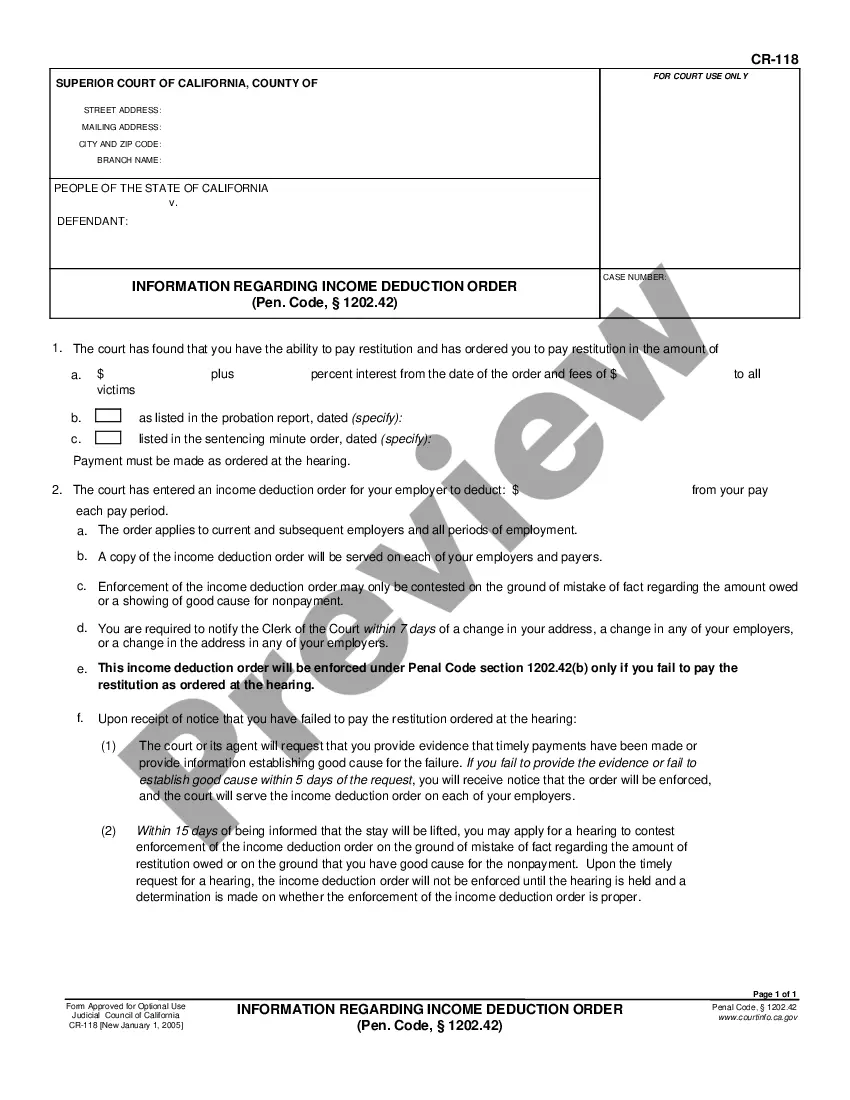

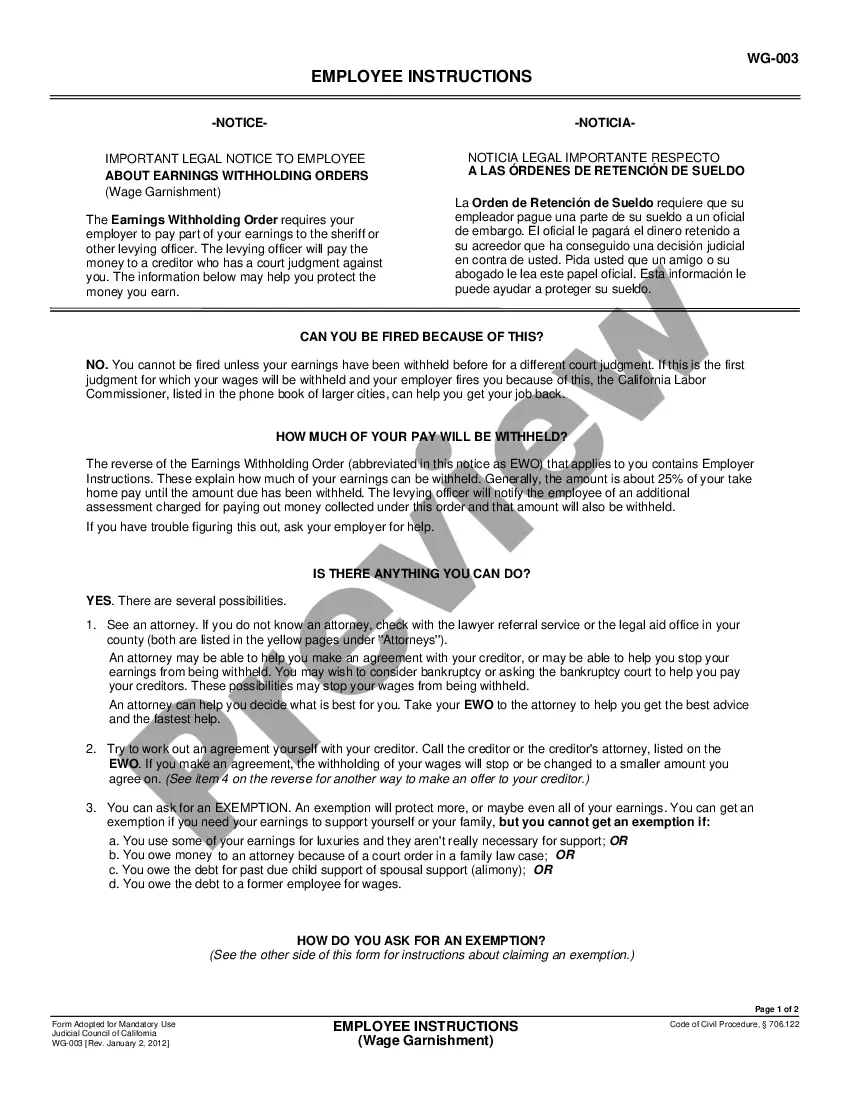

This is an order from the court to the party's employer requiring an income deduction (garnishment) be taken out of their wages as restitution.

California Order for Income Deduction

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out California Order For Income Deduction?

If you are seeking the proper California Order for Income Deduction forms, US Legal Forms is your solution; access documents provided and reviewed by state-certified lawyers.

Utilizing US Legal Forms not only saves you from hassles related to legal documents; additionally, you conserve time, effort, and resources! Downloading, printing, and completing a skilled form is significantly more cost-effective than hiring an attorney to do it for you.

And that's it. In just a few simple steps, you have an editable California Order for Income Deduction. Once you create an account, all future orders will be handled even more easily. If you have a US Legal Forms subscription, just Log In to your account and then click the Download option available on the form's page. Following that, whenever you need to access this template again, you will always be able to find it in the My documents section. Do not waste your time searching through numerous forms on various online sources. Purchase accurate templates from a single reliable service!

- To begin, finish your registration by entering your email and creating a secure password.

- Follow the instructions below to establish your account and obtain the California Order for Income Deduction template to address your issue.

- Use the Preview option or review the document details (if available) to ensure that the template is the one you need.

- Verify its validity in your state.

- Click Buy Now to place an order.

- Select a preferred payment plan.

- Create your account and pay using a credit card or PayPal.

- Choose a convenient format and save the document.

Form popularity

FAQ

You can order California tax forms online through the California Franchise Tax Board’s website, or you can request them via mail. Many forms are also available for download, which you can print at home. If you frequently deal with filings like a California Order for Income Deduction, having the appropriate forms on hand will be beneficial.

To fill out a California DE4 form, gather your personal information and understand your financial situation. After entering the required details, calculate the number of allowances you can claim. A properly completed DE4 can help in managing payroll deductions effectively and provide a smoother experience when dealing with a California Order for Income Deduction.

To obtain an income withholding order, start by filing the necessary paperwork with the family court in California. This order can help ensure that child support or other court-ordered payments are withheld directly from your paycheck. It’s essential to follow the legal process correctly, as proper documentation is crucial for establishing your California Order for Income Deduction.

