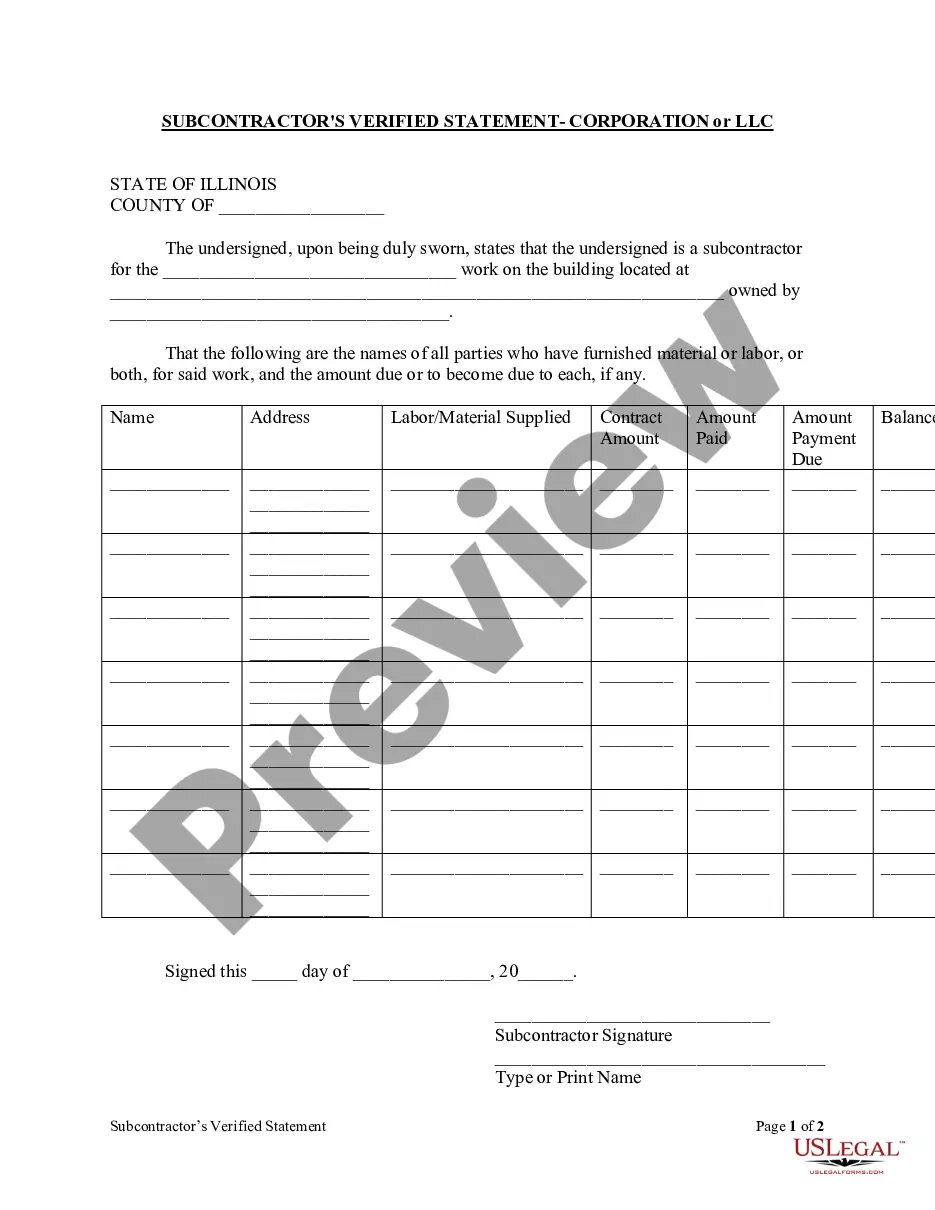

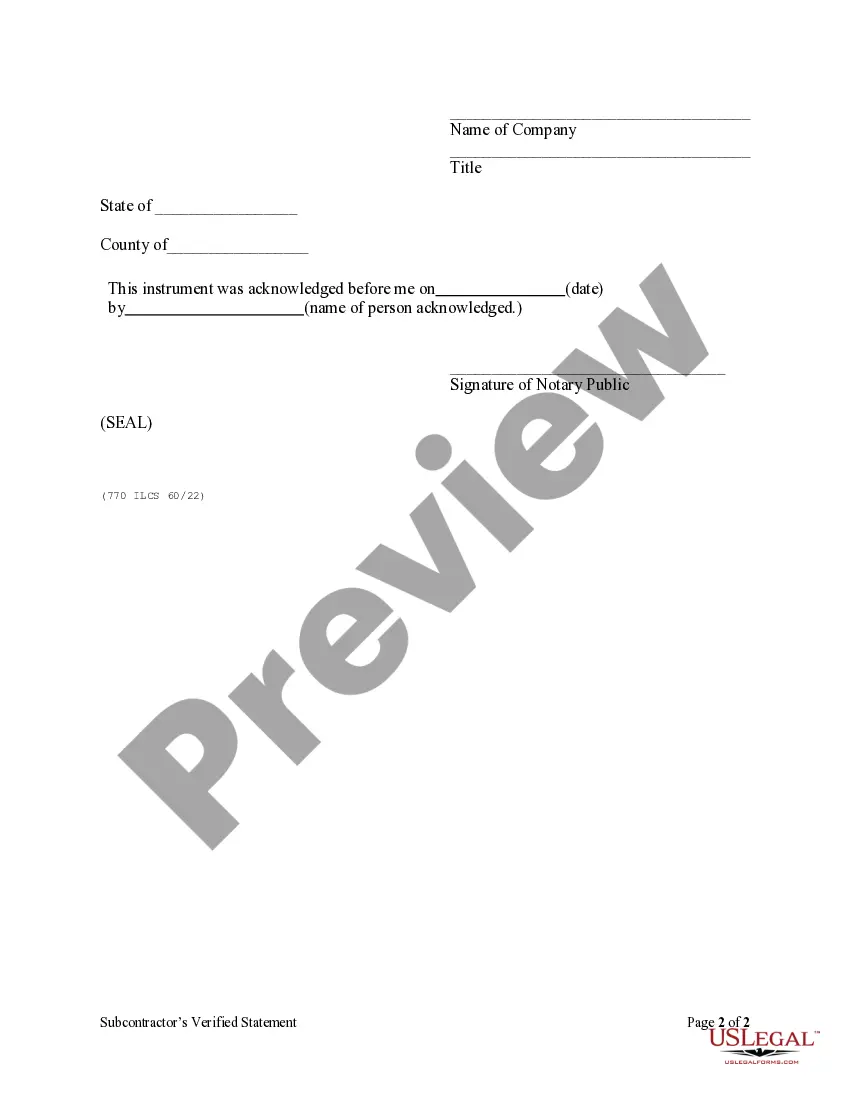

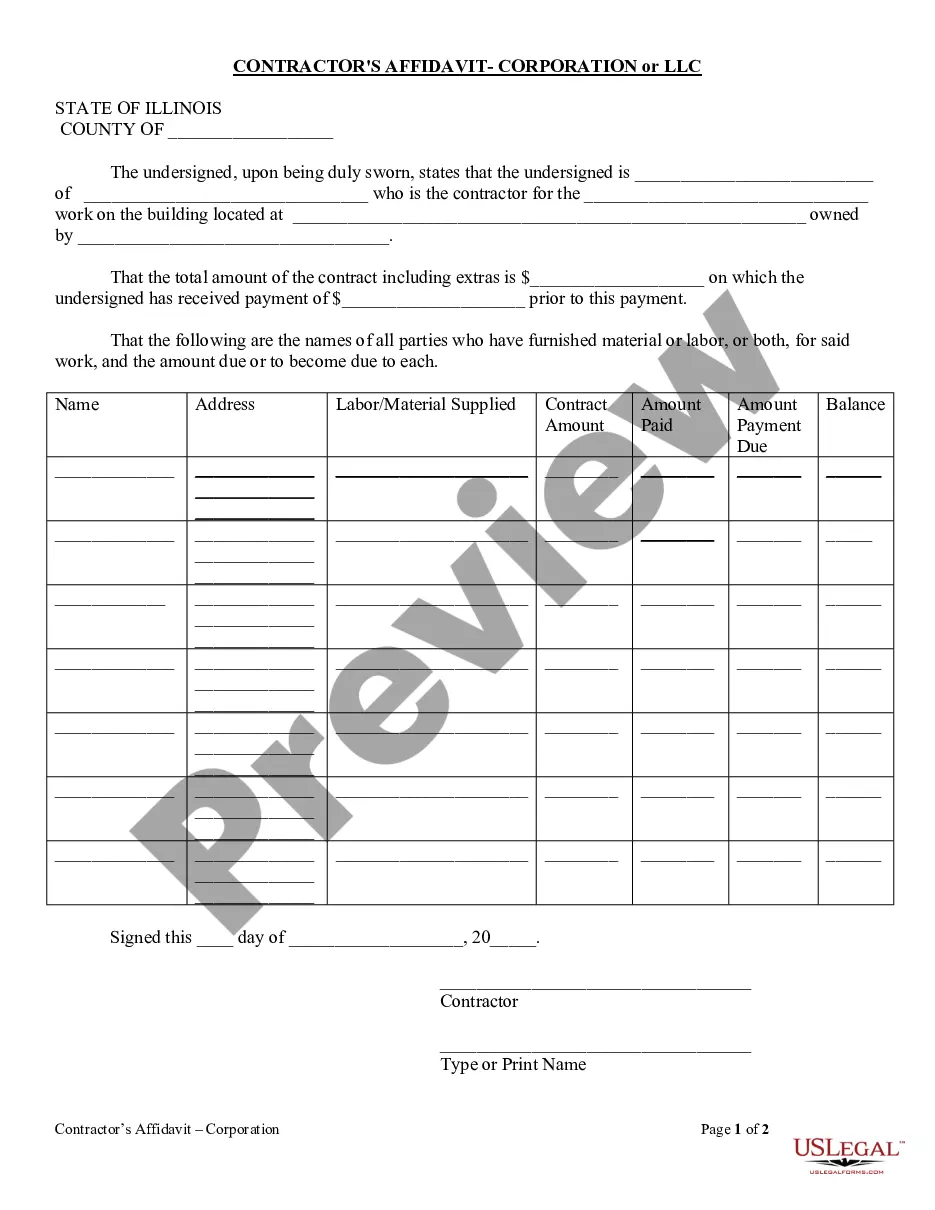

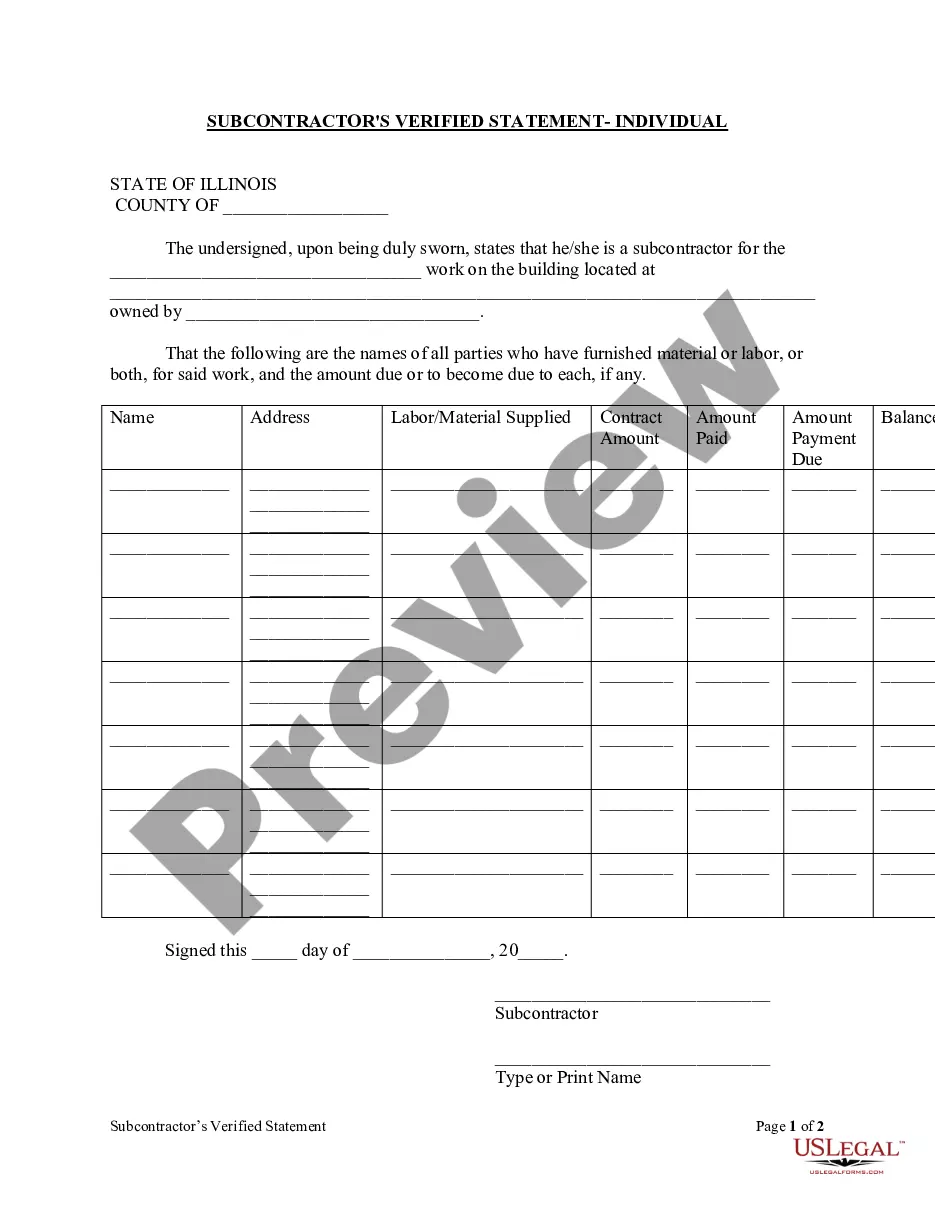

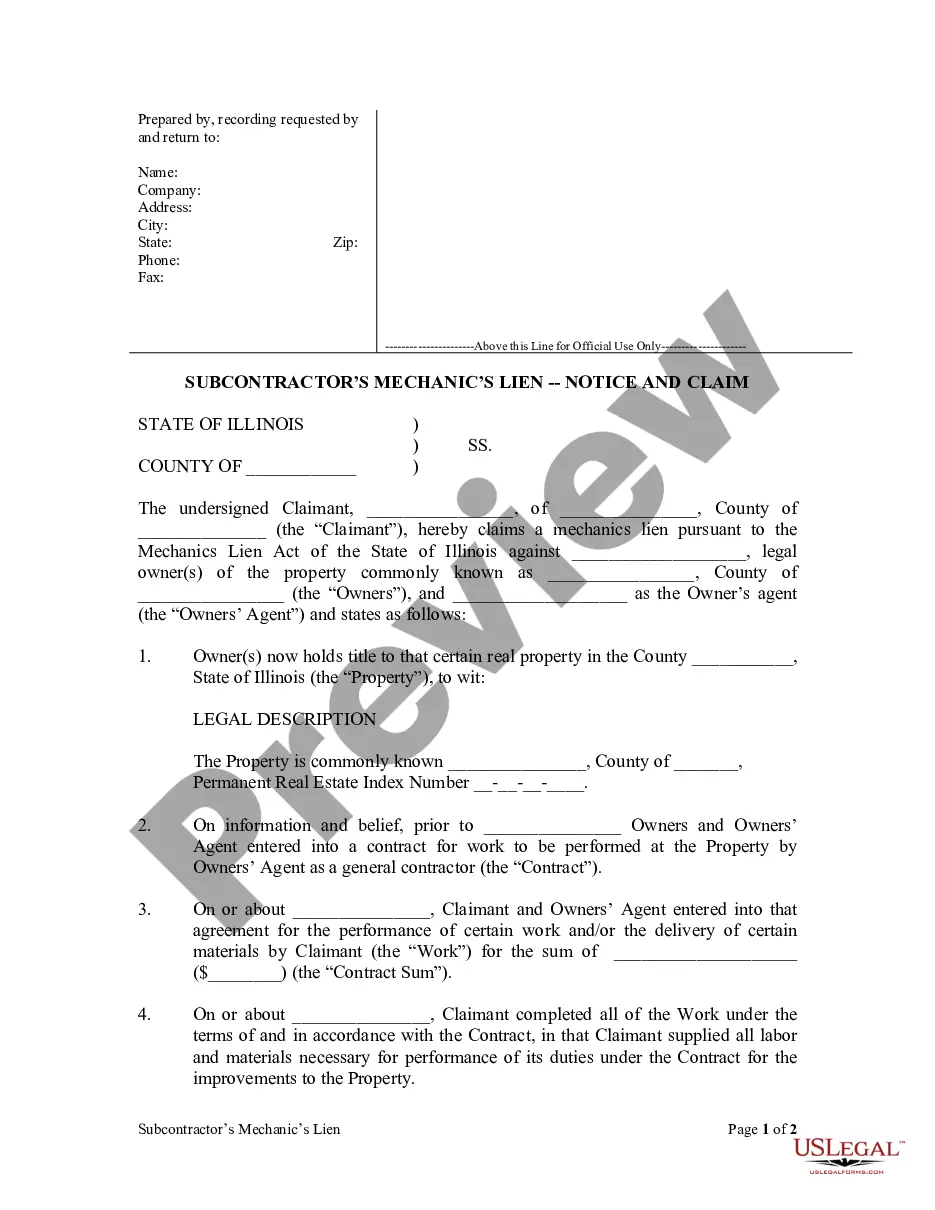

Illinois Subcontractor's Verified Statement - Mechanic Liens - Corporation or LLC

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Illinois Subcontractor's Verified Statement - Mechanic Liens - Corporation Or LLC?

Searching for Illinois Subcontractor's Verified Statement - Mechanic Liens - Corporation or LLC template can be rather challenging.

To conserve considerable time, expenses, and effort, utilize US Legal Forms and swiftly locate the appropriate sample tailored for your state with just a few clicks.

Our legal experts prepare all documents, so all you need to do is complete them.

