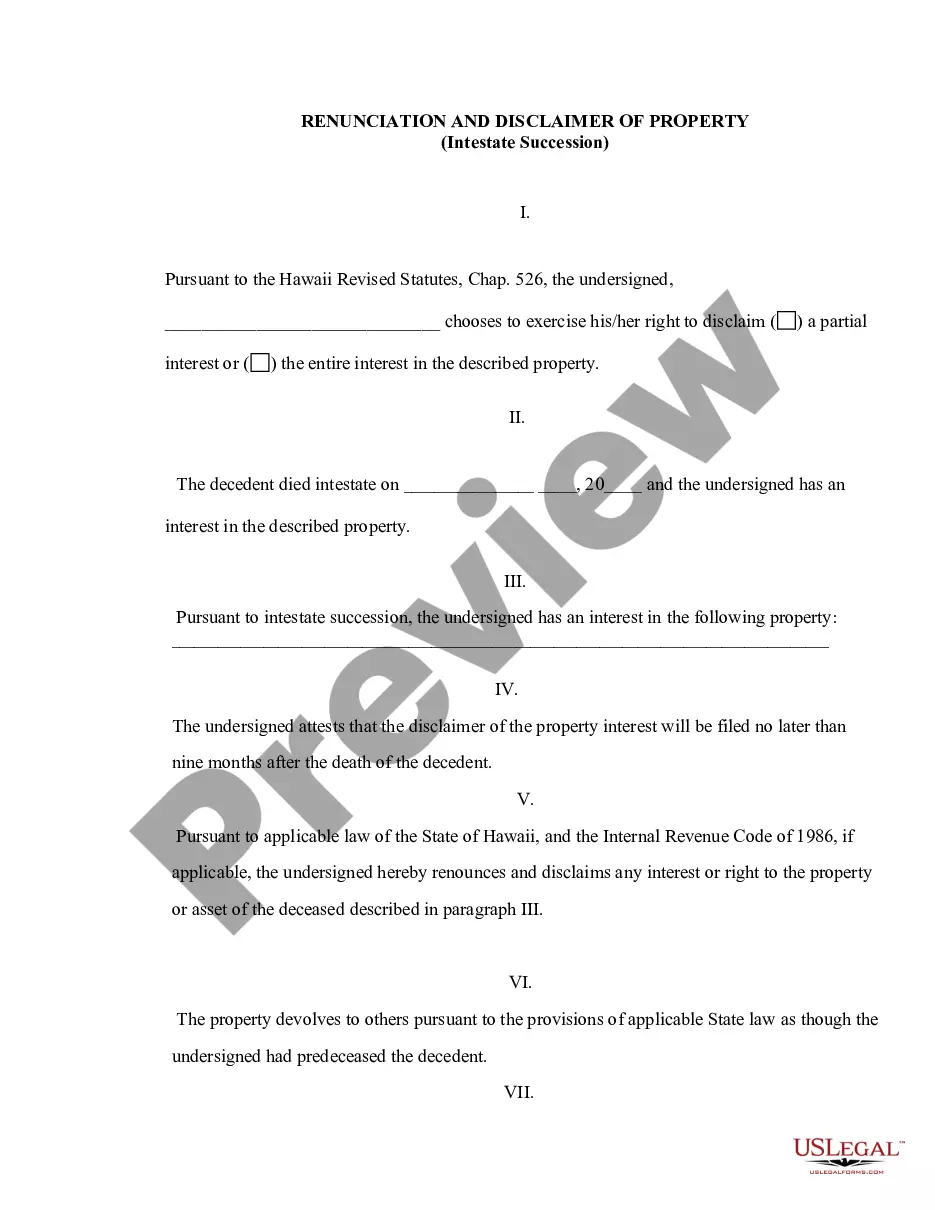

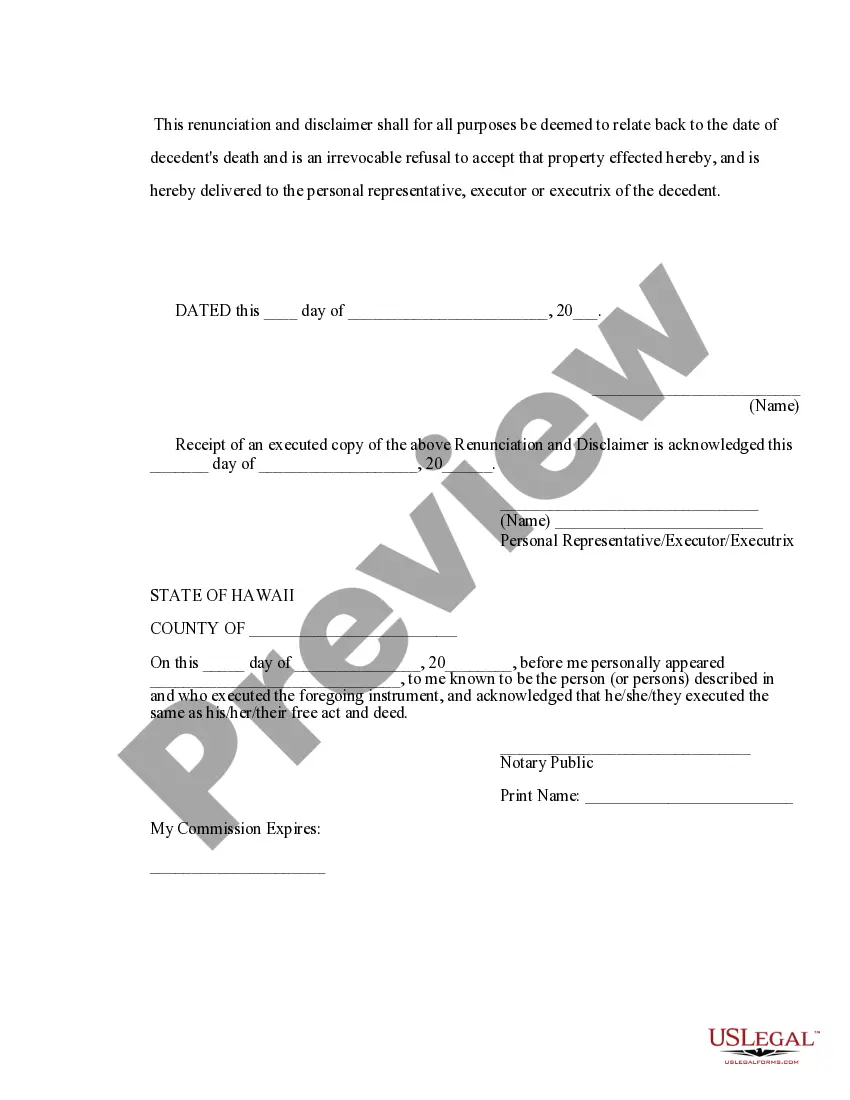

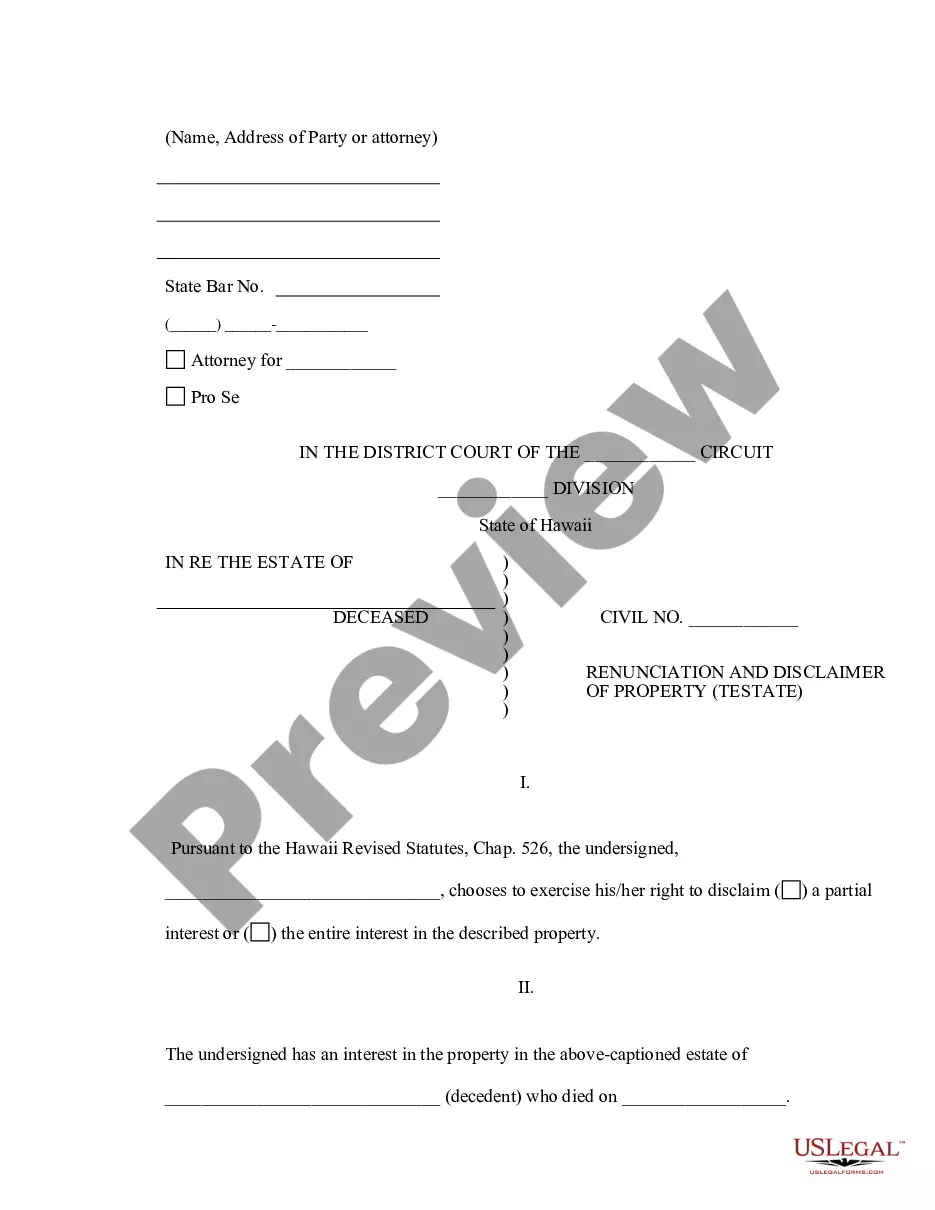

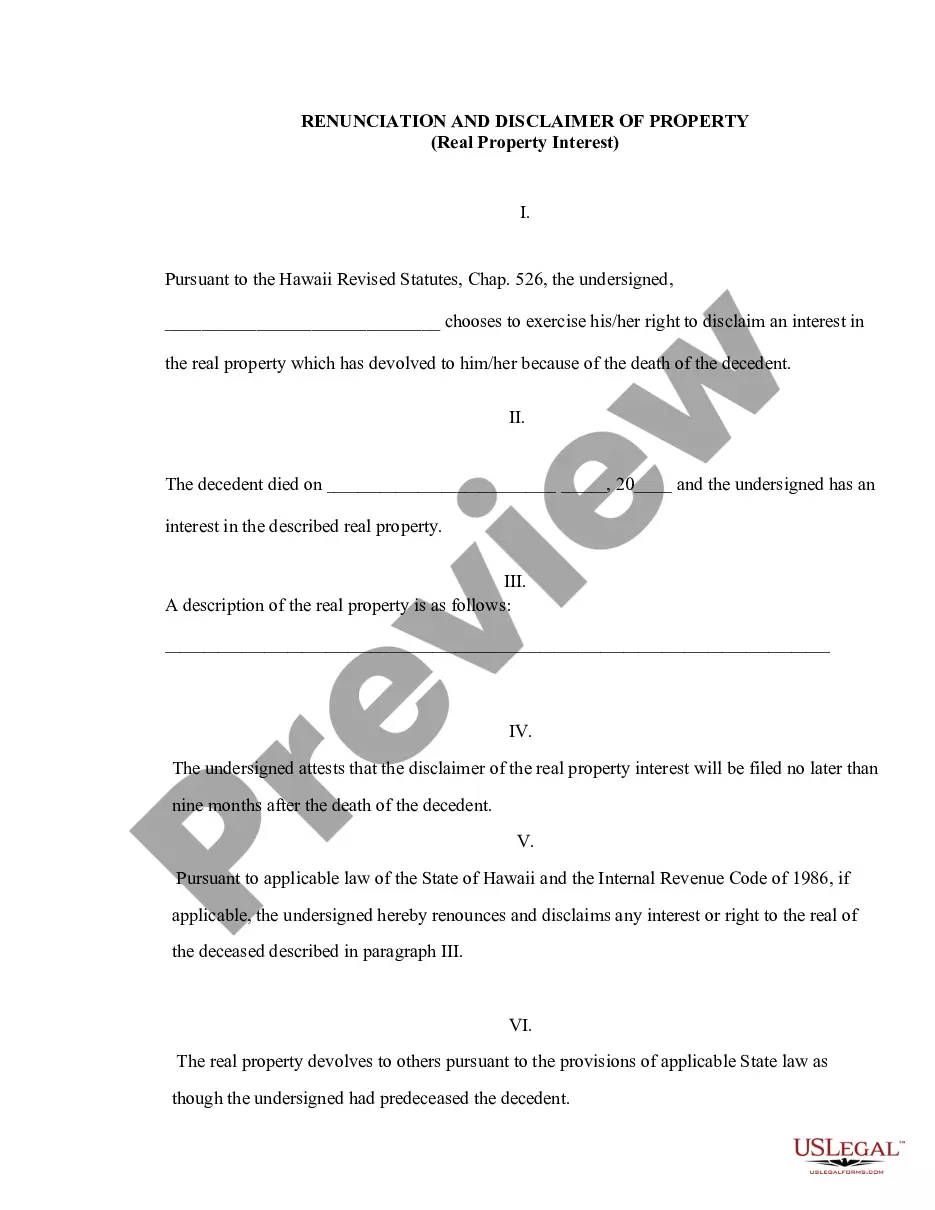

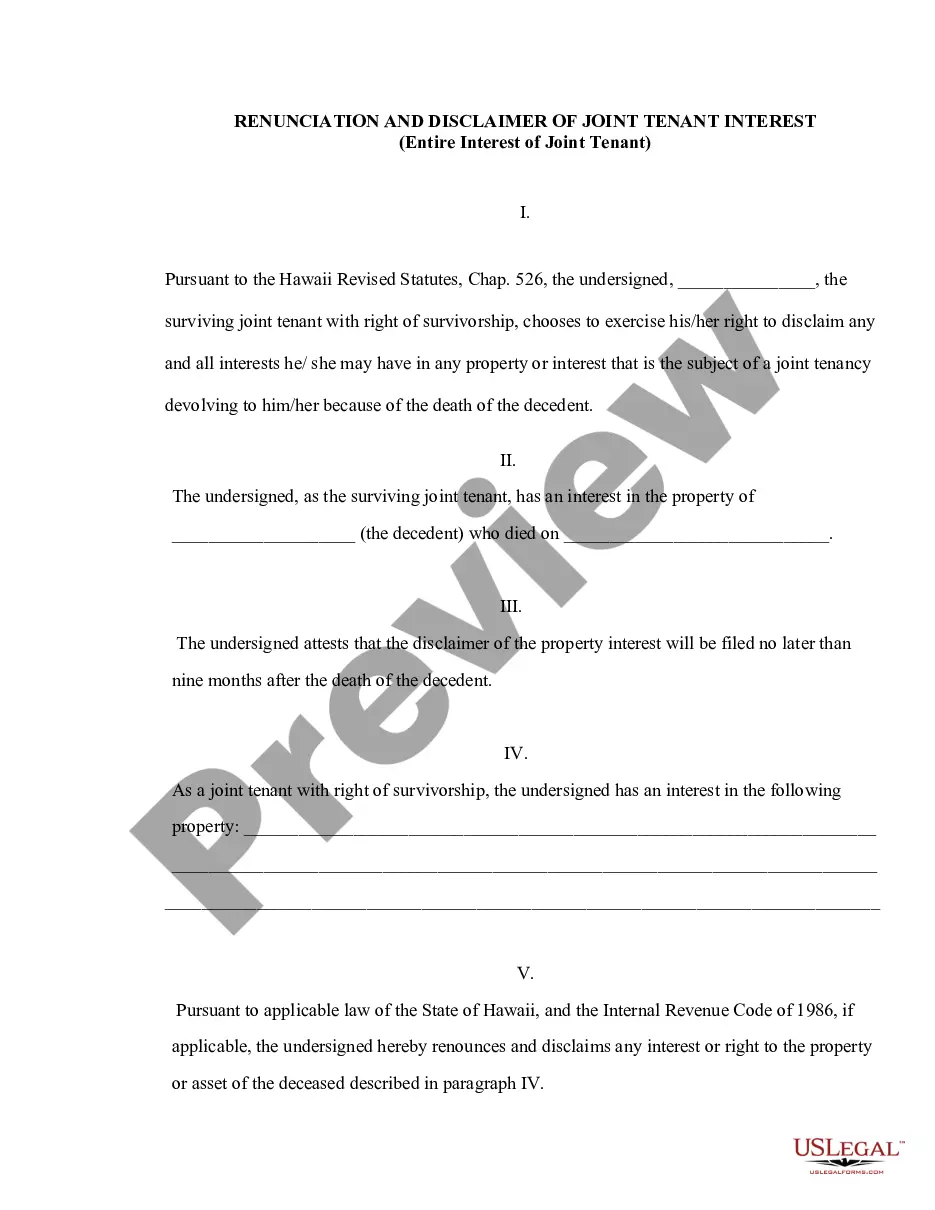

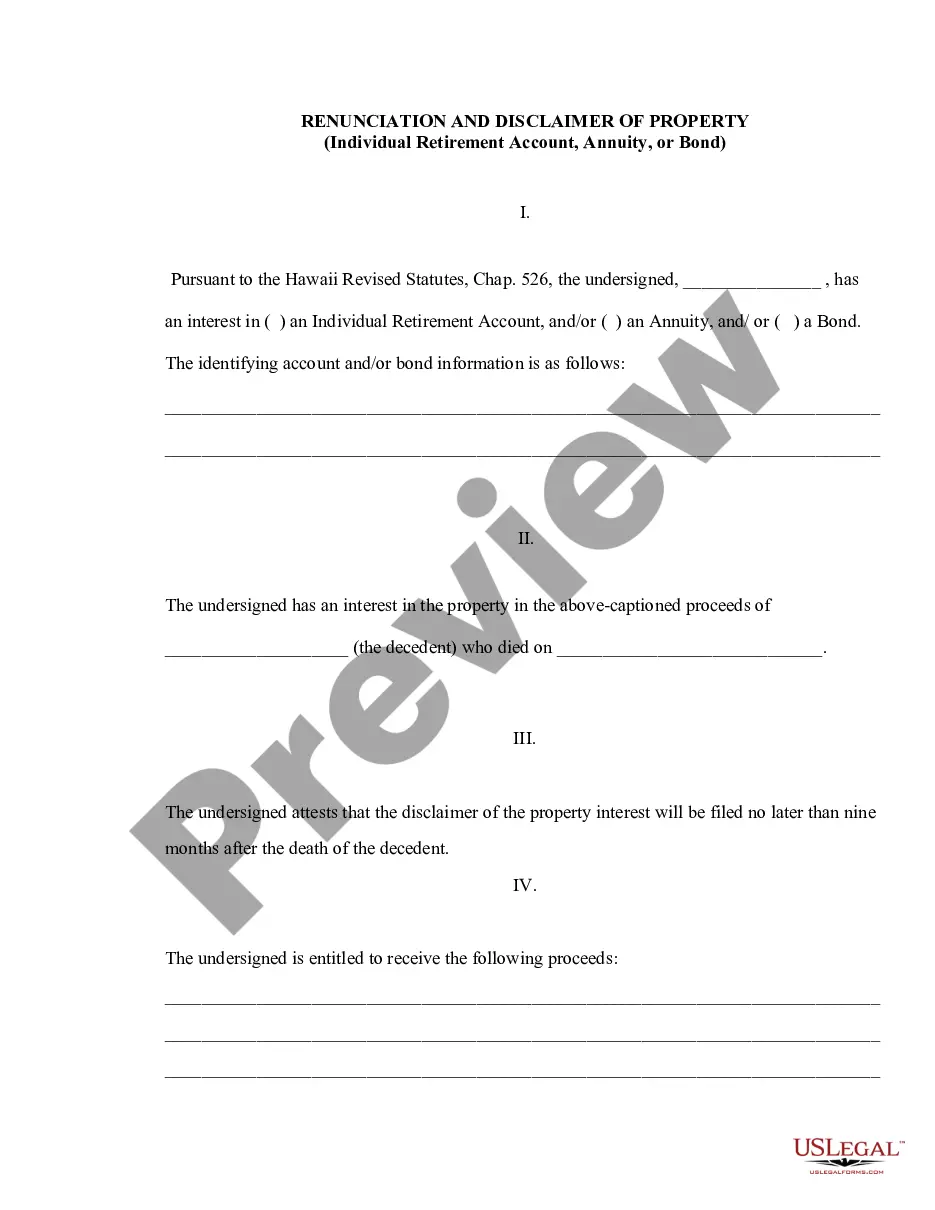

This forms is a Renunciation and Disclaimer of Property acquired by the beneficiary through intestate succession. The decedent died intestate and the beneficiary obtained an interest in the described property. Pursuant to the Hawaii Revised Statutes, Chap. 526, the beneficiary wishes to disclaim a portion of or the entire interest in the described property. The disclaimer will relate back to the death of the decedent and will serve as an irrevocable refusal to accept the property. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Hawaii Renunciation and Disclaimer of Property received by Intestate Succession

Description

How to fill out Hawaii Renunciation And Disclaimer Of Property Received By Intestate Succession?

Gain access to one of the most comprehensive collections of legal documents.

US Legal Forms truly offers a means to locate any state-specific document in just a few clicks, including examples of the Hawaii Renunciation and Disclaimer of Property received through Intestate Succession.

There’s no need to spend hours searching for a court-acceptable version.

After selecting a payment plan, create your account. Pay via card or PayPal. Download the document to your computer by clicking Download. That's it! You should fill out the Hawaii Renunciation and Disclaimer of Property received by Intestate Succession form and verify it. To ensure accuracy, consult your local legal advisor for assistance. Sign up and effortlessly browse through over 85,000 useful templates.

- To take advantage of the forms library, choose a subscription and create an account.

- If you have already signed up, simply Log In and click Download.