To reduce your income tax in California, consider strategies such as maximizing your deductions and credits. Contributing to retirement accounts and utilizing tax credits can also lower your taxable income. Additionally, understanding how a California Order for Income Deduction works can help you plan your finances more effectively, ensuring you optimize your tax situation.

Filling out the California DE4 form involves several steps. Start by entering your personal information in the designated sections, then claim the appropriate number of allowances based on your situation. Be sure to review the instructions carefully to ensure accuracy, as filling the form correctly can help you manage your taxes effectively, particularly when navigating a California Order for Income Deduction.

Calculating your qualified business income deduction requires determining your total qualified income, subtracting any applicable deductions, and applying the 20% deduction rate. It's essential to keep accurate records and consult tax resources, such as US Legal Forms, for guidance. This detailed process ensures you're compliant with the California Order for Income Deduction and can optimize your tax outcomes.

If you receive a qualified business income deduction from TurboTax, it means that your tax calculations identified eligible income under the QBI rules. This deduction is intended to maximize your tax savings, benefiting your overall financial situation. For further assistance, consider exploring how the California Order for Income Deduction applies to your specific case.

The qualified business income deduction allows California taxpayers to exclude a portion of their business income when calculating their taxable income. This benefit primarily targets sole proprietors and owners of pass-through entities. By leveraging this deduction, you can significantly lower your tax bill while ensuring compliance with the California Order for Income Deduction.

The 20% small business deduction, commonly known as the Qualified Business Income (QBI) deduction, allows sole proprietors and pass-through entities to deduct a portion of their business income from their taxable income. This deduction aims to support small businesses and stimulate economic growth in California. Understanding how the California Order for Income Deduction factors in can help you maximize your benefits.

In California, employers have specific regulations regarding deductions from a final paycheck. Typically, deductions may occur for certain obligations like taxes or other sizable debts, but they must comply with legal standards. It's crucial to consult a reliable resource, such as US Legal Forms, to understand how the California Order for Income Deduction may apply.