You can print the Illinois Subcontractor's Verified Statement - Mechanic Liens - Corporation or LLC form or complete it using any online editor. There’s no need to worry about typos since your template can be utilized and submitted, and printed as many times as you like. Visit US Legal Forms and gain access to over 85,000 state-specific legal and tax documents.

- Log in to your account and navigate back to the form's page to download the template.

- All your downloaded templates are stored in My documents and are available at all times for future use.

- If you’re not yet subscribed, you must create an account.

- Review our comprehensive instructions on how to obtain your Illinois Subcontractor's Verified Statement - Mechanic Liens - Corporation or LLC form in a matter of minutes.

- To obtain a valid template, confirm its relevance for your state.

- Examine the sample using the Preview option (if available).

- Read the description, if provided, to understand the details.

- Click the Buy Now button if you've found what you're looking for.

- Select your plan on the pricing page and set up an account.

- Decide whether to pay via a credit card or PayPal.

- Download the form in your preferred file format.

Form popularity

FAQ

Mechanic's liens create a cloud on title, meaning that they appear in public property records. Liens are sometimes said to travel with the land, meaning that anyone who buys your house would take the property subject to the contractor's lien (or, more likely, demand that you pay it off first).

Under Illinois law, any mechanics lien should be filed in the County Recorder of Deeds where the property being liened is located. This is crucial as the lien must be filed not only in the correct county but the correct office as well. The fees and specific document formatting vary depending on your county.

