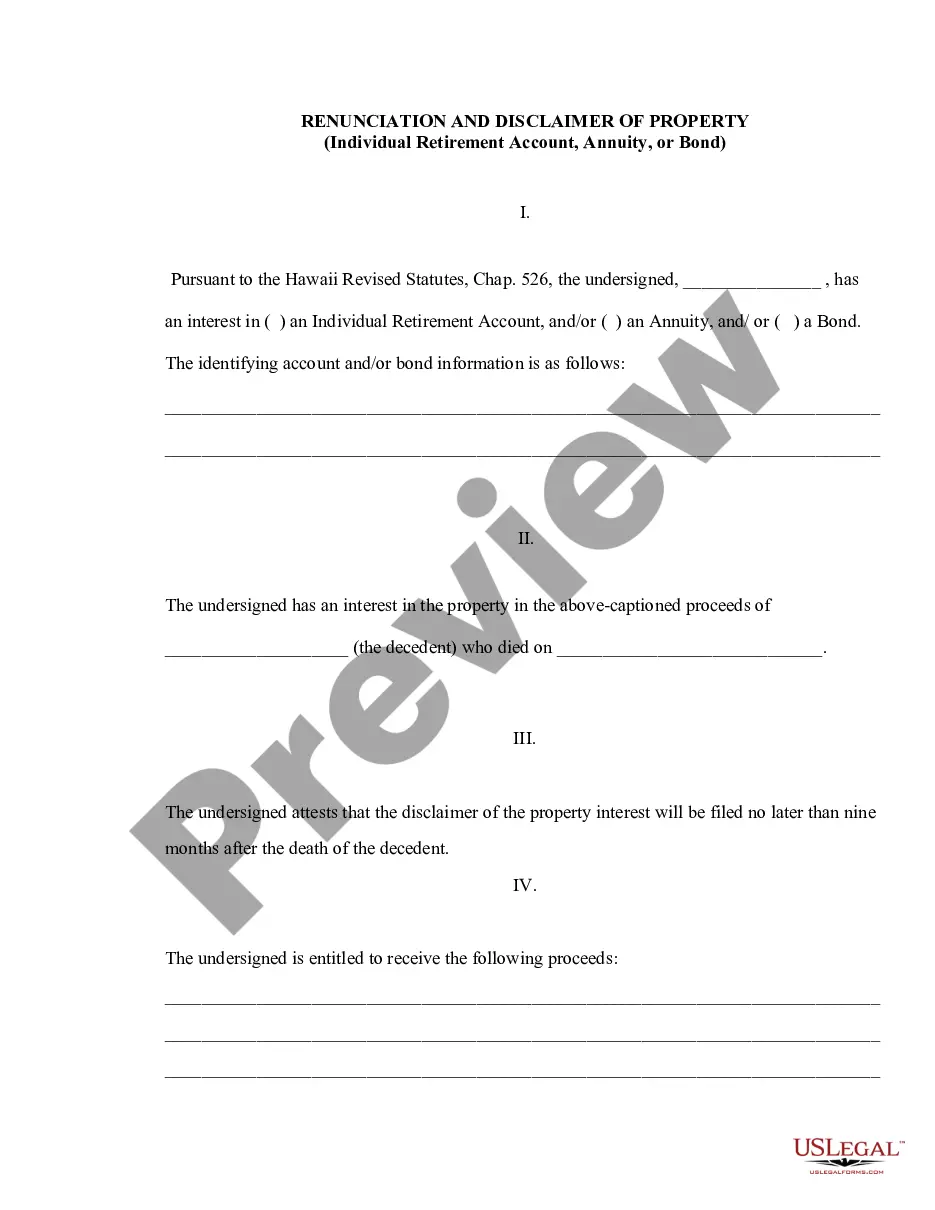

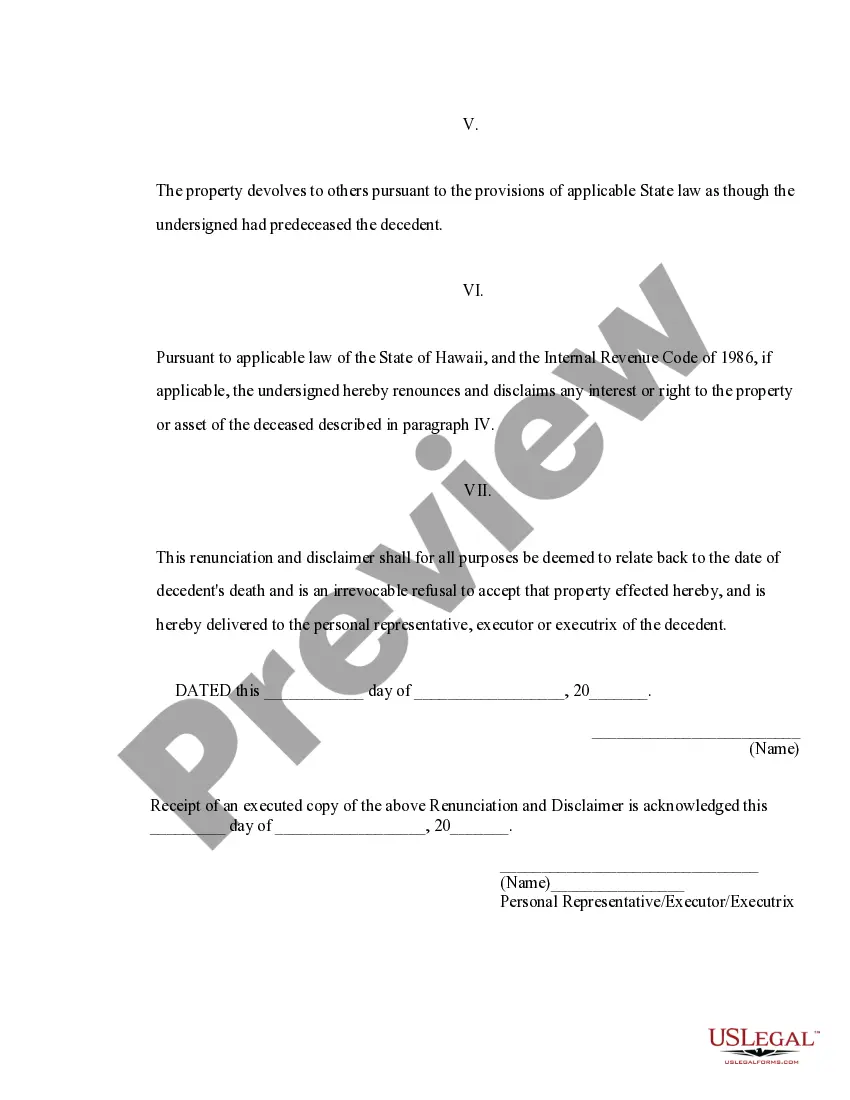

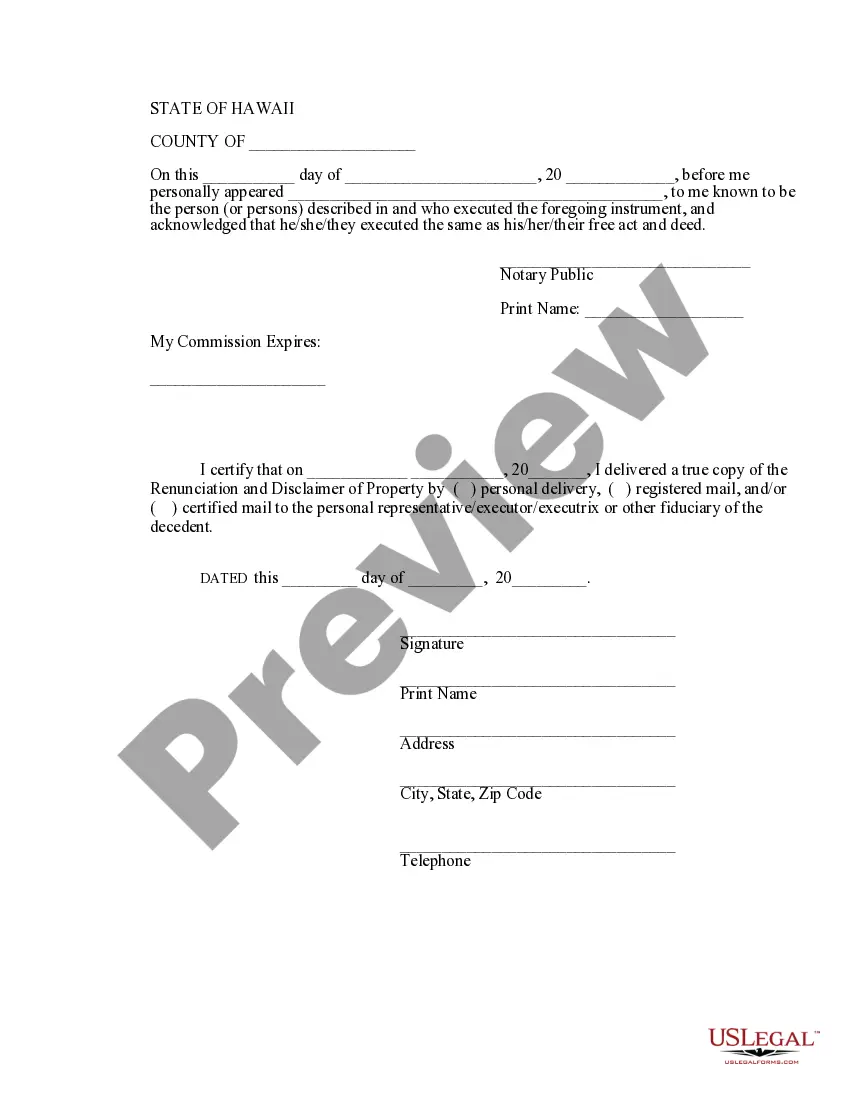

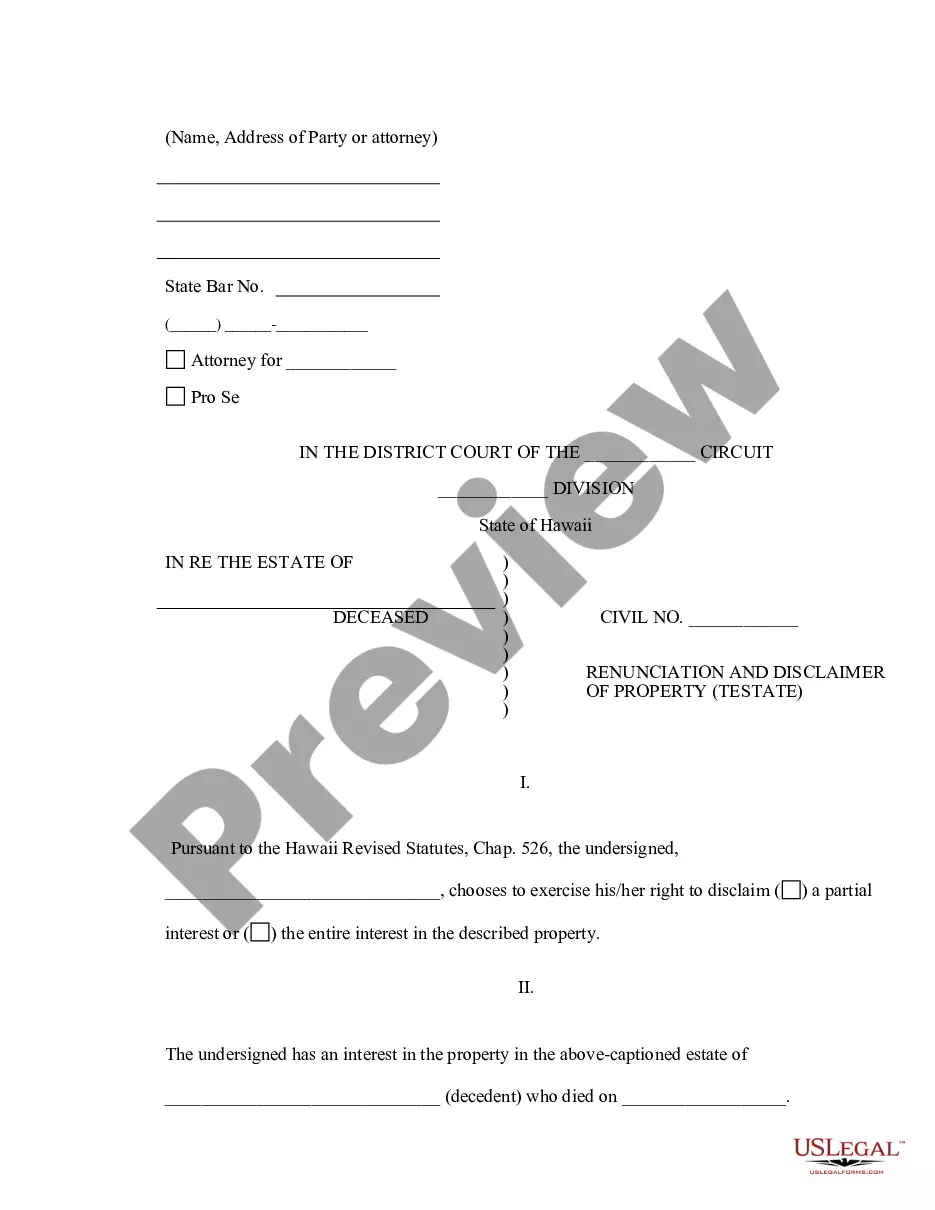

This form is a Renunciation and Disclaimer of an Individual Retirement Account (IRA), an Annuity, or Bond. The beneficiary has gained an interest in the proceeds of the account(s) due to the death of the decedent. However, the beneficiary has chosen to disclaim his/her rights to the proceeds pursuant to the Hawaii Revised Statutes, Chap. 526. The disclaimer will relate back to the death of the decedent and it will serve as an irrevocable refusal of the property. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Hawaii Renunciation and Disclaimer of Property - Individual Retirement Account, Annuity, or Bond

Description

How to fill out Hawaii Renunciation And Disclaimer Of Property - Individual Retirement Account, Annuity, Or Bond?

