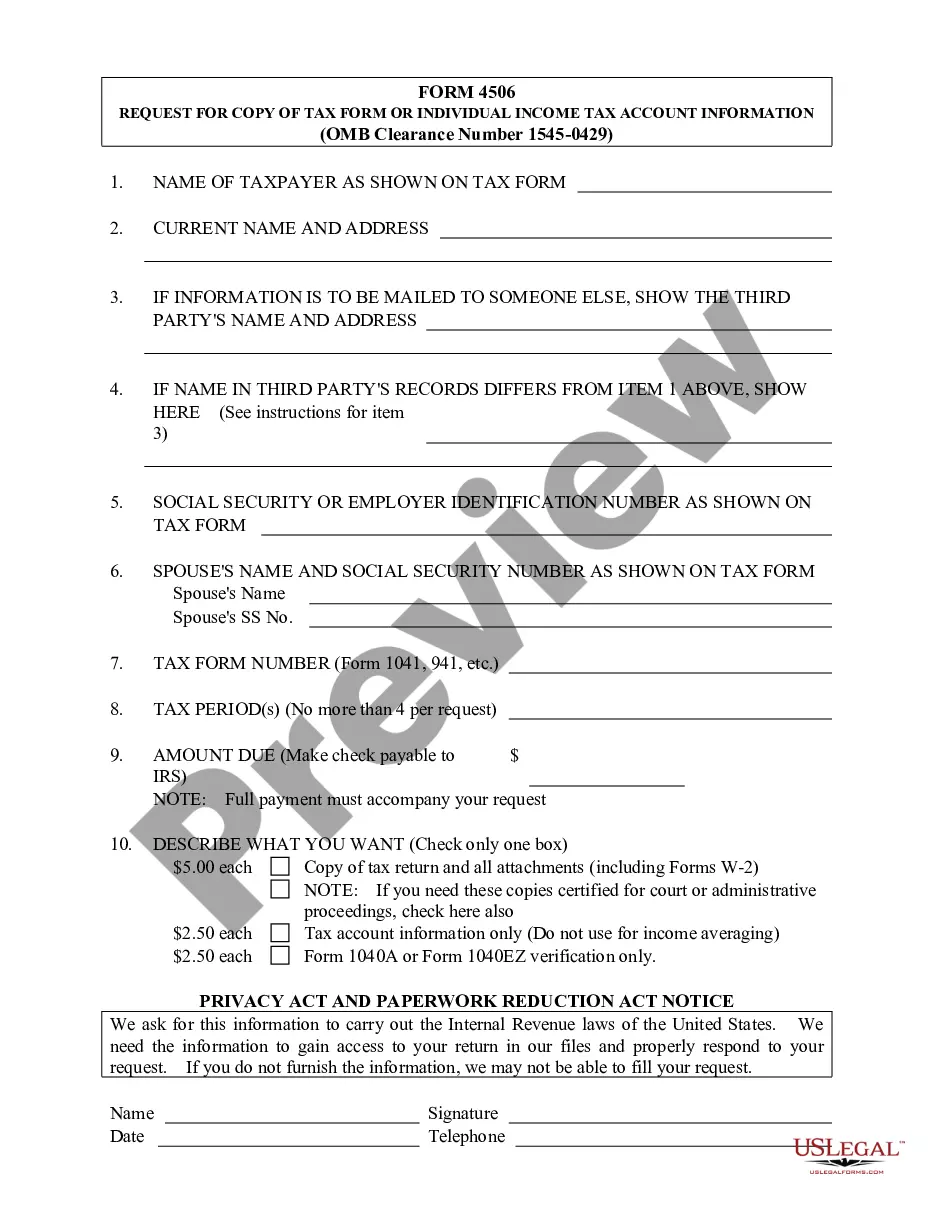

Request for Copy of Tax Form or Individual Income Tax Account Information

Description

How to fill out Request For Copy Of Tax Form Or Individual Income Tax Account Information?

When it comes to drafting a legal document, it is better to delegate it to the experts. Nevertheless, that doesn't mean you yourself cannot get a template to utilize. That doesn't mean you yourself can not find a sample to utilize, nevertheless. Download Request for Copy of Tax Form or Individual Income Tax Account Information from the US Legal Forms site. It provides numerous professionally drafted and lawyer-approved forms and templates.

For full access to 85,000 legal and tax forms, customers just have to sign up and select a subscription. As soon as you are registered with an account, log in, find a specific document template, and save it to My Forms or download it to your device.

To make things much easier, we’ve provided an 8-step how-to guide for finding and downloading Request for Copy of Tax Form or Individual Income Tax Account Information quickly:

- Be sure the document meets all the necessary state requirements.

- If available preview it and read the description before purchasing it.

- Click Buy Now.

- Select the appropriate subscription for your needs.

- Make your account.

- Pay via PayPal or by credit/bank card.

- Choose a needed format if a few options are available (e.g., PDF or Word).

- Download the document.

When the Request for Copy of Tax Form or Individual Income Tax Account Information is downloaded you can complete, print out and sign it in almost any editor or by hand. Get professionally drafted state-relevant papers in a matter of seconds in a preferable format with US Legal Forms!

Form popularity

FAQ

Use Form 4506-T to request tax return information. Taxpayers using a tax year beginning in one calendar year and ending in the following year (fiscal tax year) must file Form 4506-T to request a return transcript.

To get a transcript, taxpayers can: Order online. They can use the Get Transcript tool on IRS.gov.Taxpayers can use Get Transcript by Mail or call 800-908-9946 to order a tax return transcripts and tax account transcripts.

IRS Tax Return Transcript Request Process An IRS Record of Account can only be requested using Get Transcript ONLINE or by submitting an IRS Form 4506-T, Request for Transcript of Tax Return.

You can quickly request transcripts by using our automated self-help service tools. Please visit us at IRS.gov and click on Get a Tax Transcript... under Tools or call 1-800-908-9946. If you need a copy of your return, use Form 4506, Request for Copy of Tax Return.

Order online. Use the 'Get Transcript ' tool available on IRS.gov. There is a link to it under the red TOOLS bar on the front page. Order by phone. The number to call is 800-908-9946. Order by mail. Complete and send either Form 4506-T or Form 4506T-EZ to the IRS to get one by mail.

The primary difference between the IRS form 4506 and IRS form 4506-T is that 4506 is a request for full copies of income tax documents and 4506-T is a request for transcripts of the same documentation.The transcript is a line-by-line printout of specified information from the tax return.

Even when the 4506 is ordered early in the transaction, before loan approval, the IRS can delay things. Any mortgage lender that works through FNMA, FHLMC, FHA or VA, and even the portfolio lenders who follow their own rules, all have to have a 4506 processed; it's mandatory.

A form 4506-T simply allows your lender to verify with the IRS that the forms you supply to prove your income match those in the possession of the IRS.The IRS can provide a transcript that includes data from these information returns. State or local information is not included with the Form W-2 information.

Form 4506 T, as it is most often requested, is also called a Request for Transcript of Tax Return. This document allows for a copy of your tax return to be obtained from the IRS directly. A mortgage lender may request this to verify your income documentation that you have provided as part of your loan application.