In Texas, a mechanics lien expires after 1 or 2 years, depending on the type of project. A lien claimant will need to enforce their mechanics lien before the deadline. 1 year after termination, completion, or abandonment or the project.

In order to enforce a lien, the contractor, subcontractor or supplier must file a lawsuit. The deadline to file a lawsuit is two years from the last date work was performed or materials were supplied. A recorded lien is valid for these two years, but a failure to sue within that time frame voids the lien.

The deadline for contractors and subcontractors to file their statement of mechanic's lien is four months (not 120 days) from the last date of work (exclusive of warranty work or other work performed free of charge), or from the last date that materials were supplied to the project.

Negotiate with the contractor who placed the lien (the "lienor" to remove it. Obtain a lien bond to discharge the lien, or. File a lawsuit to vacate the lien.

The people who can file mechanic's liens are identified by state law. A subcontractor or supplier to a subcontractor may not be able to file a lien. Also, unlicensed contractors are often barred from filing a mechanic's lien.

Mechanics Liens must be recorded by a "subcontractor" within 90 days of "completion" or "cessation of work" and a general contractor who has a direct contract with the owner must record within 90 days of completion or of cessation of labor, unless completion or cessation of labor has occurred.

To enforce the lien, the contractor must file a lawsuit within 90 days from the date of recording the lien. If this deadline is passed, the contractor may not be able to enforce the lien and may be required to remove the lien.