Obtain entry to the most comprehensive collection of sanctioned documents.

US Legal Forms is essentially a platform where you can discover any state-specific paperwork in just a few clicks, like Hawaii Renunciation and Disclaimer of Property - Individual Retirement Account, Annuity, or Bond templates.

No need to waste hours of your time looking for a legally acceptable form.

If everything looks appropriate, click Buy Now. After selecting a pricing option, create your account. Make payment via credit card or PayPal. Download the document to your device by clicking the Download button. That's it! Complete the Hawaii Renunciation and Disclaimer of Property - Individual Retirement Account, Annuity, or Bond form and review it. To ensure all is accurate, consult your local attorney for assistance. Register and effortlessly explore around 85,000 helpful templates.

- To utilize the forms library, choose a subscription plan, and create an account.

- If you have done this, simply Log In and click the Download button.

- The Hawaii Renunciation and Disclaimer of Property - Individual Retirement Account, Annuity, or Bond template will be automatically saved in the My documents section (which is a section for every document you store on US Legal Forms).

- To set up a new account, follow the straightforward instructions below.

- If you intend to use a state-specific example, ensure to specify the correct state.

- If possible, review the description to understand all the details of the form.

- Utilize the Preview feature if it’s available to examine the document's content.

Form popularity

FAQ

Probate rule 107 C in Hawaii outlines the procedures for the acceptance and management of certain documents related to the probate process. This rule is particularly relevant when discussing the Hawaii Renunciation and Disclaimer of Property - Individual Retirement Account, Annuity, or Bond. Under this rule, individuals can renounce their interest in these assets, directing them toward a designated beneficiary or estate. It helps simplify the transfer of property, avoiding unnecessary taxes and fees, and ensuring that your intentions regarding your assets are honored.

In Hawaii, the threshold for probate is typically set at $100,000 for personal property and $200,000 for real estate. If the estate is below these amounts, it may not require formal probate. Understanding these thresholds can help you make informed decisions, particularly if you are considering the Hawaii Renunciation and Disclaimer of Property - Individual Retirement Account, Annuity, or Bond. The US Legal Forms website offers resources that can assist you in navigating these thresholds effectively.

In Hawaii, you generally have to file for probate within three years after someone's death. This timeline varies, depending on the circumstances surrounding the estate. It’s important to act promptly to protect your rights and interests, especially when it involves the Hawaii Renunciation and Disclaimer of Property - Individual Retirement Account, Annuity, or Bond. Consider using the US Legal Forms platform for guidance on these processes and to ensure compliance with local laws.

You can avoid probate in Hawaii by employing strategies such as using trusts, joint ownership, or designating beneficiaries. These options allow for the direct transfer of assets to heirs, bypassing courtroom delays. The Hawaii Renunciation and Disclaimer of Property - Individual Retirement Account, Annuity, or Bond provides an important mechanism for asset succession, ensuring your wishes are honored without unnecessary complications.

Probate in Hawaii is typically triggered when an individual passes away with assets directly in their name. Factors such as real estate holdings or significant personal property can lead to the need for probate proceedings. Understanding the implications of the Hawaii Renunciation and Disclaimer of Property - Individual Retirement Account, Annuity, or Bond can help you manage or mitigate these triggers effectively.

To avoid probate in Hawaii, consider establishing a living trust, naming beneficiaries on property, or holding assets jointly. Each of these strategies helps assets pass directly to your chosen heirs. Incorporating the Hawaii Renunciation and Disclaimer of Property - Individual Retirement Account, Annuity, or Bond further simplifies asset management, providing added security for your investments.

One effective way to avoid probate court is to use tools like living trusts or beneficiary designations. These methods allow assets to pass directly to heirs without going through probate. Additionally, consider the Hawaii Renunciation and Disclaimer of Property - Individual Retirement Account, Annuity, or Bond to facilitate a smoother transfer of assets.

In Hawaii, estates valued over $100,000 typically must go through probate. This threshold means that assets under this amount can often bypass the process entirely, making it easier for heirs. Utilizing Hawaii Renunciation and Disclaimer of Property - Individual Retirement Account, Annuity, or Bond can help streamline estate distribution and minimize tax implications.

Rule 50 in Hawaii addresses the procedures for timely filing of a probate petition. It emphasizes the importance of submitting required documents and adhering to statutory deadlines. Understanding this rule helps you navigate the Hawaii Renunciation and Disclaimer of Property - Individual Retirement Account, Annuity, or Bond process better, ensuring you meet essential requirements.

The minimum estate value for requiring probate in Hawaii is typically $100,000 for personal property. If an estate meets or exceeds this amount, it triggers the need for formal probate proceedings. Individuals can explore options such as the Hawaii Renunciation and Disclaimer of Property - Individual Retirement Account, Annuity, or Bond to manage their estate effectively and reduce the burdens associated with probate.