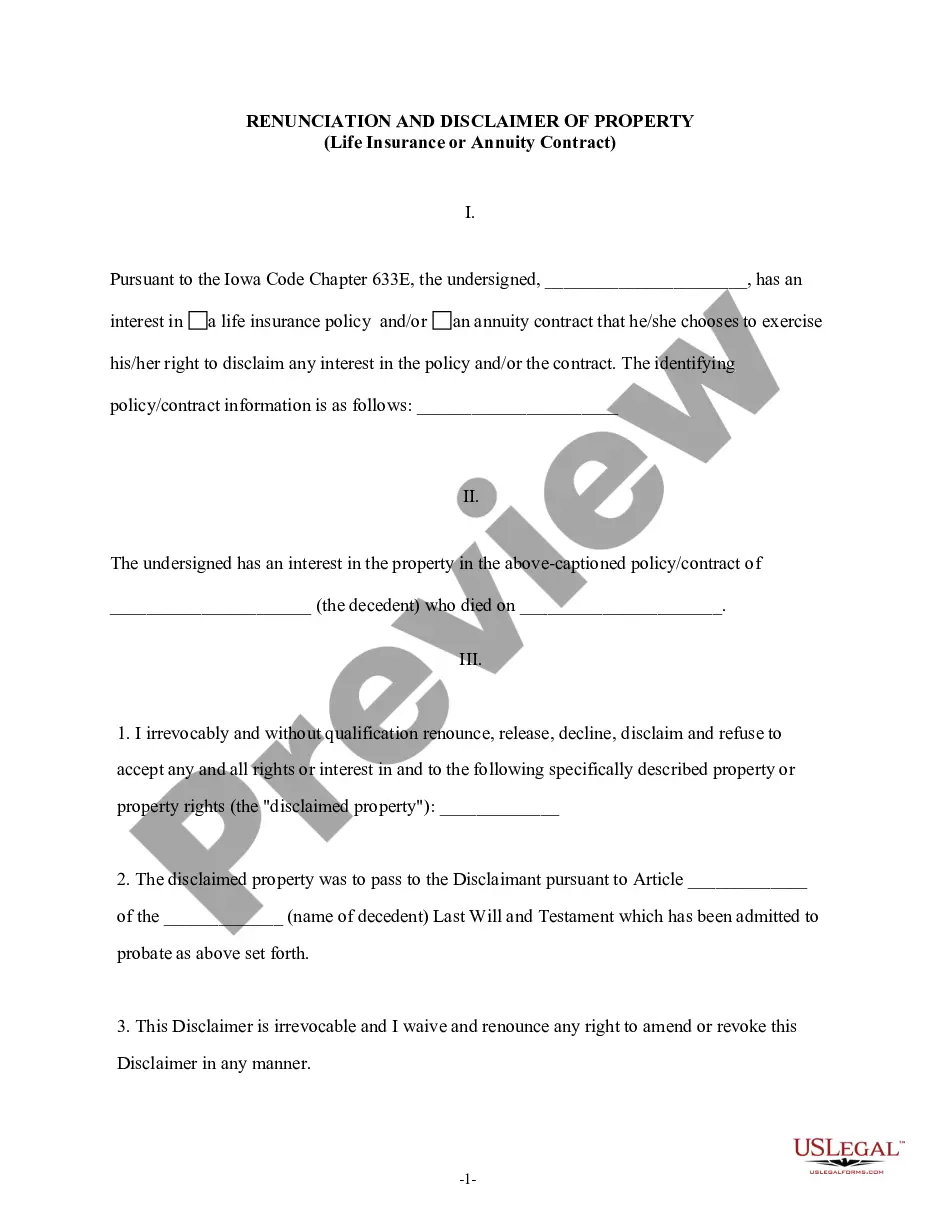

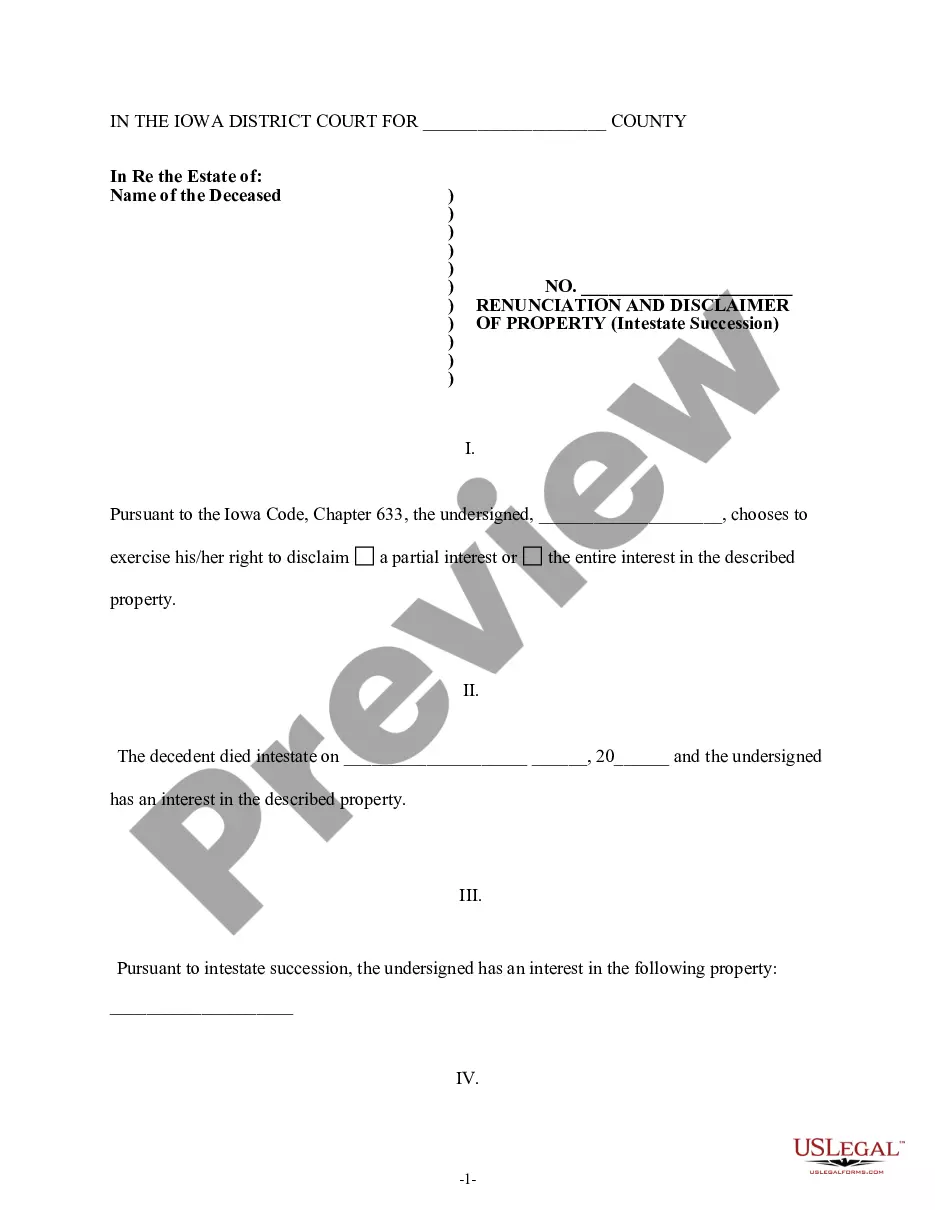

This form is a Renunciation and Disclaimer of a Real Property Interest. The beneficiary acquired an interest in the described real property upon the death of the decedent. However, the beneficiary has chosen to disclaim his/her interest in the real property pursuant to the Iowa Code, Chapter 633E. The beneficiary also attests that he/she will file the disclaimer no later than nine months after the death of the decedent to secure the validity of the disclaimer. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Iowa Renunciation and Disclaimer of Real Property Interest

Description

Key Concepts & Definitions

Iowa Renunciation and Disclaimer of Real Property refers to a legal instrument that allows an heir or a beneficiary to decline the inheritance of real estate in Iowa. This is often used to avoid inheritance taxes or the responsibility of managing or owning property. Key terms include real estate, which refers to property consisting of land and buildings, and personal representative, who is an individual appointed to administer the deceaseds estate.

Step-by-Step Guide on How to File a Renunciation

- Contact a Lawyer: It is crucial to obtain legal advice. Use a lawyer directory or an online service to find a qualified attorney in Iowa specializing in estate planning.

- Documentation: Gather necessary documents such as the death certificate of the decedent and legal descriptions of the property.

