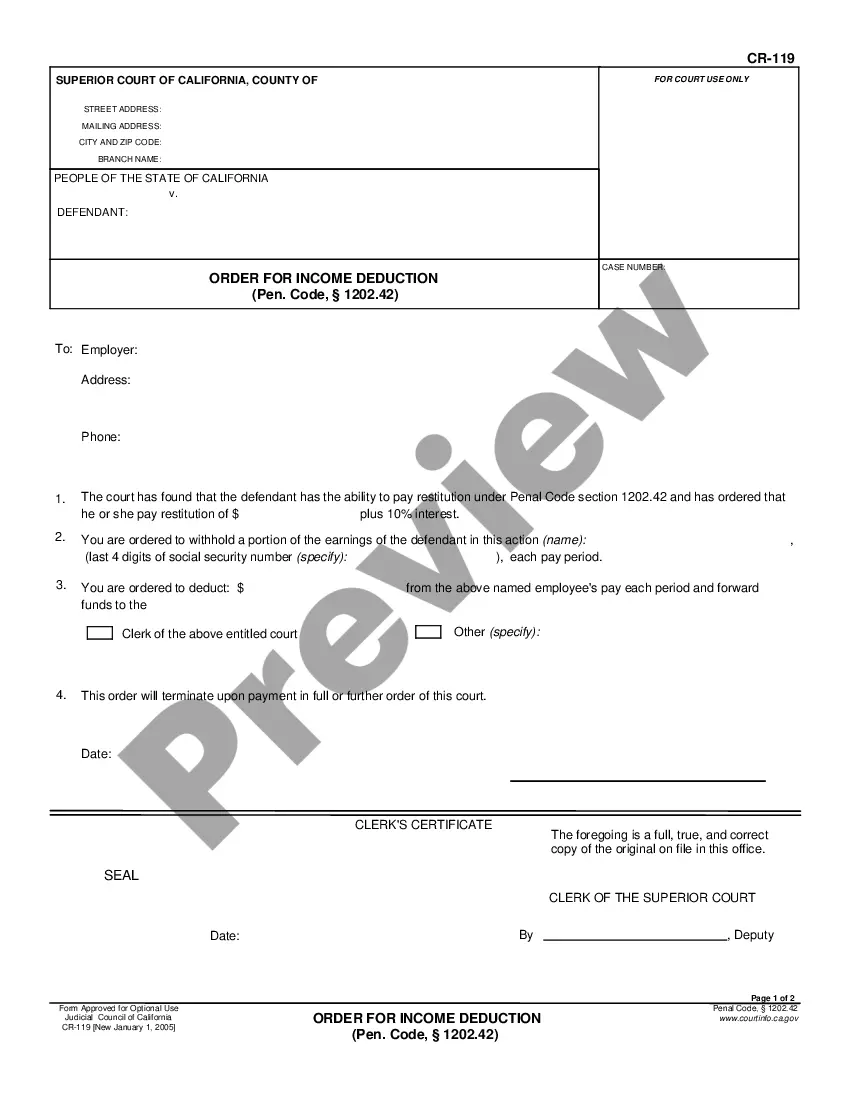

This form gives notice to a party whose income has been ordered deducted/garnished by the court as restitution.

California Information Regarding Income Deduction Order

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out California Information Regarding Income Deduction Order?

If you're looking for accurate California Information Concerning Income Deduction Order templates, US Legal Forms is precisely what you require; obtain documents provided and reviewed by state-licensed attorneys.

Using US Legal Forms not only alleviates you from complications related to legal documents; you also conserve time and energy, and financial resources! Downloading, printing, and completing a professional form is notably cheaper than hiring an attorney to do it for you.

And that’s it. With just a few simple steps, you obtain an editable California Information Concerning Income Deduction Order. After setting up your account, all future requests will be processed much easier. If you have a US Legal Forms subscription, simply Log In to your profile and click the Download button visible on the form’s page. Then, when you wish to access this template again, you'll always find it in the My documents section. Don’t squander your time comparing numerous forms on different online sites. Purchase accurate copies from one reliable service!

- To begin, finish your registration process by entering your email and creating a password.

- Follow the steps outlined below to create your account and find the California Information Concerning Income Deduction Order template to address your issue.

- Utilize the Preview tool or review the document details (if available) to ensure that the template is the one you are looking for.

- Verify its validity in your residing state.

- Click Buy Now to place an order.

- Select a preferred pricing plan.

- Create an account and pay with your credit card or PayPal.

- Choose an appropriate format and save the document.

