Hawaii Renunciation And Disclaimer of Real Property Interest

Overview of this form

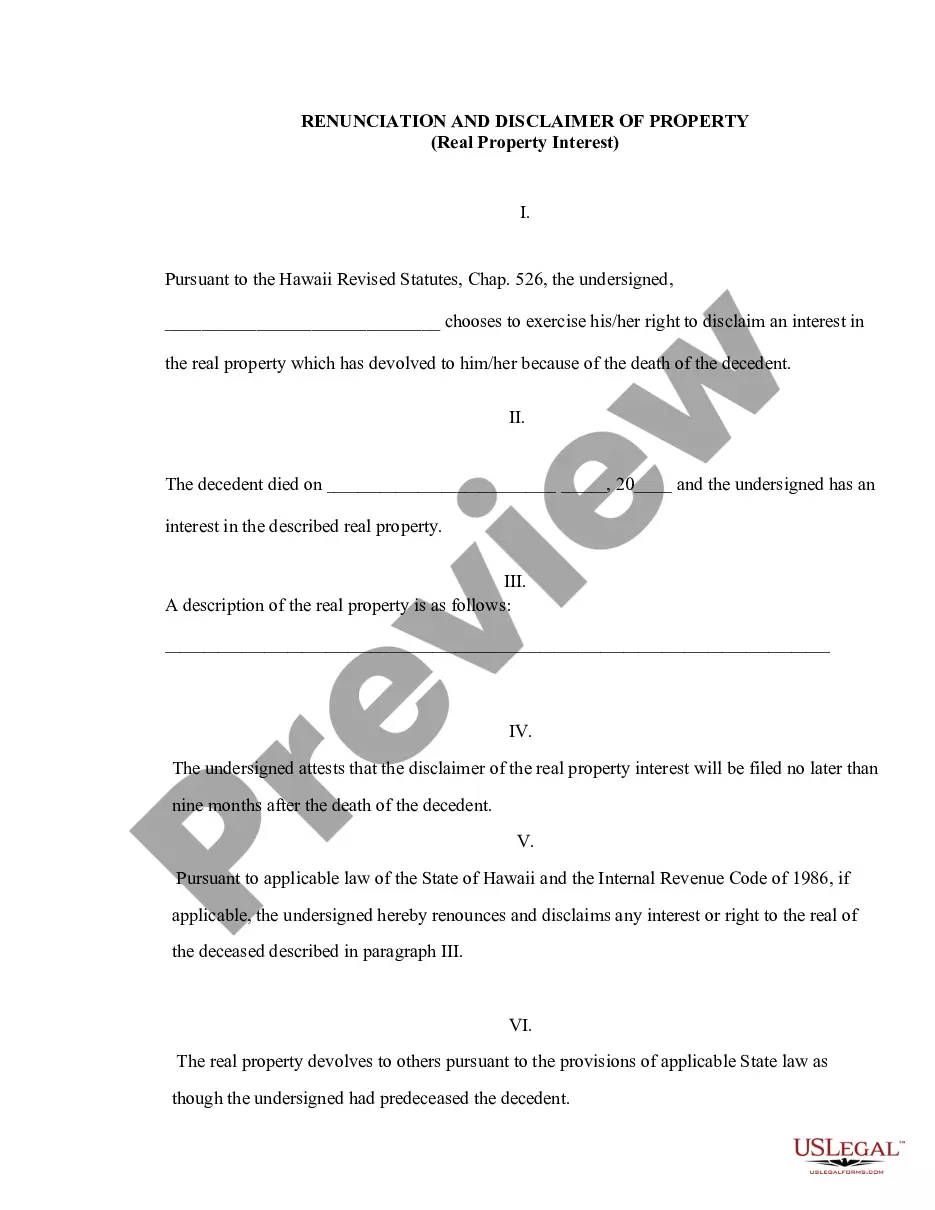

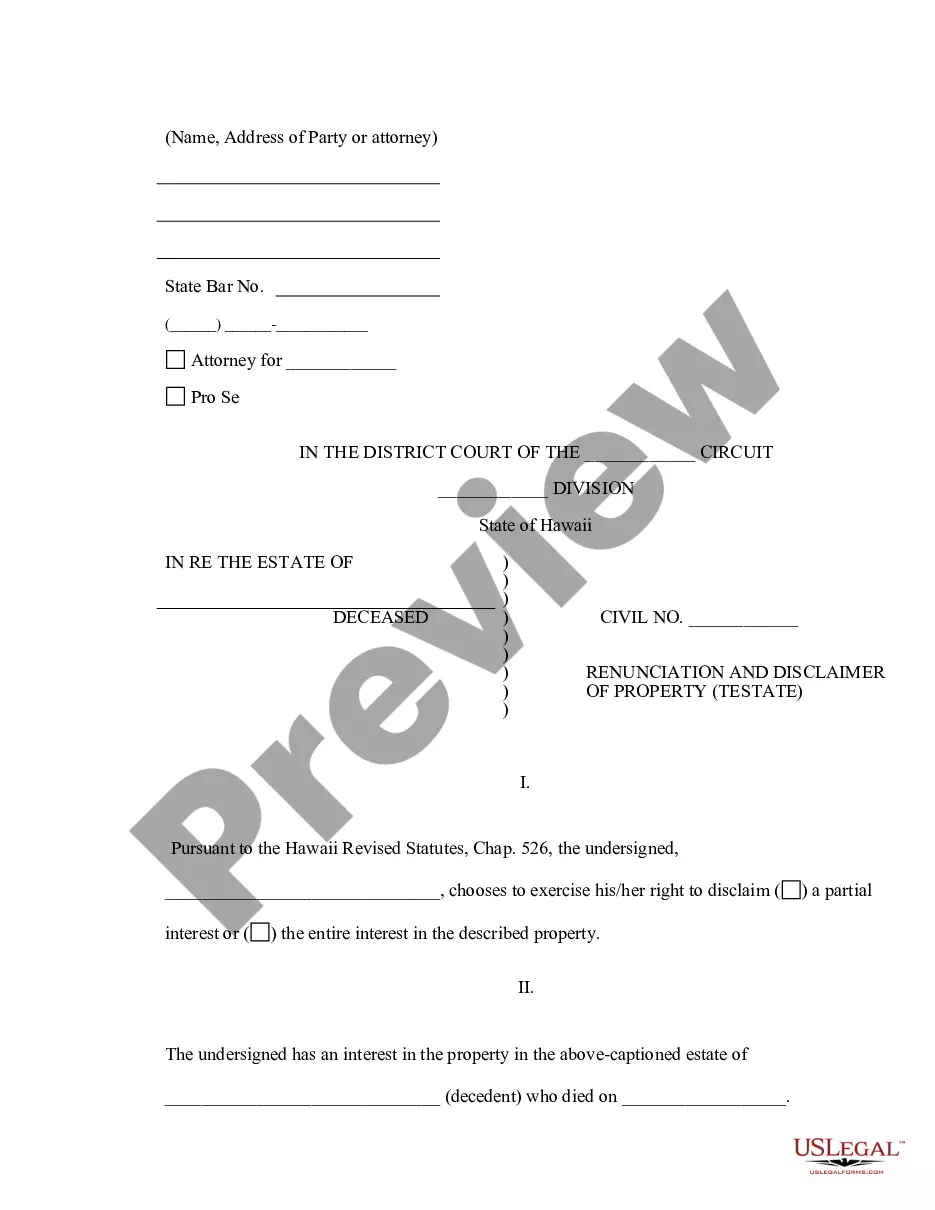

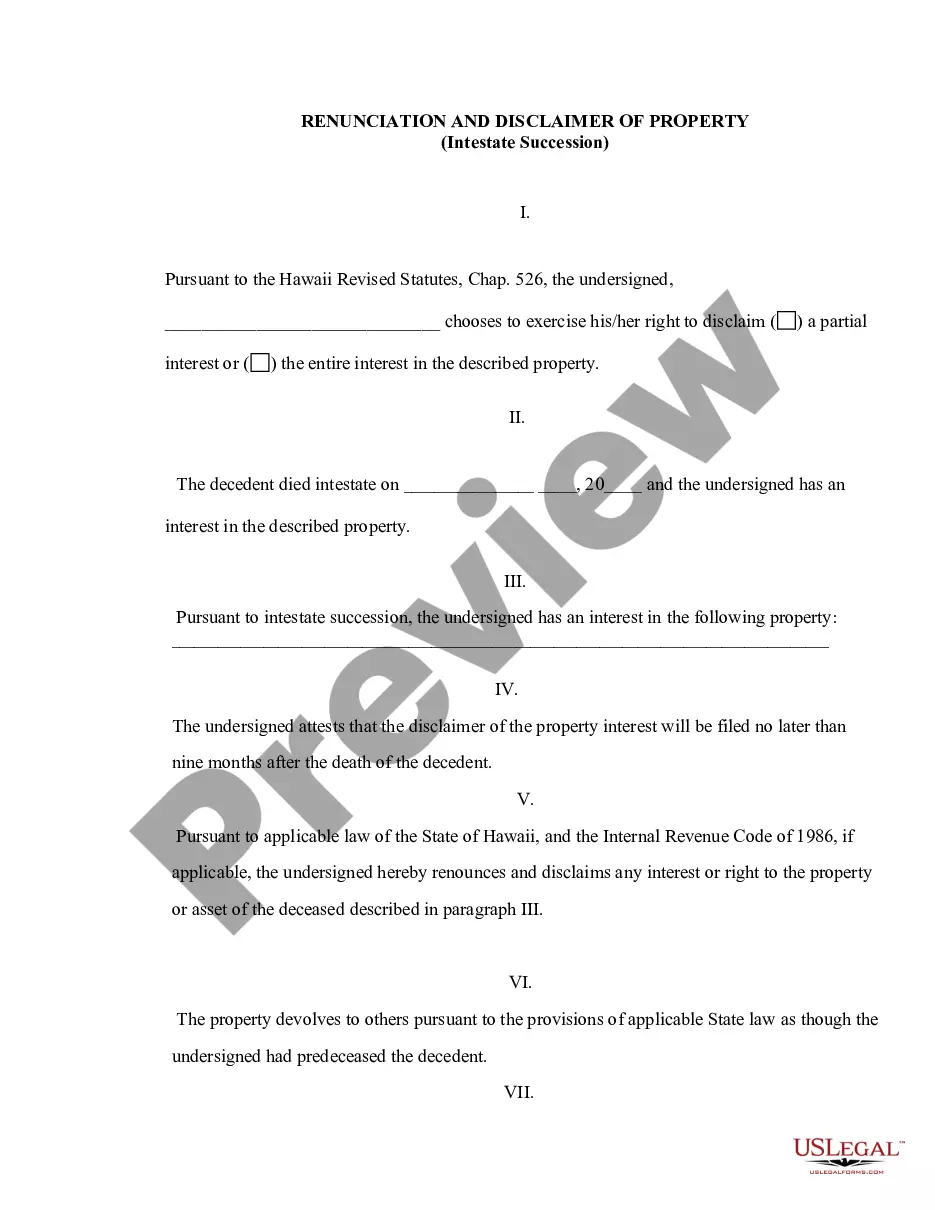

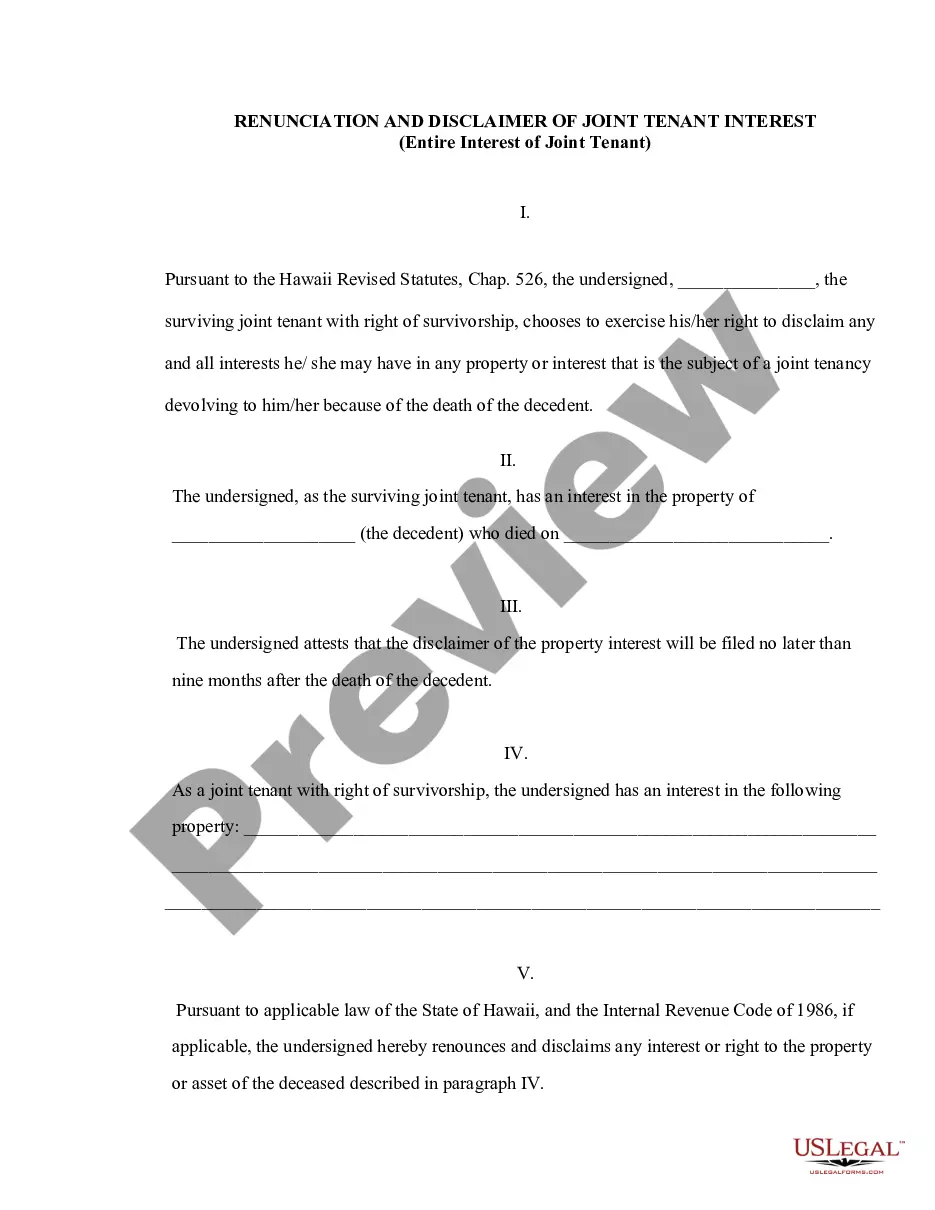

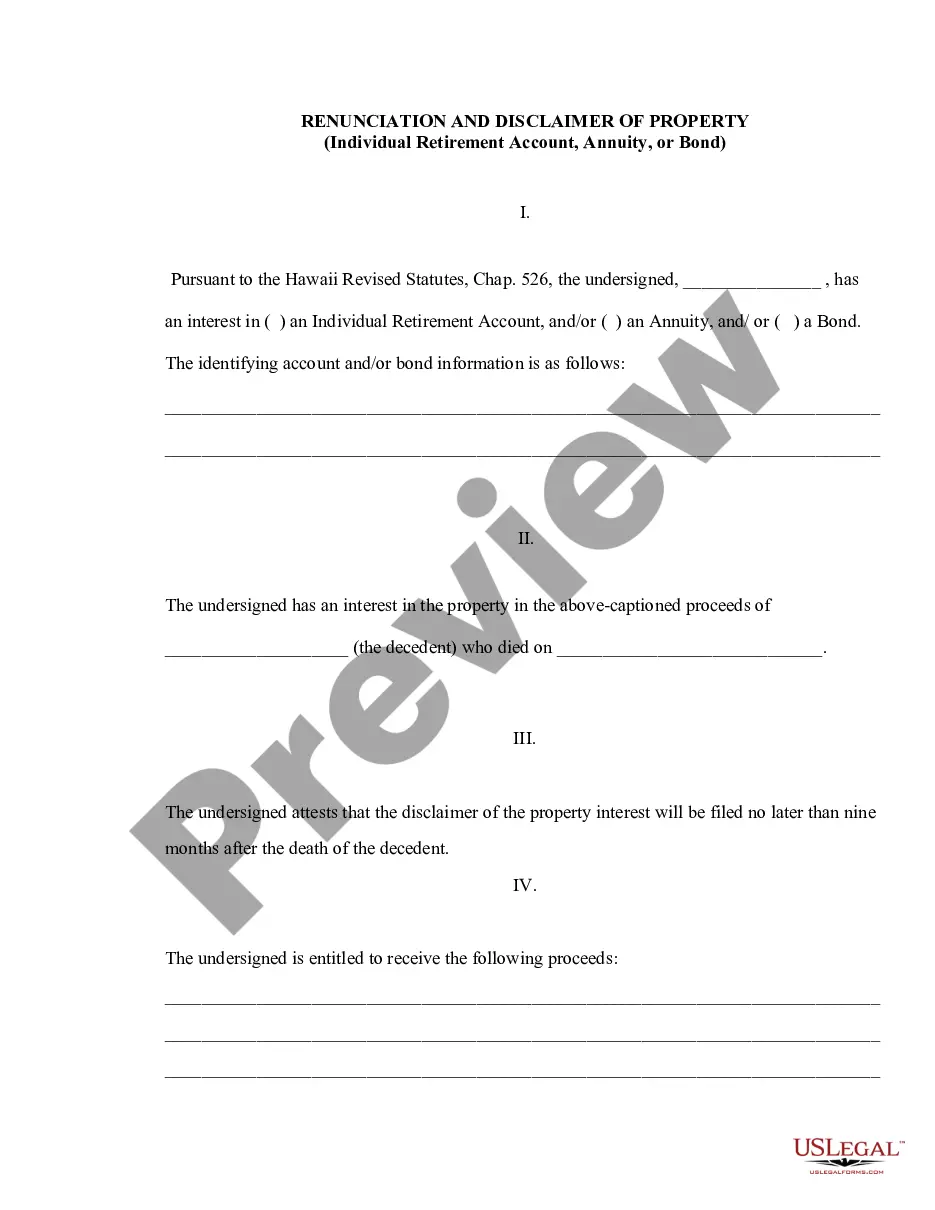

The Hawaii Renunciation and Disclaimer of Real Property Interest form allows a beneficiary to formally refuse an inherited interest in real property following the death of the decedent. This form is essential for beneficiaries who wish to disclaim their entitlement and ensures that the property devolves according to state laws, as if the beneficiary predeceased the decedent. By using this specific form, a beneficiary adheres to the legal requirements outlined in Hawaii Revised Statutes, Chapter 526, which governs such disclaimers in Hawaii.

Key parts of this document

- Identification of the beneficiary disclaiming the interest.

- Date of the decedent's death.

- Description of the real property interest being disclaimed.

- A confirmation that the disclaimer will be filed within nine months of the decedent's death.

- A declaration stating that the disclaimer is irrevocable and relates back to the date of the decedent's death.