- Filing the Disclaimer: The disclaimer must be filed in the county where the property is located, within nine months of the decedent's death.

- Court Representation: Although not always required, consider hiring a lawyer to represent you in court to ensure that the process is handled correctly.

Risk Analysis of Renouncing Property

Renouncing ownership of real property might trigger certain security triggered risks such as affecting your credit score or future loan approvals. Potential legal risks involve incorrect filing or misunderstanding the implications of the disclaimer. It's advisable to seek a free consultation with a legal expert in real estate or estate law to mitigate such risks.

Pros & Cons of Renouncing Real Property

- Pros:

- Avoids the responsibility of property management and maintenance.

- Helps sidestep potential debts or liabilities associated with the property.

- Cons:

- Potential loss of valuable property asset.

- Might affect relationships with other heirs or family members.

Common Mistakes & How to Avoid Them

- Delay in Filing: Ensure the disclaimer is filed within nine months of the inheritance to avoid unnecessary legal complications.

- Insufficient Legal Guidance: Using inadequate or no legal support can result in errors. Always consider consulting with an attorney from resources like O'Flaherty Law for specialized guidance.

FAQ

- What is a personal representative? A person assigned by court to manage the estate of the deceased.

- How long do I have to file a renunciation? The filing should be done within nine months of the death of the property owner.