Form popularity

FAQ

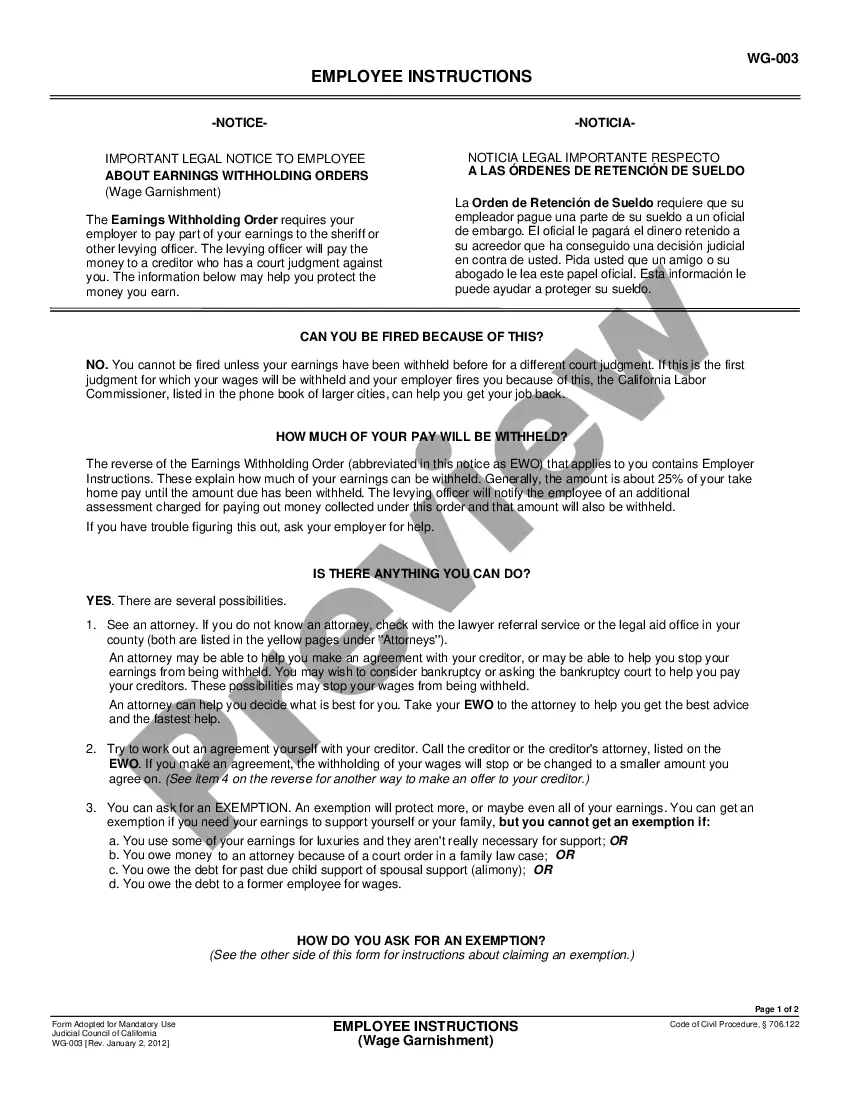

Withholding and garnishment are related but not identical concepts. Withholding refers to the practice of deducting a portion of income for taxes, while garnishment specifically refers to taking funds to settle debts. Both processes involve withholding income, but their purposes, regulations, and implications vary significantly. For clarity on your specific situation, consult the California Information Regarding Income Deduction Order.

A private income deduction order is a legal directive that allows an employer to withhold a portion of an employee's wages for specific debts or obligations not directly related to child support or tax liabilities. These orders are often set at the request of the creditor or a financial institution. It's important to navigate these orders carefully to protect your interests. Learn more through California Information Regarding Income Deduction Order.

To obtain an income withholding order, you typically need to go through a court process that involves filing a request along with the necessary documentation related to your financial obligations. Legal assistance can help streamline this process and ensure accurate filing. Utilizing resources like US Legal Forms can help simplify obtaining your income withholding order. The steps and requirements are detailed in California Information Regarding Income Deduction Order.

Terminate EWO refers to the cancellation of an Earnings Withholding Order (EWO). This process marks the end of enforced income withholding for a specific debt or obligation. Individuals should seek guidance to understand the implications of termination and ensure all financial responsibilities remain up to date. For assistance, review the California Information Regarding Income Deduction Order.

Termination of the order to withhold tax in California means that the income withholding order is no longer in effect. This could occur due to various reasons like changes in financial circumstances or compliance with a court order. It is important to understand how this affects your tax obligations and financial planning. For more details, you may refer to the California Information Regarding Income Deduction Order.

Filling out Form FL-195, the Wage Assignment Order for Child Support, involves providing detailed information about the employee and the terms of the wage assignment. Include the obligor’s personal details, the child support amount, and the withholding instructions for the employer. Accurate completion of this form is vital for proper processing in child support cases. Additionally, make sure to stay informed about any implications related to California Information Regarding Income Deduction Order.

The Income Withholding Order (IWO) format is a standard document utilized for wage garnishment purposes. It instructs employers to withhold a certain amount from an employee's wages to fulfill obligations such as child support or tax debts. Employers must follow this format to ensure compliance with federal and state guidelines. Familiarizing yourself with the IWO format can assist you in understanding how your wages may be affected.

To halt a levy by the California Franchise Tax Board (FTB), you should contact them immediately to discuss your situation. You may qualify for a payment plan or a financial hardship exemption that can suspend the levy. It is essential to document any financial difficulties you encounter and provide that information to the FTB. They are often willing to work with individuals who reach out proactively.

To stop a California state tax wage garnishment, you should first contact the California Franchise Tax Board directly. Discuss your financial situation, as there may be options like negotiating a payment plan or filing for hardship relief. Additionally, if you believe the garnishment is incorrect, you can challenge it through the appropriate legal channels. Being proactive can significantly help in stopping unwarranted garnishments.

Filling out the California Withholding Allowance Certificate, also known as Form DE 4, is a crucial step for employees in the state. On this form, you will report your personal information, such as your filing status and the number of allowances you are claiming. Accurate completion of this form ensures that your employer withholds the correct amount of state income tax from your paycheck, potentially preventing issues like wage garnishments. Be sure to review your information annually or when your circumstances change.