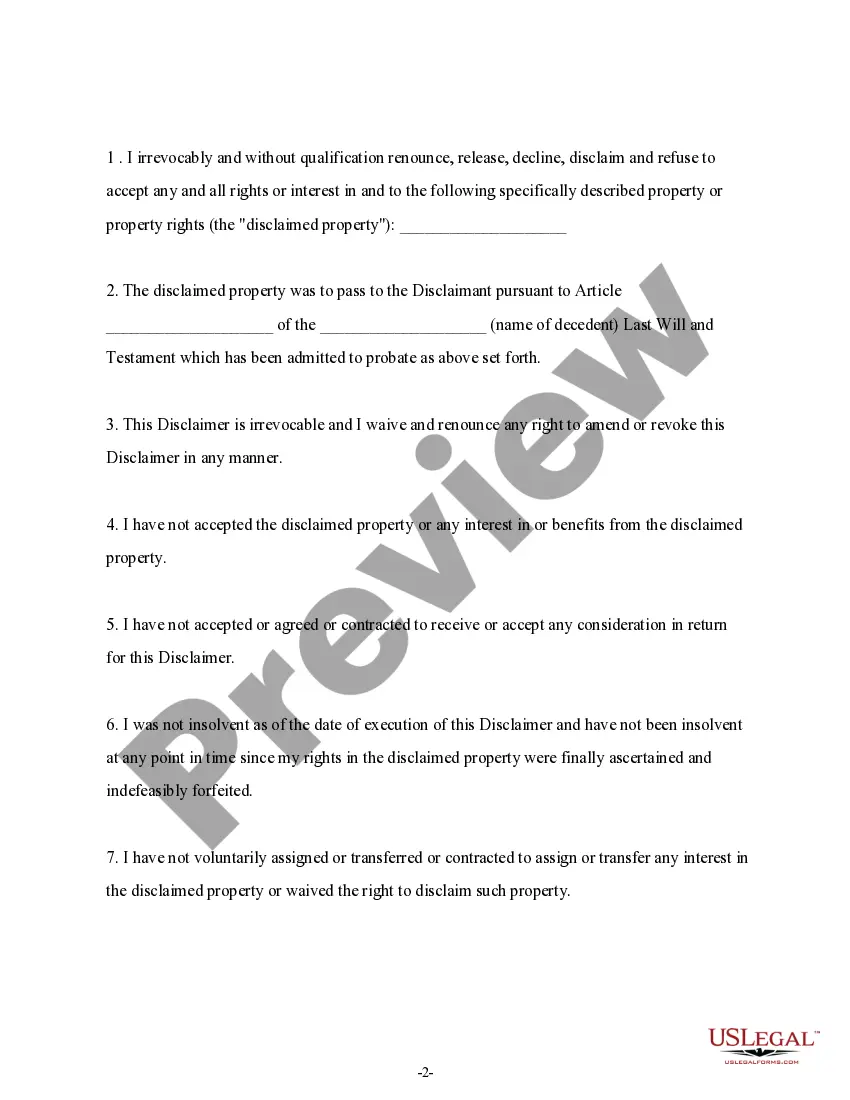

Disclaiming inherited property involves signing a formal statement that indicates your decision to renounce the inheritance. Under Iowa's intestate succession law, you must file this statement with the probate court within a specified time frame. It's important to note that disclaiming property must be done voluntarily and without any conditions attached. By properly executing this process through resources like US Legal Forms, you can ensure your disclaimer adheres to the requirements of the Iowa Renunciation and Disclaimer of Property received by Intestate Succession.

To create a sample disclaimer of inheritance, clearly state your intent to renounce the property you received under Iowa's intestate succession law. Include your name, the decedent's name, and a statement expressing your decision to disclaim the inheritance. It is essential to follow specific legal formats to ensure your disclaimer is valid under the Iowa Renunciation and Disclaimer of Property received by Intestate Succession. Utilizing templates from platforms like US Legal Forms can simplify this process and provide peace of mind.

In Iowa, the intestate succession law governs how a person's property is distributed when they pass away without a valid will. The Iowa Renunciation and Disclaimer of Property received by Intestate Succession allows heirs to decline their inheritance, which can affect how the estate is settled. Typically, the property will transfer to the deceased's spouse or children, depending on the family's structure. Understanding this law helps you navigate your options when dealing with inheritance.

To disclaim an inheritance in Iowa, you should submit a written disclaimer to the appropriate parties within a set period after the decedent's death. Familiarizing yourself with the Iowa Renunciation and Disclaimer of Property received by Intestate Succession process is essential, as it outlines the necessary steps. Utilizing resources like USLegalForms can assist greatly in navigating this process smoothly.

In Iowa, a disclaimer of inheritance does not require notarization, but it must adhere to specific legal criteria. Understanding the Iowa Renunciation and Disclaimer of Property received by Intestate Succession can clarify any questions about documentation standards. Consulting with a legal professional ensures you meet all necessary requirements.

To write a disclaimer letter for inheritance, you should clearly state your intent to renounce the inheritance. Include your full name, the deceased's information, and the property details, following the Iowa Renunciation and Disclaimer of Property received by Intestate Succession format. Platforms like USLegalForms can provide templates that simplify crafting this document accurately.

In Iowa, a disclaimer typically does not need to be notarized, but it should be in writing and comply with specific legal standards. Following the Iowa Renunciation and Disclaimer of Property received by Intestate Succession practices can help ensure your disclaimer is valid. Always verify with legal resources or professionals for any additional requirements.

To disclaim an inherited property in Iowa, you must file a written disclaimer. This document should comply with the Iowa Renunciation and Disclaimer of Property received by Intestate Succession requirements. Using platforms like USLegalForms can make this process easier by providing templates and guidance for drafting your disclaimer correctly.

In Iowa, the rules for disclaiming inheritance involve a formal process outlined by state law. You must follow the Iowa Renunciation and Disclaimer of Property received by Intestate Succession procedures to ensure your disclaimer is legally recognized. It's important to act promptly and within a specific timeframe to effectively renounce your share.