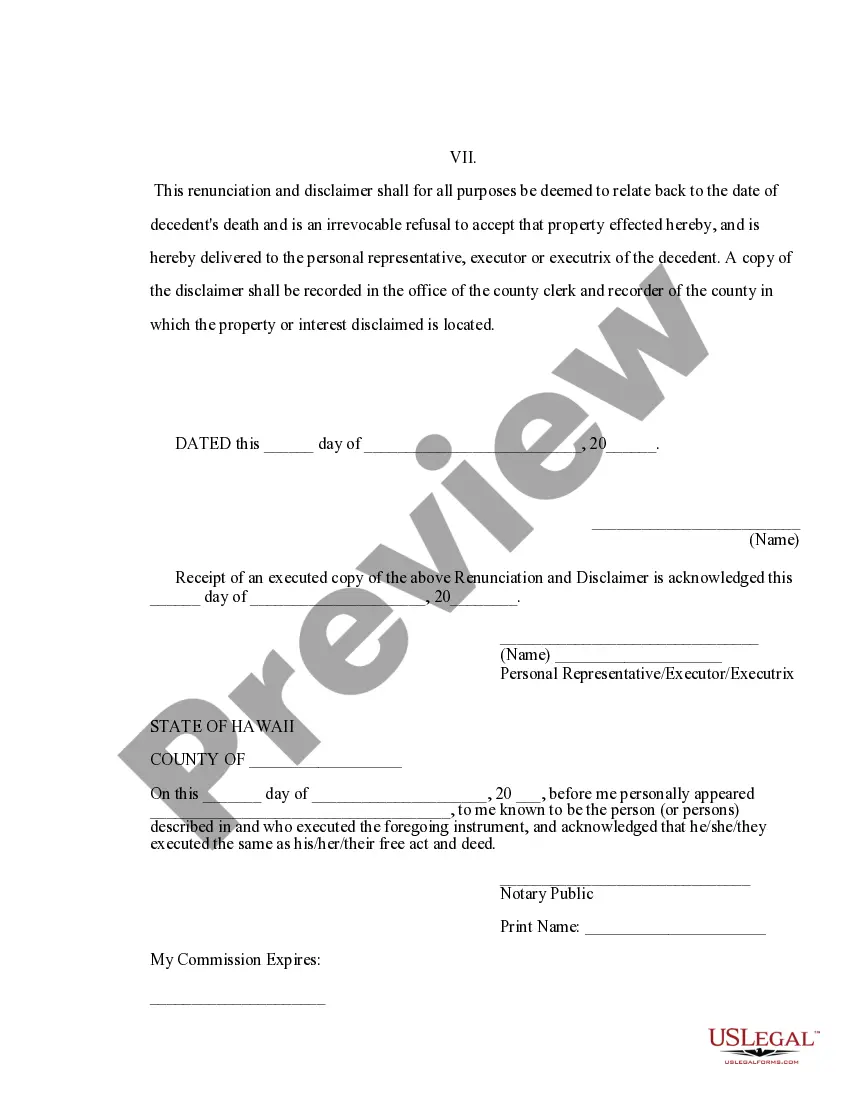

- Signature sections for both the beneficiary and the personal representative or executor.

Situations where this form applies

This form should be used when a beneficiary inherits an interest in real property but decides to refuse it. This situation might arise in cases where accepting the property may lead to unexpected financial liabilities, tax implications, or personal preferences not to inherit the property. It is a critical step to take within the specified time frame to ensure that the beneficiary does not inadvertently accept the property.

Who this form is for

- Beneficiaries who have inherited real property in Hawaii.

- Individuals who do not wish to accept their interest in the inherited property.

- Heirs looking to ensure that property transfers to other beneficiaries according to the decedent's wishes.

- Personal representatives or executors handling the estate of the decedent.

Completing this form step by step

- Enter your name as the beneficiary in the specified section.

- Fill in the date of death of the decedent accurately.

- Provide a detailed description of the real property interest being disclaimed.

- State your intent to file the disclaimer within nine months of the decedent's death.

