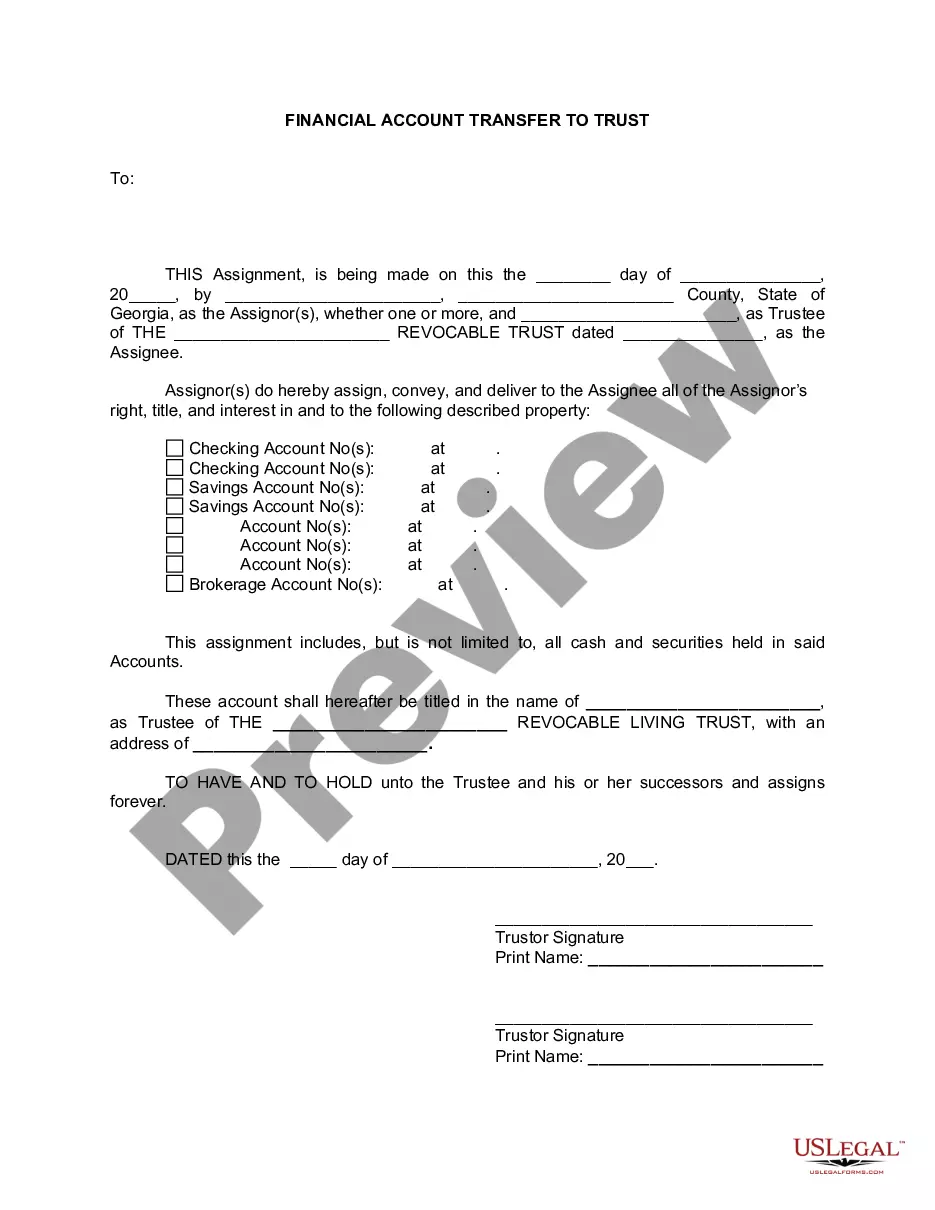

This Financial Account Transfer to Living Trust form is for transferring bank and other financial accounts to a living trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public. Assignor(s) with this form will assign, convey, and deliver to the Assignee all of the Assignors right, title, and interest in and to the described property.The assignment includes, but is not limited to, all cash and securities held in the accounts.

Georgia Financial Account Transfer to Living Trust

Description

How to fill out Georgia Financial Account Transfer To Living Trust?