- Can I renounce part of the property? Yes, it is possible to renounce a portion of the property, and retain another portion.

How to fill out Iowa Renunciation And Disclaimer Of Real Property Interest?

Obtain the most extensive collection of sanctioned documents.

US Legal Forms is fundamentally a platform where you can discover any state-specific file in just a few clicks, such as examples of the Iowa Renunciation and Disclaimer of Real Property Interest.

There's no need to waste hours searching for a court-acceptable template. Our knowledgeable professionals ensure that you receive current examples consistently.

Once you've chosen a pricing plan, register your account. Pay using a credit card or PayPal. Save the template to your computer by clicking on the Download button. That's it! You should complete the Iowa Renunciation and Disclaimer of Real Property Interest form and verify its accuracy. To ensure that everything is precise, consult your local legal advisor for assistance. Register and easily discover over 85,000 valuable templates.

- To utilize the forms library, select a subscription and create an account.

- If you have already completed this step, just Log In and click Download.

- The Iowa Renunciation and Disclaimer of Real Property Interest template will swiftly be saved in the My documents section (the section for all documents you save on US Legal Forms).

- To establish a new profile, adhere to the straightforward instructions below.

- If you intend to use a state-specific template, ensure that you select the appropriate state.

- If feasible, review the description to grasp all the details of the document.

- Utilize the Preview feature if it's available to examine the document's details.

- If everything appears correct, click Buy Now.

Form popularity

FAQ

An example of an estate disclaimer occurs when a person is named as a beneficiary in a will but chooses not to accept their share. By filing an Iowa Renunciation and Disclaimer of Real Property Interest, the beneficiary can decline the inheritance, which will then pass to the next beneficiary in line. This decision can help minimize tax implications and avoid the burden of managing an estate that one does not wish to handle. Understanding how estate disclaimers work can significantly ease estate management for everyone involved.

To disclaim interest in property means to legally refuse any rights or claims one might have to that property. This action is formalized through an Iowa Renunciation and Disclaimer of Real Property Interest. By disavowing interest, the individual effectively relinquishes their ownership or control, allowing the property to transfer to other designated beneficiaries. This process can help streamline estate transitions and reduce potential disputes.

A disclaimer on a property is a legal document that allows an individual to renounce their interest in real estate. This process often involves filing an Iowa Renunciation and Disclaimer of Real Property Interest. By disavowing any claim to the property, the owner ensures that their obligations and potential liabilities associated with it are legally removed. This option can be particularly useful in estate planning or when dealing with inherited property.

A common example of a disclaimer of interest is when someone inherits a property but decides not to accept it. In this case, the person may file an Iowa Renunciation and Disclaimer of Real Property Interest, which legally states their intention to refuse the inheritance. By doing this, the property will pass directly to the next beneficiary as outlined in the will or trust. Essentially, it allows the individual to avoid any responsibilities tied to the property.

Renunciation and disclaimer of interests in an estate refer to the legal process by which an heir chooses to reject their share of an estate. This decision impacts how the estate is distributed, emphasizing the importance of understanding the Iowa Renunciation and Disclaimer of Real Property Interest. The renouncing heir cannot later change their mind, so careful consideration is key. UsLegalForms serves as a valuable resource for individuals navigating this complex situation.

To disclaim property means to formally refuse an interest in that property, thereby relinquishing any rights or claims associated with it. This process is significant as it can have legal and financial implications, especially under the Iowa Renunciation and Disclaimer of Real Property Interest act. Disclaiming property can protect you from unwanted tax burdens or estate complications. Leveraging platforms like UsLegalForms ensures that you handle this process correctly.

To disclaim property, you must complete and file a disclaimer document that communicates your decision not to accept the property interest. This document must meet Iowa's statutory requirements under the Iowa Renunciation and Disclaimer of Real Property Interest. It's essential to file this paperwork within a specific time frame to ensure its validity. UsLegalForms offers easy-to-use templates to help you create your disclaimer efficiently.

A disclaimer of property interest is a legal declaration where an individual refuses to accept an inheritance or interest in a property. This act allows the disclaimant to avoid tax implications or complexities associated with the property. In Iowa, the process follows guidelines outlined in the Iowa Renunciation and Disclaimer of Real Property Interest. Consulting resources like UsLegalForms can provide clarity and templates needed for this process.

To disclaim inherited property in Iowa, you must create a formal renunciation document. This document should clearly state your intention to reject any interest in the property. Be sure to follow Iowa laws regarding the Iowa Renunciation and Disclaimer of Real Property Interest, which may require filing the document in a timely manner. Using a reliable platform like UsLegalForms can help you draft this document accurately.

The rules for disclaiming inheritance in Iowa typically require that you must renounce the property interest in writing. You must file your disclaimer within nine months of the decedent's death. Additionally, the disclaimer should not be conditional or have any attached benefits to comply with the Iowa Renunciation and Disclaimer of Real Property Interest guidelines. Being informed of these regulations can help you navigate the process effectively.