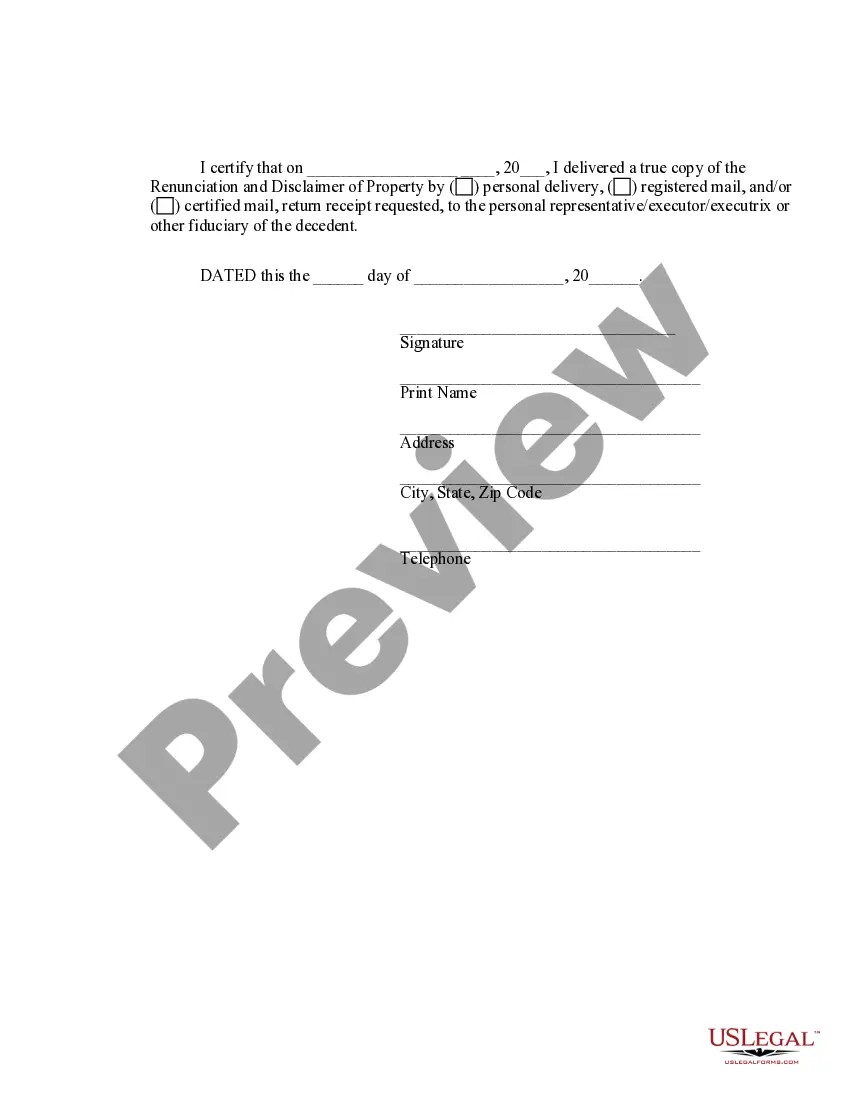

- Sign the form and ensure the personal representative or executor acknowledges receipt of the executed copy.

- Consider having the form notarized to enhance its validity.

Is notarization required?

This form needs to be notarized to ensure legal validity. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available anytime.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to submit the disclaimer within the nine-month timeframe.

- Not providing a comprehensive description of the real property interest.

- Omitting the signature of the personal representative or executor.

- Inadvertently accepting any benefits associated with the property before filing the disclaimer.

Key takeaways

- The renunciation is an irrevocable decision and should be carefully considered.

- There is a strict nine-month period to submit the disclaimer following the decedent's death.

- This form is crucial to ensure the property is passed on to other designated beneficiaries.

Looking for another form?

Form popularity

FAQ

In the context of a will, renunciation signifies that an heir or beneficiary chooses to refuse their share of the estate. This decision can simplify the distribution process and may have tax benefits. Individuals interested in renouncing property rights often utilize the Hawaii Renunciation And Disclaimer of Real Property Interest to ensure their decision is clearly documented and legally binding.

Renunciation in real estate refers to the act of formally giving up ownership rights or interests in a property. This can be particularly useful in preventing tax implications or liability associated with the property. The process typically involves using legal instruments, such as the Hawaii Renunciation And Disclaimer of Real Property Interest form, to ensure a smooth transition of ownership and clear title for future transactions.

Renouncing an interest in property means that an individual voluntarily gives up their rights to that property. This process is often formalized through legal documentation, specifically in the context of Hawaii Renunciation And Disclaimer of Real Property Interest. By renouncing, you can prevent any future claims or responsibilities associated with that property, allowing for a clean separation and clarity in ownership.