Gain entry to one of the most extensive collections of sanctioned documents.

US Legal Forms truly offers a way to locate any state-specific document with just a few clicks, including Georgia Financial Account Transfer to Living Trust templates.

No need to waste your time searching for a legally acceptable document. Our certified professionals ensure you receive the latest templates consistently.

If everything appears correct, click the Buy Now button. After choosing a pricing plan, create your account. Make payment via card or PayPal. Save the document to your device by clicking the Download button. That's it! You should complete the Georgia Financial Account Transfer to Living Trust form and double-check it. To confirm that everything is accurate, contact your local legal advisor for assistance. Sign up and easily access around 85,000 useful documents.

- To utilize the document library, select a subscription and create your account.

- If you have already done so, just Log In and click the Download button.

- The Georgia Financial Account Transfer to Living Trust template will be quickly saved in the My documents section (a section for every document you download on US Legal Forms).

- To create a new account, follow the straightforward instructions provided below.

- If you are going to utilize a state-specific template, ensure you select the correct state.

- If possible, examine the description to grasp all the details of the document.

- Take advantage of the Preview option if it's available to review the document's details.

Form popularity

FAQ

A transfer of assets may or may not be taxable, depending on the nature of the transfer and the type of trust you establish. In the context of a Georgia Financial Account Transfer to Living Trust, transferring assets to a revocable trust is usually not a taxable event. However, with an irrevocable trust, you might face gift taxes on the transferred assets. For tailored advice concerning your unique situation, consider using the uSlegalforms platform, which can guide you through the complexities.

When you perform a Georgia Financial Account Transfer to Living Trust, the tax treatment depends on whether the trust is revocable or irrevocable. Generally, transferring assets to a revocable trust does not trigger taxation because you continue to have control over these assets. On the other hand, transferring assets to an irrevocable trust may lead to tax liabilities, so it's beneficial to seek professional guidance to navigate these complexities.

In most cases, transferring assets to a revocable trust during your lifetime is not considered a taxable event. This applies to your Georgia Financial Account Transfer to Living Trust, where you retain control and can alter the trust at any time. However, if the transfer involves an irrevocable trust, different rules may apply, and it is wise to consult with a tax advisor to fully understand the implications.

Transferring stock to a revocable trust as part of your Georgia Financial Account Transfer to Living Trust typically does not incur immediate tax consequences. Since you maintain control over the assets in a revocable trust, any income generated will still be reported on your personal tax return. However, it's crucial to consider long-term implications, such as estate taxes and the treatment of the trust after your passing.

When considering a Georgia Financial Account Transfer to Living Trust, it is important to understand that gifting assets to a trust can have tax implications. Generally, if you gift assets to a revocable trust, it is not a taxable event since you retain control over those assets. However, gifting to an irrevocable trust may trigger gift tax, depending on the value of the assets. Consulting with a tax professional can help clarify your specific situation.

A significant mistake parents often make is failing to fund the trust properly after its creation. Without funding, the trust cannot operate as intended. To avoid this common pitfall, understand the steps involved in a Georgia Financial Account Transfer to Living Trust, ensuring all necessary assets are effectively placed within the trust.

One downside of placing assets in a trust is the complexity involved in managing it. Trusts might require ongoing administrative duties and sometimes may not claim certain tax benefits. It is vital to consider how a Georgia Financial Account Transfer to Living Trust could impact tax situations before making decisions.

To transfer property to a living trust in Georgia, start by establishing the trust document with the necessary provisions. Next, you will need to execute a deed to transfer the property into the trust. Utilizing services like USLegalForms simplifies the Georgia Financial Account Transfer to Living Trust, ensuring all legal documents meet state requirements.

Yes, having a trust can help your parents manage their assets efficiently. A Georgia Financial Account Transfer to Living Trust allows for smooth asset distribution and can avoid probate, saving time and potential costs. It also provides a layer of protection and privacy for their financial affairs.

To initiate the transfer of your checking account to your living trust, you will first need to consult with your bank. Complete the required transfer paperwork, while providing your trust's legal documentation. Following these steps for a Georgia Financial Account Transfer to Living Trust allows for smooth asset management and helps your beneficiaries access funds without complications.