- The template for the Hawaii Renunciation and Disclaimer of Property received by Intestate Succession will be automatically saved in the My documents section (a section for each document you download from US Legal Forms).

- To create a new profile, follow the straightforward instructions below.

- If you plan to use a state-specific document, ensure you select the correct state.

- If feasible, review the description to comprehend all aspects of the form.

- Utilize the Preview feature if available to examine the content of the document.

- If everything appears correct, click Buy Now.

Form popularity

FAQ

The duration of probate can vary significantly, depending on the complexity of the estate and any disputes among heirs. Typically, simple estates may take a few months to complete, while more complicated cases can extend to several years. Awareness of your rights under the Hawaii Renunciation and Disclaimer of Property received by Intestate Succession can help you navigate this timeline. It is beneficial to involve legal support to avoid unnecessary delays.

The probate threshold in Hawaii refers to the minimum value of the estate that mandates formal probate proceedings. Currently, this threshold limits which estates require court supervision during the distribution of assets. Being aware of this threshold is particularly useful when considering the Hawaii Renunciation and Disclaimer of Property received by Intestate Succession. This knowledge can guide your decisions and simplify potentially complex situations.

Intestate succession laws in Hawaii determine how property is distributed when a person dies without a will. Typically, these laws prioritize immediate family, such as spouses and children, before extending to other relatives. Understanding these laws is essential in navigating the Hawaii Renunciation and Disclaimer of Property received by Intestate Succession. Proper knowledge can help secure your rightful share and facilitate the appropriate legal process.

Rule 50 in Hawaii probate relates to the requirements for accounting and reporting by personal representatives. It mandates that they provide account statements to ensure transparency in estate management. Knowledge of this rule is beneficial for those involved in the Hawaii Renunciation and Disclaimer of Property received by Intestate Succession process. This awareness helps ensure all parties are informed and can make educated decisions.

To write a disclaimer of inheritance in Hawaii, you must submit a written statement declaring your intention to renounce your share of the estate. This document should clearly identify the decedent and specify the property being disclaimed. Utilizing the Hawaii Renunciation and Disclaimer of Property received by Intestate Succession can simplify this process. It also fully protects your interests and ensures compliance with state laws.

Rule 42 in Hawaii probate addresses the appointment of personal representatives and their duties. It outlines the responsibilities that personal representatives must fulfill, particularly in relation to managing and distributing the estate in line with Hawaii's laws. Understanding this rule is crucial for heirs dealing with the Hawaii Renunciation and Disclaimer of Property received by Intestate Succession. With proper guidance, the personal representative can ensure a smooth process.

When a person dies without a valid will in Hawaii, their property is distributed according to intestate succession laws. These laws dictate how the deceased's assets are allocated to heirs, usually prioritizing immediate family members. In this context, the Hawaii Renunciation and Disclaimer of Property received by Intestate Succession allows heirs to renounce their inheritance if desired. This option provides clarity and helps manage complex family dynamics.

Rule 101 in probate in Hawaii outlines the general procedures for handling estates. It emphasizes the importance of filing a petition for probate when someone passes away, particularly in cases involving the Hawaii Renunciation and Disclaimer of Property received by Intestate Succession. This rule helps streamline the process and ensure all legal requirements are met. Overall, it establishes a foundation for effective estate management.

In Hawaii, probate must generally be initiated within 3 years after the person's death. However, it's advisable to begin the process sooner to address any potential disputes or complications. Delaying probate can complicate matters, especially concerning asset distribution and debts. Utilizing Hawaii Renunciation and Disclaimer of Property received by Intestate Succession can help streamline this process for beneficiaries and executors.

When someone dies in Hawaii, the process typically begins with determining whether the deceased had a valid will. If no will exists, the estate may go through intestate succession under state law. The next steps involve appointing an executor, gathering assets, and addressing debts. Understanding Hawaii Renunciation and Disclaimer of Property received by Intestate Succession is vital for those acting on behalf of a deceased person to ensure rightful property distribution.