Probate Rule 107 C in Hawaii pertains to the procedures for the renunciation of property interests. This rule outlines how individuals can formally disclaim their interest in real property, which can significantly impact the distribution of assets. Understanding this rule is crucial for effective estate planning, especially when considering tools like the Hawaii Renunciation And Disclaimer of Real Property Interest. Utilizing resources from US Legal Forms can help you navigate these specific probate regulations.

To avoid probate in Hawaii after death, consider utilizing the Hawaii Renunciation And Disclaimer of Real Property Interest. This legal tool allows you to transfer your property interest efficiently, bypassing the lengthy probate process. By renouncing property interests, you can ensure that assets pass directly to your heirs without court intervention. Additionally, using the services provided by US Legal Forms can simplify the process for your family.

The renunciation of property interest refers to the act of rejecting any claim to an inherited asset or property. It serves as a formal declaration, allowing the renunciant to forfeit their rights, which can aid in estate planning. Engaging with the Hawaii Renunciation And Disclaimer of Real Property Interest can help clarify this process and its implications.

A disclaimer of property interest is a legal document that allows an individual to renounce their claim to a property or asset. This can be essential in situations where accepting the interest may create unwanted obligations or liabilities. Utilizing the Hawaii Renunciation And Disclaimer of Real Property Interest ensures that this process is addressed correctly and efficiently.

To disclaim a property means to formally refuse ownership or acceptance of that property. This action may occur for various reasons, such as tax implications or personal preferences. The Hawaii Renunciation And Disclaimer of Real Property Interest provides a legal framework for this important decision.

An example of a disclaimer of estate could be a scenario where a beneficiary receives a house but decides not to accept it. Instead, the individual could use the Hawaii Renunciation And Disclaimer of Real Property Interest to formally refuse the property, allowing it to pass on to the next beneficiary without complications.

When writing a letter to disclaim an inheritance, start with a clear statement of your intention to renounce the property. Include your full name, the decedent's name, and specific details about the asset you're disavowing. This letter must comply with the requirements of the Hawaii Renunciation And Disclaimer of Real Property Interest to be valid.