Michigan Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children

Description

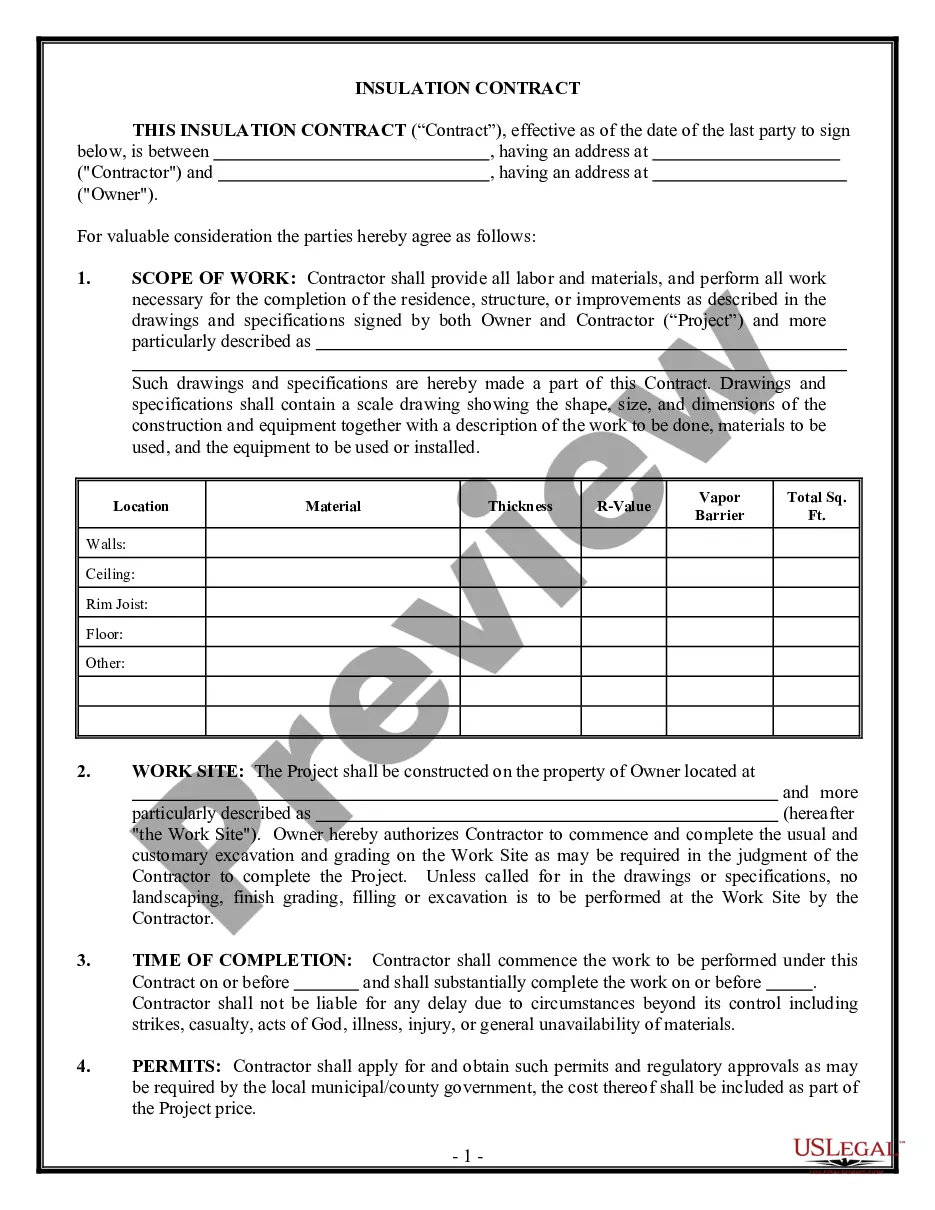

How to fill out Michigan Living Trust For Individual Who Is Single, Divorced Or Widow (or Widower) With No Children?

Have any template from 85,000 legal documents such as Michigan Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children online with US Legal Forms. Every template is drafted and updated by state-licensed legal professionals.

If you have a subscription, log in. When you are on the form’s page, click on the Download button and go to My Forms to get access to it.

If you have not subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Michigan Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children you want to use.

- Look through description and preview the template.

- Once you’re sure the sample is what you need, click Buy Now.

- Select a subscription plan that works well for your budget.

- Create a personal account.

- Pay in just one of two suitable ways: by bank card or via PayPal.

- Pick a format to download the file in; two ways are available (PDF or Word).

- Download the document to the My Forms tab.

- Once your reusable template is ready, print it out or save it to your device.

With US Legal Forms, you will always have quick access to the proper downloadable template. The platform provides you with access to forms and divides them into groups to streamline your search. Use US Legal Forms to get your Michigan Living Trust for Individual Who is Single, Divorced or Widow (or Widower) with No Children easy and fast.

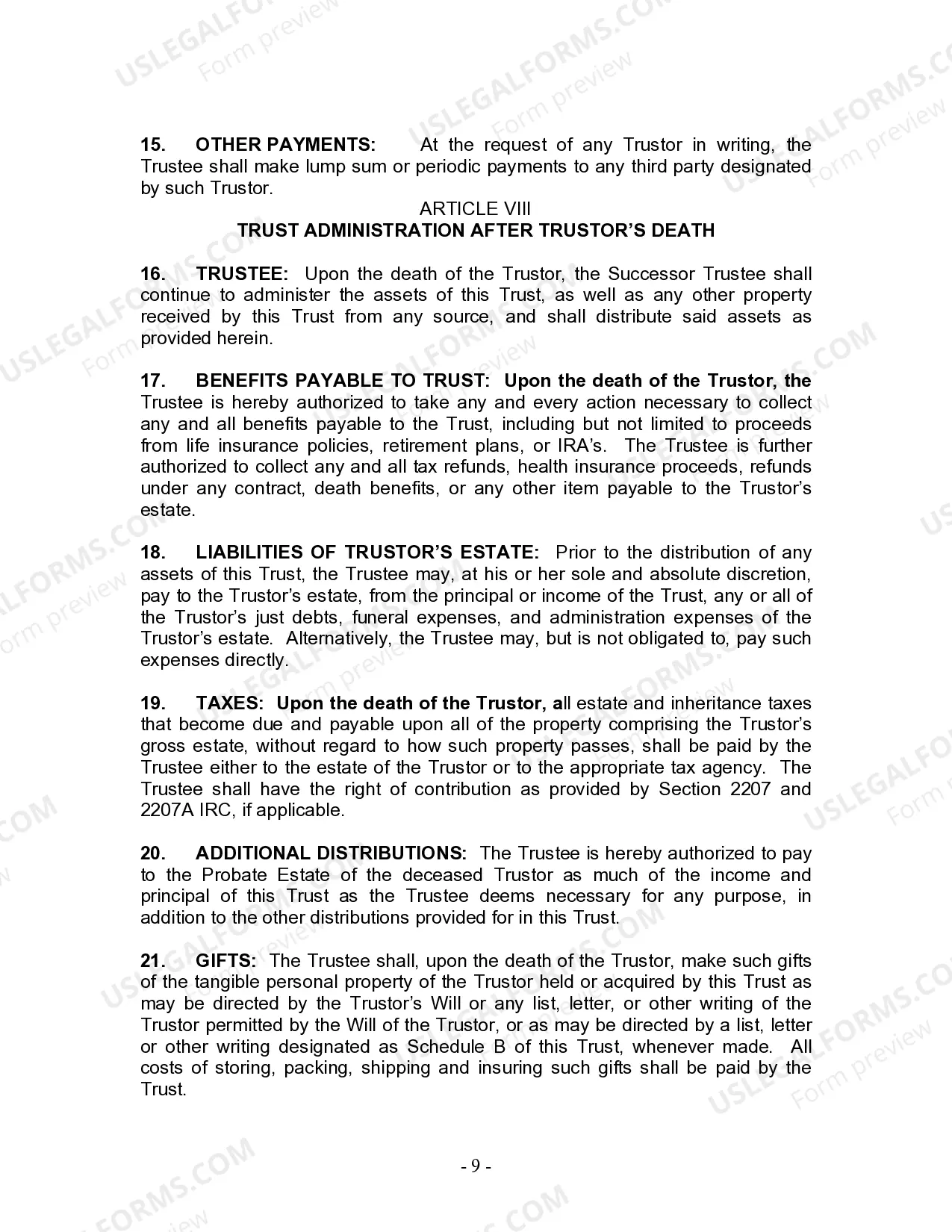

Form popularity

FAQ

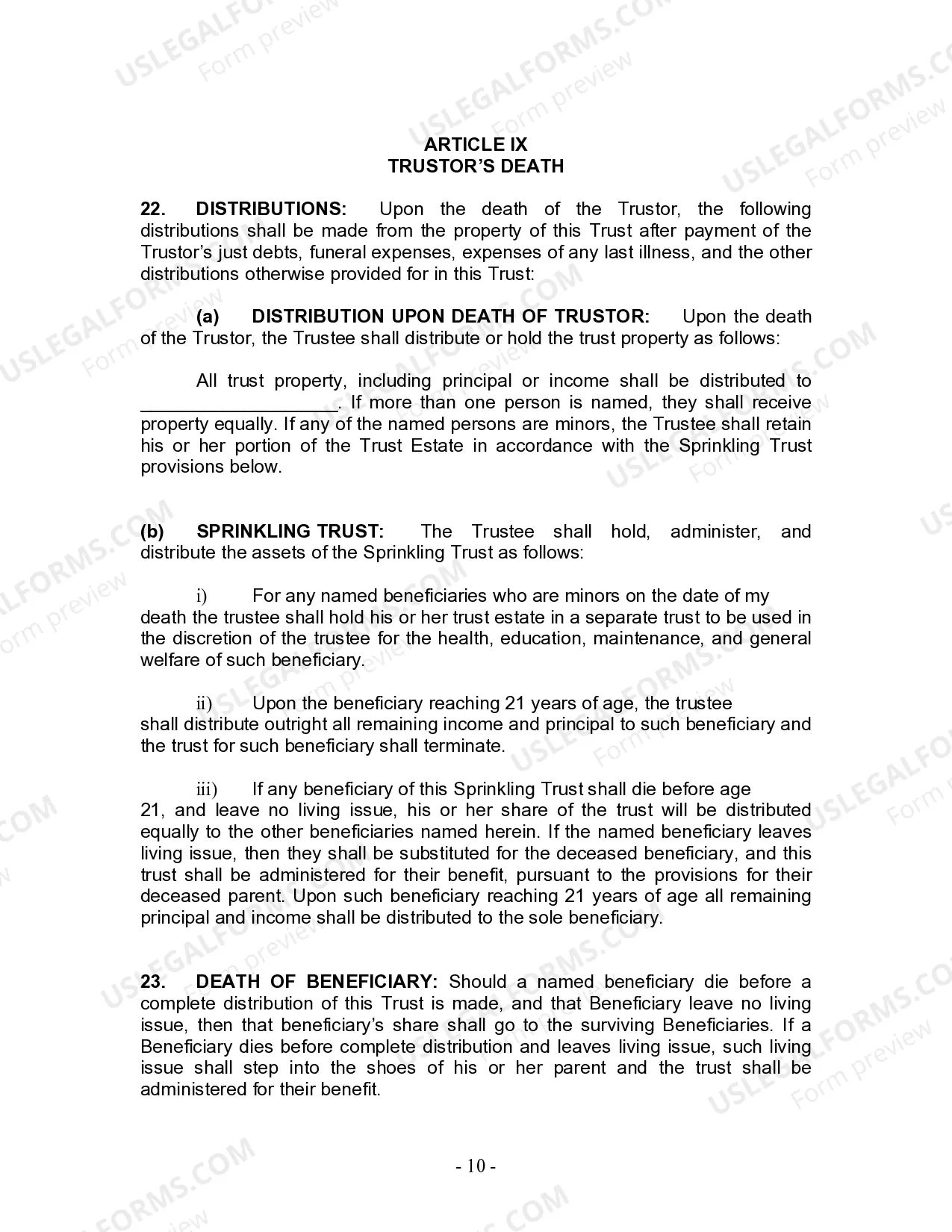

In most cases, the trust assets pass on to the couple's children or other family members when the surviving spouse passes. However, the rules of different types of marital trusts dictate whom can be named beneficiary after the surviving spouse's death.

An estate plan that includes a trust costs $1,000 to $3,000, versus $300 or less for a simple will. What a living-trust promoter may not tell you: You don't need a trust to protect assets from probate. You can arrange for most of your valuable assets to go to your heirs outside of probate.

The term usually means your nearest blood relative. In the case of a married couple or a civil partnership it usually means their husband or wife. Next of kin is a title that can be given, by you, to anyone from your partner to blood relatives and even friends.

When they pass away, the assets are distributed to beneficiaries, or the individuals they have chosen to receive their assets. A settlor can change or terminate a revocable trust during their lifetime. Generally, once they die, it becomes irrevocable and is no longer modifiable.

How Is Next of Kin Determined? To determine next of kin in California, go down the list until someone exists in the category listed.For example, if decedent had no surviving spouse or registered domestic partner, but was survived by adult children, then the adult children would be next of kin.

How Much Does It Cost to Create a Living Trust in Michigan? The cost of forming a living trust in Michigan will depend on how you go about creating it. One option is to make it yourself using an online service. You could pay less than $100 or as much as $300 if you opt for this method.

When one of the spouses dies, the trust will then split into two trusts automatically. Each trust will have half the assets of the trust along with the separate property of the spouse. The surviving spouse is the trustee over both trusts.

Like a will, a living trust can be altered whenever you wish.After one spouse dies, the surviving spouse is free to amend the terms of the trust document that deal with his or her property, but can't change the parts that determine what happens to the deceased spouse's trust property.

A revocable trust becomes irrevocable at the death of the person that created the trust.The Trust becomes its own entity and needs a tax identification number for filing of returns. 2. The Grantor (also called the Trustor) of the Trust becomes incapacitated.